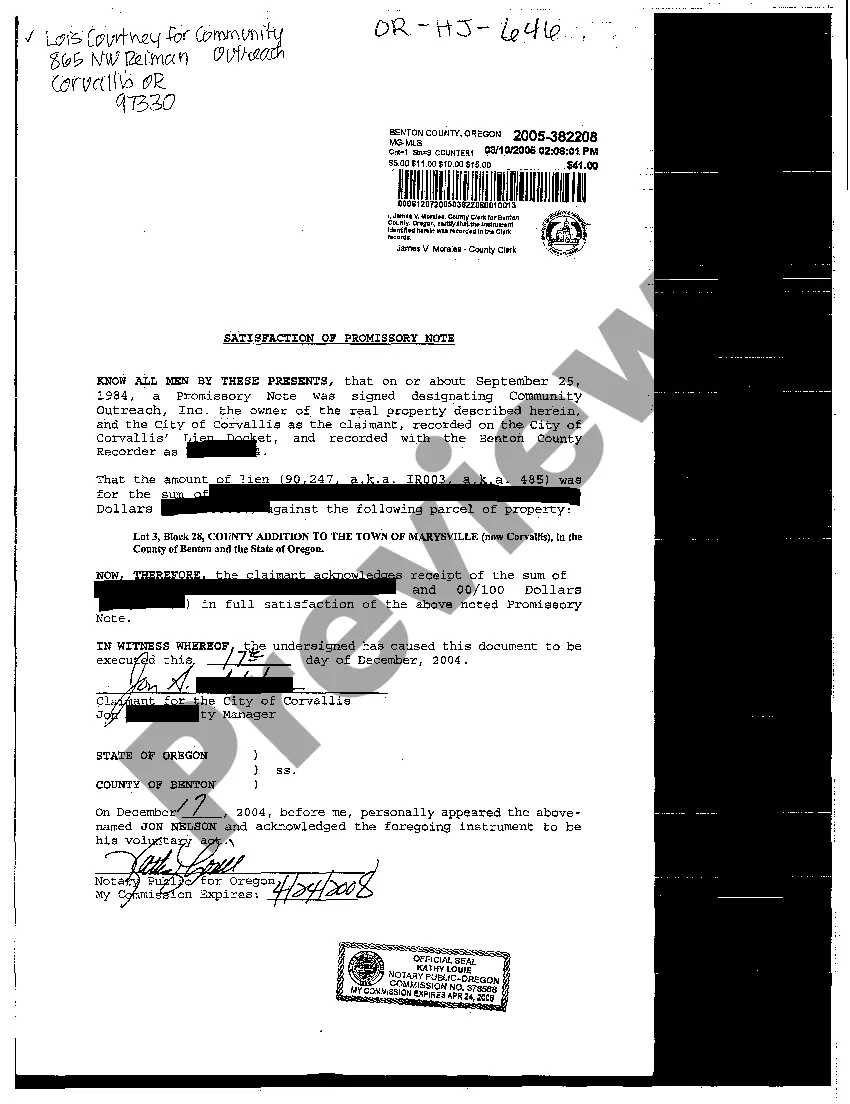

Oregon Satisfaction of Promissory Note

Description

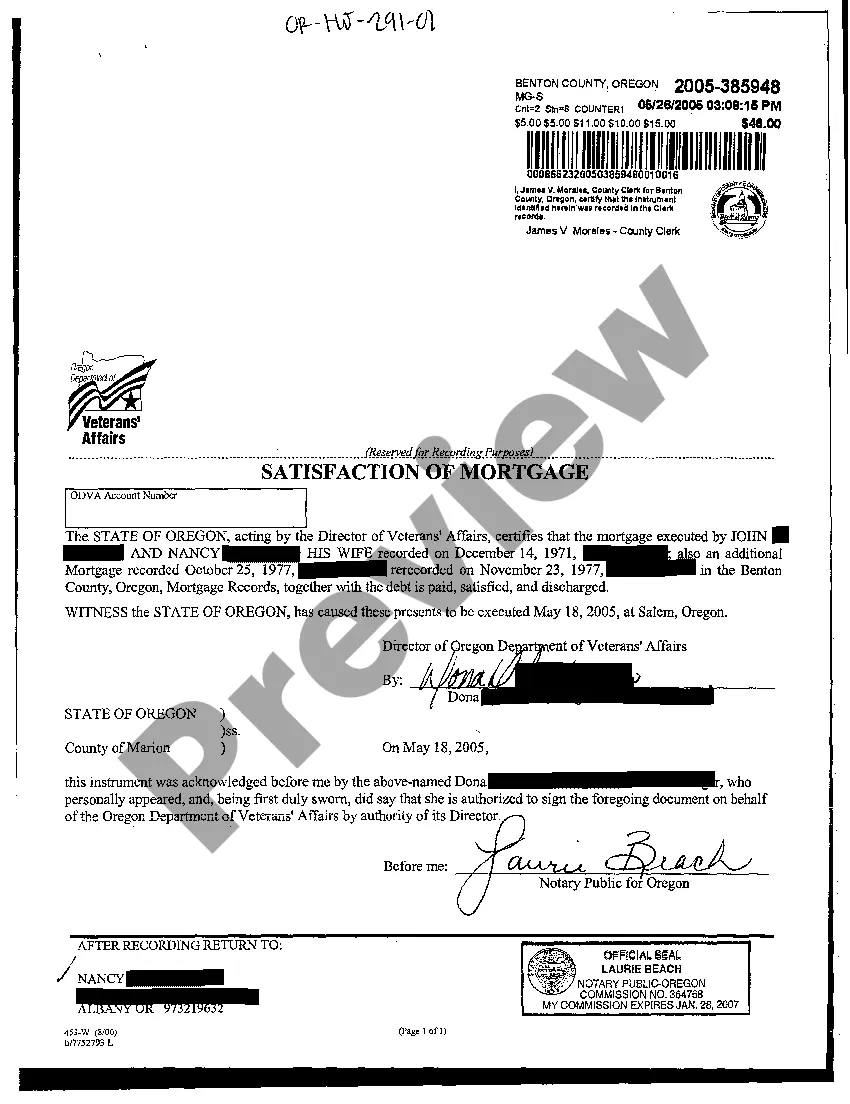

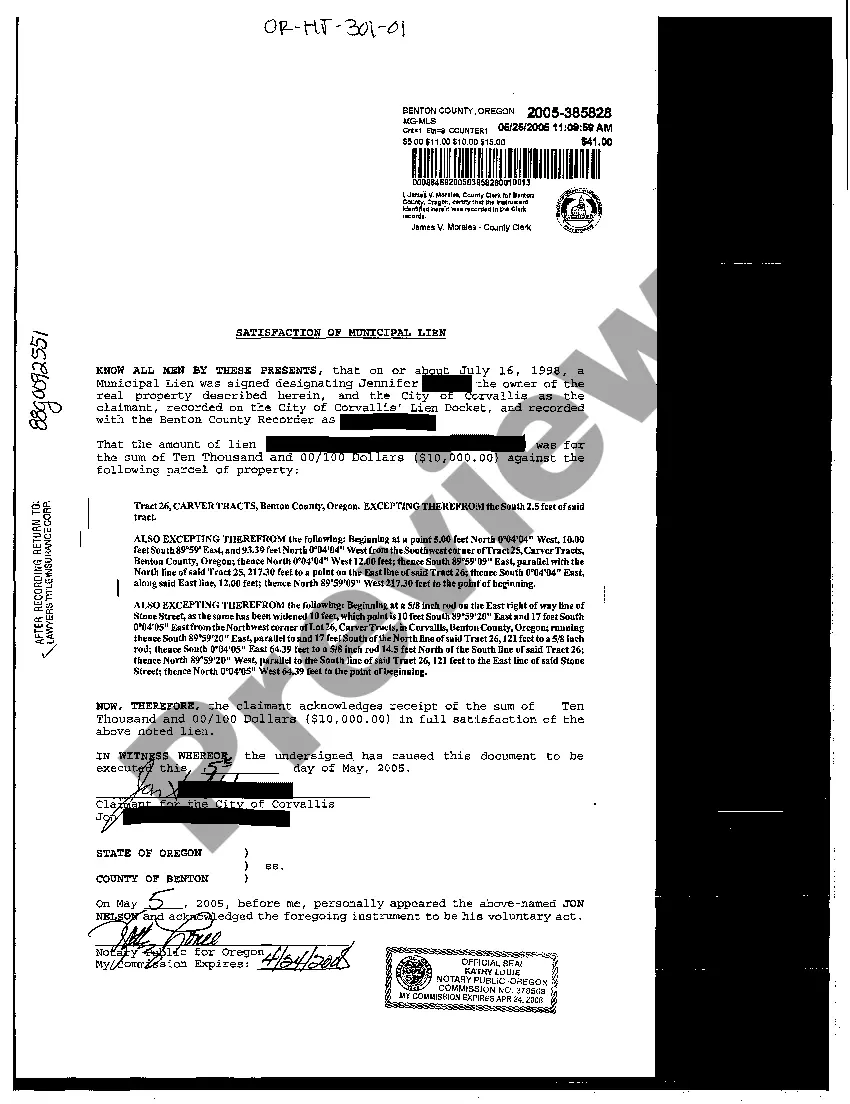

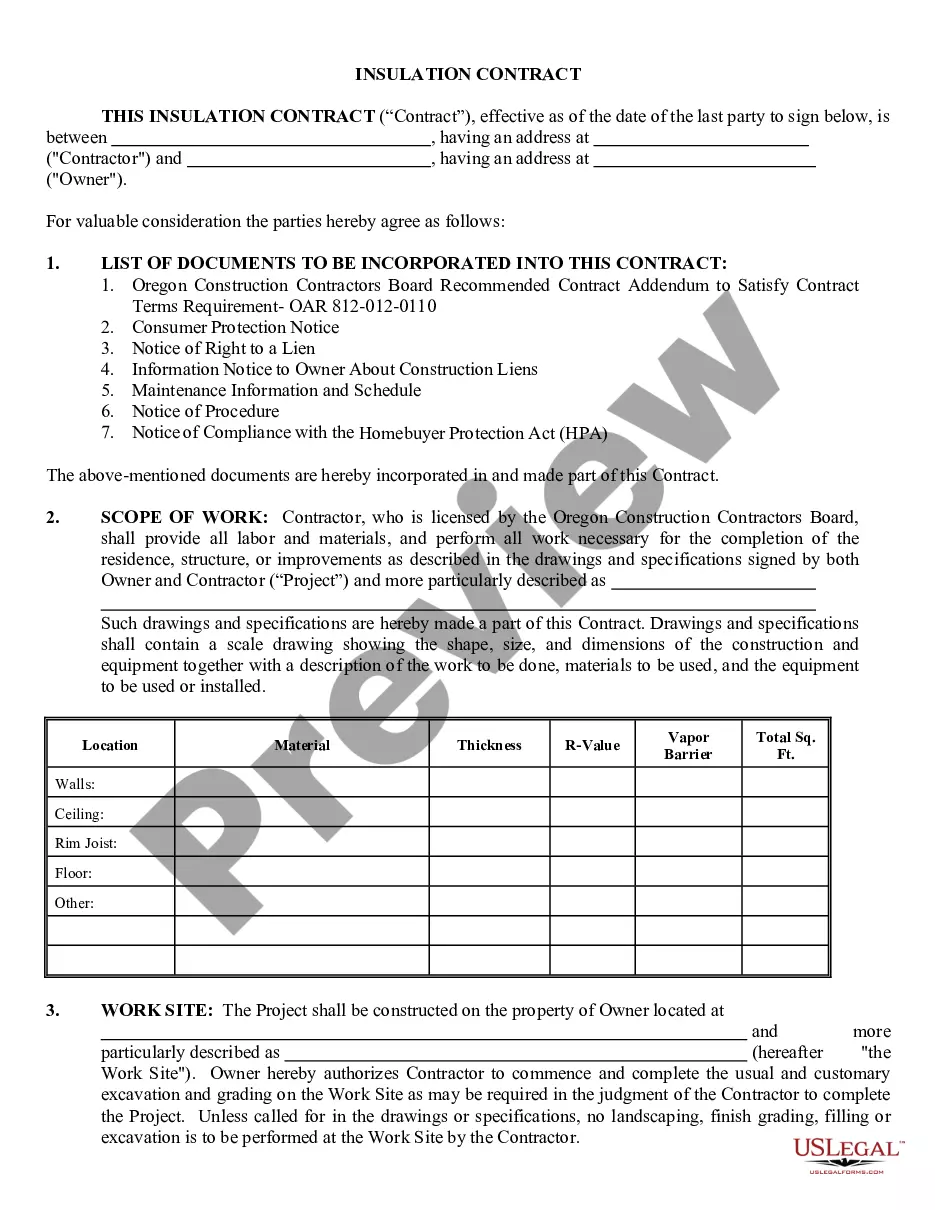

How to fill out Oregon Satisfaction Of Promissory Note?

The work with papers isn't the most easy process, especially for those who almost never deal with legal papers. That's why we advise utilizing correct Oregon Satisfaction of Promissory Note samples created by skilled attorneys. It allows you to prevent problems when in court or working with formal organizations. Find the samples you need on our site for top-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you are in, the Download button will immediately appear on the file page. After getting the sample, it will be saved in the My Forms menu.

Users without an activated subscription can quickly create an account. Make use of this brief step-by-step help guide to get the Oregon Satisfaction of Promissory Note:

- Make certain that the sample you found is eligible for use in the state it’s necessary in.

- Confirm the document. Use the Preview option or read its description (if available).

- Click Buy Now if this sample is the thing you need or go back to the Search field to find another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After finishing these easy steps, you can complete the sample in a preferred editor. Check the filled in info and consider requesting a lawyer to review your Oregon Satisfaction of Promissory Note for correctness. With US Legal Forms, everything gets easier. Test it now!

Form popularity

FAQ

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

No. California promissory notes do not need to be notarized or witnessed for validity.

However, in California, the lender is not required to produce a Promissory Note to conduct a non-judicial foreclosure (also known as a Trustee's Sale).The Promissory Note is the debt instrument, just like an IOU. The person holding the original is the one the borrower has to pay.

"A promissory note is enforceable through an ordinary breach of contract claim." In other words, it's not required that the loan be secured; an unsecured loan is still enforceable as long as the promissory note is fully completed. Lender and borrower information.

Generally, promissory notes do not need to be notarized. Typically, legally enforceable promissory notes must be signed by individuals and contain unconditional promises to pay specific amounts of money. Generally, they also state due dates for payment and an agreed-upon interest rate.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note. Accept full payment of the loan. Mark paid in full on the promissory note. Place a signature beside the paid in full notation. Mail the original promissory note to the borrower.