Michigan Pledge of Shares of Stock

Description

How to fill out Pledge Of Shares Of Stock?

Finding the appropriate legal document template could be challenging.

Certainly, there are numerous templates available online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. The platform offers a vast selection of templates, including the Michigan Pledge of Shares of Stock, suitable for both business and personal purposes.

You can review the form using the Review button and read the form description to confirm it meets your needs.

- All templates are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Michigan Pledge of Shares of Stock.

- Use your account to browse through the legal forms you have purchased in the past.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your area/state.

Form popularity

FAQ

Yes, typically you still receive dividends for pledged shares as you remain the owner of the stock. The use of a Michigan Pledge of Shares of Stock does not transfer ownership, so you retain your rights to dividends. However, it's advisable to read your pledge agreement carefully to understand any specific terms that may apply.

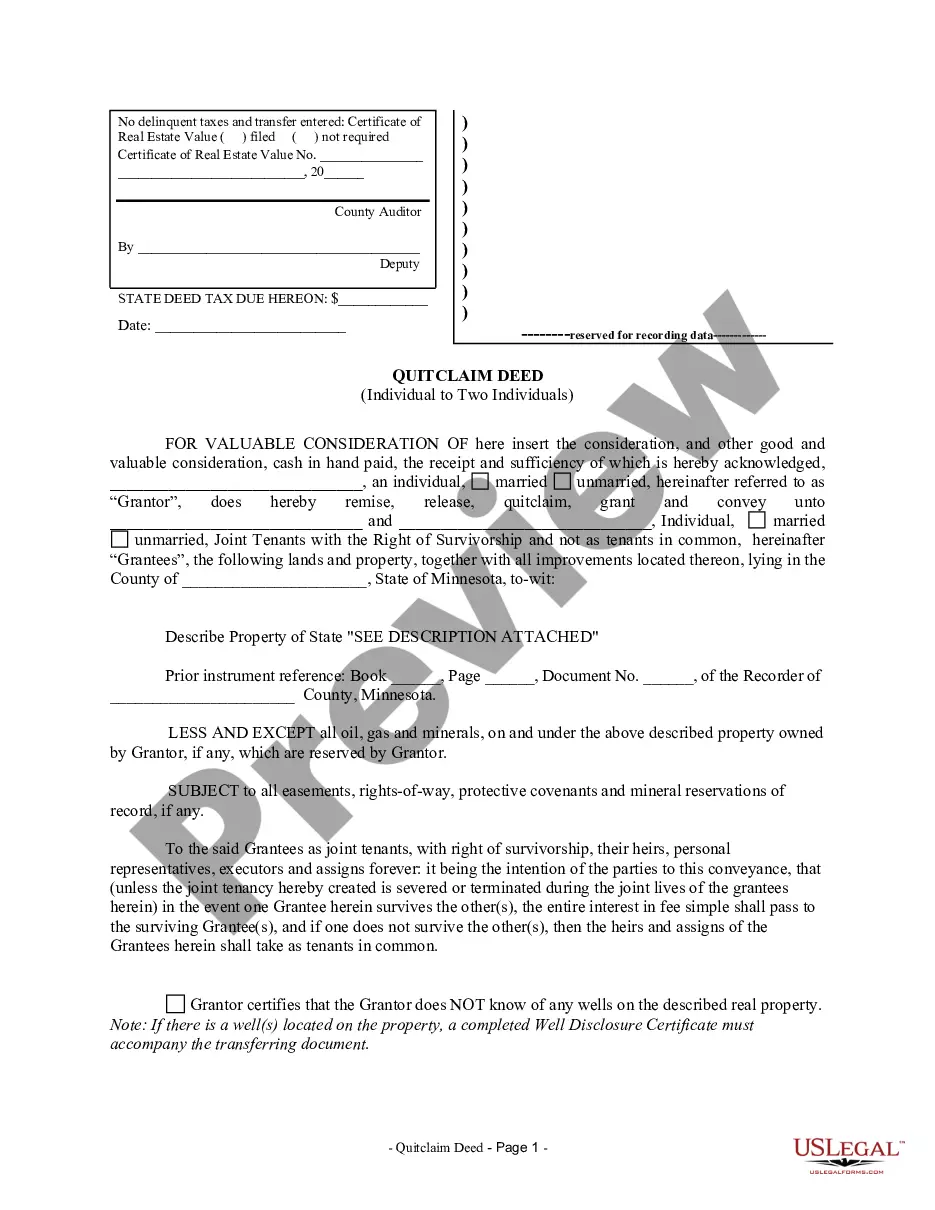

To initiate a Michigan Pledge of Shares of Stock, you will need several documents, including your share certificate, a pledge agreement, and any necessary corporate resolutions. Ensuring that you have the correct paperwork will expedite the process and help prevent potential delays. If you're unsure about the requirements, US Legal Forms can assist by providing templates and guidance.

The process to pledge shares typically takes only a few days, depending on the complexity of your situation. You must prepare the necessary documentation and submit it through the appropriate channels. Utilizing services like US Legal Forms can streamline this process, making it easier and faster to complete your Michigan Pledge of Shares of Stock.

If you choose not to pledge your shares, you retain full ownership and control over them. However, avoiding a Michigan Pledge of Shares of Stock may limit your ability to use those shares as collateral for loans or other financial opportunities. You might miss out on leveraging these assets for capital, which could impact your financial flexibility.

Michigan's Uniform Commercial Code is a collection of laws that govern commercial transactions within the state. It is closely aligned with the broader UCC adopted by most states, providing guidelines for contracts, sales, and secured transactions, including the Michigan pledge of shares of stock. This code ensures that businesses operate under clear rules, facilitating easier and more reliable transactions throughout Michigan.

To invoke a pledge of shares, a borrower typically enters into an agreement with the lender where specific shares are put up as collateral. In Michigan, the process involves delivering the stock and creating a written agreement that clearly outlines the terms of the pledge. Utilizing resources like UsLegalForms can simplify this process, ensuring that all necessary documentation is completed accurately and in compliance with state laws.

The UCC applies to a wide range of commercial transactions, including the sale of goods, leasing, negotiable instruments, and secured transactions such as the Michigan pledge of shares of stock. It covers agreements involving both tangible items and financial instruments. By offering a comprehensive legal structure, the UCC facilitates various business operations, ensuring that these transactions are conducted fairly and efficiently.

The Uniform Commercial Code aims to unify the various laws governing commercial transactions, thus creating a cohesive legal framework. This is particularly critical in cases like the Michigan pledge of shares of stock, where clear and consistent regulations foster trust between parties. Through the UCC, transactions can be executed smoothly, minimizing misunderstandings and legal complications.

The Uniform Commercial Code, or UCC, serves an important purpose in regulating commercial transactions across the United States. It provides a standardized set of rules to simplify business dealings and reduce disputes. Specifically, when it comes to Michigan pledge of shares of stock, the UCC ensures that transactions involving these securities follow consistent guidelines, making it easier for both lenders and borrowers.

A financial responsibility document is an official paper that demonstrates an individual's or entity's ability to cover potential liabilities. This may include insurance policies, bank statements, or bonding documents. In the context of the Michigan Pledge of Shares of Stock, having such documentation assures potential investors of your fiscal reliability.