This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Michigan Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

US Legal Forms - one of the largest collections of official templates in the United States - provides a broad selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest forms like the Michigan Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually within minutes.

If you already have a subscription, Log In and retrieve the Michigan Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually from the US Legal Forms repository. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents tab of your account.

Process the transaction. Use a credit card or PayPal account to complete the payment.

Select the format and download the form to your device.

- If you would like to use US Legal Forms for the first time, here are simple steps to get started.

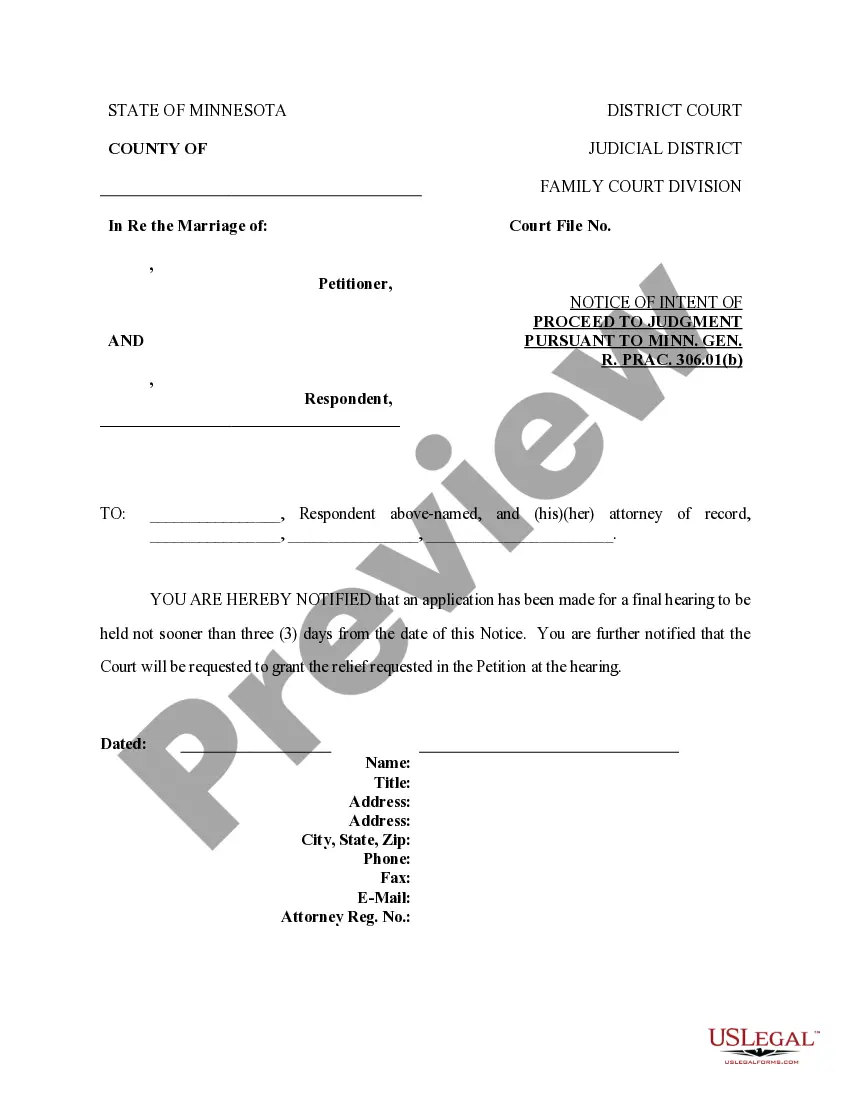

- Ensure you've selected the right form for your city/county. Click the Preview button to check the form's content.

- Read the form details to make sure you've chosen the correct document.

- If the form does not suit your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Select the payment plan you prefer and provide your information to create an account.

Form popularity

FAQ

Yes, promissory notes can accrue interest, including the Michigan Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. This type of promissory note allows interest to build over time without requiring payments until the maturity date. As the borrower, you benefit from not having to make interim payments, while the interest compounds annually, increasing the total amount owed at maturity. If you need assistance with creating or understanding such notes, consider using the uslegalforms platform for reliable legal documents.

Promissory notes must contain essential elements, including the amount owed, payment terms, and signatures from both parties. When preparing a Michigan Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, ensure the terms are clear and agreed upon by all involved. The note should also comply with Michigan laws to be enforceable. Using legal platforms can simplify the process of drafting to avoid potential pitfalls.

In Michigan, the maximum interest rate for loans is governed by the Uniform Commercial Code and typically does not exceed 6% for consumer loans. However, various exceptions exist, especially for commercial transactions. If you are drafting a Michigan Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, be sure to stay within legal limits to avoid complications. Consulting legal resources can help you understand applicable rates.

The maturity of a promissory note is the date when the note is due for repayment in full. This timeline is crucial for both lenders and borrowers, especially in instances like a Michigan Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. Marking this date helps you stay organized and avoid late fees or other penalties. Utilizing resources like US Legal Forms can guide you in tracking and documenting payment timelines accurately.

To determine the maturity value of a note, add the principal amount to the total interest accrued over the life of the note. If you have a Michigan Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, compounding will affect the interest calculation based on the frequency of compounding intervals. Thorough understanding of this process allows you to manage your debt and investment strategies effectively. Tools and forms offered by US Legal Forms can streamline this evaluation.

To calculate compound interest on a promissory note, you need to know the principal amount, the interest rate, and the compounding period. For a Michigan Promissory Note with no Payment Due Until Maturity, you can use the formula A = P(1 + r/n)^(nt) where 'A' is the final amount, 'P' is the principal, 'r' is the annual interest rate, 'n' is the number of compounding periods per year, and 't' is the time in years. Mastering these calculations allows for better financial planning.

For a 90 day note with a 12% annual interest rate and a principal of $10,000, the maturity value can be calculated based on the interest accrued over that period. Specifically, the interest for three months would total $300, leading to a maturity value of $10,300. This calculation is essential to grasp when dealing with a Michigan Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. US Legal Forms can assist you in performing these financial calculations accurately.

The maturity value of a promissory note refers to the total amount that the borrower must repay at the end of the note's term. For a Michigan Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, this amount includes the principal and any accrued interest. Understanding the maturity value helps both lenders and borrowers to plan their finances effectively. Consider using platforms like US Legal Forms for guidance on drafting or understanding promissory notes.

In most cases, interest can be structured to compound on a promissory note, including a Michigan Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. Compounding interest can significantly impact the total amount due at maturity. Therefore, it is essential to carefully review the terms of your note to understand how interest accrues over time.

While notarization is not a requirement for a promissory note in Michigan, it can enhance the document's credibility. Notarization protects both parties by providing a record of the agreement and verifying identities. If you plan to create a Michigan Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, consider having it notarized for added legal assurance.