An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

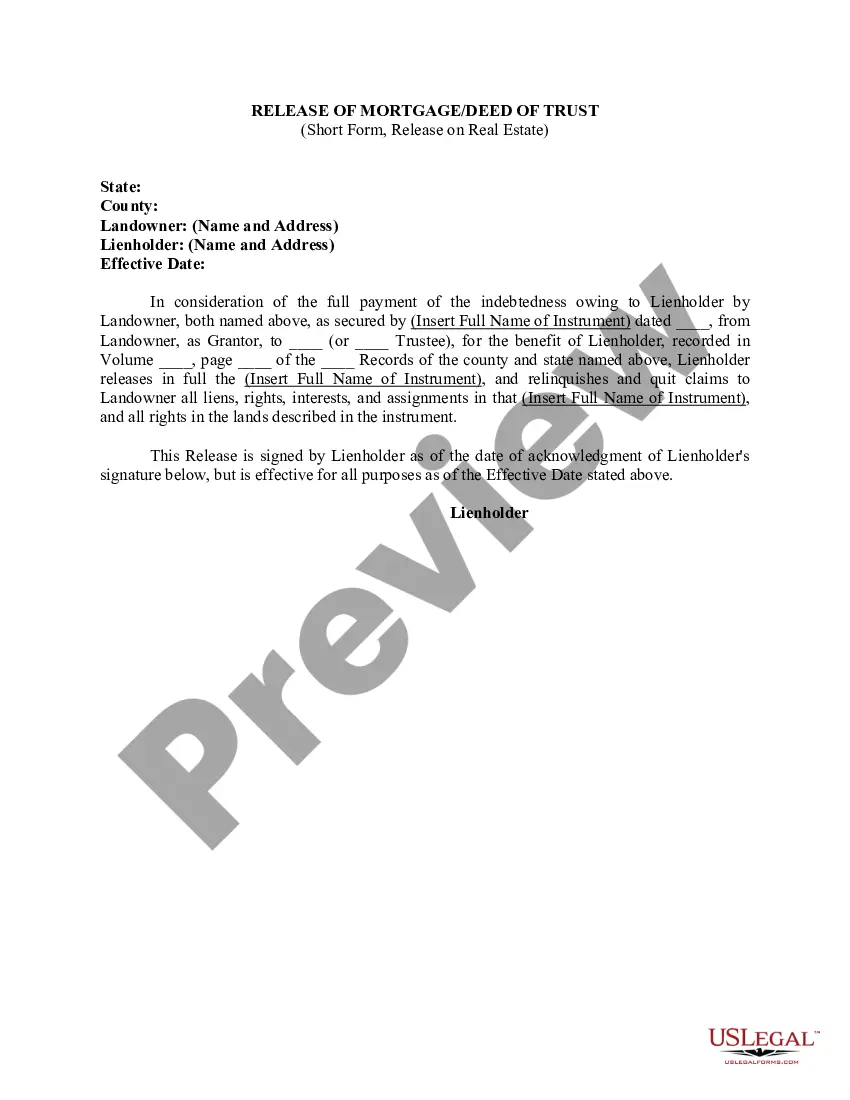

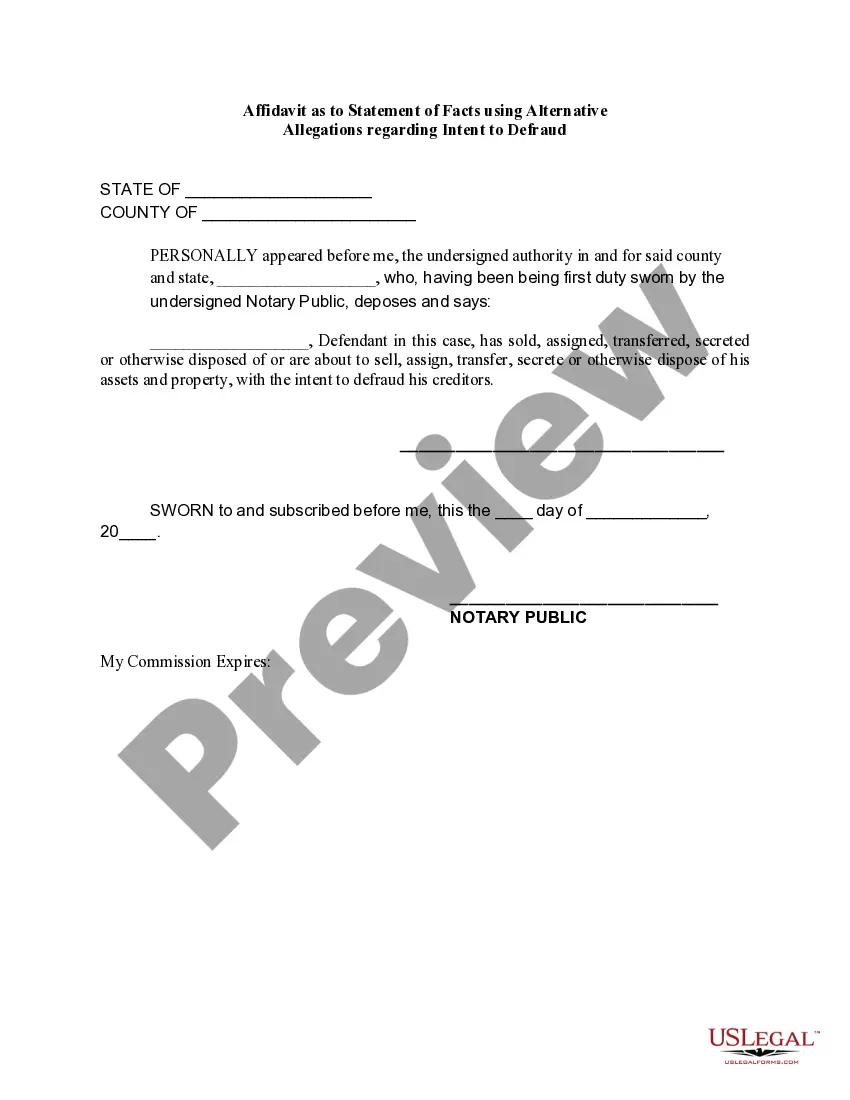

Michigan Petition to Require Accounting from Testamentary Trustee

Description

How to fill out Petition To Require Accounting From Testamentary Trustee?

US Legal Forms - one of the greatest libraries of authorized forms in America - gives a wide array of authorized document themes you may acquire or print. While using internet site, you may get 1000s of forms for company and person purposes, categorized by groups, states, or search phrases.You will find the most recent types of forms such as the Michigan Petition to Require Accounting from Testamentary Trustee within minutes.

If you already have a registration, log in and acquire Michigan Petition to Require Accounting from Testamentary Trustee from the US Legal Forms local library. The Acquire switch can look on every develop you see. You get access to all formerly saved forms inside the My Forms tab of your profile.

In order to use US Legal Forms for the first time, listed here are simple guidelines to get you started out:

- Make sure you have chosen the best develop for your personal metropolis/area. Click on the Review switch to analyze the form`s information. Read the develop explanation to actually have selected the correct develop.

- In the event the develop doesn`t satisfy your specifications, use the Lookup area near the top of the display to find the one which does.

- When you are satisfied with the form, affirm your option by simply clicking the Buy now switch. Then, select the rates prepare you like and provide your references to sign up for the profile.

- Approach the deal. Make use of your charge card or PayPal profile to complete the deal.

- Pick the file format and acquire the form on the system.

- Make modifications. Fill out, edit and print and sign the saved Michigan Petition to Require Accounting from Testamentary Trustee.

Each design you included in your bank account does not have an expiration time and it is the one you have eternally. So, if you would like acquire or print another backup, just go to the My Forms area and click on in the develop you will need.

Obtain access to the Michigan Petition to Require Accounting from Testamentary Trustee with US Legal Forms, probably the most considerable local library of authorized document themes. Use 1000s of expert and status-certain themes that meet your small business or person requirements and specifications.

Form popularity

FAQ

Although Michigan does not stipulate a legal timeframe, filing a probate petition as soon as possible will be in everybody's best interests. The probate process takes a minimum of five months in Michigan, but most probate cases take between six months and a full year. In contested cases, probate may take far longer.

In order to get a Letter of Authority, you must open a Probate Estate and petition the Probate Court to become the Estate's Personal Representative. Once the court appoints you as the Personal Representative, you will be issued your Letter of Authority.

Closing the Estate The estate must be open for at least five months. Required notice to creditors must be published at least four months before closing.

A claim that arises at or after the death of the decedent is barred unless it is presented within the following time limits: For a claim based on a contract with the personal representative, within 4 months after the performance by the personal representative is due.

Here are a few common instances where assets do not require probate in the State of Michigan: Assets owned under ?joint tenancy.? Beneficiary designation assets (i.e. retirement accounts with a listed beneficiary) When the decedent has assets named within a trust.

Simple estates might be settled within six months. Complex estates, those with a lot of assets or assets that are complex or hard to value can take several years to settle. If an estate tax return is required, the estate might not be closed until the IRS indicates its acceptance of the estate tax return.

If the estate is not settled within a year of the first personal representative's appointment, file a Notice of Continued Administration with the court stating why the estate must remain open.

Probate in Michigan can take about 7 months, whether it is supervised or unsupervised. You can expect a longer probate period in certain circumstances. These can include the size of the estate, length of time it takes to locate a will, personal representative, or heirs, disputes with creditors, and will contests.