Michigan Satisfaction, Release or Cancellation of Mortgage by Corporation

Description

How to fill out Michigan Satisfaction, Release Or Cancellation Of Mortgage By Corporation?

Obtain any variant from 85,000 lawful documents like Michigan Satisfaction, Release or Cancellation of Mortgage by Corporation online with US Legal Forms. Each template is crafted and refreshed by state-certified attorneys.

If you possess a subscription, Log In. Once you reach the form’s page, hit the Download button and navigate to My documents to access it.

If you haven't subscribed yet, adhere to the guidelines listed below.

With US Legal Forms, you’ll consistently have immediate access to the appropriate downloadable sample. The platform provides you access to forms and categorizes them to facilitate your search. Utilize US Legal Forms to quickly and effortlessly acquire your Michigan Satisfaction, Release or Cancellation of Mortgage by Corporation.

- Verify the state-specific prerequisites for the Michigan Satisfaction, Release or Cancellation of Mortgage by Corporation you intend to use.

- Examine the description and preview the template.

- When you are confident the template meets your needs, simply click Buy Now.

- Select a subscription plan that fits your financial plan.

- Establish a personal account.

- Make the payment in one of two convenient methods: by credit card or through PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable form is prepared, print it out or store it on your device.

Form popularity

FAQ

To release a mortgage in Michigan, you need to obtain a Satisfaction, Release, or Cancellation of Mortgage by Corporation form. This process typically involves the lender filing the appropriate documents with the county register of deeds. You should ensure that all payments are made before initiating this process. Using platforms like US Legal Forms can simplify your experience by providing the necessary documentation and guidance tailored to Michigan's requirements.

You can get a mortgage satisfaction letter by reaching out to your mortgage lender after making the final payment. Request the letter in writing, and be sure to provide any required information to expedite the process. In Michigan, understanding the procedures for the release or cancellation of mortgage by a corporation is crucial to ensure you receive your letter promptly. US Legal Forms can help you navigate this process effectively.

The time frame for receiving a mortgage satisfaction letter can vary based on several factors, including the lender’s processing time. Typically, it may take anywhere from a few days to a few weeks after the final payment is made. It's crucial to follow up with your lender to ensure they process your request promptly. For a smoother experience, consider using US Legal Forms to guide you through the necessary steps in Michigan.

Yes, satisfaction of a mortgage and lien release essentially refer to the same process. When a mortgage is satisfied, the lender officially acknowledges that the borrower has fulfilled their obligation, thus releasing the lien on the property. This is vital for homeowners looking to sell or refinance their property. Understanding this distinction can help you navigate the Michigan satisfaction, release or cancellation of mortgage by corporation more effectively.

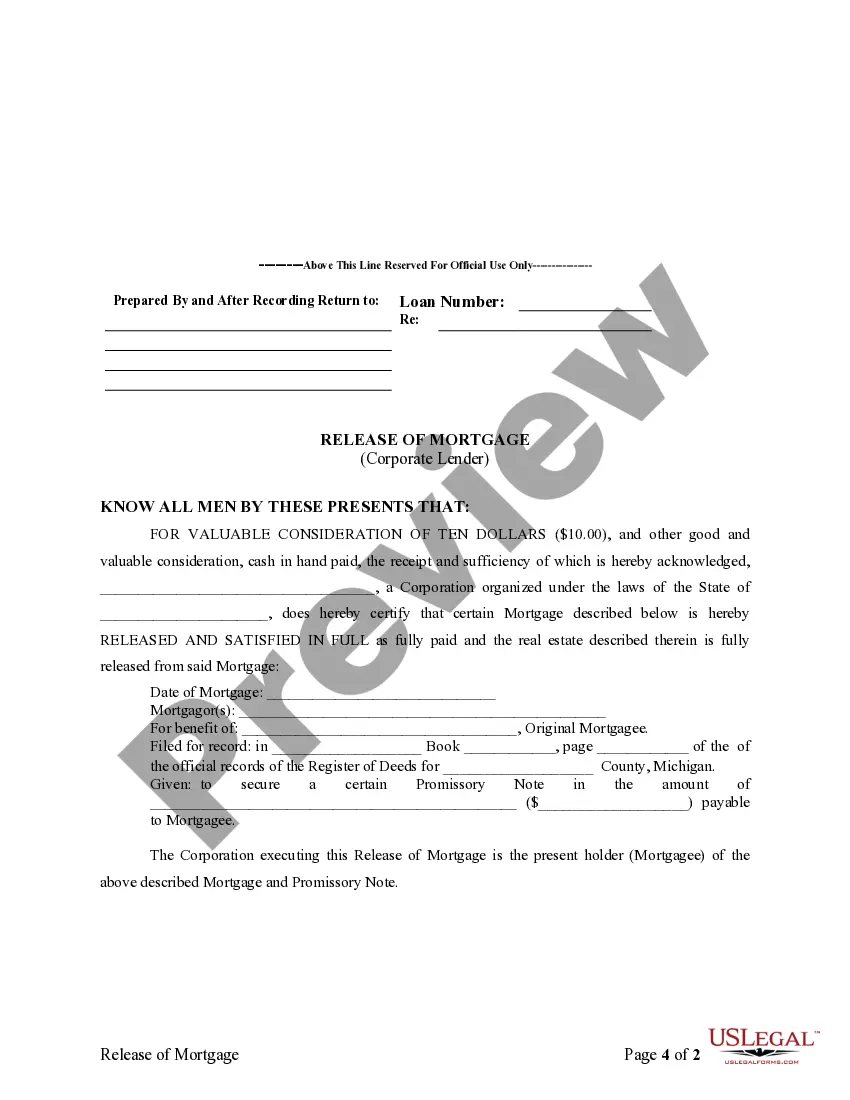

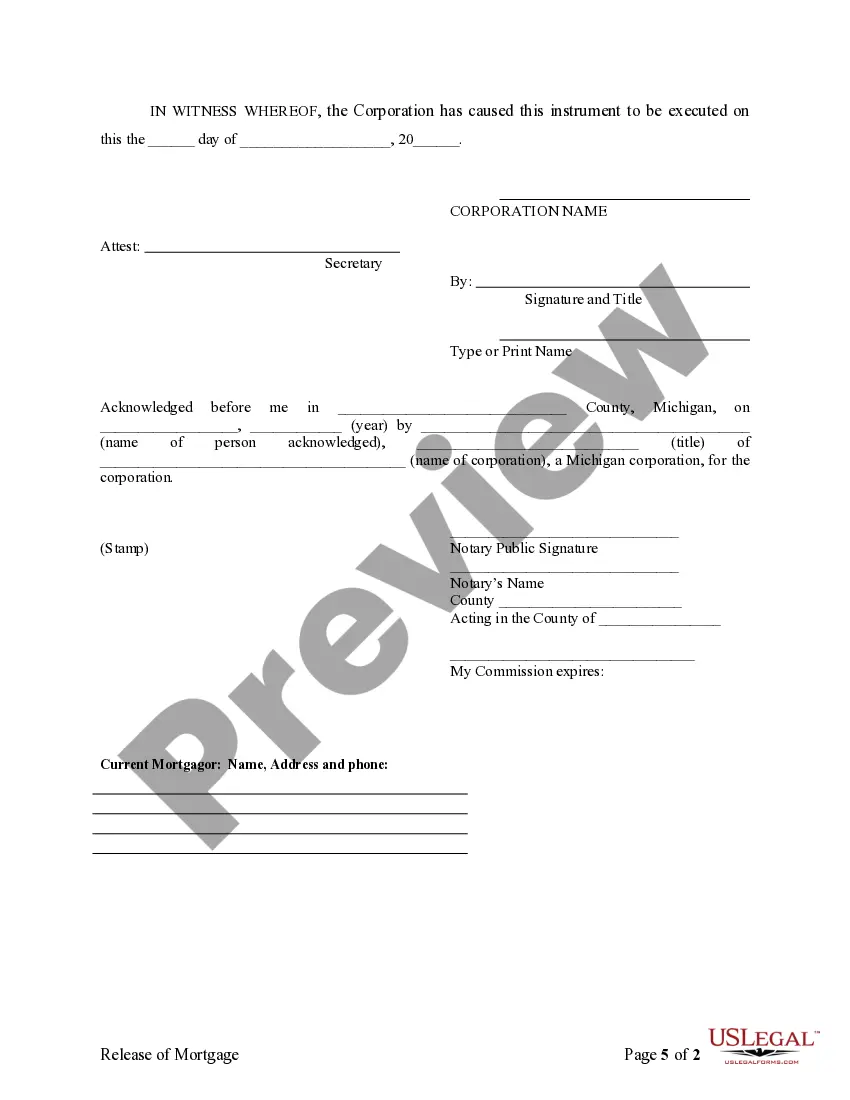

To complete a satisfaction of a mortgage in Michigan, you first need to obtain the original mortgage document. Then, fill out the satisfaction form, which includes details such as the mortgage's recording information and the borrower's name. After completing the form, ensure it is signed by a representative of the corporation that held the mortgage. Finally, file the satisfaction with the county register of deeds to officially release the mortgage.

In some cases, a mortgage may have been sold by the mortgage lender to another financial institution. If sold, the owner of the mortgage at the time of the final payment is responsible for completing the satisfaction of mortgage documentation.

If you can't find out which company took over, call the Federal Deposit Insurance Corporation's (FDIC) lien release number at (888) 206-4662 (toll free) or visit the Closed Banks and Asset Sales section on the FDIC's "Contact Us" page.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.

Go to the county recorder's office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorder's office.