Michigan Satisfaction, Release or Cancellation of Mortgage by Individual

Overview of this form

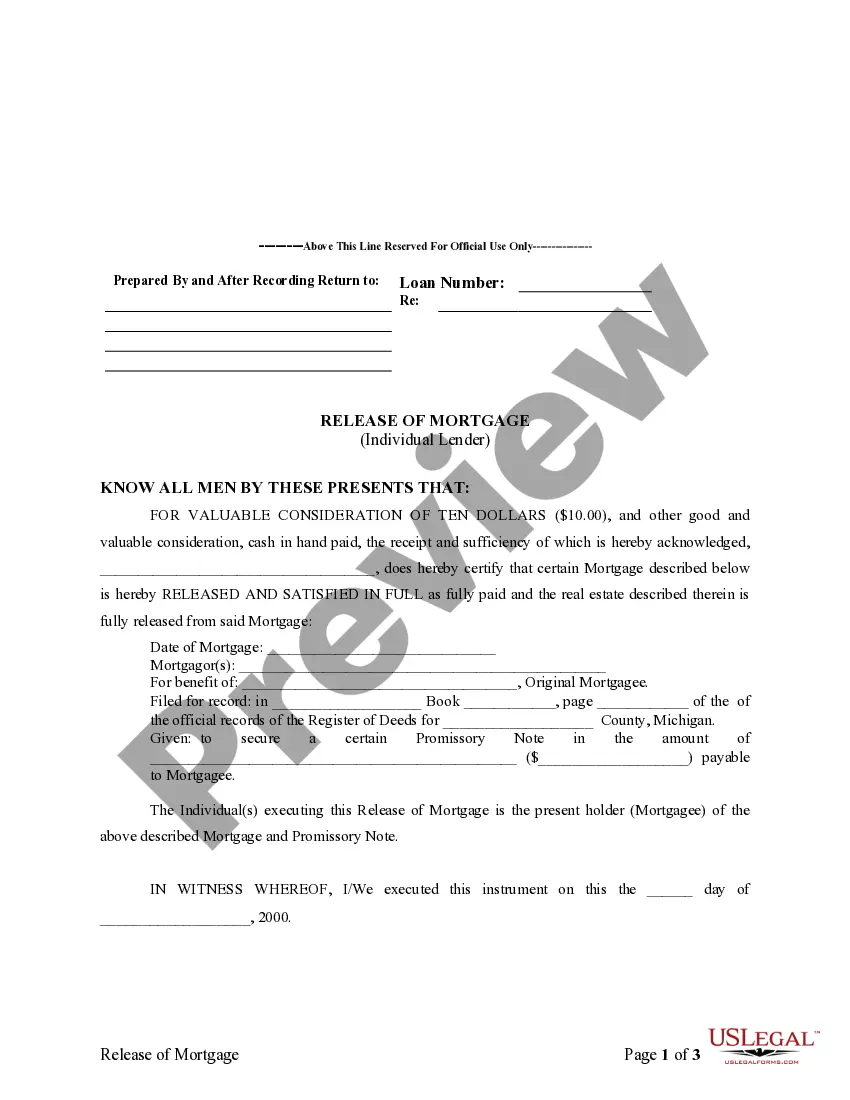

The Satisfaction, Release or Cancellation of Mortgage by Individual is a legal document used to formally release a mortgage on real estate in Michigan. This form serves to confirm that the mortgage has been paid or otherwise satisfied, effectively removing the lien from the property. It is essential for individuals looking to demonstrate that their mortgage obligations have been fulfilled, ensuring that the property is clear of encumbrances related to the mortgage. Unlike other forms related to mortgages, this document specifically addresses the release aspect, catering to individual mortgagors and not lenders.

Key parts of this document

- Identification of the mortgagor(s) and mortgagee.

- Details of the mortgage including dates and amounts.

- Statement confirming satisfaction of the mortgage.

- Signature lines for the releasing party.

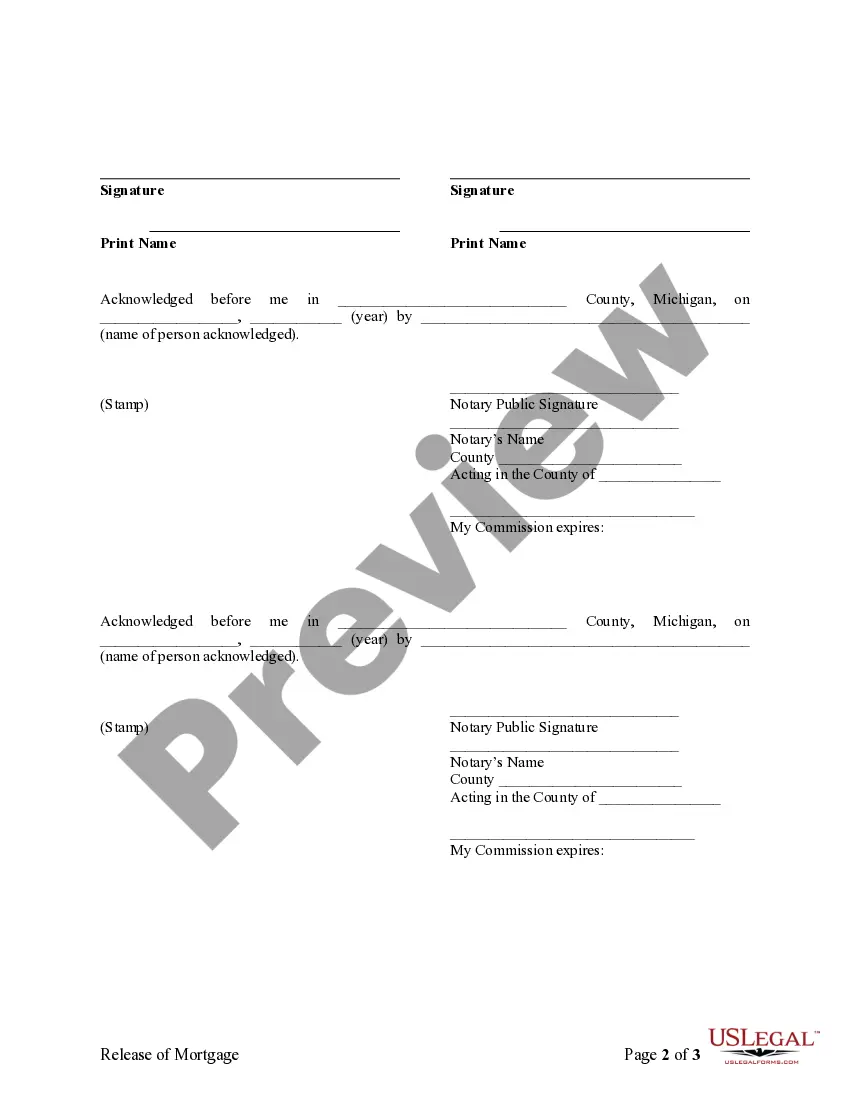

- Notary acknowledgment for validation.

Jurisdiction-specific notes

This form is specifically tailored for the state of Michigan and complies with local statutory laws regarding the release of mortgages. It must be signed in front of a notary public to ensure its legal validity.

Situations where this form applies

This form is needed when an individual has fully paid off their mortgage and wants to release the claim held by the lender on their property. It can also be used in other situations where a mortgage needs to be canceled or released, such as settling a mortgage dispute. Completing this form is essential when transferring property ownership, ensuring that the new owner receives clear title free of any mortgage liens.

Intended users of this form

- Homeowners in Michigan who have satisfied their mortgage obligations.

- Individuals seeking to clear their property's title for sale or transfer.

- Estate representatives managing a deceased person's property with an outstanding mortgage.

How to complete this form

- Identify the mortgagor(s) and the mortgagee in the designated fields.

- Provide the details of the mortgage, including the date, amount, and property address.

- Clearly state the reason for the release of the mortgage.

- Ensure both parties sign the document in the presence of a notary public.

- File the completed form with the local Register of Deeds office to ensure proper recordation.

Is notarization required?

This form must be notarized to be legally valid. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call.

Common mistakes

- Failing to have the form notarized, which can invalidate the release.

- Not providing full details of the mortgage, leading to confusion.

- Incorrectly identifying the property or parties involved.

Why use this form online

- Convenience of accessing the form anytime and anywhere.

- Editability allows users to easily complete the form with accurate information.

- Secure download ensures that your sensitive information remains protected.

Quick recap

- This form is essential for releasing a mortgage in Michigan.

- It must be notarized to ensure validity.

- Completing and filing this form clears any liens on the property.

Form popularity

FAQ

Yes, satisfaction of a mortgage is essentially the same as a lien release. Both documents confirm that the borrower has fulfilled their payment obligations, and the lender no longer has a claim against the property. Understanding this distinction can help you navigate the process more easily. If you need templates or further guidance, US Legal Forms offers a variety of resources to simplify this task.

To write a satisfaction of mortgage letter, start by including your name, address, and contact information at the top. Next, state the purpose of the letter clearly, mentioning the specific mortgage you are referring to. Include details such as the mortgage account number and property address. Finally, sign and date the letter, and consider sending it via certified mail for proof of delivery.

To record a satisfaction of your mortgage in Michigan, first, obtain a Satisfaction of Mortgage form from your lender or a legal document provider. After completing the form, take it to your county's register of deeds office for recording. This process ensures that your mortgage is officially canceled and the lien is removed from your property records. Using the US Legal platform can simplify this process, as it offers easy access to the necessary forms and guidance for a smooth Michigan Satisfaction, Release or Cancellation of Mortgage by Individual.

Filling out a Michigan quit claim deed involves a few straightforward steps. First, you need to gather the necessary information, including the names of the grantor and grantee, the property description, and the consideration amount. Next, clearly write the details on the form, ensuring accuracy to avoid issues later. Lastly, sign the deed in front of a notary public and file it with the county register of deeds to complete the process, particularly if you are also considering the Michigan Satisfaction, Release or Cancellation of Mortgage by Individual.

To acquire a copy of your mortgage satisfaction, contact your lender directly, as they should have a record of the document. You can also visit your local county recorder's office to obtain a copy if it has been filed there. If you find this process confusing, US Legal Forms can provide templates and support to help you secure your copy.

Register the discharge of mortgage Once you return the Discharge Authority form, your bank would prepare a Discharge of Mortgage document. This document must be registered at the Land Titles office.

In some cases, a mortgage may have been sold by the mortgage lender to another financial institution. If sold, the owner of the mortgage at the time of the final payment is responsible for completing the satisfaction of mortgage documentation.

What is Satisfaction of Mortgage? A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.