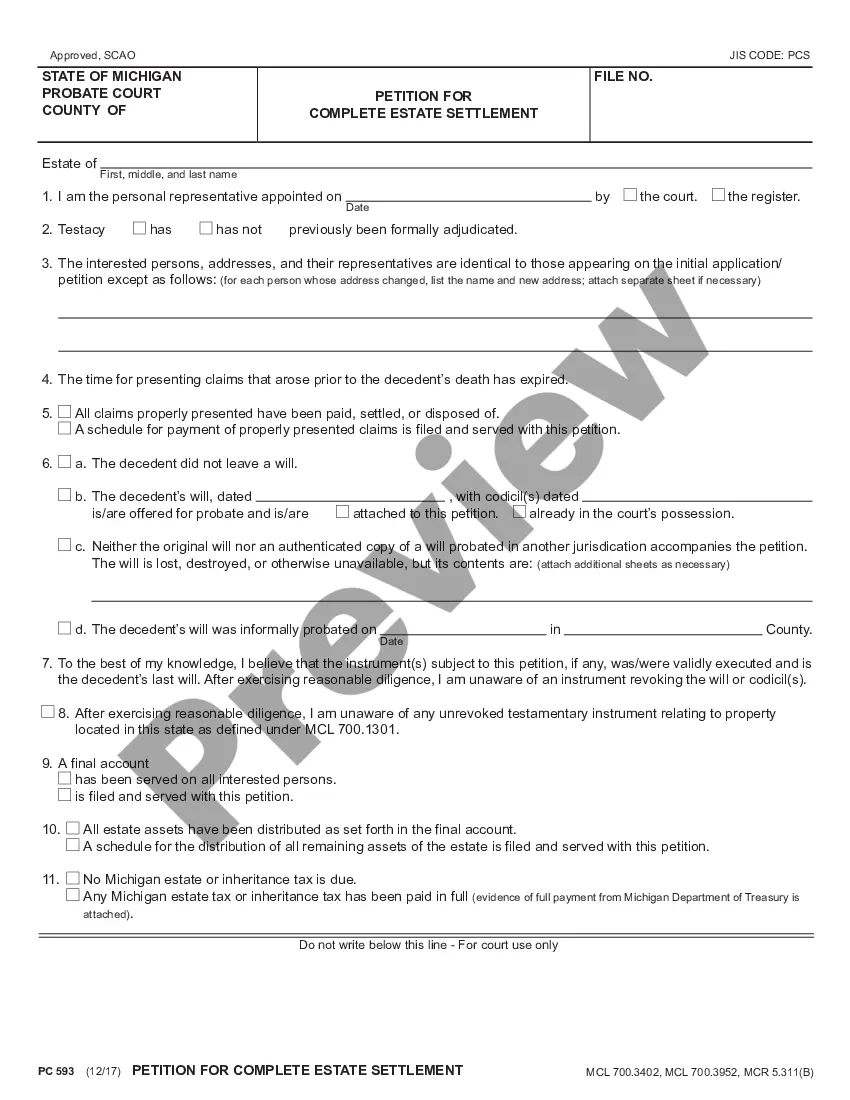

This Order for Complete Estate Settlement is an official document from the Michigan State Court Administration Office, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

Michigan Order for Complete Estate Settlement

Description

How to fill out Michigan Order For Complete Estate Settlement?

Obtain any version from 85,000 legal documents like Michigan Order for Complete Estate Settlement online with US Legal Forms. Each template is crafted and refreshed by state-authorized legal experts.

If you already possess a subscription, Log In. When you're on the form's page, press the Download button and navigate to My documents to retrieve it.

If you haven't subscribed yet, follow the steps outlined below: Check the state-specific prerequisites for the Michigan Order for Complete Estate Settlement you wish to utilize. Review the description and view the sample. Once you are confident that the sample meets your needs, click Buy Now. Select a subscription plan that fits your budget. Set up a personal account. Make payment in one of two available methods: by card or through PayPal. Choose a format to download the document in; two options are available (PDF or Word). Download the document to the My documents section. As soon as your reusable document is ready, print it out or save it to your device.

The platform ensures that you can easily find and obtain the legal documents you need.

- With US Legal Forms, you will consistently have instant access to the appropriate downloadable sample.

- The service provides you access to forms and categorizes them to streamline your search.

- Utilize US Legal Forms to acquire your Michigan Order for Complete Estate Settlement quickly and effortlessly.

Form popularity

FAQ

To settle an estate in Michigan, you need to follow a structured process. First, file the will with the probate court to start the legal proceedings. Next, you must obtain a Michigan Order for Complete Estate Settlement, which allows you to distribute the deceased's assets according to the will or state law. Utilizing platforms like US Legal Forms can simplify this process, providing you with the necessary forms and guidance to ensure a smooth estate settlement.

In Michigan, an executor generally has one year to settle an estate, but this timeframe can vary based on the complexity of the estate and any challenges that may arise. Timely settling is important for the Michigan Order for Complete Estate Settlement, as it helps beneficiaries receive their inheritance efficiently. If you find yourself or your executor needing assistance, turning to US Legal Forms can offer valuable guidance and the correct forms to help expedite the process.

In Michigan, the order of heirs typically follows the state's intestacy laws if a person dies without a will. The primary heirs include the spouse and children, followed by parents, siblings, and more distant relatives. Understanding this order is crucial when dealing with the Michigan Order for Complete Estate Settlement, as it helps ensure that assets are distributed according to the law. Utilizing resources from US Legal Forms can simplify this process and provide you with necessary legal forms.

In Michigan, a settlement agreement must be in writing and signed by the parties involved. It must clearly outline the terms agreed upon, including any division of assets or responsibilities. For estate matters, particularly with a Michigan Order for Complete Estate Settlement, it is important for the agreement to comply with state laws to ensure enforceability. Utilizing a platform like US Legal Forms can help you create a compliant settlement agreement tailored to your specific situation.

To close the estate you must file a specific document with the court that says you finished administering the estate and did what you were required to do as the personal representative. You may also need to get receipts from the estate beneficiaries and make a final accounting.

Giving away your assets before you die (directly to others, or by putting your assets into trusts) Designating beneficiaries (other than your estate) on your registered investments, life insurance policies and other investments held through life insurance companies, and. Holding your assets jointly with others.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

Probate court proceedings are necessary only if the deceased person owned assets in his or her name alone.Examples of common assets that do not need to go through probate include: assets the deceased person owned in joint tenancy form, which pass automatically to the surviving owner.

The estate must be open for at least five months. Required notice to creditors must be published at least four months before closing. The inventory fee must be paid. Any estate/inheritance taxes must be paid (proof of payment required)

How do you file for probate in Michigan? In Michigan, probate is handled by the probate court in which the decedent resided in. Once you determine whether formal or informal probate is required, you must file a petition with the probate court to get the process started.