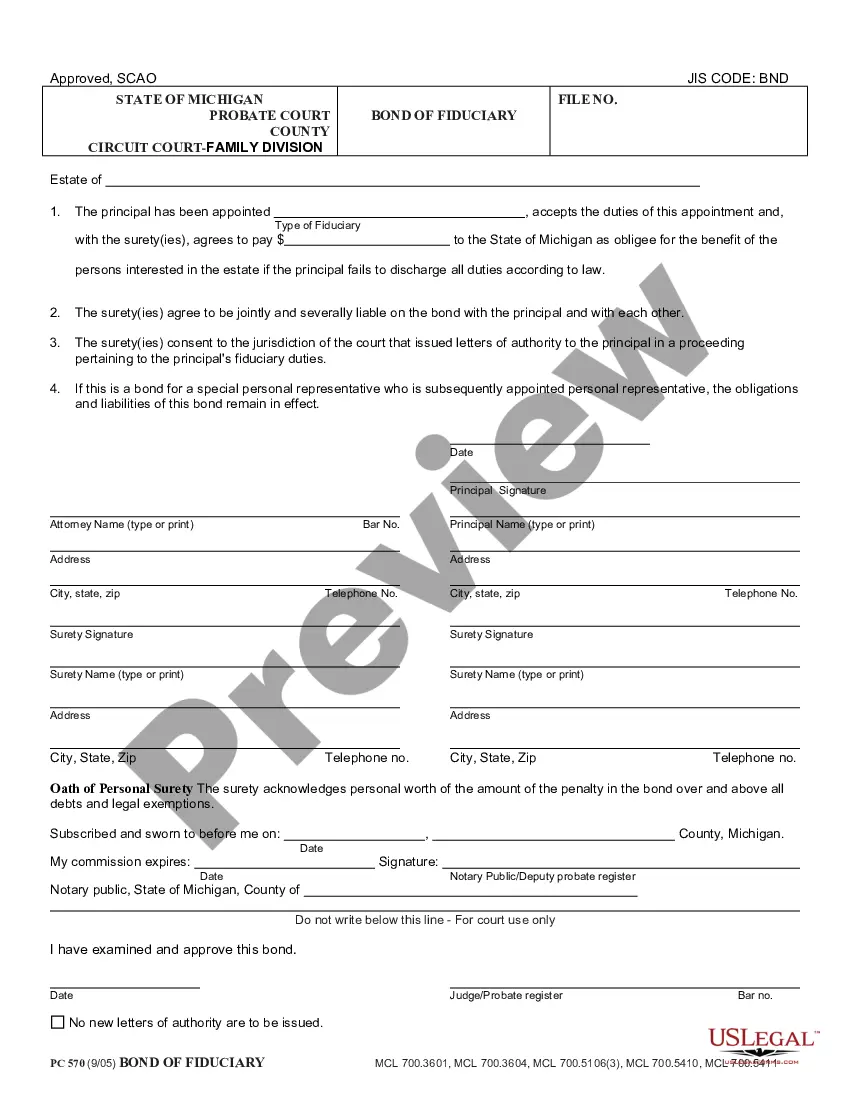

Michigan Account of Fiduciary, Short is a type of trust account set up by a fiduciary (such as a bank, trust company, or lawyer) in Michigan. The purpose of the account is to hold assets for the benefit of a beneficiary, such as a minor child, who cannot manage the assets on their own. The trust assets are managed by the fiduciary according to the terms of a trust agreement, which is established by the granter (the person setting up the trust). The fiduciary is obligated to act in the beneficiary’s best interest and use the assets to provide for the beneficiary’s needs. Michigan Account of Fiduciary, Short is a type of trust account that is set up for a specific period of time and is intended to provide a short-term solution for the beneficiary. This type of trust account may be used to provide for the beneficiary’s basic needs, such as food, shelter, and clothing, until the beneficiary is able to manage the assets on their own. There are two types of Michigan Account of Fiduciary, Short: revocable and irrevocable. A revocable trust allows the granter to make changes to the trust agreement and to revoke the trust at any time. An irrevocable trust is a more permanent arrangement that cannot be changed or revoked.

Michigan Account of Fiduciary, Short

Description

How to fill out Michigan Account Of Fiduciary, Short?

Drafting official documents can be quite a hassle if you lack accessible fillable templates. With the US Legal Forms online collection of formal documents, you can trust the blanks you find, as all of them adhere to federal and state regulations and are reviewed by our experts.

Acquiring your Michigan Account of Fiduciary, Short from our service is as easy as pie. Previously registered users with an active subscription simply need to Log In and click the Download button once they locate the right template. Later, if necessary, users can retrieve the same document from the My documents section of their account. However, even if you are new to our service, registering with a valid subscription will only take a few moments. Here’s a brief guideline for you.

Haven’t you utilized US Legal Forms yet? Subscribe to our service today to obtain any formal document swiftly and effortlessly whenever you need to, and maintain your paperwork organized!

- Document compliance verification. You should thoroughly review the content of the form you desire and confirm whether it meets your requirements and adheres to your state laws. Previewing your document and assessing its overall description will assist you in doing just that.

- Alternative search (optional). If there are any discrepancies, explore the library using the Search tab at the top of the page until you locate a suitable blank, and click Buy Now once you find the one you wish.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, Log In and choose your most appropriate subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Michigan Account of Fiduciary, Short and click Download to save it on your device. Print it to fill out your documents manually, or use a feature-rich online editor to create an electronic version more swiftly and effectively.

Form popularity

FAQ

In Michigan, individuals entitled to a copy of a will include the named beneficiaries and the personal representative of the estate. If a will has been filed with the probate court, any interested party can request a copy for review. Understanding these rights is crucial when establishing a Michigan Account of Fiduciary, Short, because it directly impacts estate administration. US Legal Forms offers resources to assist you through this process effectively.

In Michigan, to utilize a small estate affidavit, you must meet specific requirements. The total value of the estate should not exceed $25,000, excluding certain items like real estate. You need to wait at least 28 days after the death of the individual before filing the affidavit. US Legal Forms provides the necessary templates and guidance to help you create a Michigan Account of Fiduciary, Short, streamlining the process.

The $25.00 filing fee and the $12.00 certified copy fee). If the decedent left a Last Will and Testament, it WOULD NOT be admitted to Probate by filing a Petition and Order for Assignment.

Probate in Michigan can take about 7 months, whether it is supervised or unsupervised. You can expect a longer probate period in certain circumstances. These can include the size of the estate, length of time it takes to locate a will, personal representative, or heirs, disputes with creditors, and will contests.

How do you start the Probate process in Michigan? Probate must go through the county Probate Court in which the decedent resided at the time of their death. Once you determine whether you need a formal or informal probate proceeding, you need to file a petition with the county Probate Court to get the process started.

7. If the estate is not settled within a year of the first personal representative's appointment, file a Notice of Continued Administration with the court stating why the estate must remain open.

Ancillary probate normally requires a lawyer in the state in which the probate is being executed in order to complete. Real Estate Probate ? If a property is valued below $22,000, a spouse or any surviving heirs can petition a probate court to have the estate probated.

If you are serving as the personal representative (executor) of someone's estate, you might be wondering how quickly after their death you must file probate. Unlike some states, Michigan does not have a required filing deadline for a probate case.

The personal representative is under a duty to settle and distribute the estate "as expeditiously and efficiently as is consistent with the best interests of the estate" and "except as otherwise specified or ordered in regard to a supervised personal representative, without adjudication, order or direction of the court

A Michigan Personal Representative is responsible for: Carrying out the decedent's wishes regarding the distribution of the estate. Locating the decedent's assets. Paying creditors. Preparing an Inventory. Paying any estate expenses. Closing the estate.