A Michigan Bond of Fiduciary is a type of surety bond required by the Michigan Department of Treasury. It is required by individuals who are appointed as a fiduciary in Michigan, such as an executor of an estate, a receiver, a guardian, a conservator, a trustee, or a power of attorney. The bond guarantees that the fiduciary will fulfill their duties according to the laws of Michigan. There are three types of Michigan Bond of Fiduciary: • Fiduciary Bond: This bond is required for fiduciaries who are responsible for the management of the estate of a deceased individual. • Conservator Bond: This bond is required for conservators appointed by a court to manage the property of a minor or incapacitated adult. • Trustee Bond: This bond is required for trustees appointed by a court to manage the assets of a trust.

Michigan Bond of Fiduciary

Description

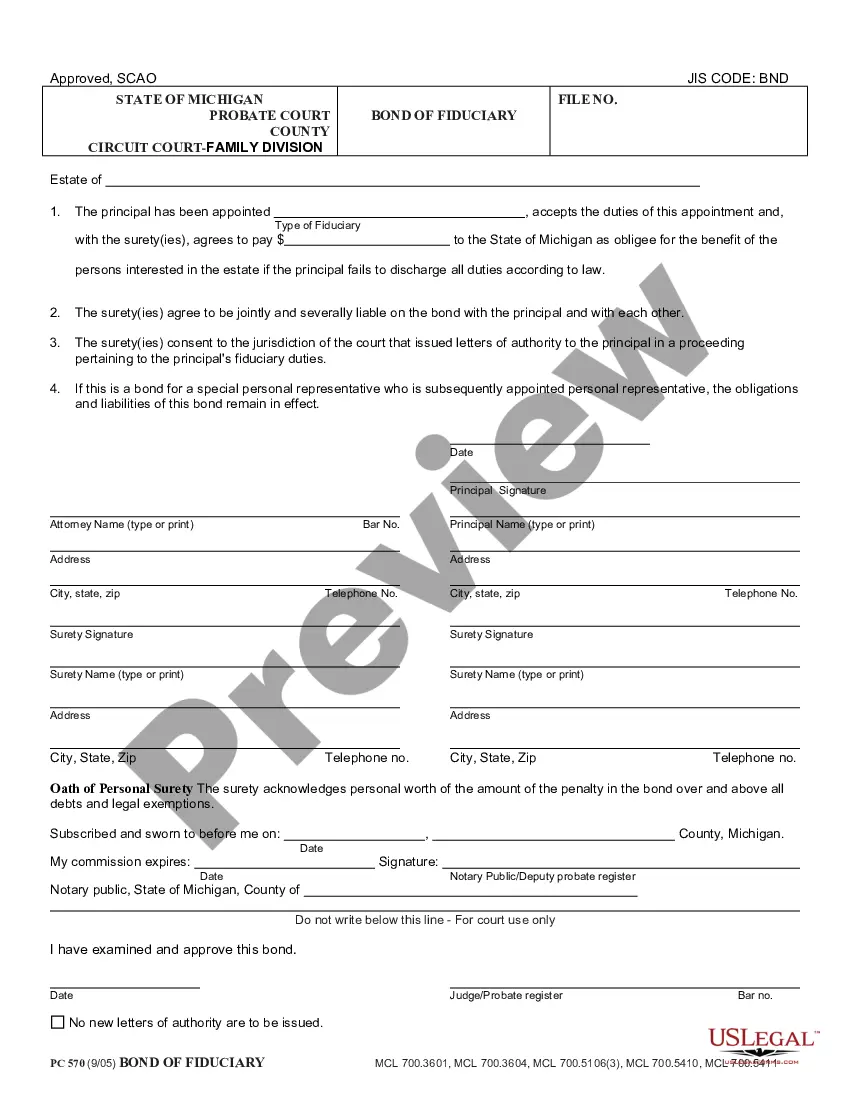

How to fill out Michigan Bond Of Fiduciary?

How much time and resources do you frequently expend on drafting formal documentation.

There’s a superior method to obtain such forms than employing legal professionals or spending countless hours scouring the internet for an adequate template.

Register for an account and pay for your subscription. Payments can be made via credit card or through PayPal - our service is entirely secure for that.

Download your Michigan Bond of Fiduciary onto your device and complete it on a printed hard copy or electronically.

- US Legal Forms is the leading online repository that provides expertly crafted and validated state-specific legal documents for any purpose, such as the Michigan Bond of Fiduciary.

- To obtain and fill out a suitable Michigan Bond of Fiduciary template, follow these straightforward instructions.

- Examine the form content to ensure it meets your state’s requirements. To do this, review the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, find another one using the search tab at the top of the page.

- If you already possess an account with us, Log In and download the Michigan Bond of Fiduciary. If not, move to the next steps.

- Hit Buy now once you identify the right document. Select the subscription plan that best fits your needs to access our library’s complete services.

Form popularity

FAQ

Yes, fiduciaries are typically required to obtain a bond to ensure accountability for their decisions and actions. This bonding process provides financial security for the beneficiaries, ensuring that funds are managed appropriately. In Michigan, a bond of fiduciary is crucial for maintaining trust and protection over the assets managed. It is essential to understand this requirement when choosing a fiduciary for your estate planning.

Fiduciary law in Michigan governs the responsibilities of individuals entrusted with managing another person's assets. This includes the duty to act in the best interests of the beneficiaries and uphold transparency in financial dealings. The Michigan bond of fiduciary plays a vital role in ensuring that fiduciaries abide by these laws and protect the interests of those they serve. Familiarizing yourself with these laws can enhance your confidence in managing estate-related matters.

A fiduciary bond is a type of insurance that protects beneficiaries from potential misconduct by the fiduciary. When a fiduciary is appointed, they secure a bond to guarantee their actions comply with legal requirements and uphold their duties. This bond is essential in Michigan, as it provides an extra layer of security for all parties involved. Understanding the function of a Michigan bond of fiduciary can clarify its importance in your financial planning.

A fiduciary holds significant responsibilities, which can lead to potential disadvantages. For instance, if a fiduciary fails to perform duties properly, they may face personal liability. This is where a Michigan bond of fiduciary becomes important, as it provides financial protection for the beneficiaries. It's crucial to choose a reliable fiduciary to minimize risks and maintain trust in the arrangement.

To avoid probate in Michigan, consider establishing a revocable living trust. This allows your assets to transfer directly to your beneficiaries without going through the probate process. Additionally, using a Michigan bond of fiduciary can help ensure that any appointed fiduciary handles the trust's assets responsibly. Making informed decisions about your estate planning can save time and reduce costs for your loved ones.

A fiduciary deed in Michigan is a legal document used to transfer property from a deceased person’s estate to a beneficiary or heir. This type of deed is often necessary when the property is part of probate proceedings. When filing a fiduciary deed, you may also need a Michigan Bond of Fiduciary, which provides assurance that the executor handles the transfer according to state laws. For assistance with fiduciary deeds, consider using uslegalforms for clear instructions and required documentation.

A fiduciary bond is a type of surety bond required by the court to ensure that a fiduciary, such as an executor or administrator, acts in the best interests of the estate or those it represents. For example, if someone is appointed to manage an estate during probate, they may need a Michigan Bond of Fiduciary to guarantee their compliance with legal obligations. This bond protects beneficiaries and ensures accountability.

To transfer property after a death in Michigan, you will typically need to start by determining whether the estate must go through probate. If it does, you will file a petition with the probate court to open the estate. The court may require a Michigan Bond of Fiduciary, which ensures that the executor will manage the estate responsibly. Using uslegalforms can simplify the process by providing the necessary forms and guidance.

To obtain letters of testamentary in Michigan, you must first file the decedent's will with the probate court. After filing, you will petition the court to appoint you as the executor. Once the court approves, you will receive the letters of testamentary, granting you the authority to manage the estate. Using US Legal Forms, you can find all the required forms and detailed instructions to streamline this process effectively.

A fiduciary bond requirement ensures that a fiduciary, such as a guardian or executor, will manage assets honestly and responsibly. In Michigan, this legal bond serves as a safety net for the beneficiaries or heirs, protecting them from any potential mismanagement. If you need assistance with securing a Michigan Bond of Fiduciary, US Legal Forms can provide you with all the necessary resources and forms to ensure compliance.