This package is an important tool for complying with foreclosure procedures in Michigan. Included in this package are the following forms:

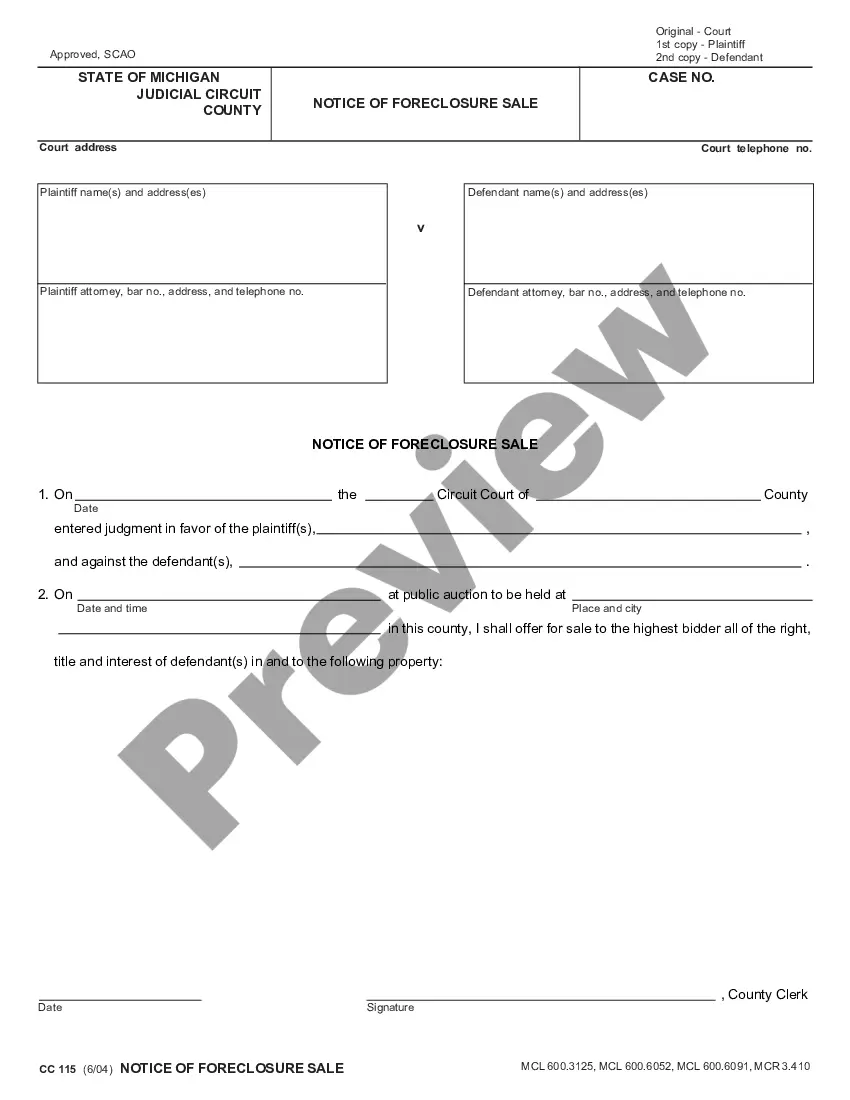

1. Michigan Notice of Sale in Foreclosure

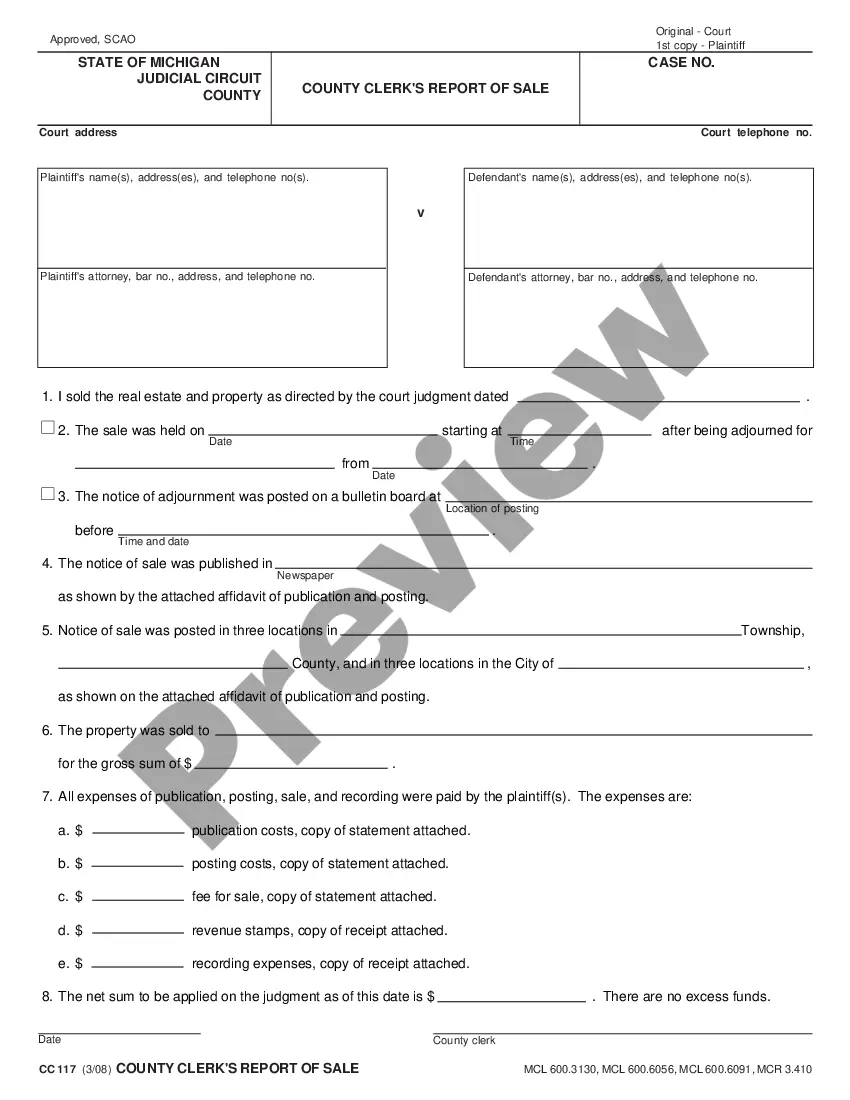

2. Michigan Report of Sale in Foreclosure

3. Clerk's Certificate Of Sale Of Real Estate Pursuant To Judgment

4. Summary of Michigan Law and Tenants' Rights in Foreclosure

5. USLegal Guide to Eviction in Foreclosure

Purchase of this package is a savings of almost 50% compared to purchase of the forms individually!