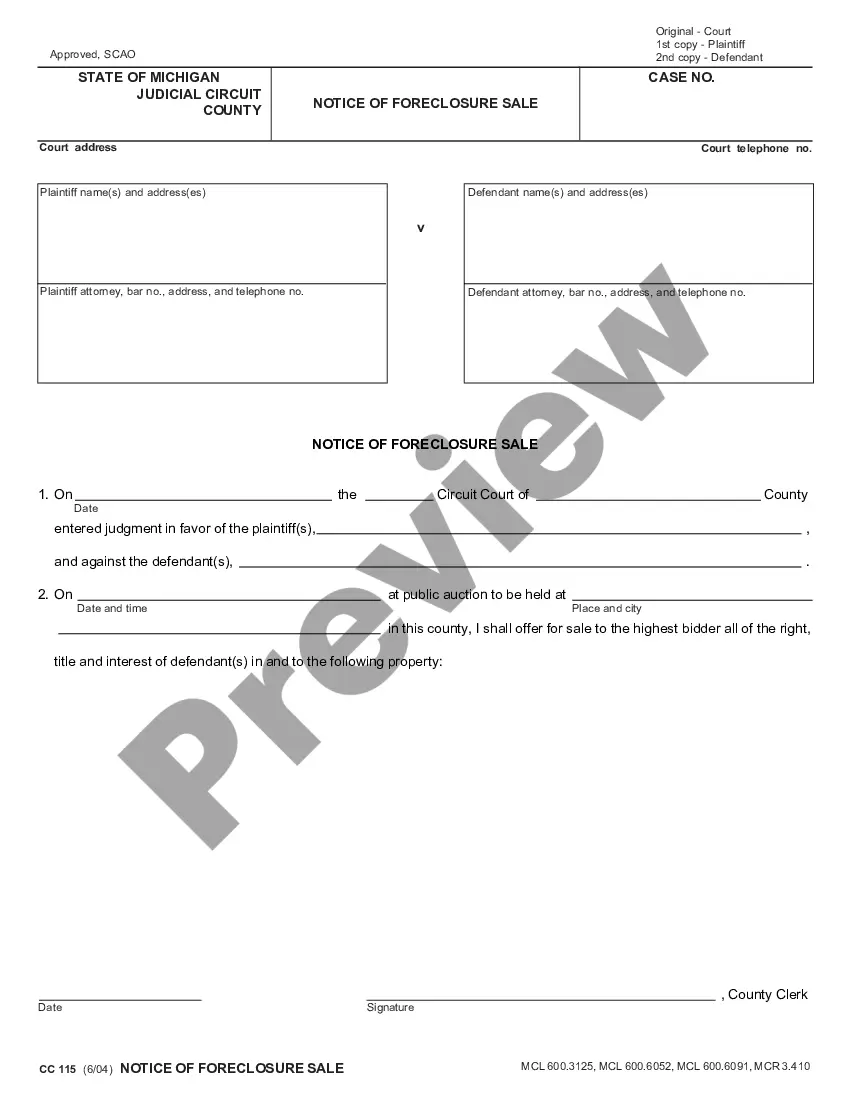

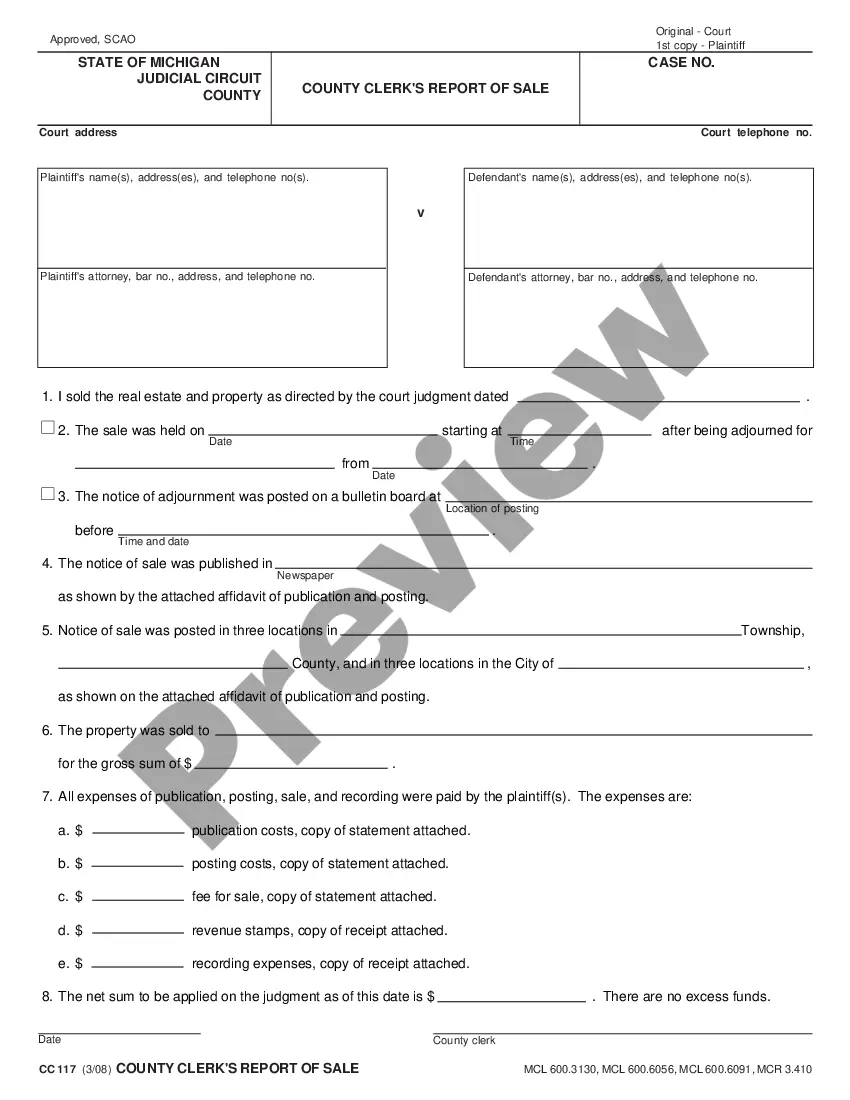

This is an official state form to be used when selling a house in foreclosure. An affidavit of publication and affidavit of posting are included.

Michigan Notice of Sale in Foreclosure

Description

How to fill out Michigan Notice Of Sale In Foreclosure?

Obtain any template from 85,000 legal documents like Michigan Notice of Sale in Foreclosure available online with US Legal Forms. Each template is created and revised by state-licensed attorneys.

If you have a membership, sign in. Once you're on the form’s page, hit the Download button and navigate to My documents to access it.

If you haven't subscribed yet, follow the guidelines below.

With US Legal Forms, you will consistently have immediate access to the suitable downloadable template. The platform provides you with access to documents categorized to ease your search. Utilize US Legal Forms to acquire your Michigan Notice of Sale in Foreclosure swiftly and conveniently.

- Review the state-specific criteria for the Michigan Notice of Sale in Foreclosure you wish to utilize.

- Examine the description and preview the sample.

- When you're confident the sample suits your needs, simply click Buy Now.

- Select a subscription plan that fits your financial plan.

- Establish a personal account.

- Complete payment in one of two acceptable methods: by card or through PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable form is downloaded, print it or store it on your device.

Form popularity

FAQ

In Michigan, the foreclosure process typically begins with a default on your mortgage payments. After a missed payment, your lender may send a notice and wait for 90 days before initiating foreclosure proceedings. Following this period, a Michigan Notice of Sale in Foreclosure is issued, detailing the sale date and other relevant information. Understanding this timeline is critical for homeowners to explore their options and protect their rights.

Yes, a home can be sold during foreclosure in Michigan, often through a sheriff's sale. This process allows the lender to recover funds from the mortgage default by selling the property at public auction. If you're facing this situation, it's important to consult resources that detail the Michigan Notice of Sale in Foreclosure, and platforms like US Legal Forms can provide valuable assistance in ensuring you understand your options.

In Michigan, a foreclosure auction takes place after a property has gone through the necessary legal processes. At the auction, a representative of the lender presents the property, and interested bidders can place offers. Understanding how this auction process unfolds is essential, as it relates directly to the Michigan Notice of Sale in Foreclosure, which details the specific terms and conditions of the sale.

To begin the foreclosure, the lender's attorney publishes a notice of sale once a week for four successive weeks in a newspaper published in the county in which the property is located. If no newspaper is published in the county, the notice must be published in an adjacent county.

Phase 1: Payment Default. Phase 2: Notice of Default. Phase 3: Notice of Trustee's Sale. Phase 4: Trustee's Sale. Phase 5: Real Estate Owned (REO) Phase 6: Eviction. The Bottom Line.

The automatic stay will stop the foreclosure in its tracks. The bank may file a motion for relief from the stay. Benefits of a Chapter 13 bankruptcy.

If a foreclosure sale is scheduled to occur in the next day or so, the best way to stop the sale immediately is by filing for bankruptcy. The automatic stay will stop the foreclosure in its tracks. Once you file for bankruptcy, something called an "automatic stay" immediately goes into effect.

Negotiate With Your Lender. If you are having financial difficulties, the worst thing that you can do is bury your head in the sand. Request a Forbearance. Modify Your Loan. Make a Claim. Get a Housing Counselor. Declare Bankruptcy. Use A Foreclosure Defense Strategy. Make Them Produce The Not.

Gather your loan documents and set up a case file. Learn about your legal rights. Organize your financial information. Review your budget. Know your options. Call your servicer. Contact a HUD-approved housing counselor.

The auction notice, or Notice of Sale, is your final notice that the lender intends to sell the property at auction. The county prints the location, time and date of the trustee's auction on the Notice of Sale. It also contains the name and contact information for the trustee in charge of the sale.