Michigan Summary Administration Package for Small Estates

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Summary Administration Package for Small Estates: A legal process in the United States designed to simplify the settlement of smaller estates typically under specific asset value thresholds, which varies by state. This procedure bypasses the longer process of regular probate, making it faster and less expensive for the beneficiaries.

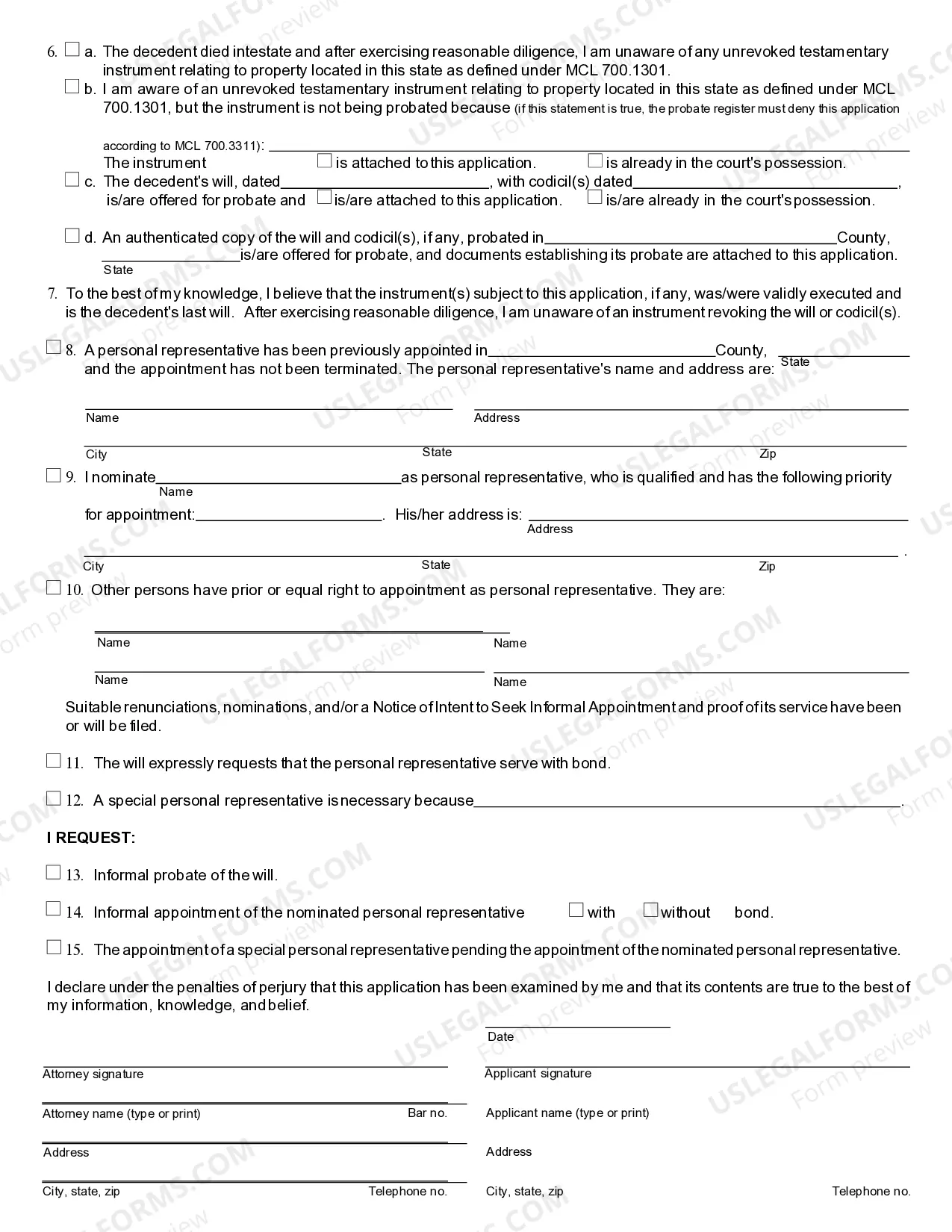

Step-by-Step Guide

- Assess Eligibility: Verify if the estate qualifies as a 'small estate' under your states law. Typically, this includes checking the total asset value and the type of assets held.

- Collect Required Documents: Gather necessary documents such as the death certificate, will (if applicable), and list of assets and debts.

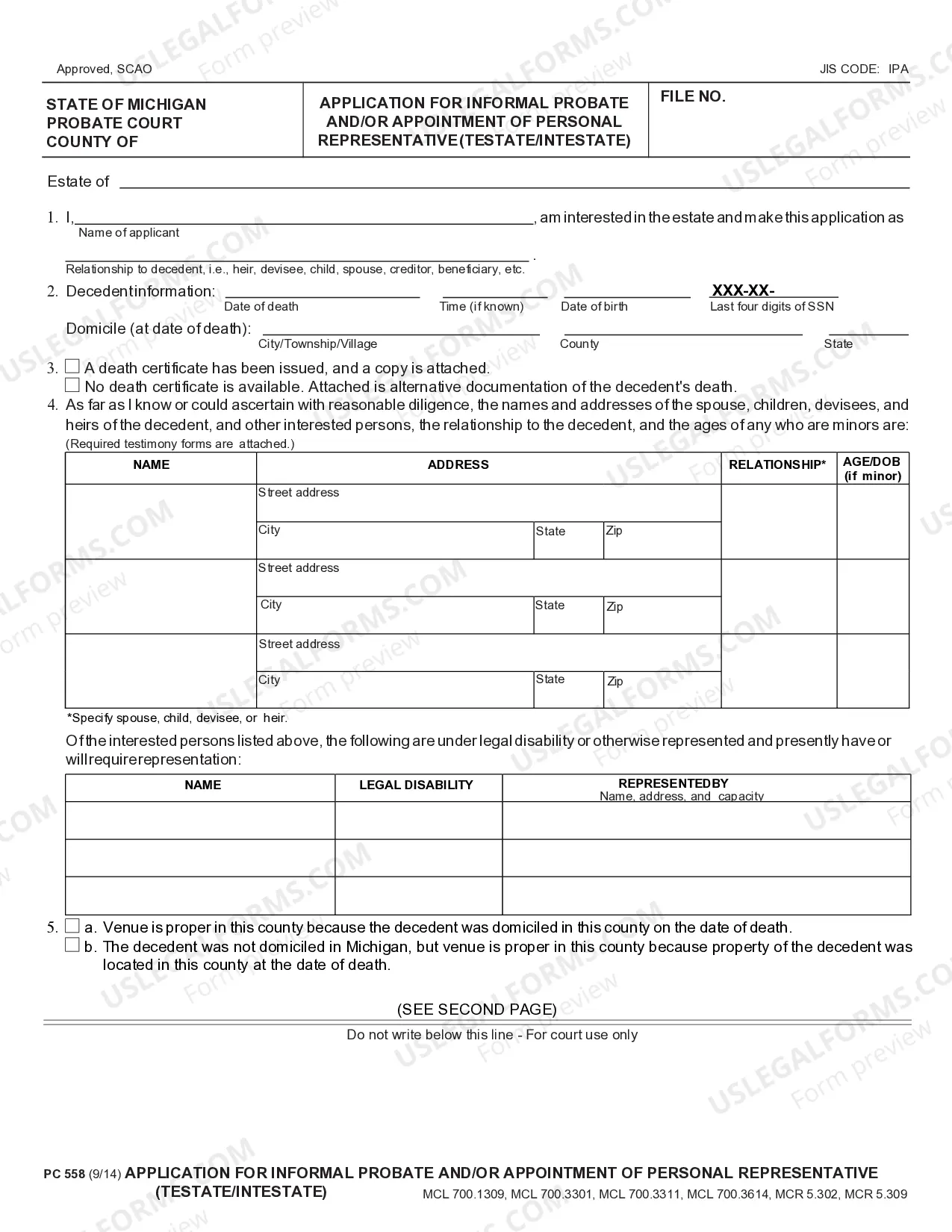

- File Petition: Complete and file a petition for summary administration with the probate court in the county where the deceased resided.

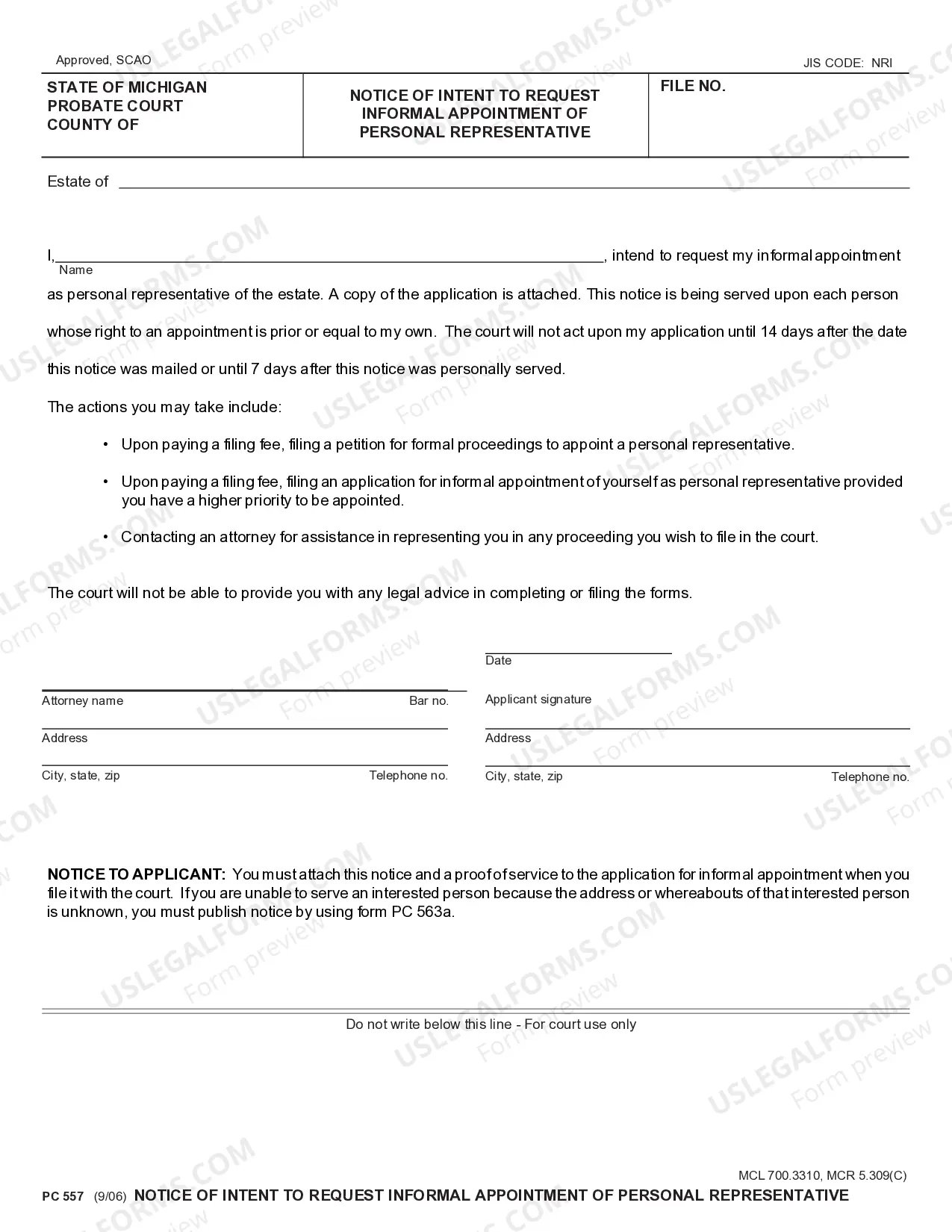

- Notify Interested Parties: Inform all potential beneficiaries and creditors of the estate about the ongoing proceedings, if required by state law.

- Distribute Assets: Once approved, distribute the estate's assets according to the will or state intestacy laws.

Risk Analysis

- Legal Risks: Incorrect filing or misunderstanding of state laws may expose the process to legal challenges from disgruntled beneficiaries or creditors.

- Financial Risks: Potential undervaluation of assets could result in financial losses for the beneficiaries.

- Time Delays: Errors in filing or in the notice to creditors and beneficiaries can lead to significant time delays, extending even a simplified process like summary administration.

Pros & Cons

Pros:- Reduced legal fees and court costs.

- Faster distribution of assets to beneficiaries.

- Less paperwork and fewer court appearances.

- Limited by the total value or type of assets, not applicable to all estates.

- Potential for disputes if not all beneficiaries agree on proceeding summarily.

- May not prevent all claims against the estate post-distribution.

Common Mistakes & How to Avoid Them

- Incorrect Assessment of Estate Size: Always consult a legal expert to accurately determine the estate's qualification for summary administration.

- Failing to Notify Creditors: Proper notification helps avoid future claims and legal complications. Ensure all required notifications are made.

- Overlooking Assets: Create a comprehensive list of assets with professional assistance to prevent future disputes or financial discrepancies.

FAQ

Q: What is the typical asset threshold for a small estate to qualify for summary administration?A: The threshold varies by state, generally ranging from $50,000 to $150,000.Q: Can summary administration be used if there is a will?A: Yes, summary administration can be applied whether or not the deceased had a will, as long as other qualifying criteria are met.

How to fill out Michigan Summary Administration Package For Small Estates?

Obtain any template from 85,000 legal documents such as the Michigan Summary Administration Package for Small Estates available online with US Legal Forms.

Each template is designed and revised by state-certified lawyers.

If you already possess a subscription, Log In. When you reach the form’s page, hit the Download button and navigate to My documents to gain access to it.

When your reusable template is ready, print it out or save it to your device. With US Legal Forms, you will consistently have instant access to the relevant downloadable sample. The platform grants you access to forms and categorizes them to facilitate your search. Utilize US Legal Forms to acquire your Michigan Summary Administration Package for Small Estates swiftly and effortlessly.

- Review the state-specific criteria for the Michigan Summary Administration Package for Small Estates you intend to utilize.

- Examine the description and preview the template.

- Once you are sure the sample is suitable for your needs, simply click Buy Now.

- Select a subscription option that aligns well with your financial plan.

- Establish a personal account.

- Make payment using one of two convenient methods: by credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents tab.

Form popularity

FAQ

If the estate is less than R250,000, you may still qualify for the Michigan Summary Administration Package for Small Estates. This package simplifies the probate process, allowing for faster distribution of assets without extensive legal procedures. It is important to follow the correct filing methods and requirements outlined by the state, and platforms like US Legal Forms can provide valuable guidance to streamline this process.

Filing a small estate affidavit in Michigan involves several steps. First, you complete the necessary forms provided in the Michigan Summary Administration Package for Small Estates. Next, submit the affidavit to the probate court where the decedent lived, along with a certified copy of the death certificate. Utilizing resources from platforms like US Legal Forms can simplify the process and ensure all documentation meets legal standards.

Yes, anyone can fill out a small estate affidavit in Michigan, but it is essential to understand the legal requirements involved. The Michigan Summary Administration Package for Small Estates outlines specific eligibility criteria including that the total value of the estate must be within a certain limit. It is often helpful to seek guidance from a legal professional or use reliable platforms like US Legal Forms to ensure that the affidavit is completed correctly and adheres to state laws.

A motion for summary disposition in Michigan allows a party to request the court to rule in their favor without a full trial. This motion argues that there are no genuine disputes over material facts, which could affect the outcome of the case. In the context of managing estates, such motions might relate to the proper handling and distribution of assets under the Michigan Summary Administration Package for Small Estates. Overall, this can simplify legal proceedings and expedite the resolution of estate-related issues.

While a lawyer is not strictly necessary to create a small estate affidavit in Michigan, having one can provide valuable insights and assistance. A legal professional can help ensure that your affidavit meets all state requirements and can facilitate smoother transactions. The Michigan Summary Administration Package for Small Estates is designed to make this process accessible, even if you choose to proceed without an attorney.

No, in most cases, a small estate affidavit does not need to be filed with the court in Michigan. Instead, the affidavit is typically presented to the institutions holding the decedent's assets. However, a well-prepared Michigan Summary Administration Package for Small Estates will guide you through the process and is essential for interacting with those institutions.

Yes, in Michigan, all affidavits must be notarized to be legally valid. Notarization verifies the authenticity of signatures and ensures that the document will be reputable in court if needed. By utilizing the Michigan Summary Administration Package for Small Estates, you can ensure that all forms are properly notarized according to state regulations.

Writing a small estate affidavit requires a clear outline of essential details, including the decedent's information, details of the estate, and identification of heirs. It's important to follow Michigan's legal format and include all required statements. Consider using the Michigan Summary Administration Package for Small Estates; this package simplifies the writing process and provides necessary templates.

In Michigan, to utilize a small estate affidavit, the estate must not exceed $24,000. Additionally, the affidavit needs to meet specific legal criteria, including information about the deceased, debts, and requested assets. The Michigan Summary Administration Package for Small Estates offers a comprehensive guide to help you ensure compliance with these requirements.

Yes, in Michigan, an executor is required to provide an account of transactions to the beneficiaries. This accounting helps maintain transparency and builds trust among all parties involved. Using the Michigan Summary Administration Package for Small Estates can streamline this process, ensuring all necessary documents are properly organized.