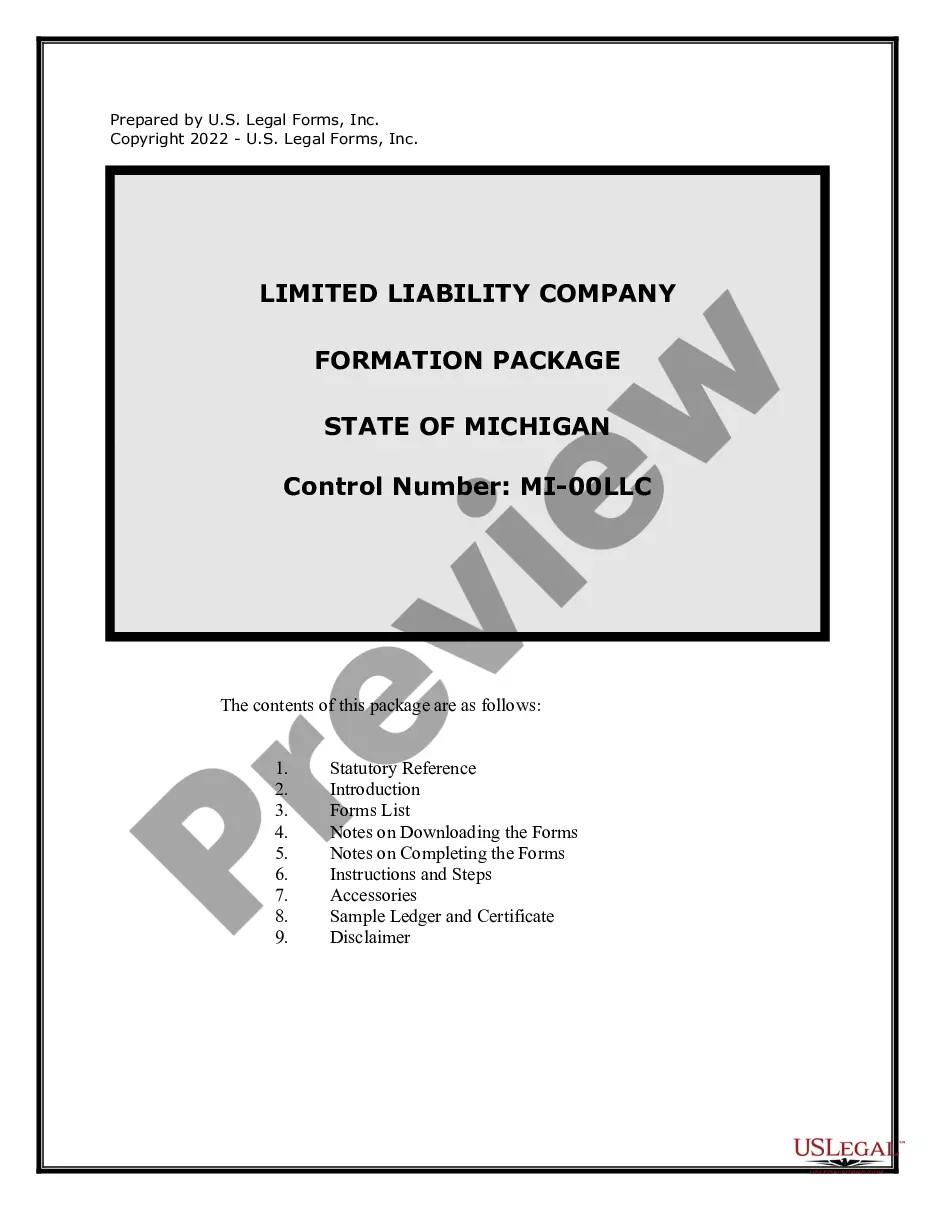

Michigan Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out Michigan Dissolution Package To Dissolve Limited Liability Company LLC?

Get any template from 85,000 legal documents such as Michigan Dissolution Package to Dissolve Limited Liability Company LLC online with US Legal Forms. Every template is drafted and updated by state-certified legal professionals.

If you already have a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to access it.

If you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Michigan Dissolution Package to Dissolve Limited Liability Company LLC you would like to use.

- Read description and preview the template.

- Once you are sure the template is what you need, click Buy Now.

- Choose a subscription plan that actually works for your budget.

- Create a personal account.

- Pay out in one of two suitable ways: by bank card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- When your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have immediate access to the proper downloadable template. The service provides you with access to forms and divides them into groups to simplify your search. Use US Legal Forms to obtain your Michigan Dissolution Package to Dissolve Limited Liability Company LLC easy and fast.

Form popularity

FAQ

Yes, notifying the IRS is necessary when you close your LLC. You will need to file a final tax return and check the box indicating that it is your final return. Using the Michigan Dissolution Package to Dissolve Limited Liability Company LLC provides guidance on handling this aspect correctly. Proper notification prevents complications later and ensures that your business closure goes smoothly.

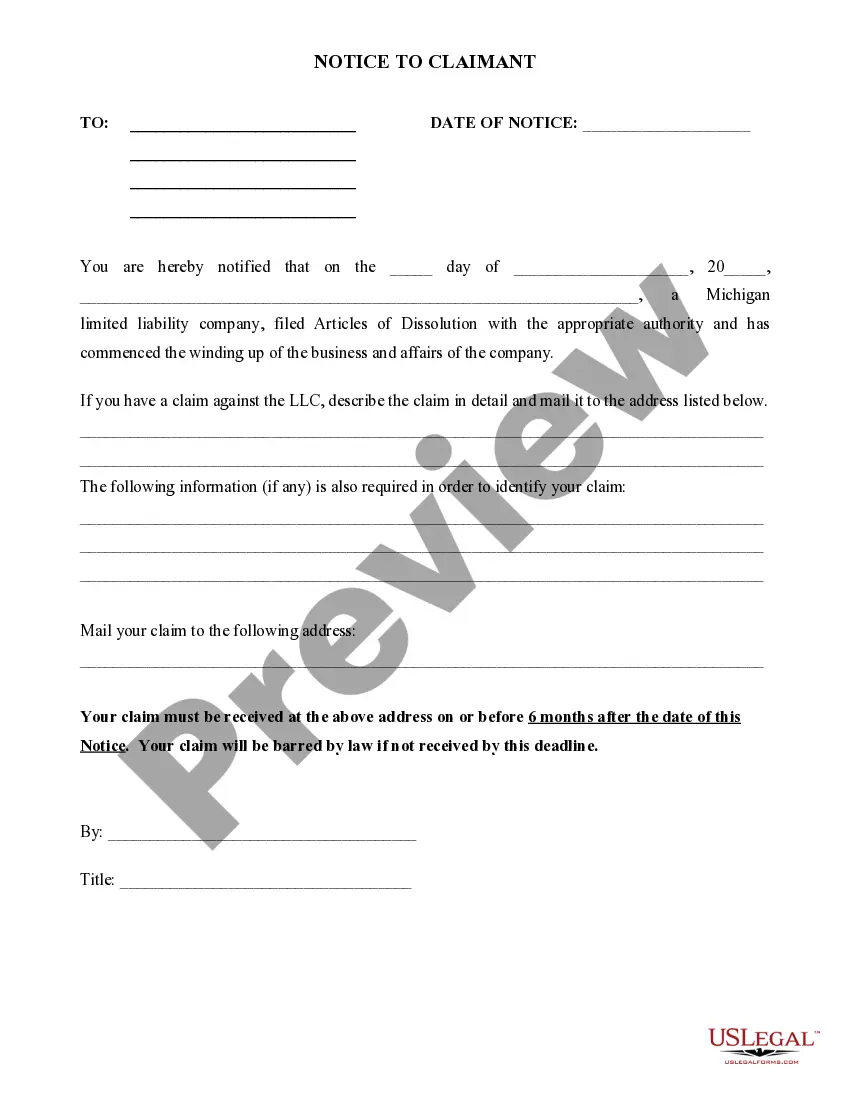

Dissolving an LLC in Michigan involves filing appropriate documents with the state, which can be efficiently handled using the Michigan Dissolution Package to Dissolve Limited Liability Company LLC. This package includes essential forms and guidelines tailored to meet Michigan's requirements. By following the structured process outlined in the package, you can oversee the dissolution confidently and thoroughly. Remember, ensuring compliance with state laws is paramount in this process.

To fully dissolve your LLC, follow a clear process by submitting the necessary forms and paperwork through a Michigan Dissolution Package to Dissolve Limited Liability Company LLC. This package offers a step-by-step guide, ensuring that you complete all required tasks effectively. From notifying your members to settling debts, each detail is crucial in this process. Trust the structured approach to ensure everything is covered.

Deciding between dissolving your LLC or leaving it inactive is crucial. An inactive LLC still incurs fees and requires some maintenance to keep it registered with the state. Choosing a Michigan Dissolution Package to Dissolve Limited Liability Company LLC can help you formally close your business, saving you time and reducing ongoing obligations. Consider your long-term goals to make the best choice.

The easiest way to close an LLC is to utilize a Michigan Dissolution Package to Dissolve Limited Liability Company LLC. This package provides all the necessary forms and instructions you need to efficiently dissolve your company. By following a straightforward process, you can ensure that all legal obligations are met. It simplifies the entire experience, allowing you to focus on the next steps in your entrepreneurial journey.

Unless dissolved, your California LLC will continue to be liable for state fees, it will continue to be open to incurring more debts, it will continue to own the assets under its name, and you won't be able to sell those assets as your own.

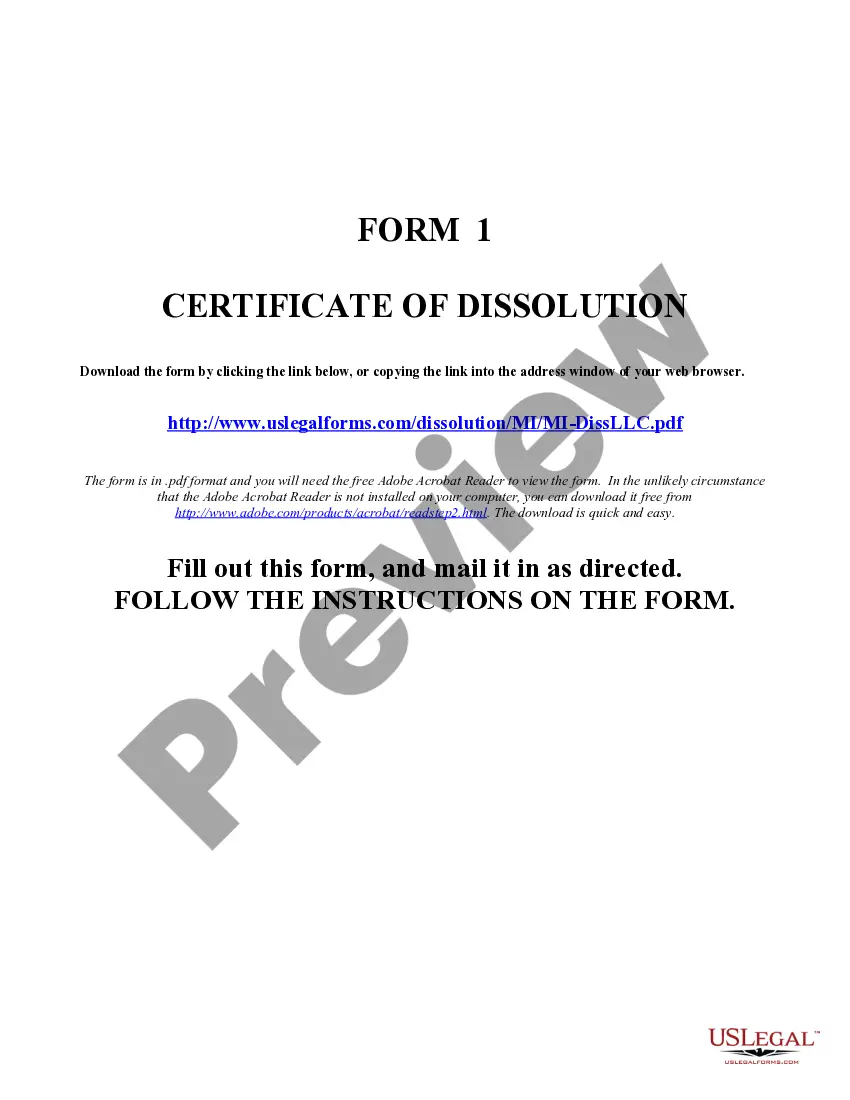

The dissolution is effected by executing and filing a Certificate of Dissolution (form CSCL/CD-531) on behalf of the corporation with the Corporations Division. The certificate must state the name of the corporation and that the corporation is dissolved pursuant to an agreement under section 488.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

The power of the Secretary of State, however, is broad, and in many states, an LLC can be dissolved for nearly any reason the Secretary deems fit. Voluntary dissolution is the result of members willingly choosing to close their business.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.