Connecticut Dissolution Package to Dissolve Corporation

What this document covers

The Connecticut Dissolution Package to Dissolve Corporation provides all the necessary forms and instructions required to legally dissolve a corporation in Connecticut. This package differs from other legal dissolution forms by including specific guidelines for both corporations that have issued shares and those that have not. It ensures compliance with Connecticut laws and facilitates the winding up of corporate affairs effectively.

When to use this form

This dissolution package should be utilized when a corporation in Connecticut is ready to cease operations. Common scenarios include completing a business restructuring, concluding a business that is no longer viable, or following the decision of shareholders to dissolve the corporation after issuing shares or commencing business activities.

Who should use this form

- Corporation owners and shareholders looking to formally dissolve their business.

- Corporate directors responsible for making dissolution decisions.

- Legal representatives assisting with the dissolution process.

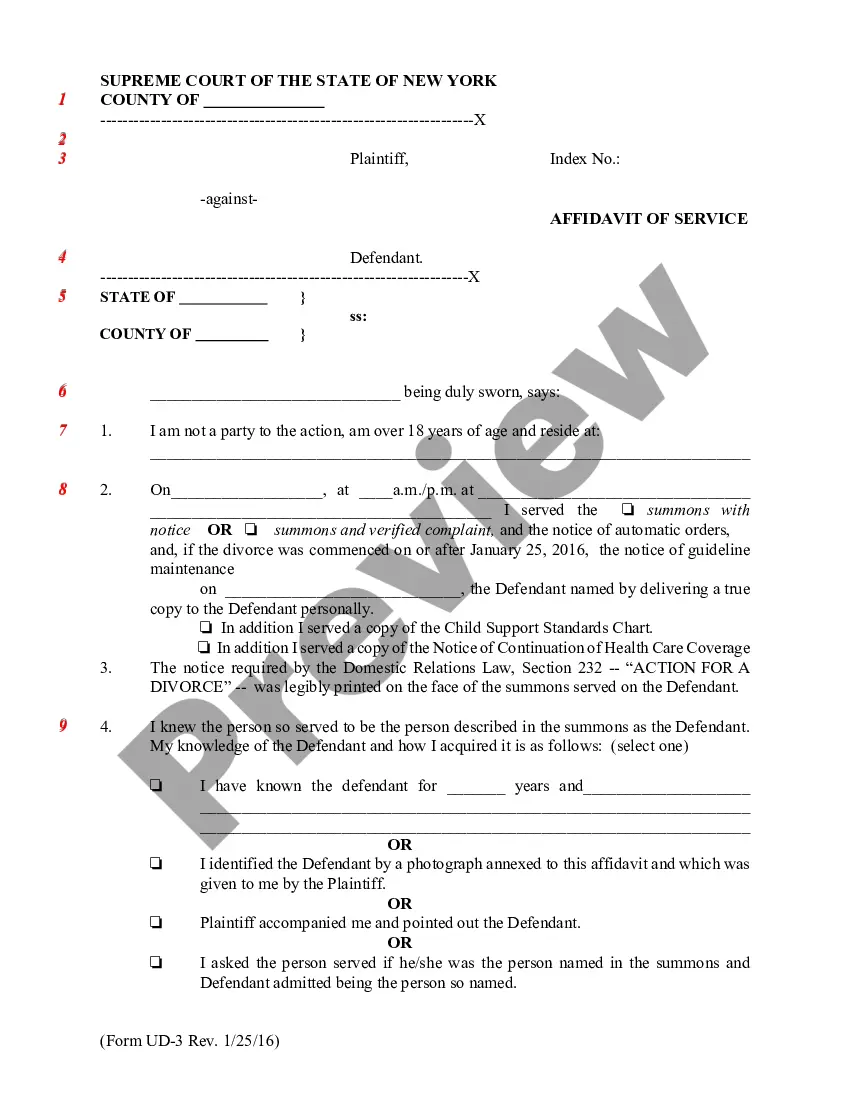

Completing this form step by step

- Determine if the corporation has issued shares or commenced business.

- If no shares have been issued, complete the Certificate of Dissolution and file it with the Secretary of State.

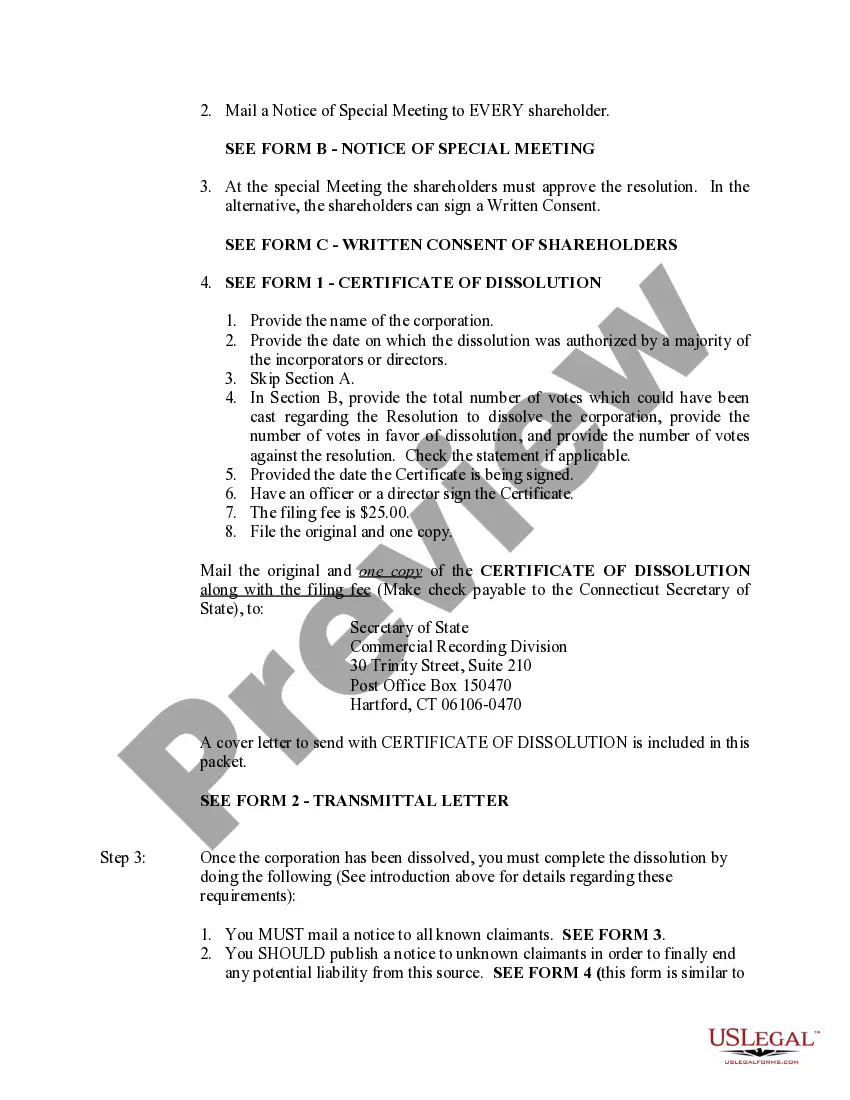

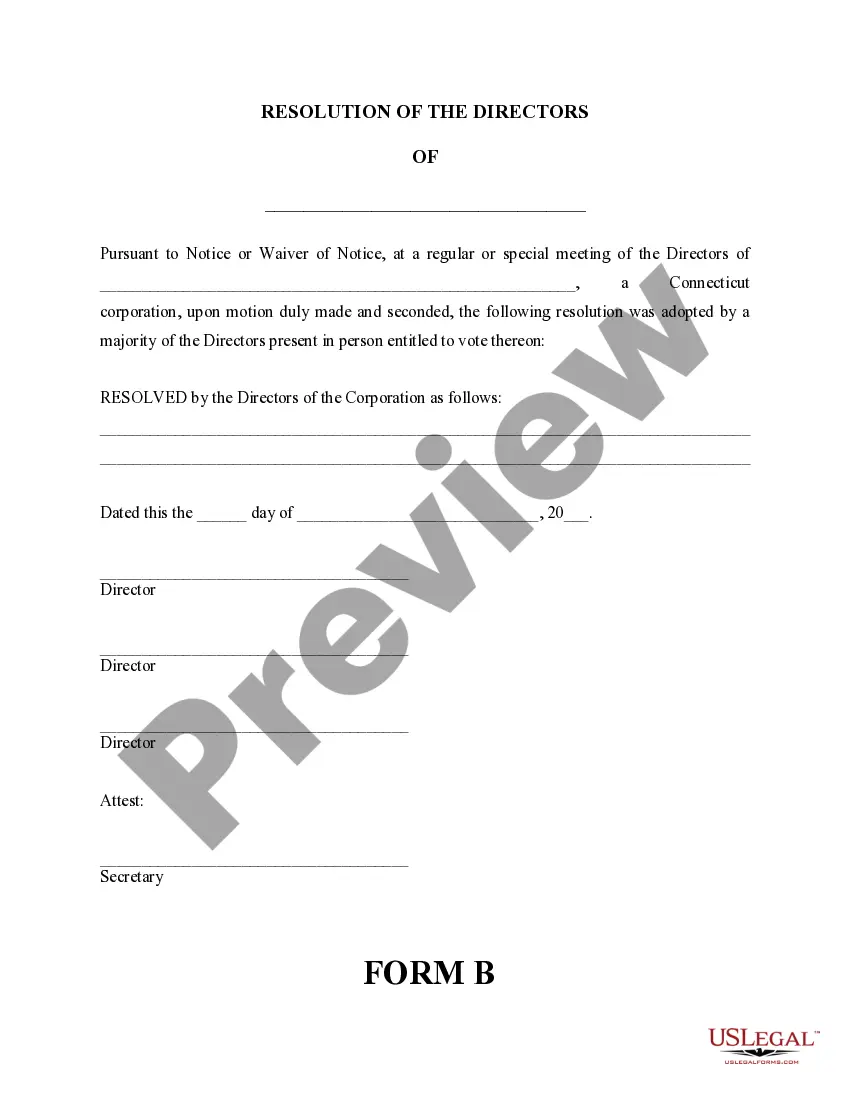

- If shares have been issued, obtain a board resolution recommending dissolution and notify shareholders of a special meeting.

- Following shareholder approval, complete and file the Certificate of Dissolution, including the necessary votes on the resolution.

- Mail notifications to all known claimants and publish notices for unknown claims as required to finalize the dissolution.

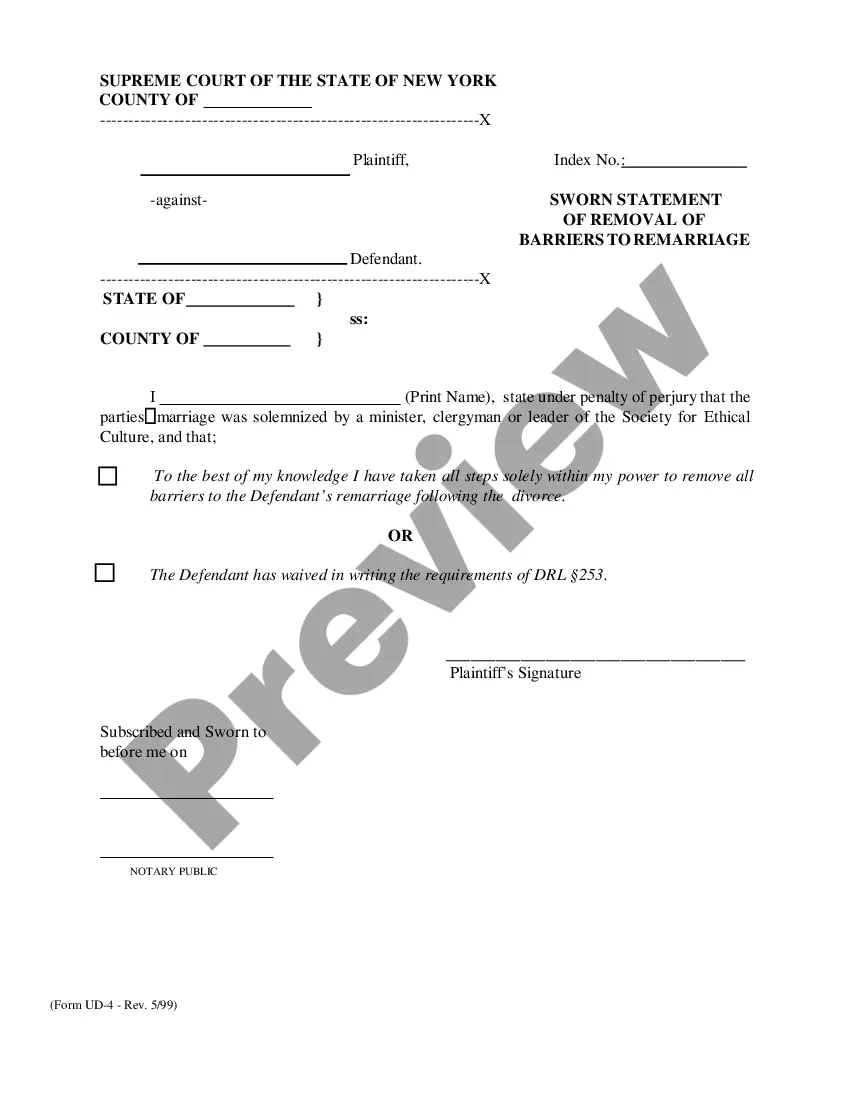

Notarization guidance

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to notify all shareholders adequately before the dissolution vote.

- Underestimating the time required for claimants to respond during the notification process.

- Not filing the Certificate of Dissolution properly with the Secretary of State.

- Neglecting to settle all outstanding debts and obligations before distribution of remaining assets.

Advantages of online completion

- Convenience of downloading all necessary documents in one package.

- Editable forms that can be tailored to meet specific corporate needs.

- Access to step-by-step instructions simplifying the dissolution process for users.

Looking for another form?

Form popularity

FAQ

To terminate a corporation with the IRS, submit the necessary forms, including Form 966, along with your final income tax filings. This informs the IRS of the dissolution while ensuring compliance with all tax obligations. Incorporating the Connecticut Dissolution Package to Dissolve Corporation can simplify these steps and provide clarity on required documentation.

Notifying the IRS that your business is closed requires completing Form 966 and filing it with your corporation's final tax return. You should also ensure that all outstanding tax liabilities are resolved. By using the Connecticut Dissolution Package to Dissolve Corporation, you can streamline this notification process and ensure you meet all legal obligations.

The first step to terminate a corporation involves calling a shareholders’ meeting to vote on the decision to dissolve. It’s crucial to document this decision in minutes and ensure it aligns with your corporation's bylaws. Following this, you can proceed with using the Connecticut Dissolution Package to Dissolve Corporation to formalize the process.

A letter of dissolution is an official document that informs relevant parties, including the IRS, that a corporation is ceasing its operations. This letter typically accompanies the dissolution application and outlines the reasons for dissolving. When using a Connecticut Dissolution Package to Dissolve Corporation, templates for this letter can often be included, ensuring you meet all necessary conditions.

There are several methods for dissolving a corporation, including voluntary dissolution initiated by the shareholders or involuntary dissolution decided by a court. You might also consider using the Connecticut Dissolution Package to Dissolve Corporation to simplify the process and meet all legal requirements. Each method has specific steps that you must follow, so knowing your options will help you choose the best path.

To dissolve a corporation with the IRS, you must first ensure that all federal tax obligations are settled. After that, you will need to file Form 966 to officially notify the IRS of the corporation’s dissolution. It's essential to complete any necessary state filings as well when using the Connecticut Dissolution Package to Dissolve Corporation.

When you dissolve a corporation, there can be various tax consequences depending on your situation. For instance, any assets distributed might be subject to capital gains tax. Therefore, it's wise to consult with a tax professional during this process. The Connecticut Dissolution Package to Dissolve Corporation may also provide insights into these tax implications, ensuring you understand your responsibilities.

Dissolving a corporation with the IRS involves filing your final tax return and submitting it with the articles of dissolution. Utilizing the Connecticut Dissolution Package to Dissolve Corporation can simplify this task by providing all the necessary documentation. Indicate on your tax return that it is the final return, and ensure that all tax obligations are met. This will minimize any potential issues with the IRS after dissolution.

To dissolve a Connecticut corporation, start by obtaining a Connecticut Dissolution Package to Dissolve Corporation. This package will guide you through the steps, including filing the articles of dissolution and notifying creditors. After completing the forms and settling any outstanding obligations, submit everything to the Secretary of State. Doing this ensures a clear and legal termination of your business.

Yes, you need to file articles of dissolution with the Secretary of State to officially dissolve a corporation in Connecticut. This process is a key part of using a Connecticut Dissolution Package to Dissolve Corporation. Make sure to complete the necessary forms accurately to avoid delays. Once filed, your corporation will be recognized as dissolved.