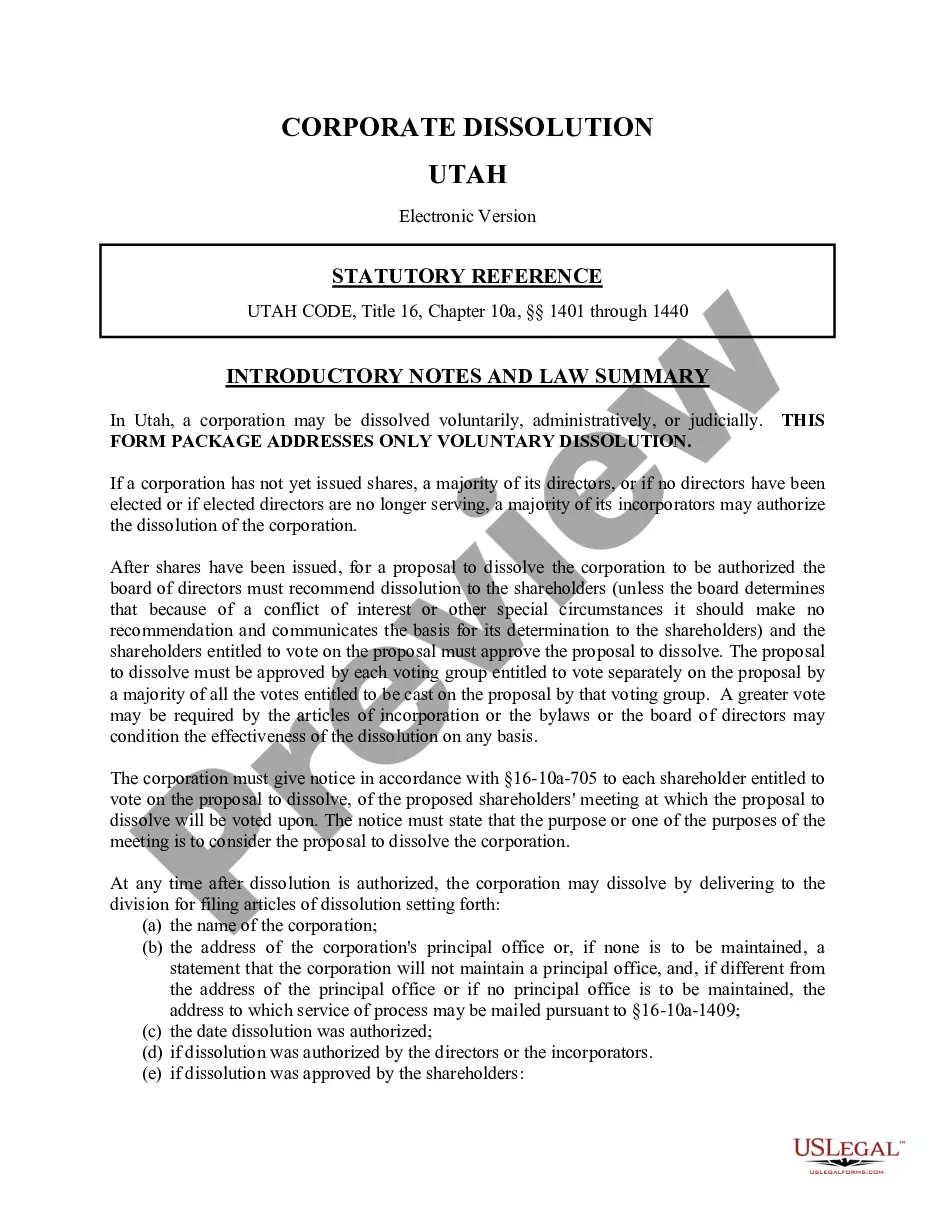

Utah Dissolution Package to Dissolve Limited Liability Company LLC

Understanding this form

The Utah Dissolution Package to Dissolve Limited Liability Company LLC is a comprehensive set of legal documents designed to assist in the formal dissolution of an LLC in Utah. It includes various forms, detailed instructions, and guidelines specific to the dissolution process. This package ensures compliance with Utah state laws, differentiating it from other dissolution forms that may not provide the same level of detail or state-specific requirements.

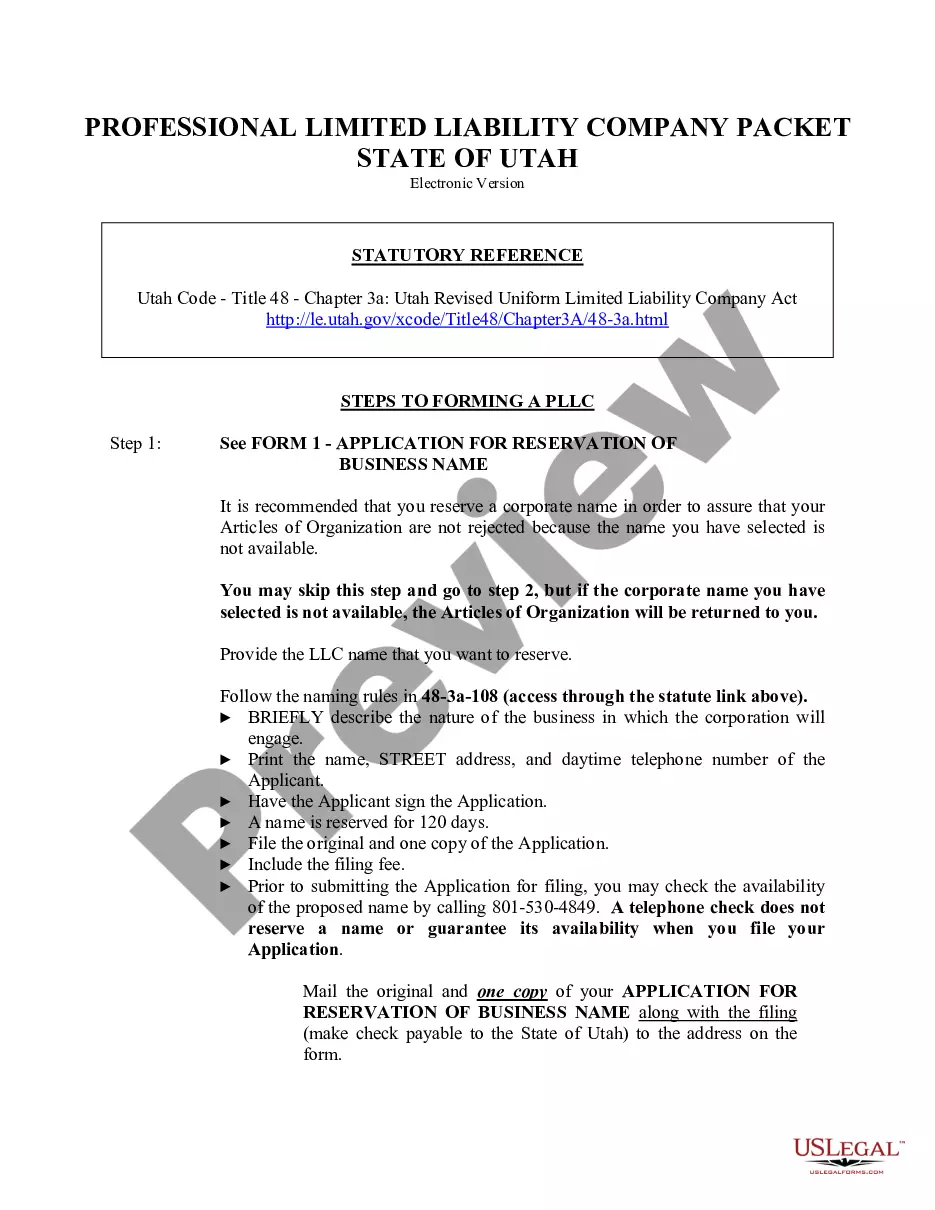

Form components explained

- Articles of Dissolution: The primary form needed to officially dissolve the LLC.

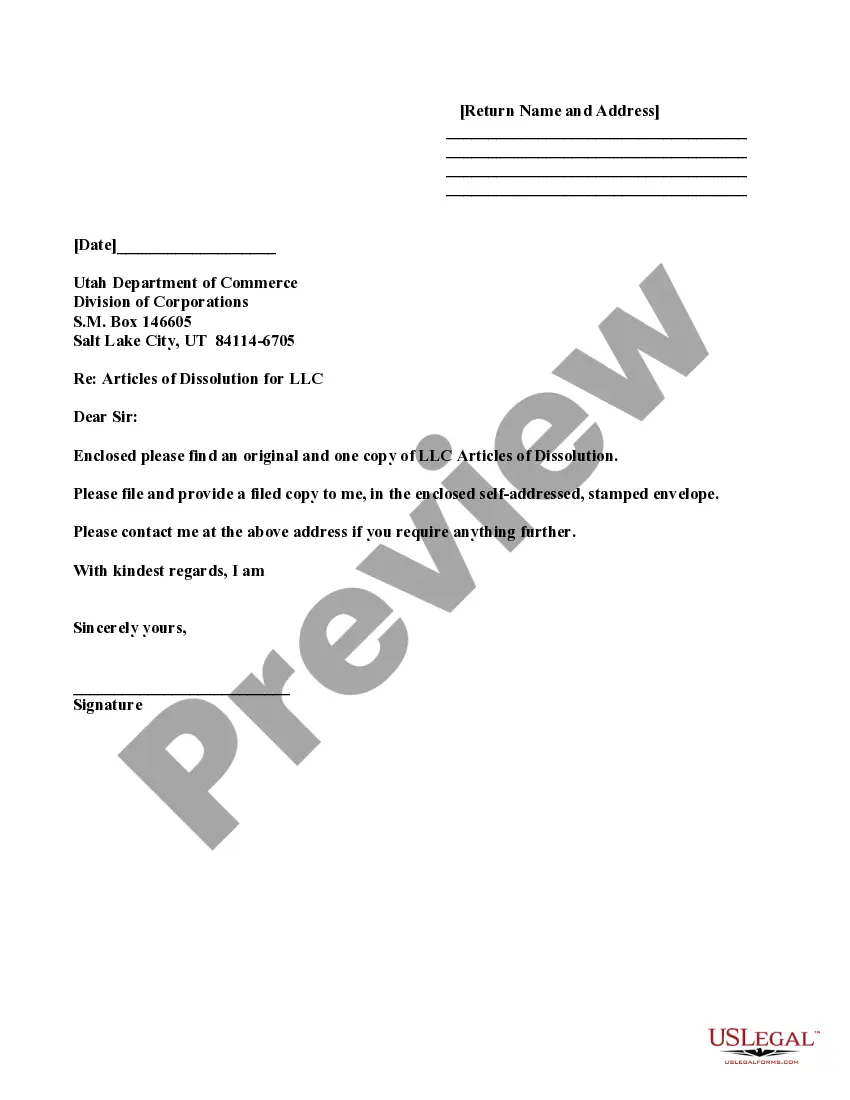

- Transmittal Letter: Instructions for submitting the Articles of Dissolution.

- Winding Up Instructions: Guidelines on how to handle the LLC's assets and liabilities post-dissolution.

- Notices to Claimants: Forms to notify any potential claimants about the LLC's dissolution.

- Publication Requirements: Details on how to publish a notice of dissolution in a local newspaper.

When to use this form

This form package should be used when the members of a limited liability company in Utah decide to formally dissolve the business. Situations may include the expiration of the LLC's duration, consent among all members to dissolve, or the company not having any members. Using this form ensures that all legal requirements are met for dissolution, which can help avoid future liabilities.

Intended users of this form

- LLC members seeking to dissolve their business in Utah.

- Business owners who have agreed to dissolve an LLC under the terms of their operating agreement.

- Individuals representing the company in the formal dissolution process.

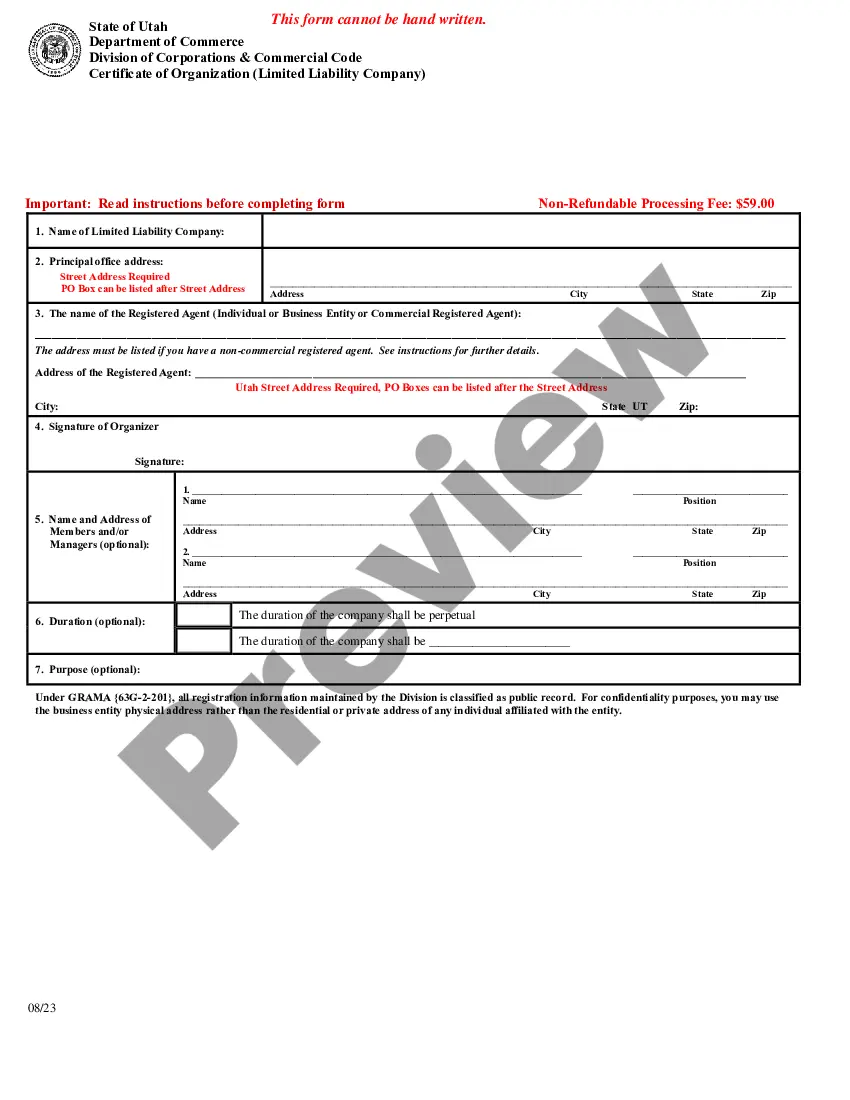

Instructions for completing this form

- Identify all members of the LLC and confirm their agreement to dissolve.

- Complete the Articles of Dissolution with accurate and up-to-date information.

- Prepare the transmittal letter as instructed in the dissolution package.

- File the Articles of Dissolution with the Utah Department of Commerce, along with the required filing fee, if any.

- Notify known claimants regarding the dissolution and provide instructions for submitting any claims against the LLC.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to obtain consent from all members before filing for dissolution.

- Not providing adequate notice to claimants about the dissolution.

- Submitting incomplete forms or missing required information.

- Ignoring state-specific filing deadlines which could affect compliance.

Benefits of completing this form online

- Convenience: Download and complete the forms at your own pace without the need for a physical appointment.

- Editability: Modify the documents as needed before finalizing them for submission.

- Reliability: Forms are drafted by licensed attorneys and compliant with state laws.

Legal use & context

- This form is legally binding once filed with the state, ensuring the LLC is officially recognized as dissolved.

- Failure to properly dissolve the LLC may result in ongoing liabilities or claims against the members.

Quick recap

- The Utah Dissolution Package is essential for safely and legally dissolving an LLC in Utah.

- It is crucial to follow all required steps and notify interested parties during the dissolution process.

- Using this form package ensures compliance with state laws and reduces the risk of future legal issues.

Looking for another form?

Form popularity

FAQ

For example, in California any member can leave an LLC any time he wants, simply by providing written notice to the other members.If his leaving breaks an operating agreement, then the amount of damages that the LLC suffered will be subtracted from his economic interests.

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

When it comes to kicking out a business partner, you have three options: Follow the procedure set out in your operating agreement, negotiate a different deal altogether, or go to court. If you have an operating agreement, it doesn't matter whether your partner wants to be bought out or not.

Can one partner force the dissolution of an LLC partnership? The short answer is yes. If there are two partners, each holding a 50% stake in the business, one partner can force the LLC to dissolve.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Holding a vote with LLC members to dissolve the LLC. Recording the dissolution vote in the LLC's meeting minutes. Determining the formal date of dissolution. Distribution of LLC assets. Notifying creditors and settling any business debts.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

3 attorney answers A general partnership can be dissolved when a partner withdraws or dies. However, dissolution is only the beginning of the winding up process. Assets must be divided and liabilities paid.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.