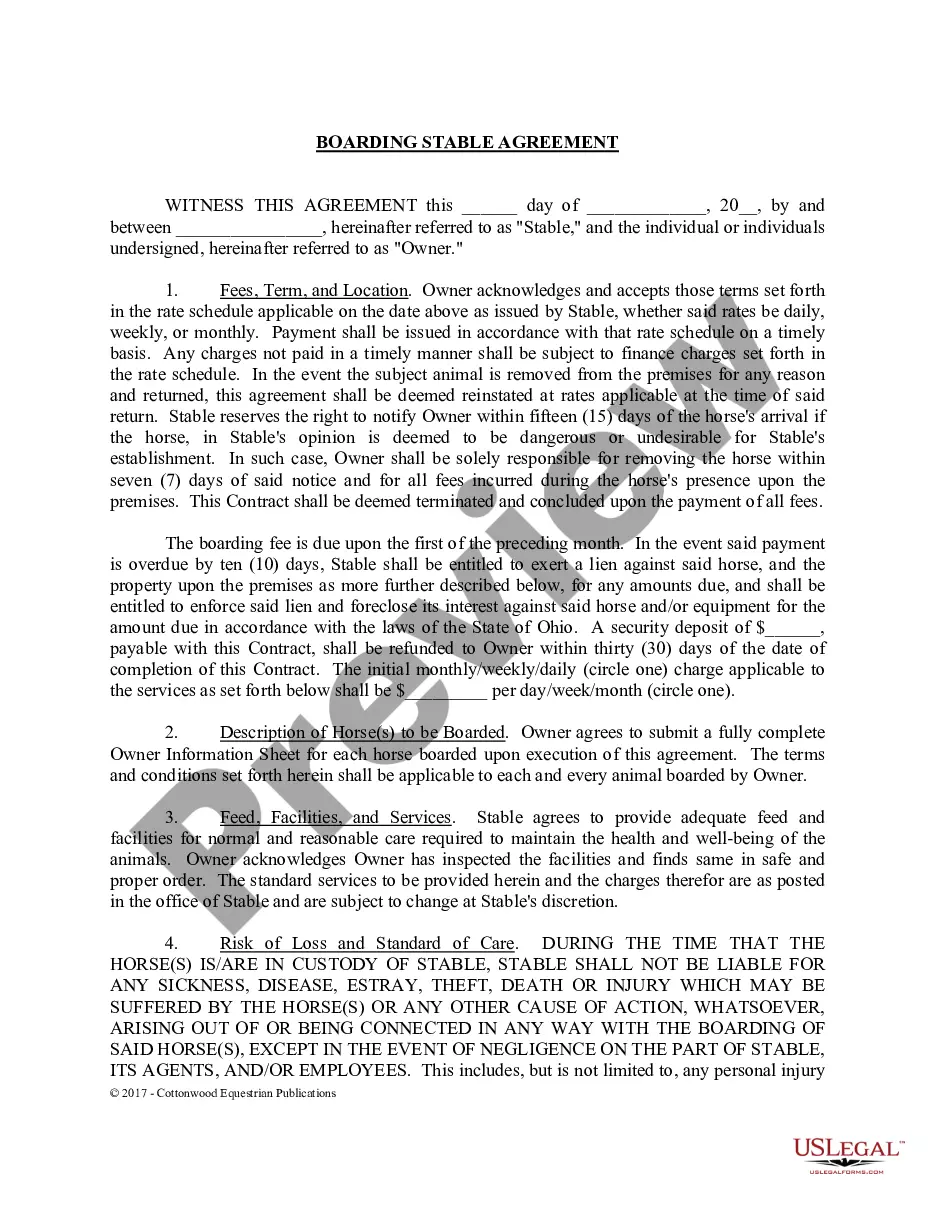

Michigan Execution Against Property is a legal remedy that allows creditors to collect on a debt. It is a type of writ of execution that allows a creditor to seize a debtor's property to satisfy the debt. Michigan Execution Against Property is used when a court judgment has been granted and the debtor has failed to make a payment. The writ is served to the debtor and the sheriff or other authorized officer will seize the debtor's property as payment toward the debt. There are two types of Michigan Execution Against Property: personal property and real property. Personal property is tangible property such as vehicles, jewelry, furniture, electronics and other items of value. Real property is any land and/or buildings owned by the debtor. Both types of property can be seized and sold by the sheriff or other authorized officer to satisfy the court judgment.

Michigan Execution Against Property

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Execution Against Property?

Engaging with legal documents demands vigilance, precision, and employing properly crafted templates. US Legal Forms has been assisting individuals nationwide with this for 25 years, so when you select your Michigan Execution Against Property form from our collection, you can trust it complies with federal and state laws.

Using our service is simple and fast. To acquire the necessary documents, you only need an account with an active subscription. Here’s a quick guideline for you to obtain your Michigan Execution Against Property in just moments.

All documents are designed for multiple uses, like the Michigan Execution Against Property you find on this page. If you require them again in the future, you can fill them out without re-payment - just access the My documents tab in your profile and complete your document whenever you need it. Experience US Legal Forms and complete your business and personal paperwork swiftly and in complete legal adherence!

- Ensure that you carefully review the form's content and its alignment with general and legal standards by previewing it or examining its description.

- Seek another official template if the one initially accessed does not conform to your circumstances or state laws (the tab for that is located at the top page corner).

- Click Log In to your account and download the Michigan Execution Against Property in your desired format. If it’s your first time visiting our site, click Buy now to proceed.

- Establish an account, choose your subscription plan, and complete payment with your credit card or PayPal account.

- Select the format in which you want to save your form and click Download. Print the document or upload it to a professional PDF editor for a paperless submission.

Form popularity

FAQ

To protect your car from a Michigan Execution Against Property, consider filing for exemptions. Michigan law allows certain personal property, including vehicles, to be protected from creditors under specific conditions. You may also explore options like creating a trust, which can provide additional protection against collections. Additionally, staying informed about your rights and utilizing resources from platforms like US Legal Forms can guide you in safeguarding your assets effectively.

In Michigan, a writ of execution can be served by a court officer, typically a sheriff or a designated law enforcement officer. These individuals are authorized to carry out the orders of the court regarding the collection of debts as part of the Michigan Execution Against Property process. This ensures that the enforcement of the judgment is handled securely and lawfully. If you need more information or assistance, visit UsLegalForms for comprehensive legal support.

A 6500 motion in Michigan refers to a legal request for a court to set aside a judgment and allow a party another opportunity to present their case. It is usually filed after a default judgment has been entered against a party who did not appear in court. This motion is crucial for those seeking a chance to defend their interests in matters related to Michigan Execution Against Property. To navigate this process effectively, consider leveraging the resources available on the UsLegalForms platform.

In Michigan, certain assets are protected from seizure in the event of a judgement. This includes social security benefits, unemployment compensation, and retirement accounts like IRAs and 401(k)s. Michigan Execution Against Property laws outline these protections clearly. To understand your specific situation and rights, consider leveraging the resources provided by USLegalForms to ensure your assets remain secure.

The 7 day rule in Michigan court refers to the time limit for a debtor to respond to a garnishment notice after a judgement has been entered. Debtors must act within this time frame to protect their rights and potentially challenge the garnishment. Knowledge of the 7 day rule is essential for anyone facing Michigan Execution Against Property proceedings. For more detailed information on how to proceed, explore solutions available through USLegalForms.

Certain properties are exempt from judgement in Michigan, providing protection to debtors. Common exemptions include your primary home, necessary clothing, and essential household items. Also, any tools or equipment used for your profession may be safeguarded under Michigan Execution Against Property laws. To gain clarity on what qualifies as exempt, consider consulting USLegalForms for comprehensive guidance.

In Michigan, personal property that can be seized under a judgement includes items like vehicles, bank accounts, and valuable personal belongings such as jewelry and art. Michigan Execution Against Property allows creditors to claim these assets to satisfy debts. However, it's crucial to understand the specifics of a judgement, as certain items may have additional protections. Using USLegalForms can help you navigate these complexities and ensure you understand your rights.

The 77 day rule in Michigan refers to a time frame concerning property execution under the Michigan Execution Against Property law. This rule allows property owners a specific period to respond before certain actions can take place. If a creditor does not enforce a judgment within 77 days, they may lose the ability to execute against the property. Understanding this rule can help you protect your assets effectively.