To transfer assets into a trust, a "Certificate of Trust" is needed. This is a summary or quotation of selected parts of the trust. Its purpose is to allow a person to know the correct name of the trust and to be sure that the trust has power over its assets. It usually does not identify the beneficiaries or the assets, so that information is kept confidential.

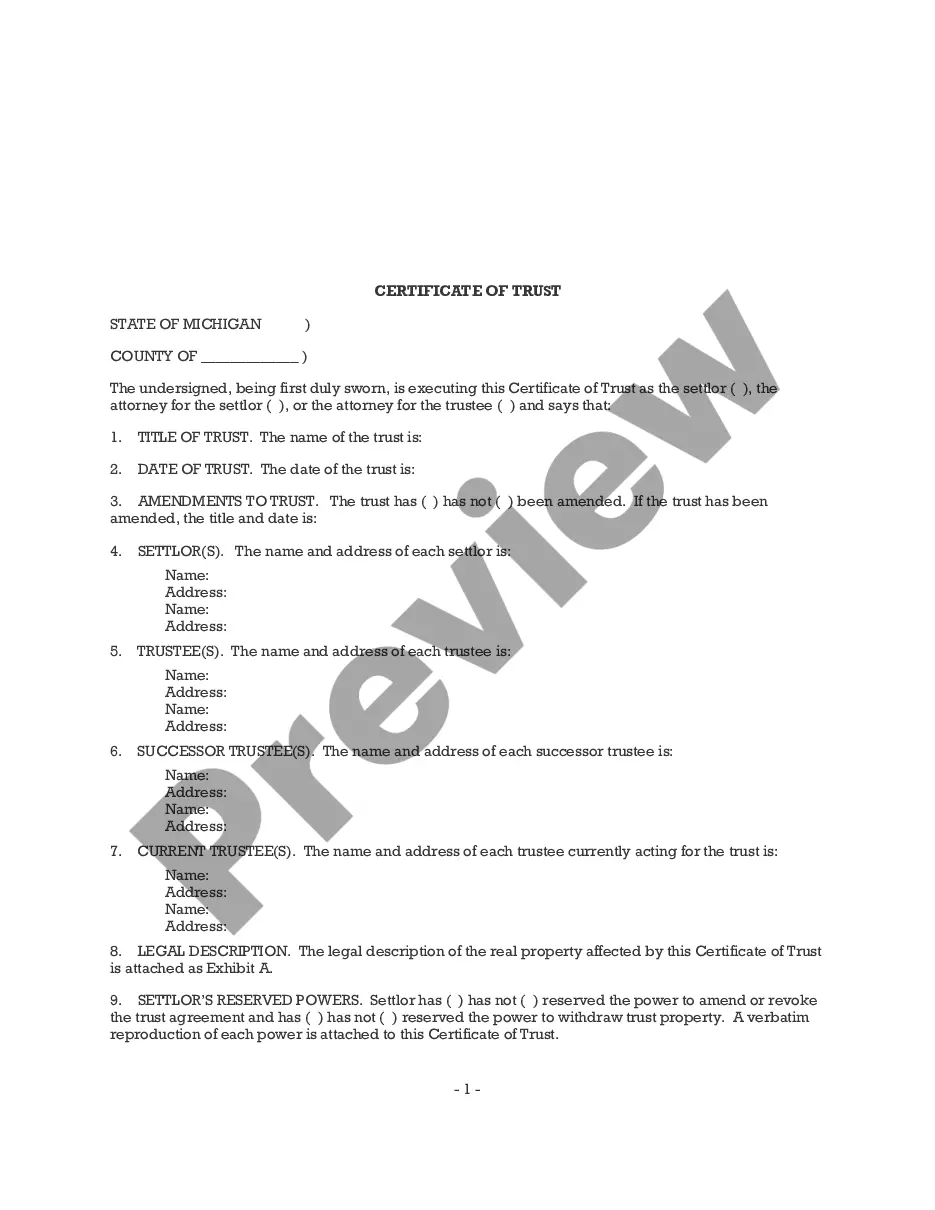

Michigan Certificate of Trust

Description

Definition and meaning

The Michigan Certificate of Trust is a legal document that allows individuals to establish a trust in the state of Michigan. This document serves as evidence of the trust's existence and outlines the trustee's authority to manage and operate the trust's assets. It provides a means of handling property and finances without the need for probate, thereby simplifying the management of assets for beneficiaries.

Who should use this form

This form is particularly useful for individuals who wish to create a trust to manage their assets, facilitate estate planning, or protect their family’s financial future. Anyone looking to designate a trustee for their trust or to formalize their trust arrangement should consider using the Michigan Certificate of Trust.

Key components of the form

The Michigan Certificate of Trust typically includes several essential components:

- Name of the trust: The official title under which the trust operates.

- Trustee information: Details about the person or entity responsible for managing the trust.

- Beneficiaries: A list of individuals or entities that will benefit from the trust.

- Powers of the trustee: A description of the trustee's authority in managing the trust assets.

Each section must be completed accurately to ensure that the form is legally effective.

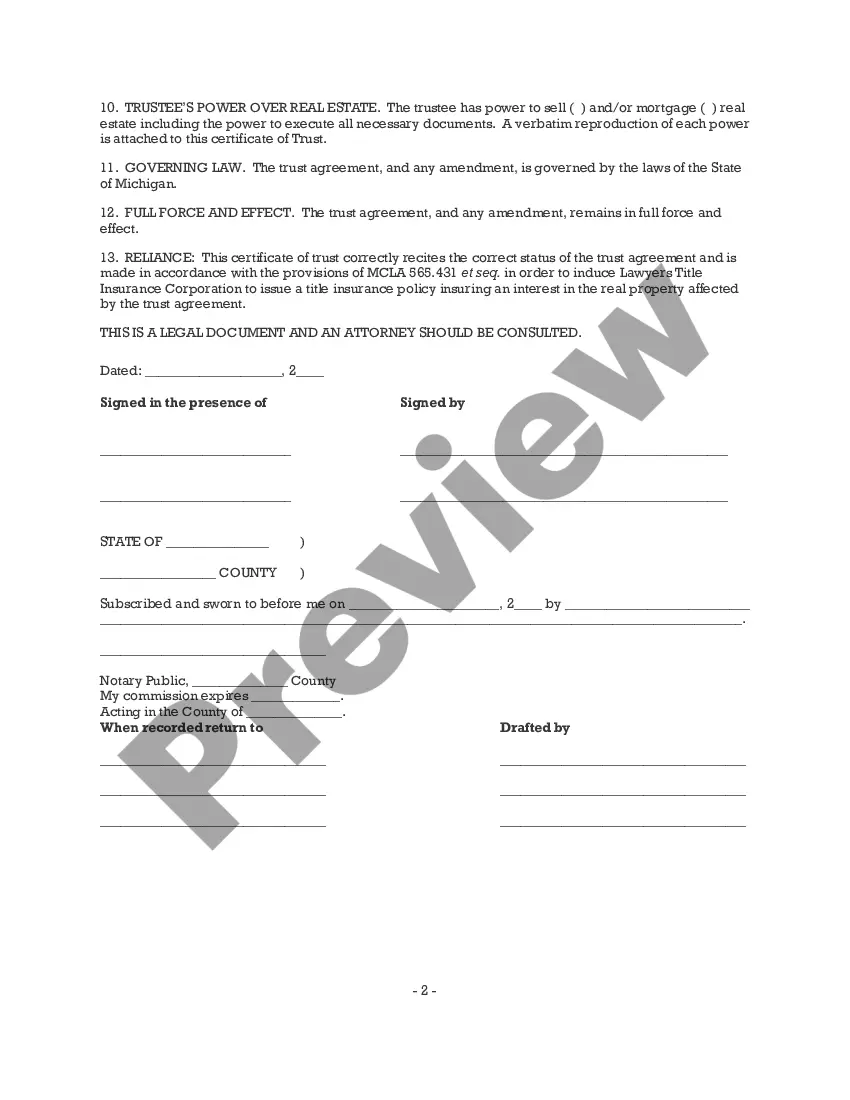

Legal use and context

The Certificate of Trust is often utilized in legal contexts as it aids in avoiding probate. It is a vital part of estate planning in Michigan and is recognized by banks, financial institutions, and courts. Proper usage of the form helps in establishing the intentions of the individual creating the trust and ensures legal recognition of the trust by all stakeholders involved.

Common mistakes to avoid when using this form

When completing the Michigan Certificate of Trust, it is crucial to avoid several common pitfalls:

- Not properly identifying the trust and its components.

- Failing to specify the powers of the trustee.

- Not signing and dating the document correctly.

- Overlooking the need for notarization in certain situations.

Taking care to avoid these mistakes can help prevent delays and complications in trust management.

What documents you may need alongside this one

In conjunction with the Michigan Certificate of Trust, you might need the following documents:

- Trust agreement: The foundational document that outlines the trust’s terms.

- Identification documents: Proof of identity for the grantor and trustee.

- Asset documentation: Information about the assets being placed into the trust.

Having these documents prepared will aid in the smooth execution of the trust’s establishment and management.

How to fill out Michigan Certificate Of Trust?

Have any template from 85,000 legal documents including Michigan Certificate of Trust on-line with US Legal Forms. Every template is prepared and updated by state-licensed lawyers.

If you have a subscription, log in. When you are on the form’s page, click on the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the tips listed below:

- Check the state-specific requirements for the Michigan Certificate of Trust you would like to use.

- Look through description and preview the sample.

- As soon as you’re sure the sample is what you need, just click Buy Now.

- Choose a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in one of two appropriate ways: by bank card or via PayPal.

- Select a format to download the file in; two ways are available (PDF or Word).

- Download the file to the My Forms tab.

- As soon as your reusable template is downloaded, print it out or save it to your device.

With US Legal Forms, you’ll always have quick access to the right downloadable sample. The service gives you access to forms and divides them into categories to simplify your search. Use US Legal Forms to get your Michigan Certificate of Trust fast and easy.

Form popularity

FAQ

A: An affidavit of trust and a certificate of trust are essentially the same thing. At least they serve the same functions. Simply put, an affidavit of trust is an abbreviated version of the trust agreement that provides general information about the terms of the trust.

A Michigan living trust provides privacy in a way a will cannot. A will is probated and made part of the public record. A trust remains private and does not need court approval and is not made public.

A Certificate of Trust is recorded in the Official Records of the county in which any trust real property is located. It aids in clearing title to the property. Generally, where the trust owns no real property, there is no need to record a Certificate...

A certificate of trust existence and authority contains specific information about an existing trust agreement.

A certification of trust (or "trust certificate") is a short document signed by the trustee that simply states the trust's essential terms and certifies the trust's authority without revealing private details of the trust that aren't relevant to the pending transaction.

The declaration of trust is your trust. The certificate of trust is not needed but can help keep things private and provide a easier way to open bank or stock accounts...

A trust document isn't required to be filed. If you are transferring real estate into a trust, a deed will need oo be filed at the county recorder's office.The declaration will detail the terms and conditions of the living trust, including who will serve as the Trustee.

If you have a trust in Michigan, state law provides that you can register the trust. Registering a Michigan trust is not required (except for certain charitable trusts, as discussed below). Even for non-charitable trusts, there are good reasons that a trust should be registered.