Michigan Fiduciary Deed

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Fiduciary Deed?

Utilize US Legal Forms to obtain a printable Michigan Fiduciary Deed.

Our forms are accepted in court and are crafted and frequently refreshed by expert attorneys.

Ours is the most extensive collection of forms available online, offering reasonably priced and precise samples for individuals, legal professionals, and small to medium-sized businesses.

Press Buy Now if it’s the template you seek. Establish your account and complete the payment via PayPal or credit card. Download the template to your device and feel free to reuse it multiple times. Utilize the Search field if you're looking for alternative document templates. US Legal Forms offers a vast array of legal and tax templates and bundles for both personal and business requirements, including the Michigan Fiduciary Deed. Over three million users have effectively made use of our service. Choose your subscription plan and access quality forms in just a few clicks.

- The documents are categorized by state and many can be reviewed before download.

- To access samples, users must possess a subscription and Log In to their account.

- Click Download next to any template you require and locate it in My documents.

- For those without a subscription, refer to the suggestions below for swiftly locating and downloading Michigan Fiduciary Deed.

- Ensure you have the correct template relevant to the state required.

- Examine the document by checking the description and utilizing the Preview option.

Form popularity

FAQ

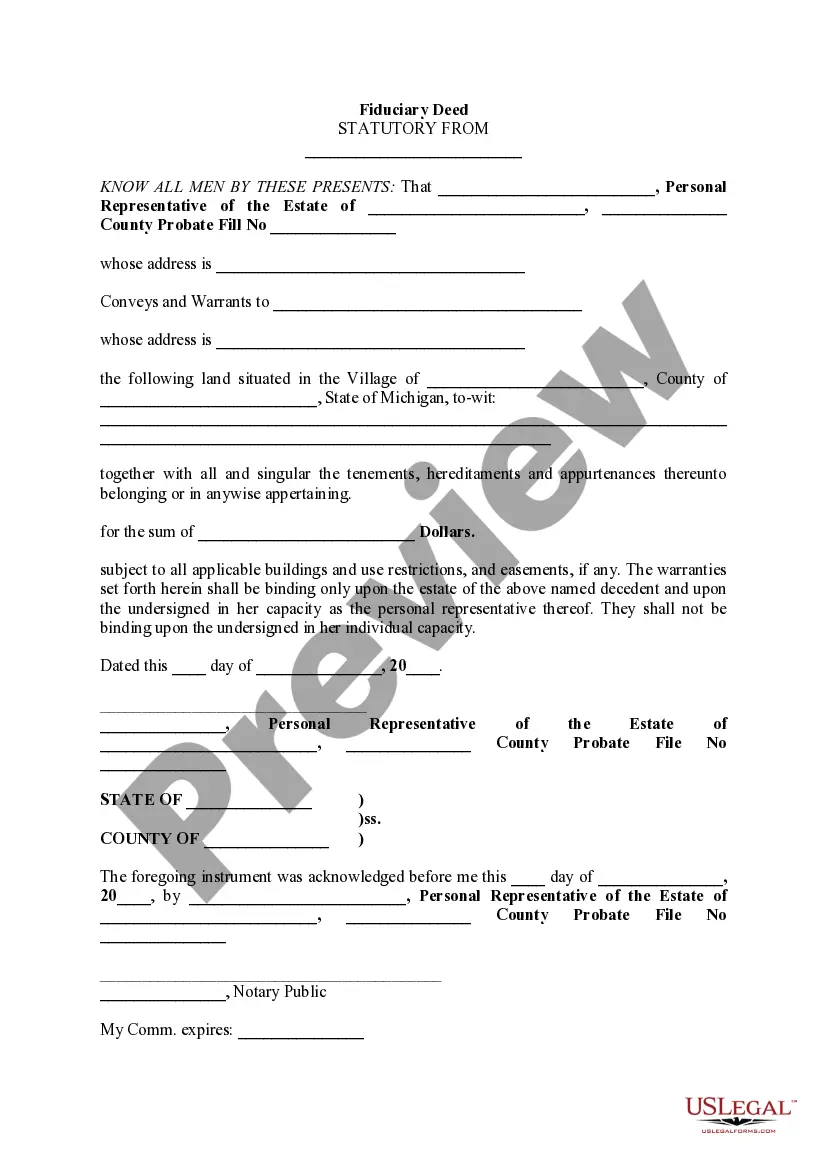

Filling out a personal representative deed requires attention to detail. First, ensure you have the necessary information about the estate and the Michigan Fiduciary Deed form. Next, accurately enter the names of the parties involved, the legal description of the property, and date the document. After completing the form, it’s important to sign it in front of a notary, as this step assures legal validity and adherence to Michigan requirements.

No, you do not need an attorney to execute a quit claim deed in Michigan. Many individuals choose to follow a DIY approach, thanks to accessible resources like US Legal Forms that guide you through the process. However, consulting with a legal professional can be advantageous if you have questions about your specific situation.

Yes, you can create your own quit claim deed in Michigan without an attorney. By utilizing templates from US Legal Forms, you can easily prepare your documents correctly. This allows for a simple and effective transfer of property interests between parties, ensuring you meet all legal standards.

Transferring a deed in Michigan does not necessarily require you to hire a lawyer. Many people successfully complete the process on their own, especially when using resources like US Legal Forms. However, just remember that legal terms and requirements can be complex, so having a professional review your documents can provide additional peace of mind.

Fiduciary law in Michigan governs the duties and responsibilities of individuals acting in fiduciary roles, such as executors or trustees. These laws ensure that fiduciaries manage and distribute assets in accordance with the wishes of the deceased or the stipulations of a trust. Understanding fiduciary law is crucial for anyone involved in property management in Michigan.

A fiduciary deed is utilized by anyone acting on behalf of another, such as a trustee or a guardian, to convey property. An executor deed, specifically, is used by an executor of an estate to convey property as part of the estate’s settlement. In Michigan, both deeds serve unique roles, but the fiduciary deed encompasses a broader range of fiduciary roles.

A fiduciary deed is a legal instrument used by a fiduciary to transfer ownership of property. This type of deed is essential in situations involving estates or trusts, facilitating the management of assets for the benefit of beneficiaries. In Michigan, fiduciaries can use these deeds to fulfill their responsibilities efficiently and legally.

A fiduciary deed in Michigan is a specialized legal document that allows someone in a fiduciary role to convey property on behalf of another person. This deed is commonly used in the context of administering estates or trusts. It allows the fiduciary to effectively manage and transfer assets while ensuring compliance with Michigan's laws.

The purpose of a Michigan Fiduciary Deed is to facilitate the legal transfer of property by someone acting in a fiduciary role, such as an executor of a will or a trustee. This deed ensures that the estate's assets are administered effectively and that the property ownership is clear. By using a fiduciary deed, you help protect the interests of heirs while adhering to legal obligations.

You should use a Michigan Fiduciary Deed when you need to convey property held by a fiduciary, such as an executor or trustee, during estate settlement or trust administration. This deed type is essential when handling the property of someone who has passed away or is otherwise unable to manage their estate. It ensures the legal transfer of property while complying with fiduciary responsibilities.