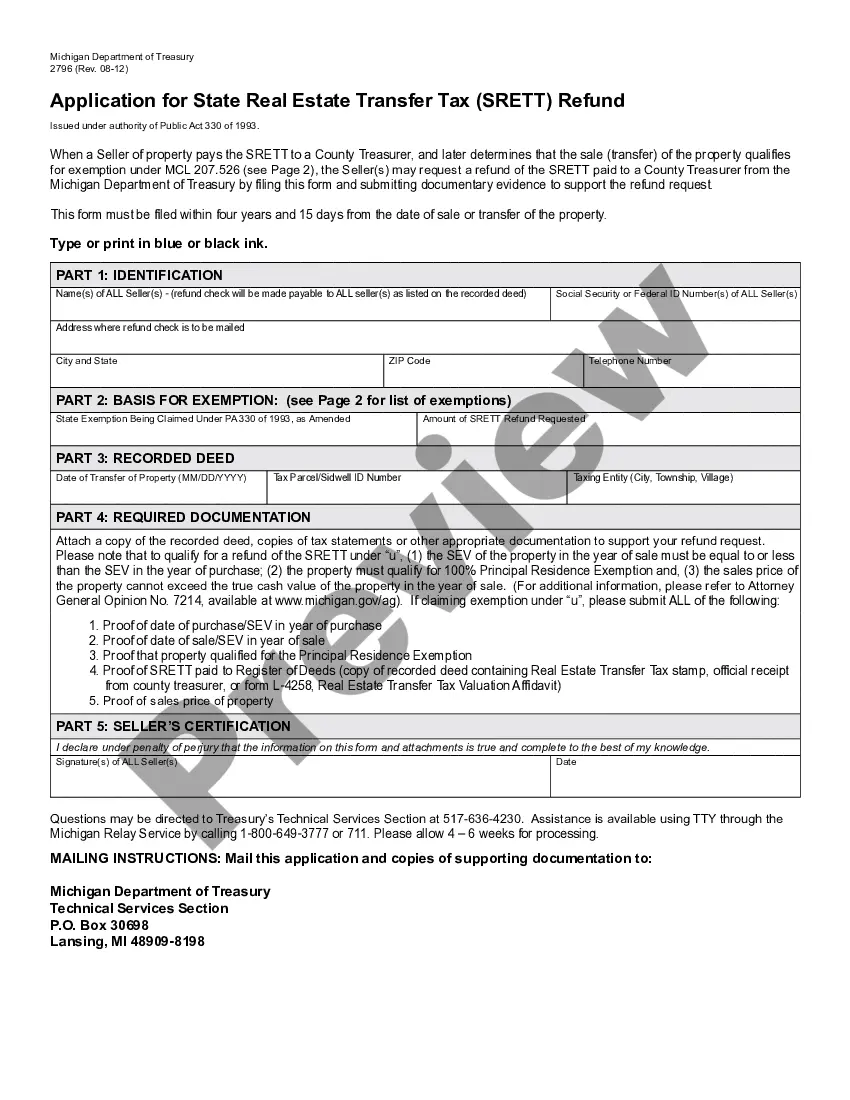

Michigan Real Estate Transfer Tax Evaluation Affidavit

Description

How to fill out Michigan Real Estate Transfer Tax Evaluation Affidavit?

Obtain any document from 85,000 legal forms such as the Michigan Real Estate Transfer Tax Evaluation Affidavit online with US Legal Forms.

Each template is crafted and refreshed by attorneys licensed in the state.

If you already have a subscription, Log In. Once you reach the form’s page, click on the Download button and navigate to My documents to find it.

With US Legal Forms, you'll consistently have immediate access to the relevant downloadable document. The service provides access to forms and organizes them into categories to make your search easier. Use US Legal Forms to obtain your Michigan Real Estate Transfer Tax Evaluation Affidavit quickly and effortlessly.

- Check the specific state requirements for the Michigan Real Estate Transfer Tax Evaluation Affidavit you need.

- Browse through the description and view the template preview.

- Once you are sure that the sample is what you require, click on Buy Now.

- Select a subscription plan that fits your financial situation.

- Establish a personal account.

- Make a payment using one of two available methods: by credit card or through PayPal.

- Choose a format to download the document in; there are two options (PDF or Word).

- Download the document to the My documents section.

- After your reusable form is downloaded, you can print it or save it to your device.

Form popularity

FAQ

Property transfer tax is an assessment charged by both the State of Michigan and the individual county. When you transfer real estate, they charge a fee as a percentage of the sales price. The seller is responsible for this fee unless it is otherwise agreed to be paid by the buyer.

Seller closing costs in Michigan The home seller typically pays the real estate transfer taxes. The state tax is calculated at $3.75 for every $500 of value transferred and the county tax is calculated at $0.55 for every $500 of value transferred.

A Property Transfer Affidavit is a form that notifies the local taxing authority of a transfer of ownership of real estate.The law requires a new owner to file this within 45 days after a transfer of ownership.

Property transfer tax is an assessment charged by both the State of Michigan and the individual county. When you transfer real estate, they charge a fee as a percentage of the sales price. The seller is responsible for this fee unless it is otherwise agreed to be paid by the buyer.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.

A real estate transfer tax, sometimes called a deed transfer tax, is a one-time tax or fee imposed by a state or local jurisdiction upon the transfer of real property. Usually, this is an ad valorem tax, meaning the cost is based on the price of the property transferred to the new owner.

Calculating the Michigan Real Estate Transfer Tax State Transfer Tax Rate $3.75 for every $500 of value transferred. County Transfer Tax Rate $0.55 for every $500 of value transferred.

How Do You Calculate Transfer Tax? Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property that's changing hands. State laws usually describe transfer tax as a set rate for every $500 of the property value.