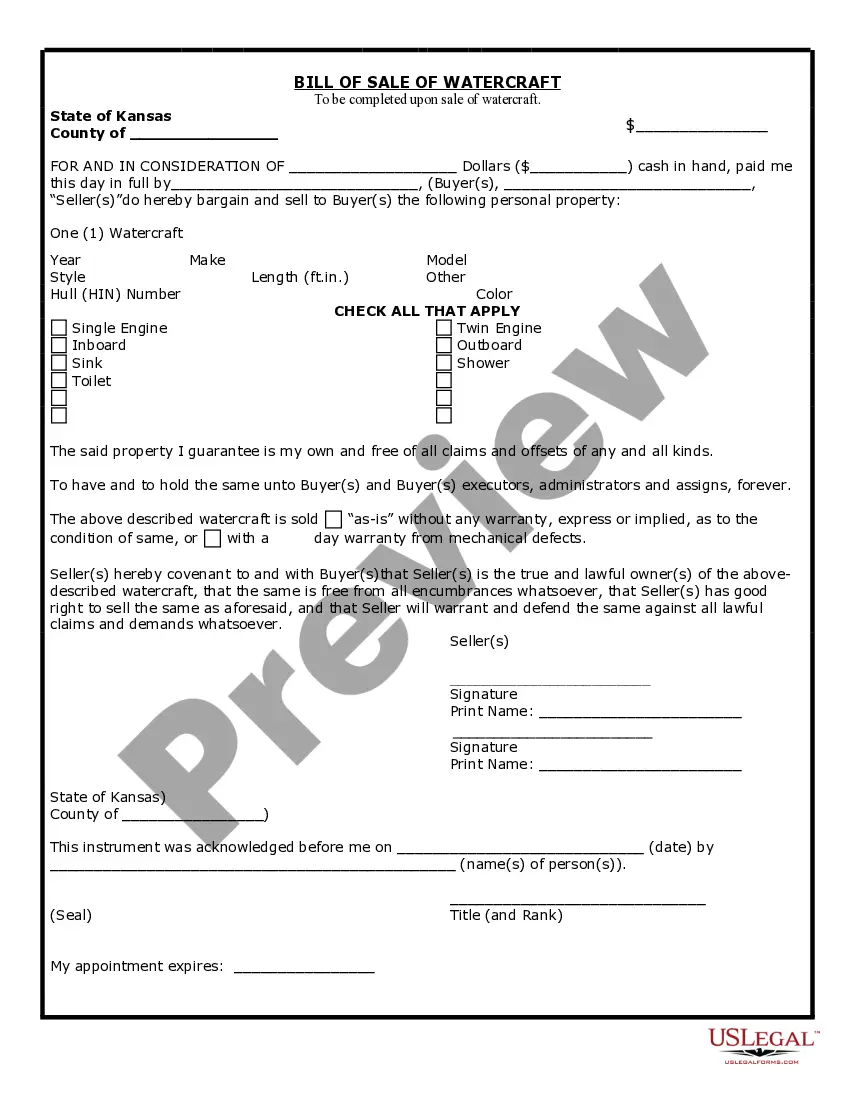

This form is a Quitclaim Deed where the Grantor is a Trust and the Grantees are Husband and Wife. Grantor conveys and quitclaims the described property to Grantees. This deed complies with all state statutory laws.

Michigan Quityclaim Deed from a Trust to Husband and Wife

Description

How to fill out Michigan Quityclaim Deed From A Trust To Husband And Wife?

Have any template from 85,000 legal documents including Michigan Quitclaim Deed from a Trust to Husband and Wife online with US Legal Forms. Every template is prepared and updated by state-accredited legal professionals.

If you have a subscription, log in. Once you’re on the form’s page, click the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Michigan Quitclaim Deed from a Trust to Husband and Wife you want to use.

- Look through description and preview the sample.

- When you are confident the template is what you need, simply click Buy Now.

- Choose a subscription plan that really works for your budget.

- Create a personal account.

- Pay out in just one of two suitable ways: by bank card or via PayPal.

- Pick a format to download the document in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- After your reusable form is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have quick access to the proper downloadable template. The platform will give you access to forms and divides them into categories to simplify your search. Use US Legal Forms to obtain your Michigan Quitclaim Deed from a Trust to Husband and Wife easy and fast.

Form popularity

FAQ

To add your spouse to your property deed: Have your lawyer do a Michigan Quit Claim Deed for you and then record it with your County's Register of Deeds. If you croak before you get it recorded, your property goes into probate, instead of to your spouse.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

Step 1: Download the MI quitclaim deed form. Step 2: Add the name and address of the preparer under Prepared By on the first line of the document. Step 3: Add the return address under After Recording Return To. This is typically the name and address of the grantee, but it could be a different party.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)