This form is a Warranty Deed where the Grantor is a limited liability company and the Grantee is a trust. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

Michigan Warranty Deed - Limited Liability Company to a Trust

Description

How to fill out Michigan Warranty Deed - Limited Liability Company To A Trust?

Have any template from 85,000 legal documents including Michigan Warranty Deed - Limited Liability Company to a Trust online with US Legal Forms. Every template is drafted and updated by state-accredited lawyers.

If you have a subscription, log in. When you are on the form’s page, click the Download button and go to My Forms to access it.

If you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Michigan Warranty Deed - Limited Liability Company to a Trust you want to use.

- Look through description and preview the template.

- As soon as you’re confident the sample is what you need, just click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in one of two suitable ways: by card or via PayPal.

- Pick a format to download the file in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable form is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have instant access to the right downloadable sample. The platform provides you with access to documents and divides them into groups to simplify your search. Use US Legal Forms to get your Michigan Warranty Deed - Limited Liability Company to a Trust fast and easy.

Form popularity

FAQ

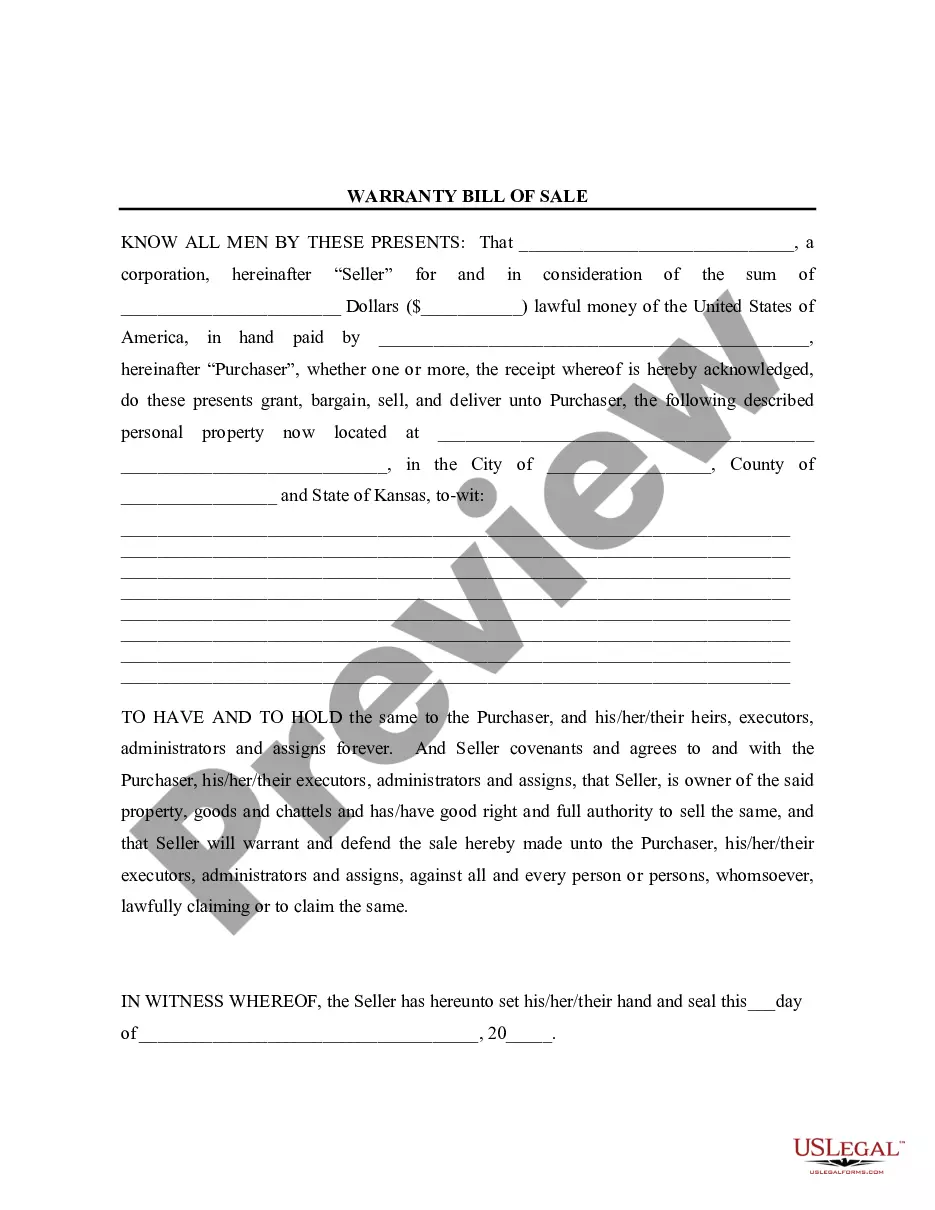

A trustee deed offers no such warranties about the title.

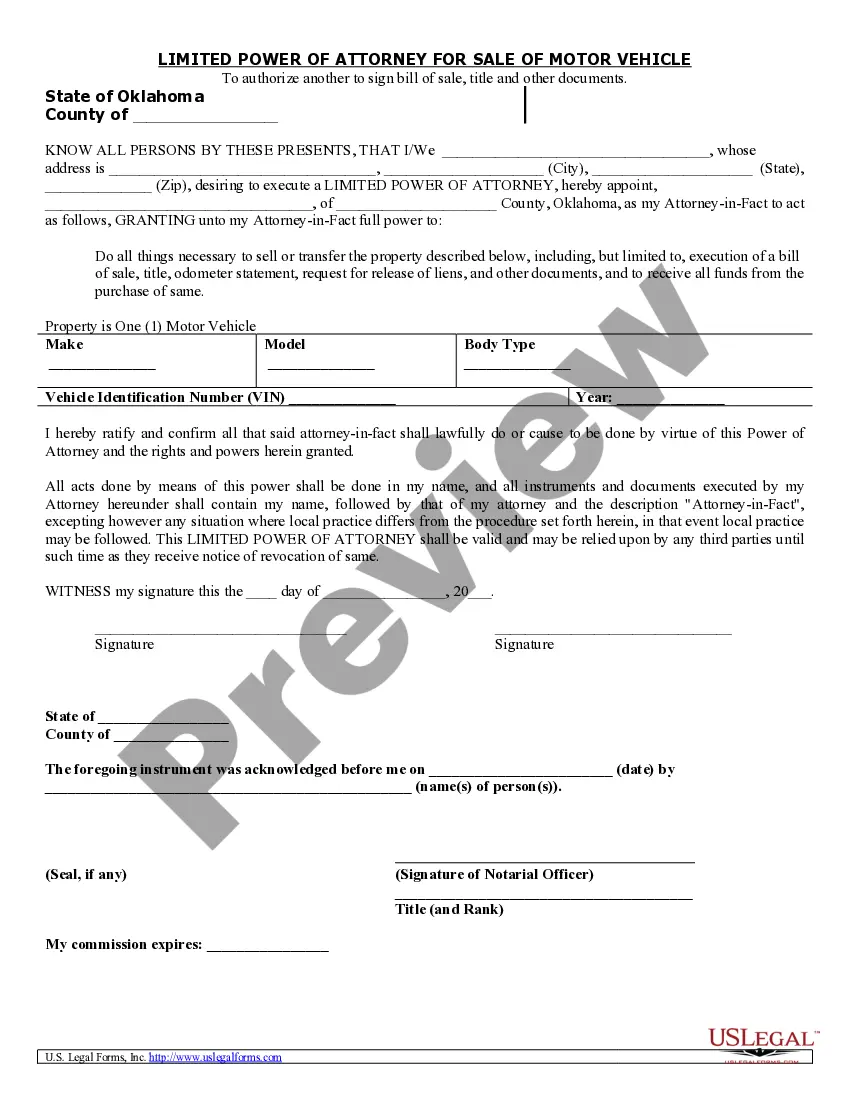

Draft and Execute the Transfer Document. Draft and File an Amendment to your Articles of Organization with the Arizona Corporation Commission. Amend the Operating Agreement. Have LLC Members Sign a Resolution Accepting Transfer.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.

Because an LLC and a trust both provide significant benefits to the owner of real property, a smart investor should consider using both a LLC and a trust to adequately protect himself and his property. Utilizing both a trust and a LLC creates the best combination of liability protection and favorable estate planning.

By placing a business into a living trust -- a trust that is created for you and your family's benefit while you are alive -- you transfer legal ownership of your business to the trustee, which is usually a third party but can also be the business owner.

Locate the deed that's in trust. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office.

Membership of a Trust in an LLCIf the grantor is an owner of an LLC, that ownership is considered an asset. State laws governing living trusts allow trustees to manage nearly any asset of the grantor. Thus, since LLC ownership is considered an asset, a living trust can be a member of the LLC.

Contrary to normal expectations, the Deed DOES NOT have to be recorded to be effective or to show delivery, and because of that, the Deed DOES NOT have to be signed in front of a Notary Public. However, if you plan to record it, then it does have to be notarized as that is a County Recorder requirement.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.