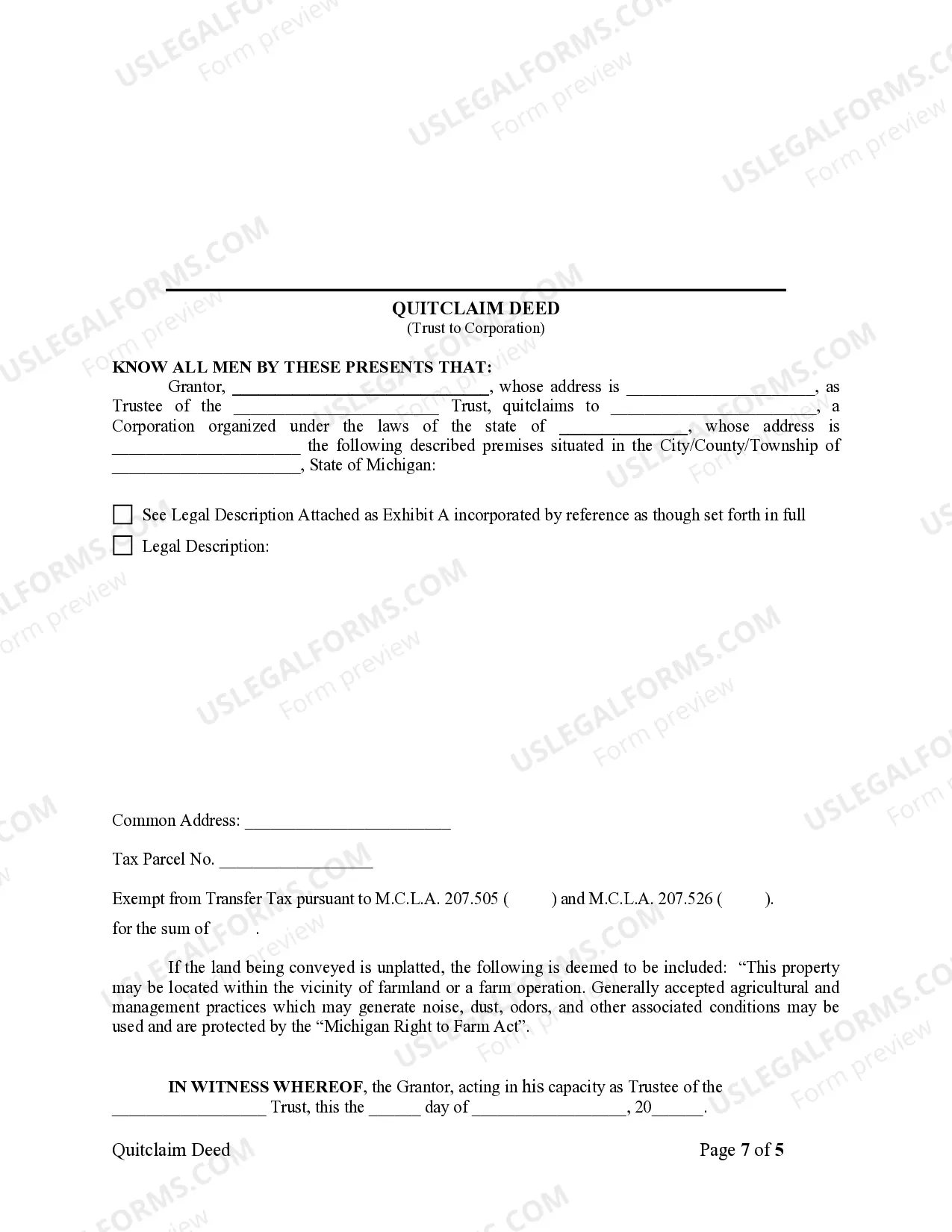

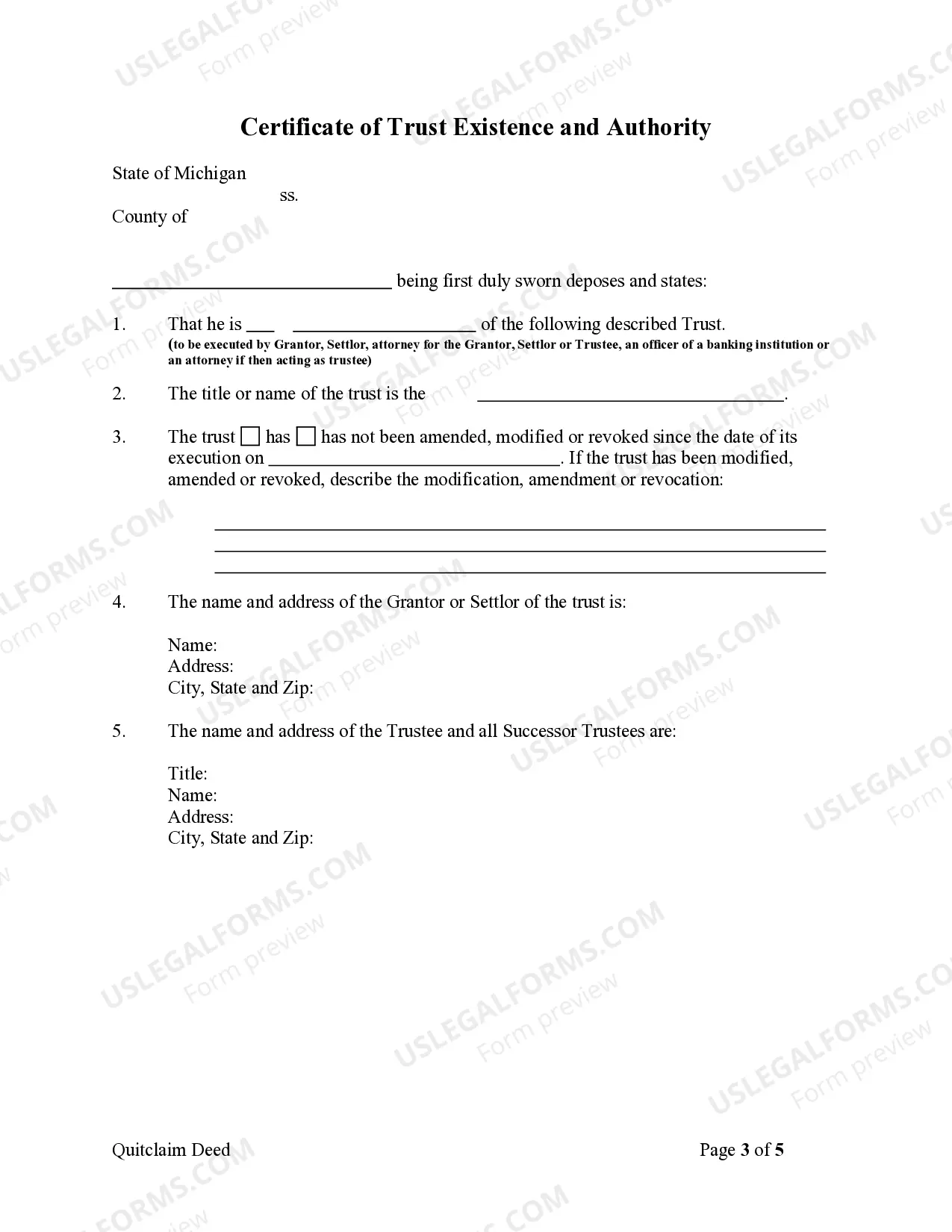

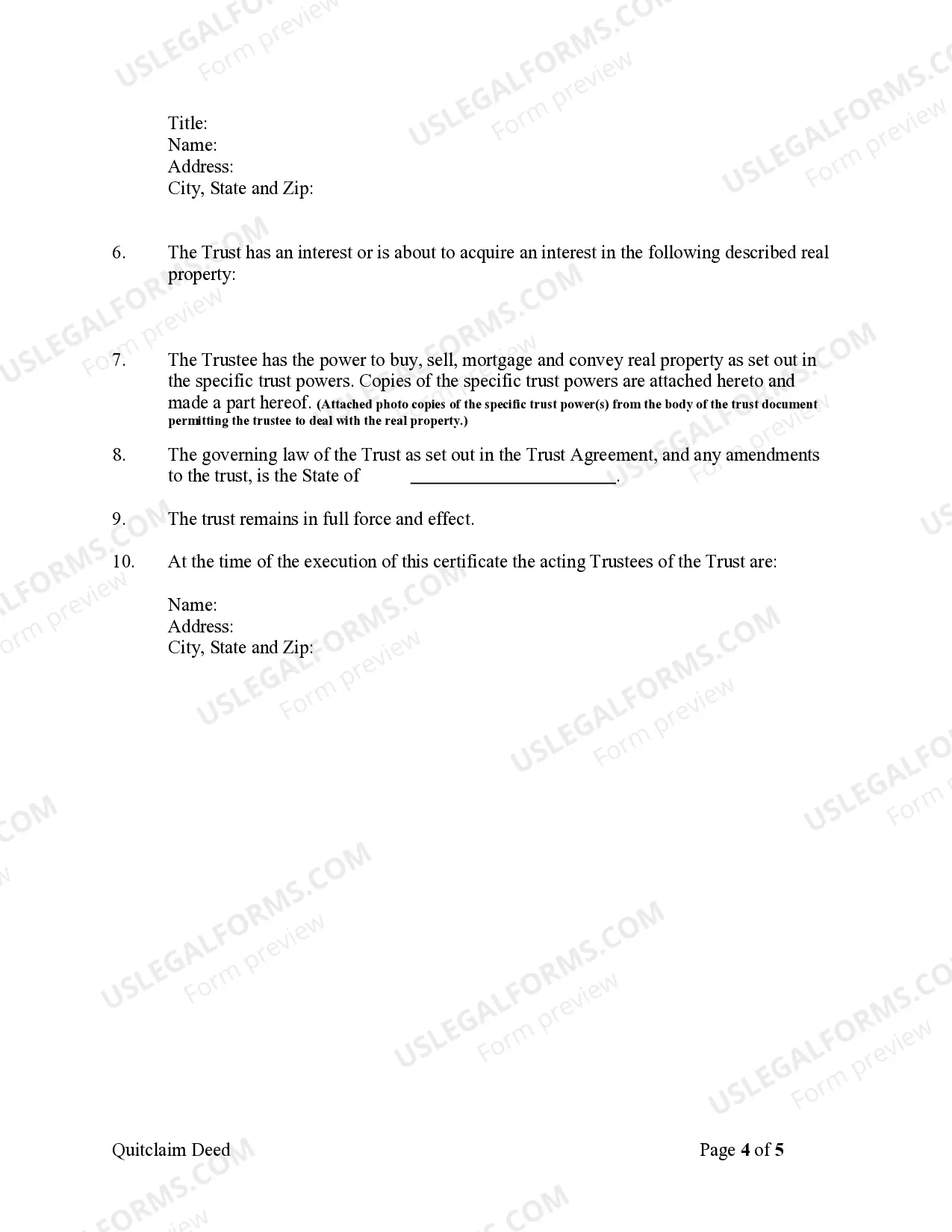

This form is a Quitclaim Deed where the grantor is a Trust and the grantee is a Corporation. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

Michigan Quitclaim Deed - Trust to a Corporation

Description

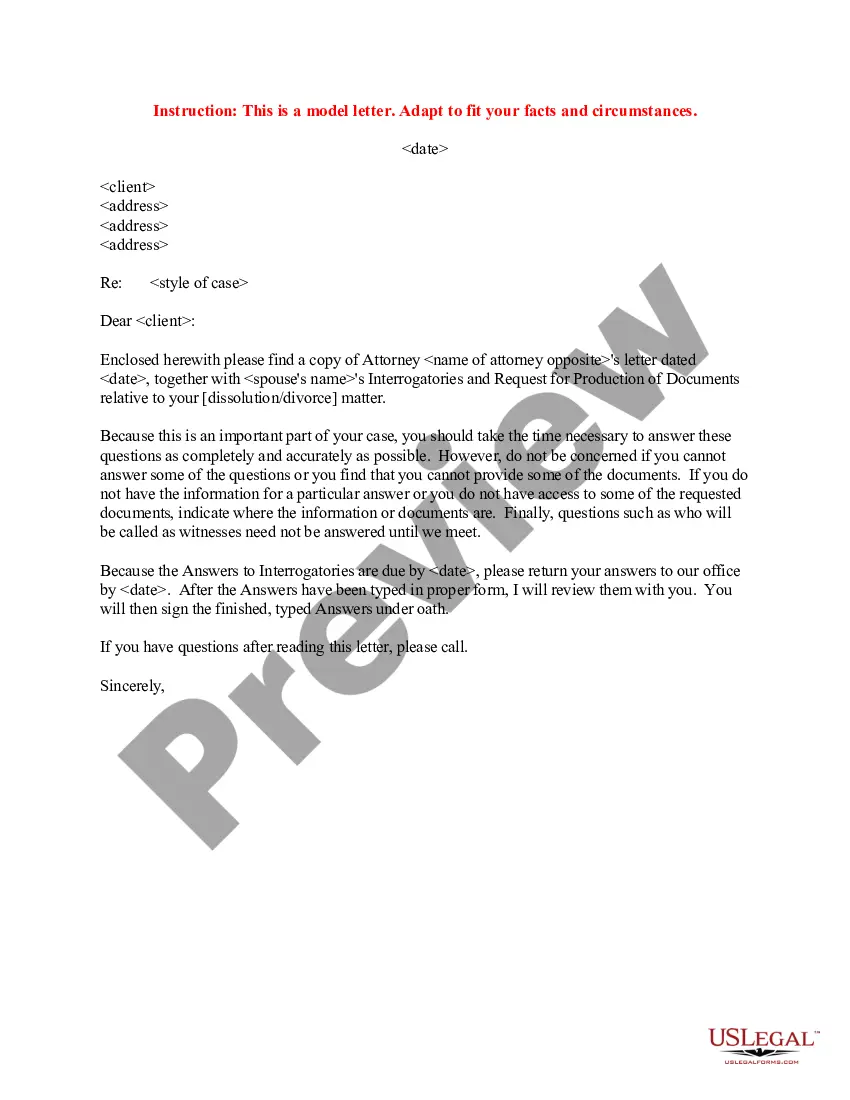

How to fill out Michigan Quitclaim Deed - Trust To A Corporation?

Access any type from 85,000 lawful documents, including Michigan Quitclaim Deed - Trust to a Corporation, online with US Legal Forms.

Each template is crafted and revised by state-authorized legal experts.

If you already possess a subscription, Log In. After you reach the form's page, click the Download button and navigate to My documents to retrieve it.

With US Legal Forms, you will consistently have rapid access to the appropriate downloadable template. The platform offers forms and categorizes them to make your search easier. Utilize US Legal Forms to obtain your Michigan Quitclaim Deed - Trust to a Corporation swiftly and effortlessly.

- Verify the state-specific prerequisites for the Michigan Quitclaim Deed - Trust to a Corporation you intend to utilize.

- Review the description and preview the template.

- When you are confident that the template meets your needs, click on Buy Now.

- Choose a subscription plan that suits your financial situation.

- Set up a personal account.

- Complete the payment using one of two valid methods: by card or via PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable template is ready, print it or save it to your device.

Form popularity

FAQ

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

If the quitclaim deed requires the signature of all co-owners, the deed is invalid unless all co-owners have signed it and the deed is then delivered to the grantee.If one individual owns real estate and desires to add a co-owner such as a spouse, a quitclaim deed might be used.

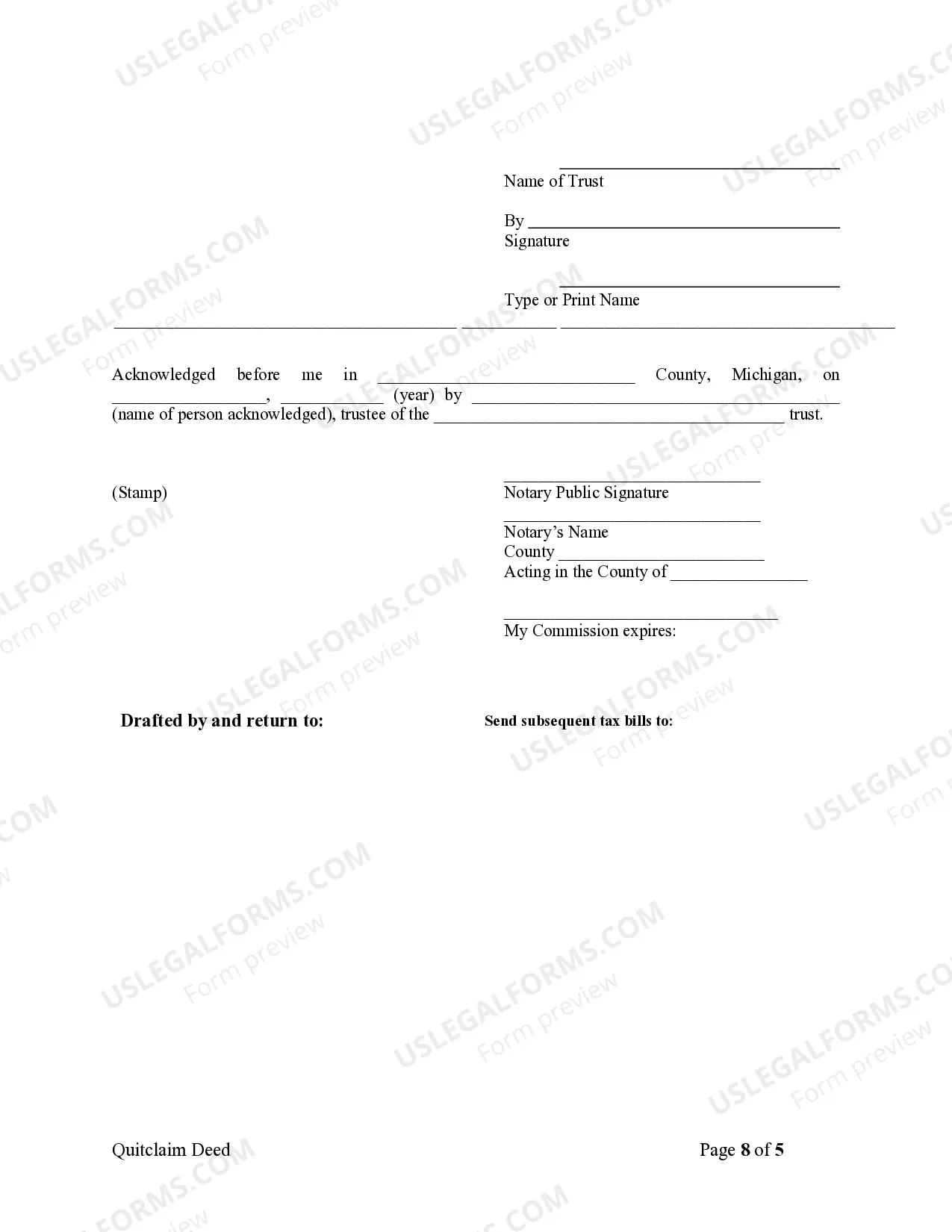

In Michigan, a quit claim deed must be signed by a witness, in addition to the notary, to make it legal.After all required signatures are collected and notarized, file the document with your local register of deeds to complete the transaction.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

Signing: § 565.201 requires that the grantor sign the document in front of a notary public. Recording: All quitclaim deeds in Michigan must be filed with the Michigan Register of Deeds in the county where the property is located.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...