Maine Term Nonparticipating Royalty Deed from Mineral Owner

Description

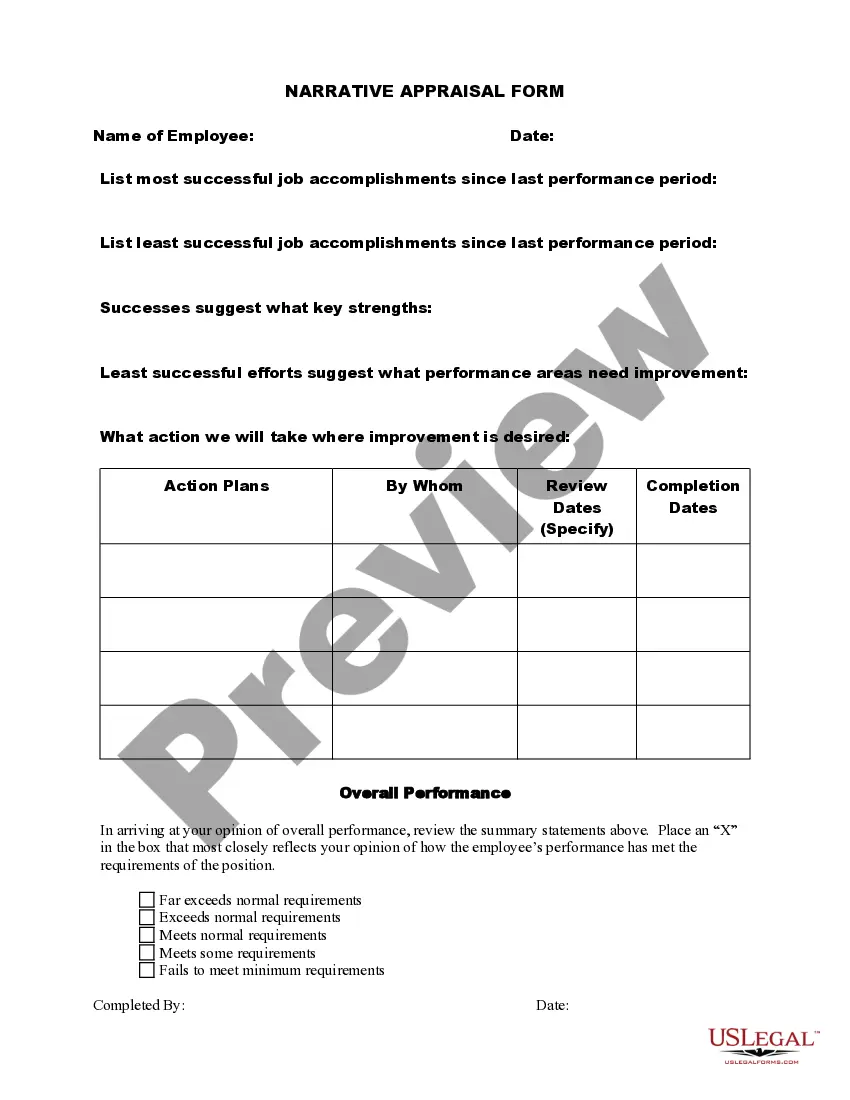

How to fill out Term Nonparticipating Royalty Deed From Mineral Owner?

If you wish to full, obtain, or produce legal record templates, use US Legal Forms, the greatest selection of legal types, that can be found online. Utilize the site`s simple and easy convenient research to obtain the paperwork you will need. Numerous templates for company and person functions are categorized by categories and states, or keywords and phrases. Use US Legal Forms to obtain the Maine Term Nonparticipating Royalty Deed from Mineral Owner in just a number of click throughs.

In case you are already a US Legal Forms buyer, log in for your bank account and click the Obtain key to find the Maine Term Nonparticipating Royalty Deed from Mineral Owner. Also you can accessibility types you earlier delivered electronically in the My Forms tab of your bank account.

If you are using US Legal Forms for the first time, refer to the instructions under:

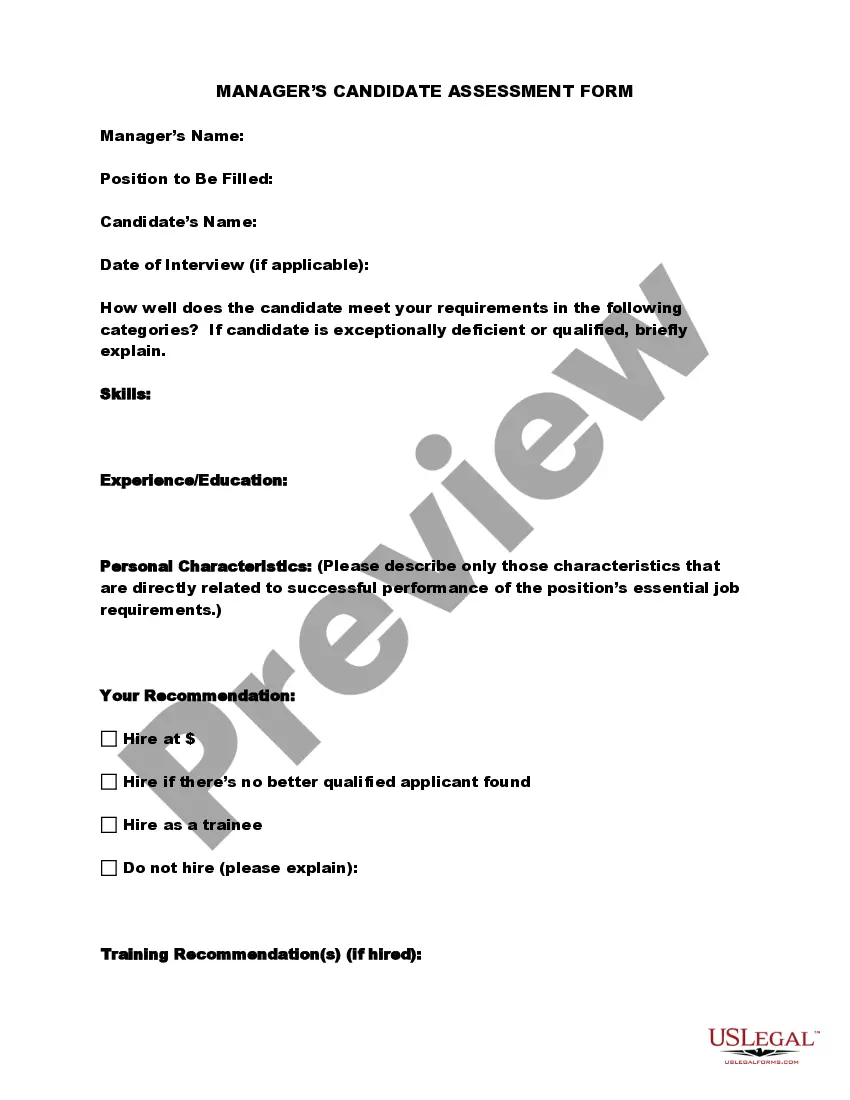

- Step 1. Be sure you have selected the form for your right city/nation.

- Step 2. Use the Preview choice to look through the form`s information. Never overlook to read through the description.

- Step 3. In case you are unsatisfied together with the develop, use the Search field on top of the screen to locate other versions from the legal develop template.

- Step 4. Upon having found the form you will need, select the Get now key. Opt for the prices prepare you favor and add your qualifications to register for an bank account.

- Step 5. Process the purchase. You may use your charge card or PayPal bank account to perform the purchase.

- Step 6. Select the file format from the legal develop and obtain it on your own system.

- Step 7. Full, change and produce or indication the Maine Term Nonparticipating Royalty Deed from Mineral Owner.

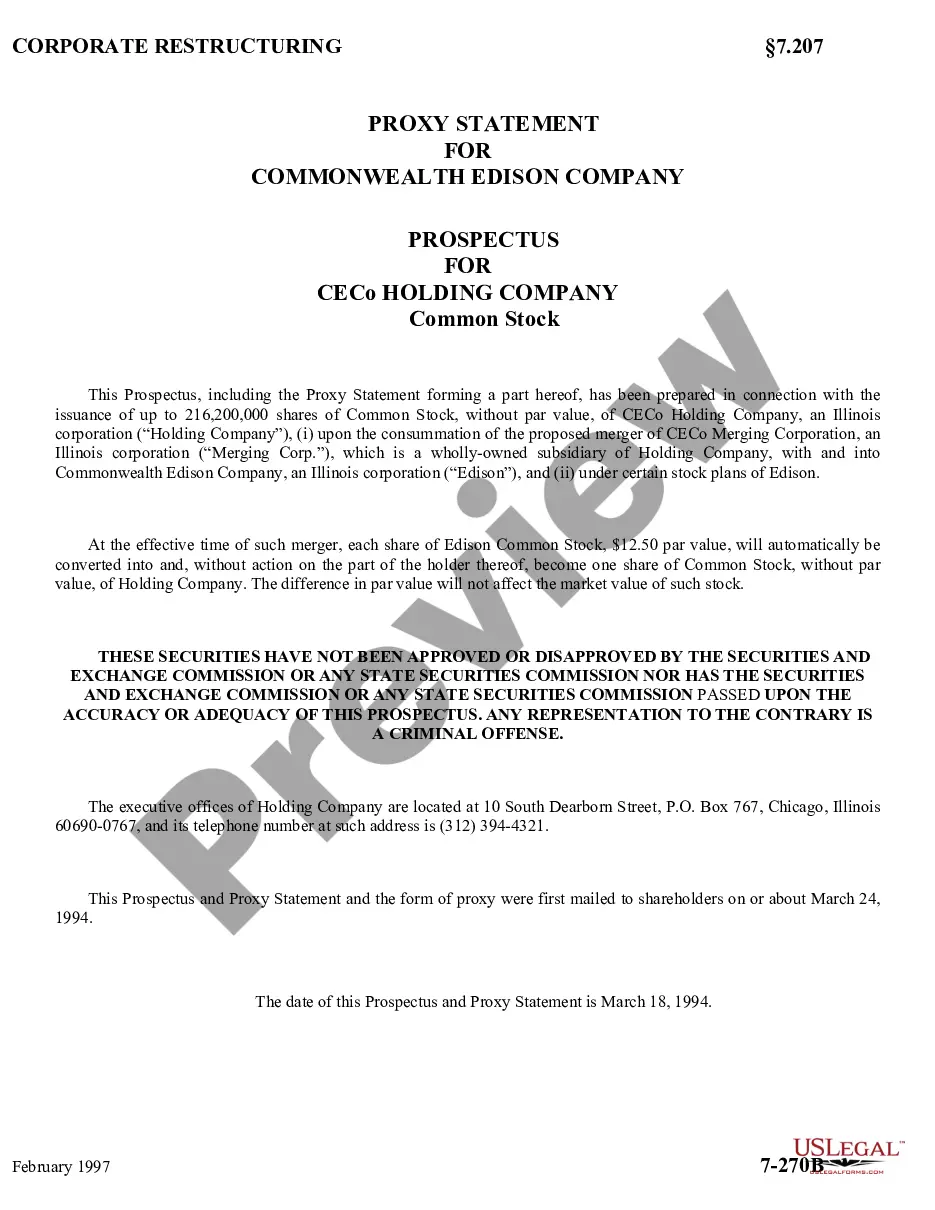

Every legal record template you get is the one you have permanently. You may have acces to every develop you delivered electronically with your acccount. Go through the My Forms area and decide on a develop to produce or obtain once more.

Compete and obtain, and produce the Maine Term Nonparticipating Royalty Deed from Mineral Owner with US Legal Forms. There are millions of skilled and condition-particular types you may use for your personal company or person needs.

Form popularity

FAQ

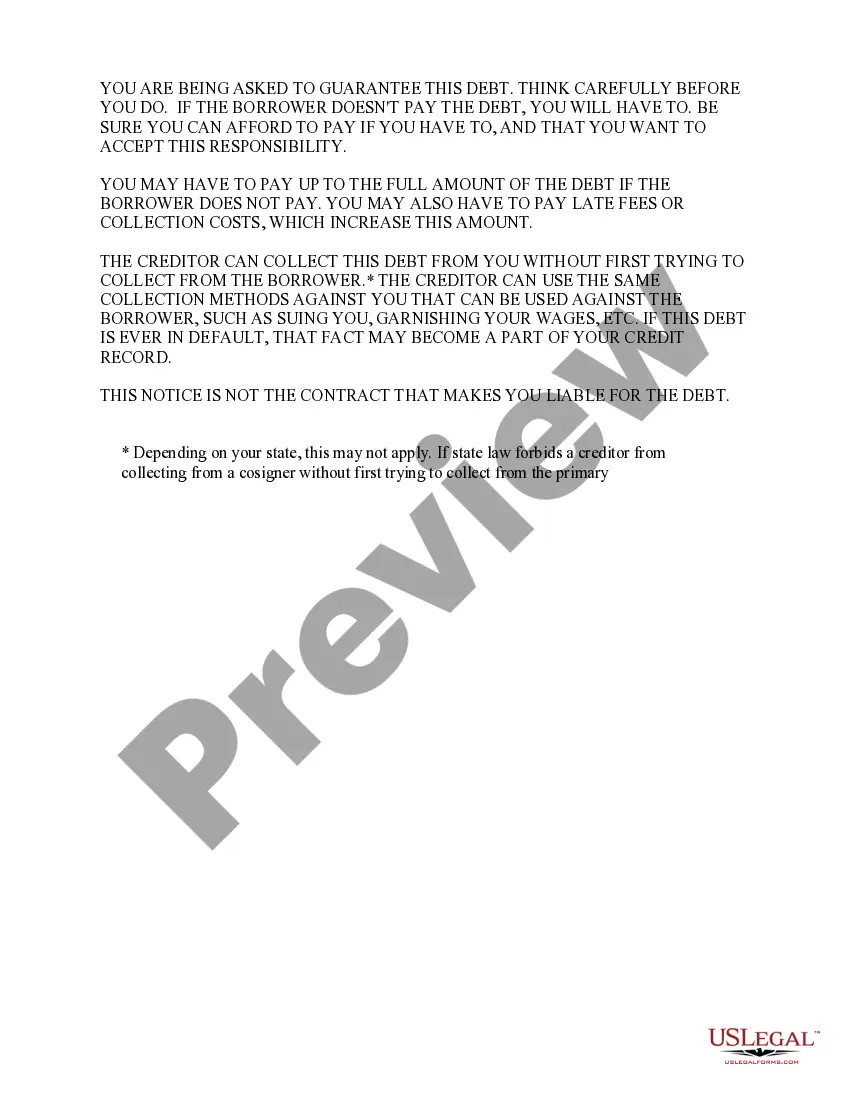

As ownership of land changes, NPRIs are commonly created and assigned to whoever the owners want. The amount of revenue the mineral and surface rights generate can make present and past owners want to share in the future resources of their royalty payments.

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

An NPRI owner also does not have the right to produce the minerals by himself, and they are not responsible for the operational costs associated with production or drilling. An NPRI has fewer rights than a 'regular' mineral rights owner as they do not have the right to make decisions related to the execution of leases.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

In the oil & gas industry, an NEMI is a mineral interest the owner of which does not have the right to execute an oil and gas lease. As with a non-participating royalty interest (NPRI), a NEMI owner must consent for its interest to be pooled with other oil and gas interests.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

The revenue remaining after the RI is paid out of the WI is called the net revenue interest (NRI). If you are the lessor of an ORRI, you will receive your proportional share of the working interest lease based on the net revenue interest (NRI).