Maine Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest

Description

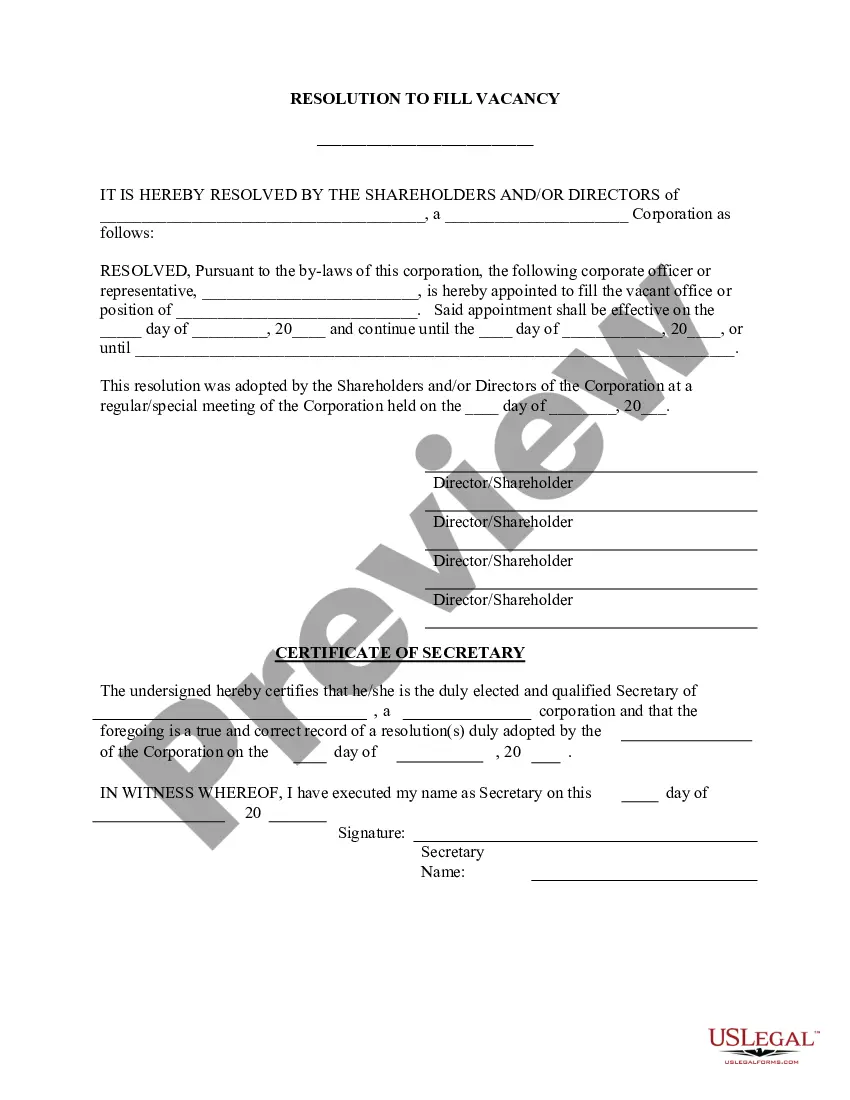

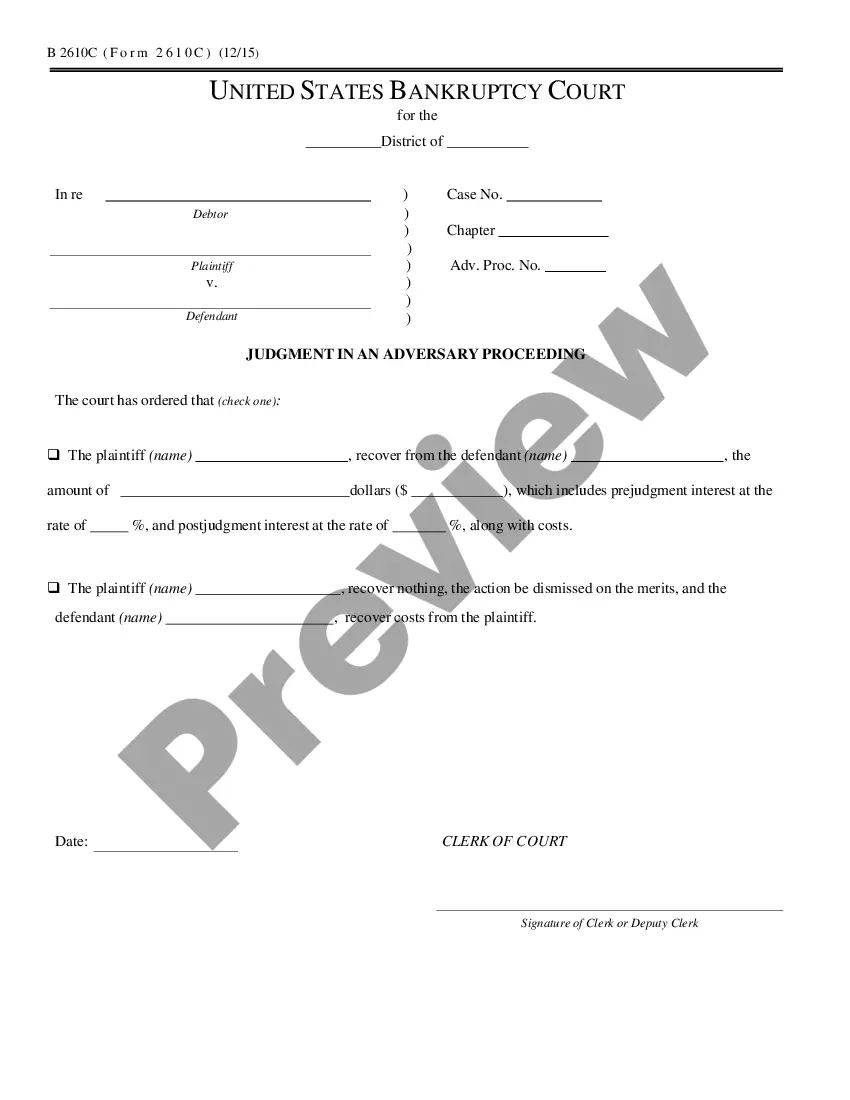

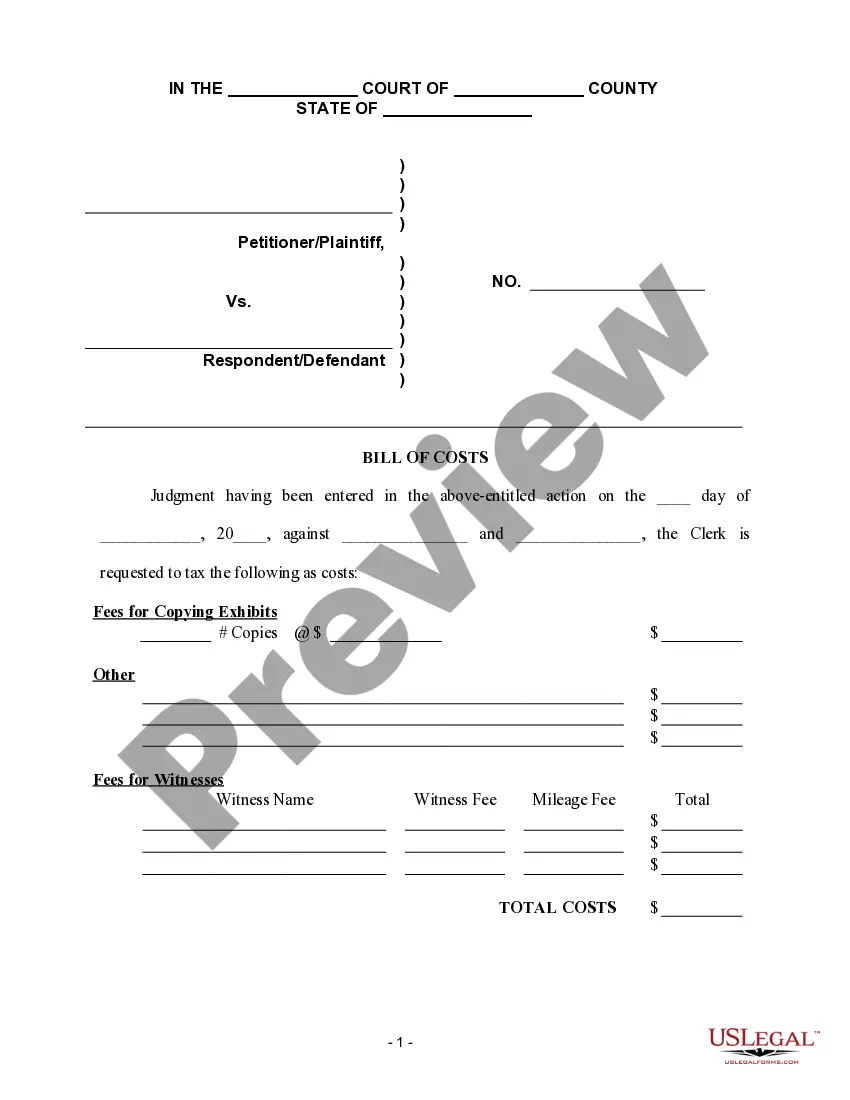

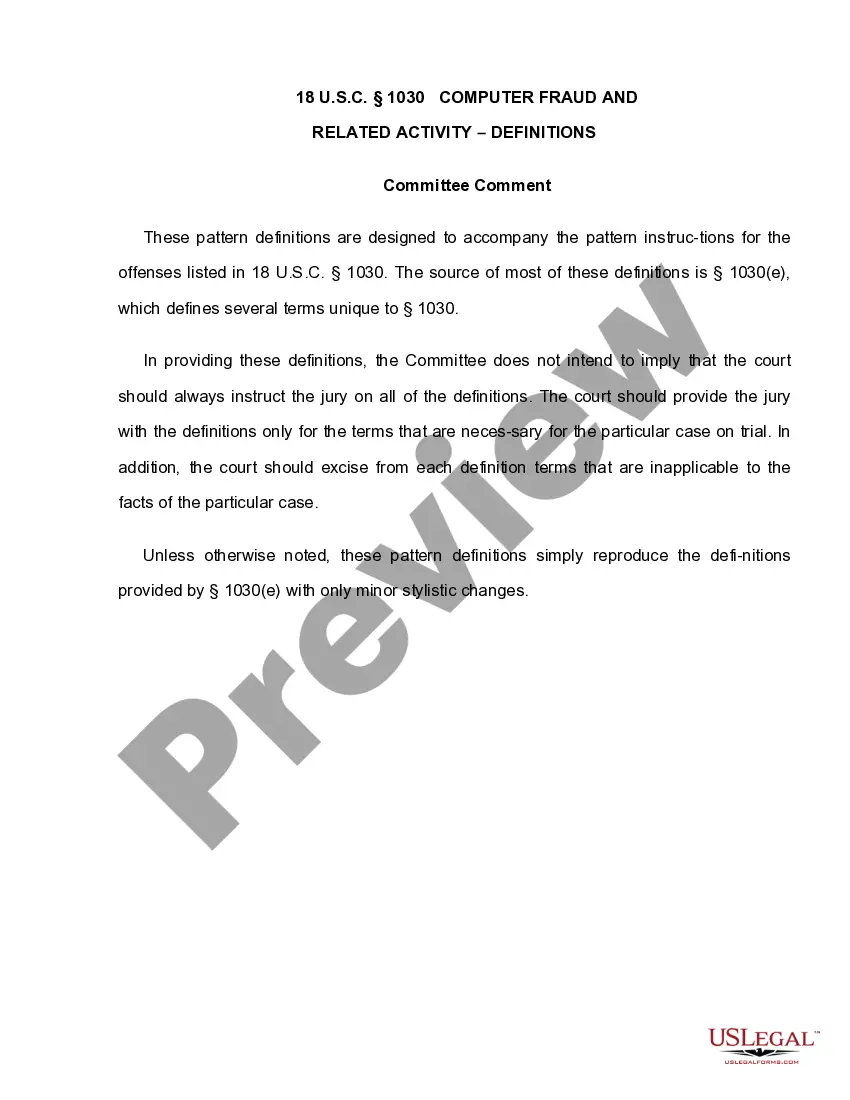

How to fill out Mineral Deed With Grantor Reserving Nonparticipating Royalty Interest?

US Legal Forms - among the greatest libraries of lawful kinds in the United States - provides a variety of lawful file themes you can acquire or print out. While using internet site, you can find thousands of kinds for company and specific purposes, categorized by groups, says, or search phrases.You will find the most up-to-date models of kinds like the Maine Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest in seconds.

If you already have a registration, log in and acquire Maine Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest from the US Legal Forms library. The Obtain option will show up on every develop you perspective. You have access to all earlier acquired kinds from the My Forms tab of your respective profile.

In order to use US Legal Forms for the first time, here are easy guidelines to help you started out:

- Be sure to have chosen the right develop for the area/state. Select the Review option to review the form`s articles. Read the develop information to ensure that you have selected the proper develop.

- When the develop does not satisfy your specifications, use the Search industry near the top of the screen to find the one which does.

- If you are satisfied with the shape, validate your selection by simply clicking the Get now option. Then, select the rates strategy you want and supply your qualifications to sign up to have an profile.

- Method the financial transaction. Utilize your charge card or PayPal profile to finish the financial transaction.

- Find the structure and acquire the shape in your device.

- Make adjustments. Fill out, revise and print out and indicator the acquired Maine Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest.

Every template you added to your account does not have an expiry particular date which is your own property for a long time. So, if you would like acquire or print out yet another duplicate, just proceed to the My Forms area and click around the develop you will need.

Get access to the Maine Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest with US Legal Forms, probably the most substantial library of lawful file themes. Use thousands of skilled and express-particular themes that meet your business or specific demands and specifications.

Form popularity

FAQ

This is an estate or ownership in fee simple in and to the minerals. A conveyance or reservation of a mineral fee gives title to the minerals. The ownership of a mineral interest includes all ownership, including the right to execute oil, gas and mineral leases and the right to receive bonuses, rentals and royalties.

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

An Overriding Royalty Interest IORRI), commonly referred to as an override, is a fractional, undivided interest granting the right to receive proceeds from the sale of oil and gas. It is not an interest in the minerals themselves, but rather in the proceeds of the sale of oil and gas.

A mineral interest is simply a real property interest obtained from the severance or exploitation of minerals ? say natural gas ? from the surface. On the other hand, a royalty interest is the property interest that grants an owner a portion of the production revenue generated.

Typically, NPRIs are created by an express grant or reservation in a deed and are entirely different from a ?leasehold? royalty. The holder of a NPRI has no power to negotiate or execute an oil and gas lease and has no power to enter upon the land to extract the hydrocarbons.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Non-Participating Royalty Interest (NPRI) Unlike a mineral interest owner, the NPRI owner does not have ?executive? rights, meaning they cannot sign an oil and gas lease or participate in the benefits of lease bonus or delay rentals.

An ORRI is a fractional, undivided interest with the right to participate or receive proceeds from the sale of oil and/or gas. It is not an interest in the minerals, but an interest in the proceeds or revenue from the oil & gas minerals sold.