Maine Self-Employed Independent Contractor Consideration For Hire Form

Description

How to fill out Self-Employed Independent Contractor Consideration For Hire Form?

It is feasible to spend hours online trying to find the appropriate legal format that meets the federal and state requirements you need.

US Legal Forms offers a plethora of legal forms that can be reviewed by professionals.

You can easily download or print the Maine Self-Employed Independent Contractor Consideration For Hire Form from their services.

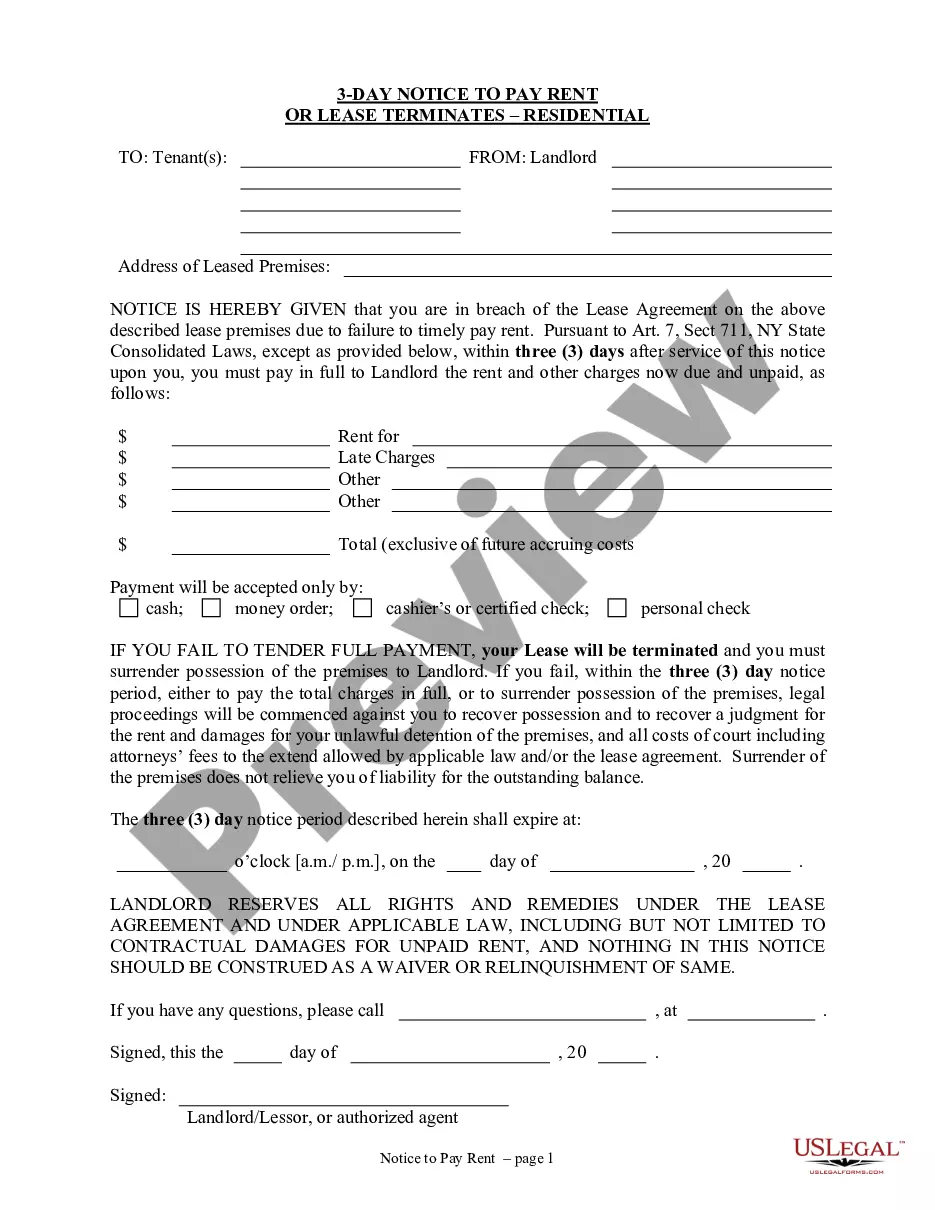

Review the form description to confirm you have chosen the right type. If available, use the Review option to examine the format as well.

- If you already possess a US Legal Forms account, you can Log In and select the Acquire option.

- Then, you can complete, modify, print, or sign the Maine Self-Employed Independent Contractor Consideration For Hire Form.

- Each legal format you purchase belongs to you indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and select the relevant option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct format for the state/city you choose.

Form popularity

FAQ

To hire an independent contractor, you will need several crucial documents. First, prepare the Maine Self-Employed Independent Contractor Consideration For Hire Form to outline the work arrangement. Don't forget the W-9 form to collect tax information, ensuring compliance and smooth financial reporting.

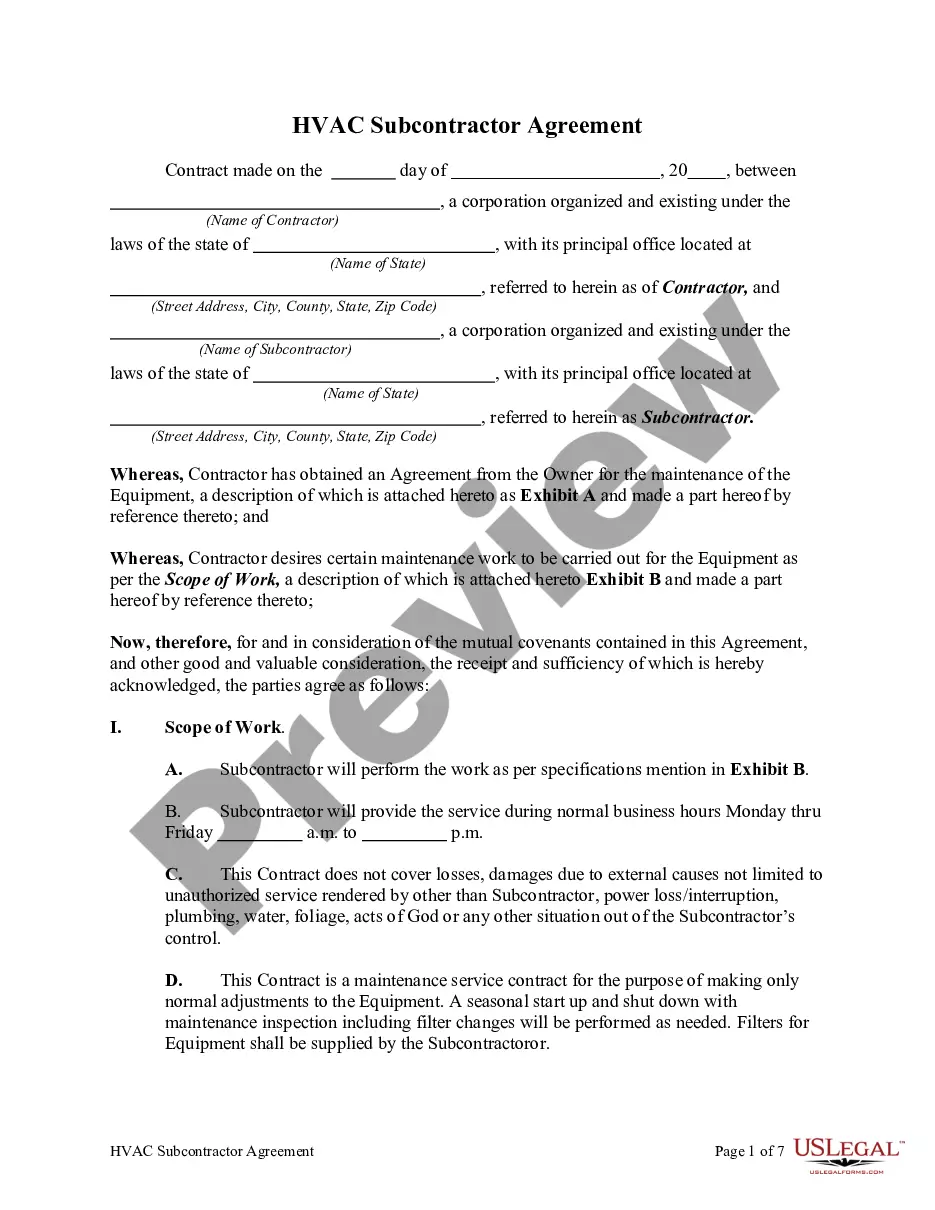

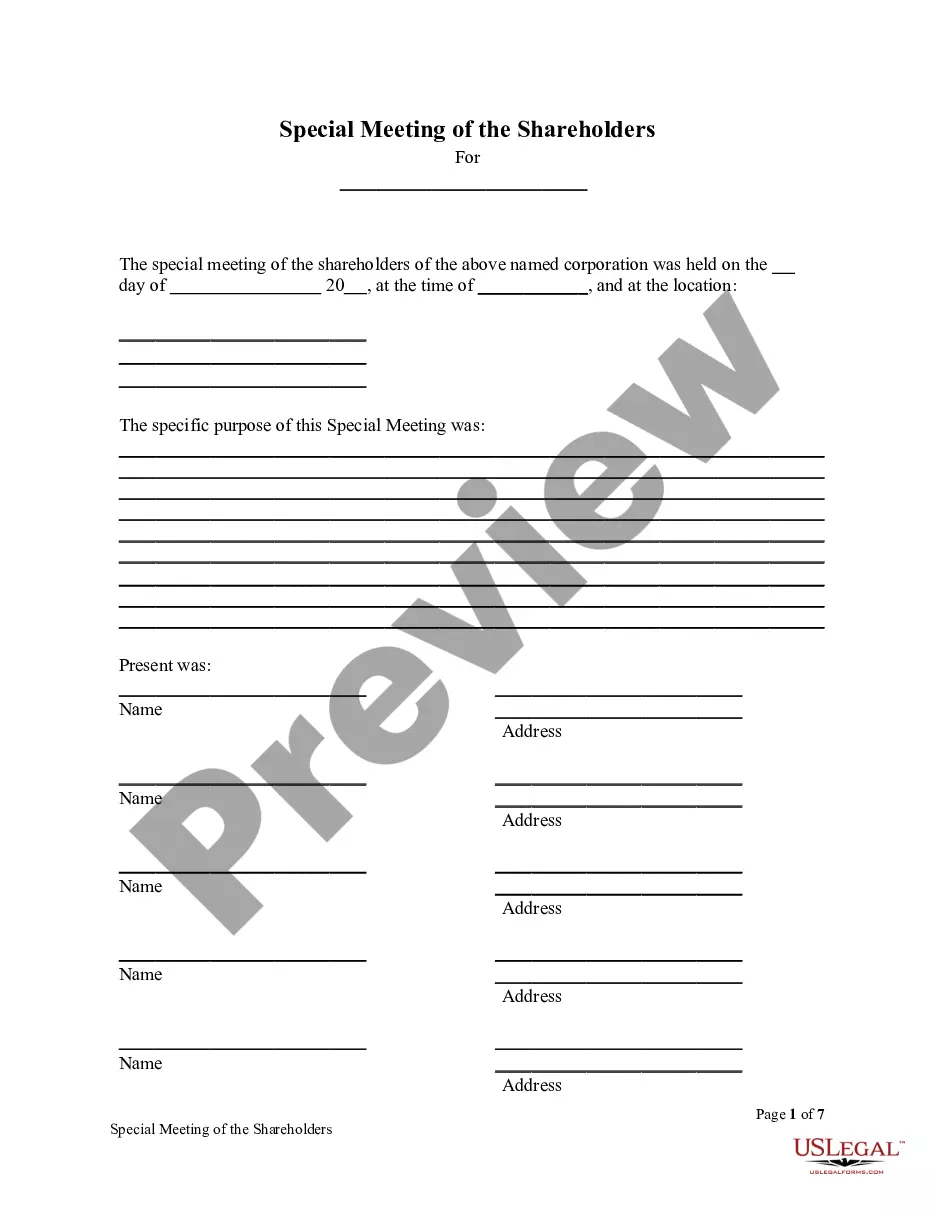

As a sole proprietor, hiring independent contractors involves defining clear expectations. You should start by drafting a contract that includes work details and payment terms. Additionally, utilizing the Maine Self-Employed Independent Contractor Consideration For Hire Form will help you streamline the hiring process and meet legal requirements.

An independent contractor typically needs to complete a W-9 form to provide their tax information. Depending on your state, they may also need to fill out the Maine Self-Employed Independent Contractor Consideration For Hire Form, which establishes work terms. Ensuring all forms are accurately completed helps prevent issues down the line.

Legal requirements for independent contractors can vary, but generally, they must not be subject to the same level of control as employees. It's essential to ensure that your contract specifies the nature of the work and payment terms. Consider using the Maine Self-Employed Independent Contractor Consideration For Hire Form to clarify these aspects and meet legal standards.

To hire an independent contractor, you need to gather a few essential documents. First, you should complete the Maine Self-Employed Independent Contractor Consideration For Hire Form. This form helps outline the terms of the contract and ensures compliance with legal requirements. Additionally, you may require a W-9 form for tax purposes.

The most important factor is typically the level of control exercised by the hiring party over the worker's tasks. This includes how much direction is given regarding work processes and outcomes. The Maine Self-Employed Independent Contractor Consideration For Hire Form can help clarify the relationship dynamics in such situations.

Factors include the degree of control exerted by the employer, investment in equipment and facilities, and the degree of financial risk taken by the worker. The IRS tests are often used to assess these elements. The Maine Self-Employed Independent Contractor Consideration For Hire Form can serve as a useful reference in this classification process.

Key factors include the degree of independence in how work is done, who provides tools and resources, and whether the worker has the opportunity for profit or loss. The agreement terms, established via the Maine Self-Employed Independent Contractor Consideration For Hire Form, can be essential in demonstrating this independence.

A variety of factors, including the level of control an employer has over a worker and the nature of the work relationship, determine classification. The IRS uses several criteria, including behavioral control, financial control, and the type of relationship. Utilizing the Maine Self-Employed Independent Contractor Consideration For Hire Form can clarify this status for all parties involved.

Independent contractors typically need to complete tax forms, such as a W-9, to provide their taxpayer information to clients. Additionally, the Maine Self-Employed Independent Contractor Consideration For Hire Form can help establish the terms of your engagement with clients officially. Keeping organized records is vital for tax purposes.