Maine MHA Request for Short Sale

Description

How to fill out MHA Request For Short Sale?

You might invest numerous hours online attempting to discover the legal document format that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal templates that are assessed by professionals.

You can obtain or print the Maine MHA Request for Short Sale from their services.

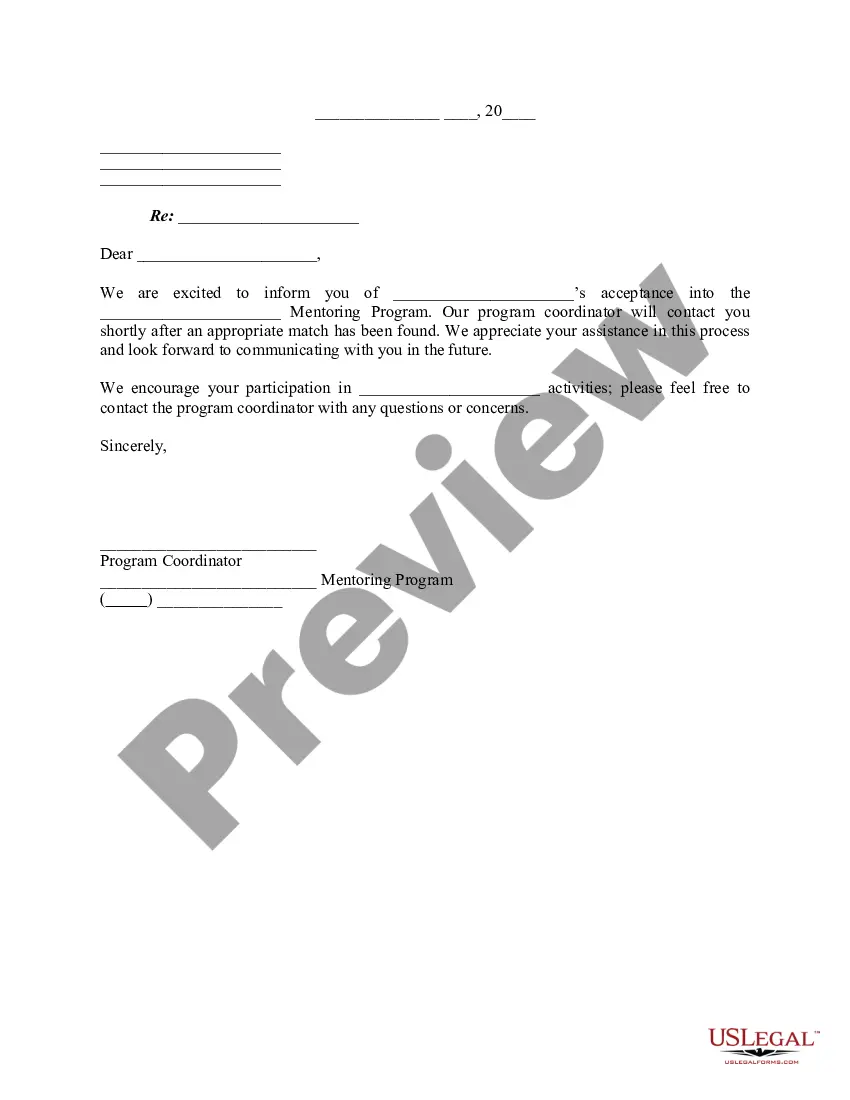

If available, use the Preview button to view the document format as well.

- If you have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can fill out, modify, print, or sign the Maine MHA Request for Short Sale.

- Every legal document format you purchase is yours indefinitely.

- To acquire another copy of any purchased document, go to the My documents tab and click the corresponding button.

- When using the US Legal Forms site for the first time, follow the straightforward guidelines provided below.

- First, ensure you have chosen the correct document format for the state/region of your choice.

- Check the document description to confirm that you have selected the right form.

Form popularity

FAQ

In Maine, the redemption period for foreclosure is typically 90 days after the foreclosure deed is recorded. During this time, homeowners have the opportunity to regain ownership of their home by paying off the owed amount. If you are facing foreclosure, considering the Maine MHA Request for Short Sale can be a useful alternative. The US Legal Forms platform can assist you in understanding your rights and options during this crucial timeframe.

The foreclosure diversion program in Maine aims to assist homeowners facing financial difficulties by providing a structured way to negotiate with lenders. This program offers mediation services, allowing homeowners to explore alternatives like a Maine MHA Request for Short Sale. Participants receive support in resolving their mortgage issues, potentially avoiding foreclosure. It's a valuable resource for those in need of guidance during tough times.

In Maine, the timeframe for foreclosure can vary, often taking several months to over a year. This duration depends on various factors, including court proceedings and the type of foreclosure. Homeowners can potentially lengthen this process by requesting mediation or looking into the Maine MHA Request for Short Sale. Being proactive may help you find financial relief during this challenging time.

The foreclosure process in Maine typically begins after a borrower defaults on their mortgage. Lenders must send a notice of default before initiating foreclosure proceedings. If the borrower does not resolve the issue, the lender can move forward with foreclosure, leading to a public auction of the home. Homeowners can explore options like the Maine MHA Request for Short Sale to prevent this outcome.

To avoid capital gains tax on the sale of your home in Maine, you may consider utilizing the Maine MHA Request for Short Sale. By negotiating with your lender for a short sale, you can potentially exempt certain gains from taxation, especially if you lived in the home for two out of the last five years. Additionally, if your total gain is under $250,000 for single filers or $500,000 for married couples, you may not owe taxes on that gain. Consulting with a tax professional can provide you with personalized solutions and strategies.

A short sale negotiator works on behalf of a seller to reach a short sale approval with a bank or other lender. The individual's job is to persuade the lender to agree to accept less than the debt owed on the mortgage in order to allow the short sale to occur.

Offer a Strong Earnest Money Deposit.Check the Comparable Sales.Don't Ask for Special Reports or Repairs.Give the Bank Some Time.Assure the Seller You'll Wait.Offer to Pay the Seller's Fees.Shorten Your Inspection Period.Provide a Strong Preapproval Letter.

Can You Negotiate A Short Sale? It is entirely possible to negotiate a short sale, but doing so can be a time-consuming process. Instead of negotiating with the seller alone, as is the case with most traditional sales, short sale negotiations must be approved by the lender, too.

If you're planning to buy a short sale, you should talk to the listing agent. At the very least, before writing an offer, ask your agent to speak to the listing agent. You'll find different skill sets and education levels among real estate agents.

The Short Sale Process For Buyers: 6 StepsStep 1: Get Approved For Financing. As with any home purchase, the first step is getting approved.Step 2: Get A Real Estate Agent And Find A Home.Step 3: Do Your Research.Step 4: Make An Offer.Step 5: Have The Home Inspected.Step 6: Close On The Property.