Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

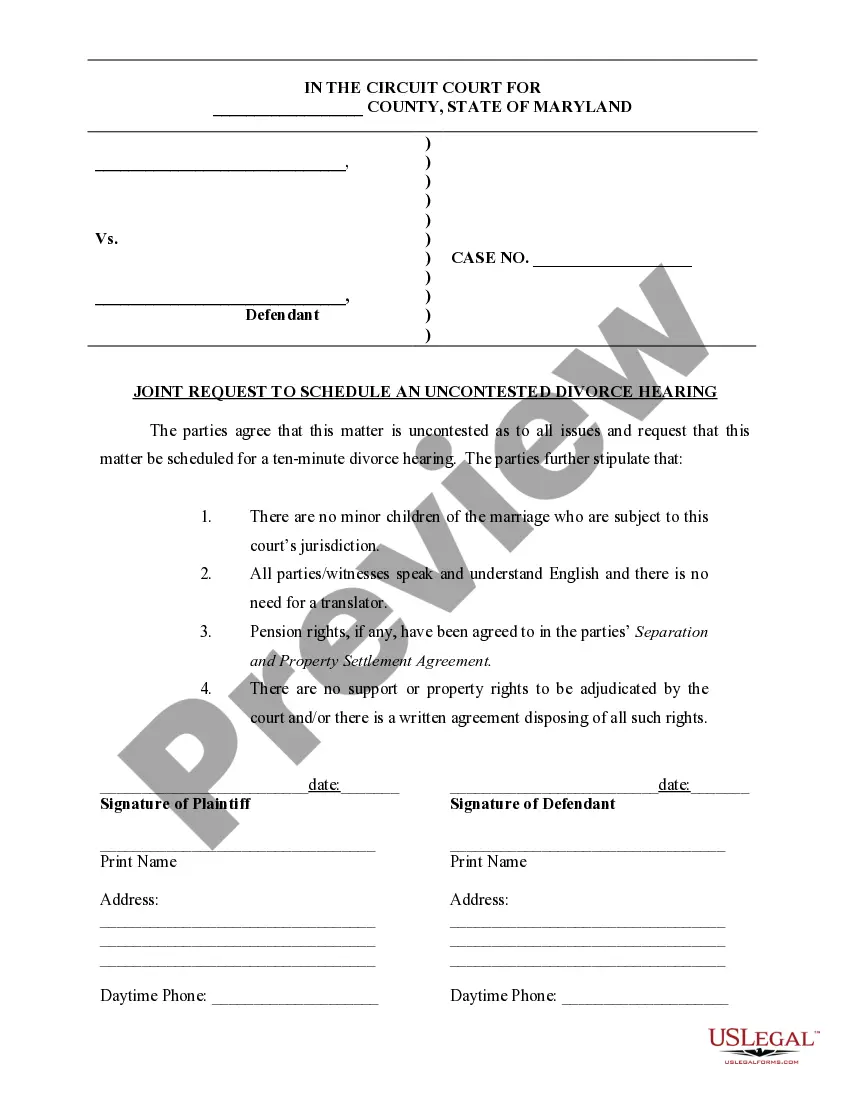

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

If you aim to be thorough, acquire, or generate legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are sorted by categories and states, or by keywords.

Step 4. Once you’ve found the form you need, click the Get it now button. Choose your preferred pricing plan and input your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.Step 6. Select the format of your legal document and download it to your device.Step 7. Complete, edit, and print or sign the Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

- Use US Legal Forms to obtain the Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP in just a few clicks.

- If you are an existing US Legal Forms customer, Log In to your account and click on the Download button to get the Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Remember to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

The Home Affordable Modification Program, or HAMP, officially ended on December 30, 2016. However, many homeowners still seek assistance with the Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP to navigate their current financial challenges. While HAMP itself is no longer available, various programs and resources may provide similar options for mortgage relief and modification. It’s essential to explore updated avenues for help through your lender or by using platforms like US Legal Forms, which can guide you through the loan modification process.

Getting approved for a loan modification under the Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can vary based on individual circumstances. While some people find it straightforward, others may encounter challenges depending on their financial history and current mortgage status. To improve your chances, it’s essential to provide accurate information and complete documentation. Services like USLegalForms can simplify this process for you, ensuring you meet all necessary requirements.

To qualify for a loan modification under the Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you typically need to demonstrate financial hardship. This may include a loss of income, increased expenses, or any situation that affects your ability to make mortgage payments. Additionally, you must show that you can afford the modified payment based on your current financial situation. By working with platforms like USLegalForms, you can easily navigate the documents and requirements for this process.

The loan modification process typically begins with submitting an application for assistance. This often requires financial documentation to assess your situation. With the Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, our platform can guide you through each step, ensuring you have the necessary support to successfully modify your loan.

A mortgage loan modification can be a beneficial option if you are struggling to keep up with payments. It may reduce your monthly financial burden and help you avoid foreclosure. By exploring the Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you can potentially find a solution that works for your unique situation.

A HAMP modification involves adjusting the terms of your existing mortgage to make it more affordable. This can include lowering the interest rate, extending the loan term, or even reducing the principal balance. The Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is an excellent choice for accessing these modifications, helping you manage your mortgage more effectively.

HAMP stands for the Home Affordable Modification Program, which aims to help homeowners avoid foreclosure. It provides a way for borrowers to modify their existing loan terms to lower monthly payments and restore financial stability. Utilizing the Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP gives you access to numerous benefits tailored to your specific situation.

The MaineHousing Home Affordable Modification Program is a state-specific initiative that aims to assist homeowners in Maine facing financial hardships. This program offers various resources, including the Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, to make mortgage payments more manageable. It provides guidance and support throughout the loan modification process.

A HAMP loan modification is a program designed to help homeowners struggling to make their mortgage payments. It modifies existing loans to make them more affordable by reducing monthly payments. Through the Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you can seek assistance in restructuring your loan for better financial stability.

The Home Owners' Loan Corporation (HOLC) is not active today as it was dissolved in the 1950s. It played a significant role during the Great Depression by offering refinancing options to struggling homeowners. While HOLC is no longer available, programs like the Maine Request for Loan Modification RMA Under Home Affordable Modification Program HAMP have emerged to fill that gap. These contemporary solutions provide essential support to homeowners facing challenges today.