Maine Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

If you require detailed, download, or print official document templates, utilize US Legal Forms, the largest collection of official forms available online.

Take advantage of the site's straightforward and user-friendly search function to locate the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to obtain the Maine Notice of Violation of Fair Debt Act - Notice to Stop Contact in just a few clicks.

Every official document template you purchase is yours indefinitely. You will have access to every form you saved in your account. Go to the My documents section and select a form to print or download again.

Compete and download, and print the Maine Notice of Violation of Fair Debt Act - Notice to Stop Contact with US Legal Forms. There are countless professional and state-specific templates you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the Maine Notice of Violation of Fair Debt Act - Notice to Stop Contact.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

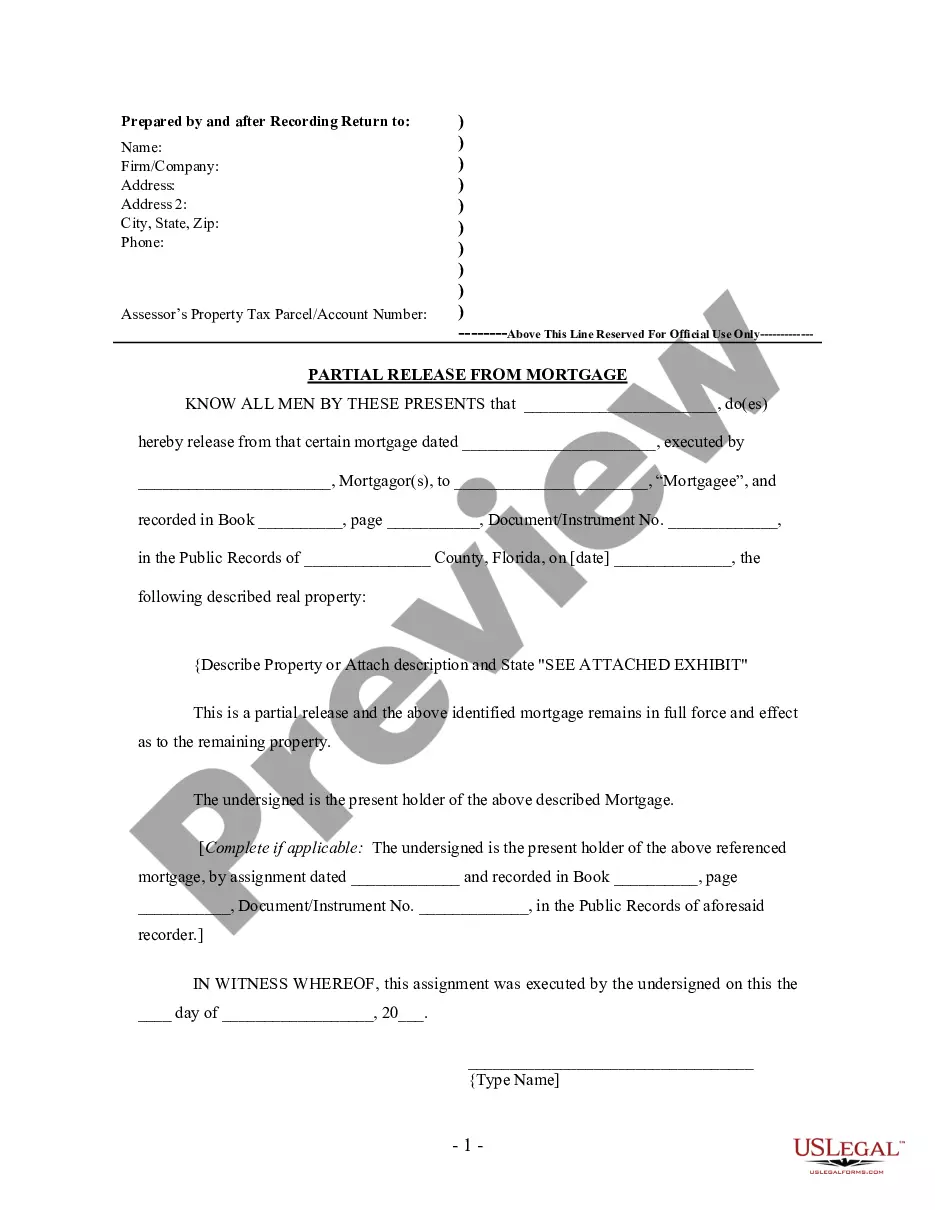

- Step 2. Use the Preview option to review the content of the form. Don’t forget to review the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the official form template.

- Step 4. Once you have found the form you desire, click the Buy now button. Select your preferred payment plan and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the official form and download it onto your device.

- Step 7. Complete, modify, and print or sign the Maine Notice of Violation of Fair Debt Act - Notice to Stop Contact.

Form popularity

FAQ

How do Collection Agencies Apply for a License in Michigan?Step 1 Become a Licensed Collection Agency Manager. Collection agencies in Michigan must employ a licensed collection agency manager at each licensed office location.Step 2 Purchase a Surety Bond.Step 3 Complete the Application.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

The Top 8 Characteristics of Successful Collection AgentsGreat Listener. This holds true for most successful people.Understands How to Overcome Objections.Gets Past the Gatekeeper.Closes the Deal.Comfortable Communicator.Creative Problem Solver.Balances Empathy with Collections.Competitive.

What Is an FDCPA Validation Letter? The FDCPA is a federal law that protects consumers from abusive collection practices by debt collectors and collection agencies. Whether the FDCPA applies to foreclosures generally depends on if the foreclosure is judicial or nonjudicial.

Debt collectors are required to give the full mini Miranda in their initial communication with you, no matter what form. 1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included.

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

An application for registration as a debt collector must be lodged with the Council on the prescribed form and must be accompanied by the registration fee and annual subscription fee prescribed by Regulation. No application will be finalized if the proof of payment is not attached.

The average salary of a debt collector was $13.79 per hour or $37,041 annually in August of 2019. This salary could be higher in some positions, if the company offers bonuses and/or commissions on the accounts you're able to collect on.

The CFPB explicitly states that the final rule does not require a debt collector to use the model validation notice and that use of the model notice is one way to comply to comply with the content and format requirements in Regulation F. It states further that debt collectors who choose not to use the model

How do Collection Agencies Apply for a License in Michigan?Step 1 Become a Licensed Collection Agency Manager. Collection agencies in Michigan must employ a licensed collection agency manager at each licensed office location.Step 2 Purchase a Surety Bond.Step 3 Complete the Application.