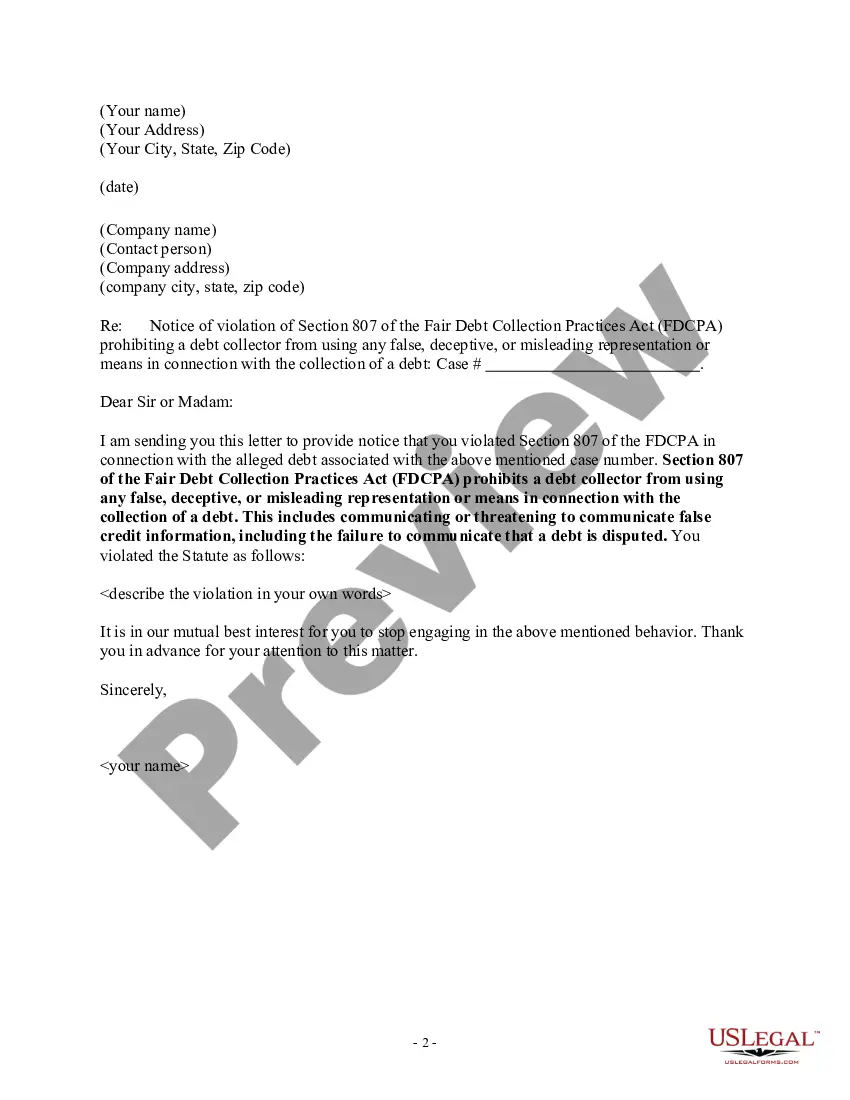

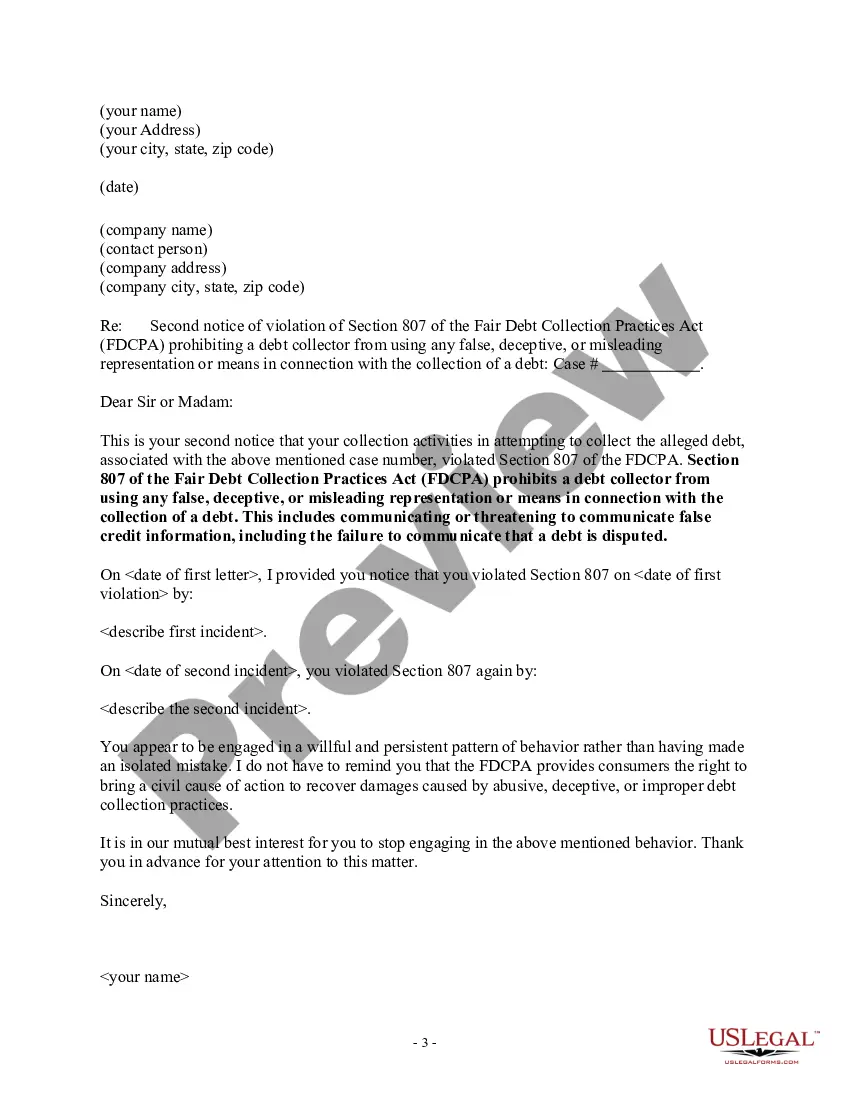

Maine Notice of Violation of Fair Debt Act - False Information Disclosed

Description

How to fill out Notice Of Violation Of Fair Debt Act - False Information Disclosed?

US Legal Forms - one of the finest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the most recent editions of forms such as the Maine Notice of Violation of Fair Debt Act - False Information Disclosed within minutes.

If you already have an account, Log In and acquire the Maine Notice of Violation of Fair Debt Act - False Information Disclosed from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Maine Notice of Violation of Fair Debt Act - False Information Disclosed. Each template added to your account has no expiration date and belongs to you forever. Therefore, if you wish to download or print another copy, just navigate to the My documents section and click on the form you desire. Access the Maine Notice of Violation of Fair Debt Act - False Information Disclosed with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and specifications.

- Ensure you have selected the correct form for your locality/state.

- Click the Review button to examine the content of the form.

- Check the form's summary to confirm you have chosen the right document.

- If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the pricing plan you wish and provide your details to create an account.

Form popularity

FAQ

Write a dispute letter and send it to each credit bureau. Include information about each of the disputed itemsaccount numbers, listed amounts and creditor names. Write a similar letter to each collection agency, asking them to remove the error from your credit reports.

Yes, you may be able to sue a debt collector or a debt collection agency if it engages in abusive, deceptive, or unfair behavior. A debt collector is generally someone who buys a debt from a creditor who, for whatever reason, has been unable to collect from a consumer.

If a creditor takes too long to take action to recover a debt it becomes 'statute barred', meaning it can no longer be recovered through court action. In practical terms, this effectively means the debt is written off, even though technically it still exists.

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof. (2) The false representation of -- (A) the character, amount, or legal status of any debt; or.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Review the debt validation letter The debt validation letter includes: The amount owed. The name of the creditor seeking payment. A statement that the debt is assumed valid by the collector unless you dispute it within 30 days of the first contact.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.