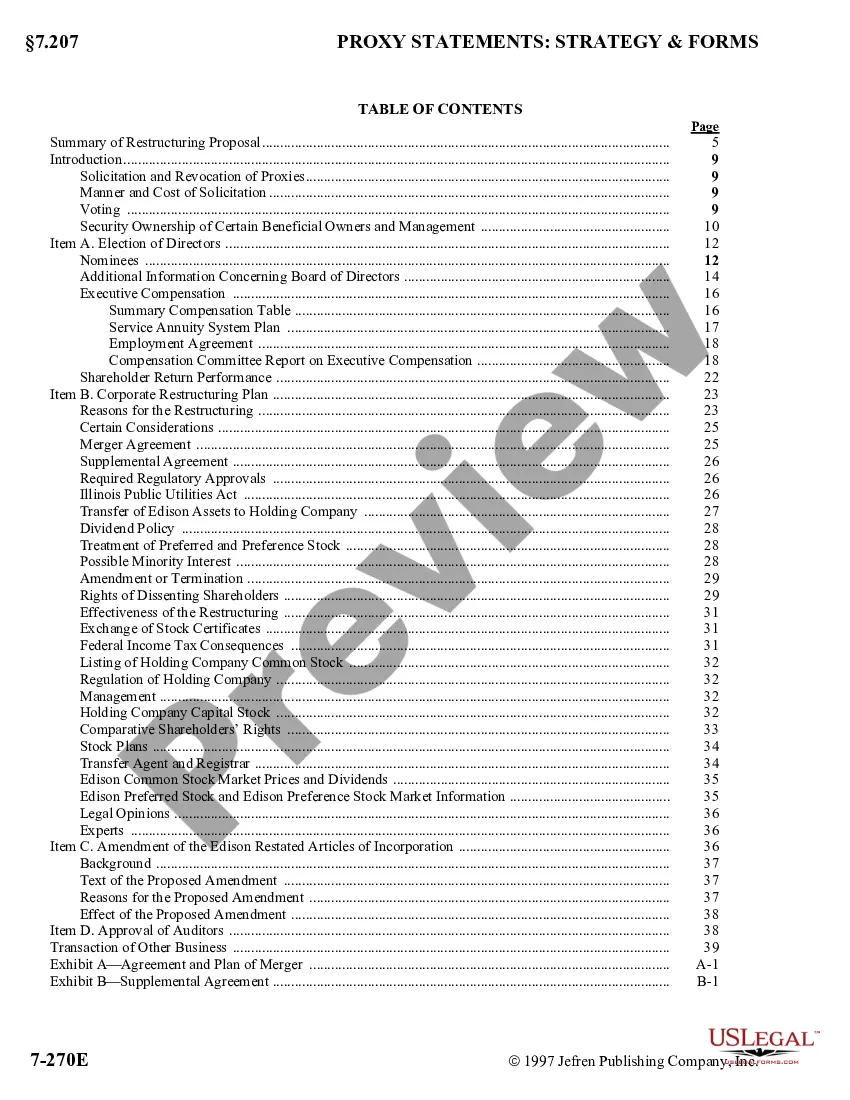

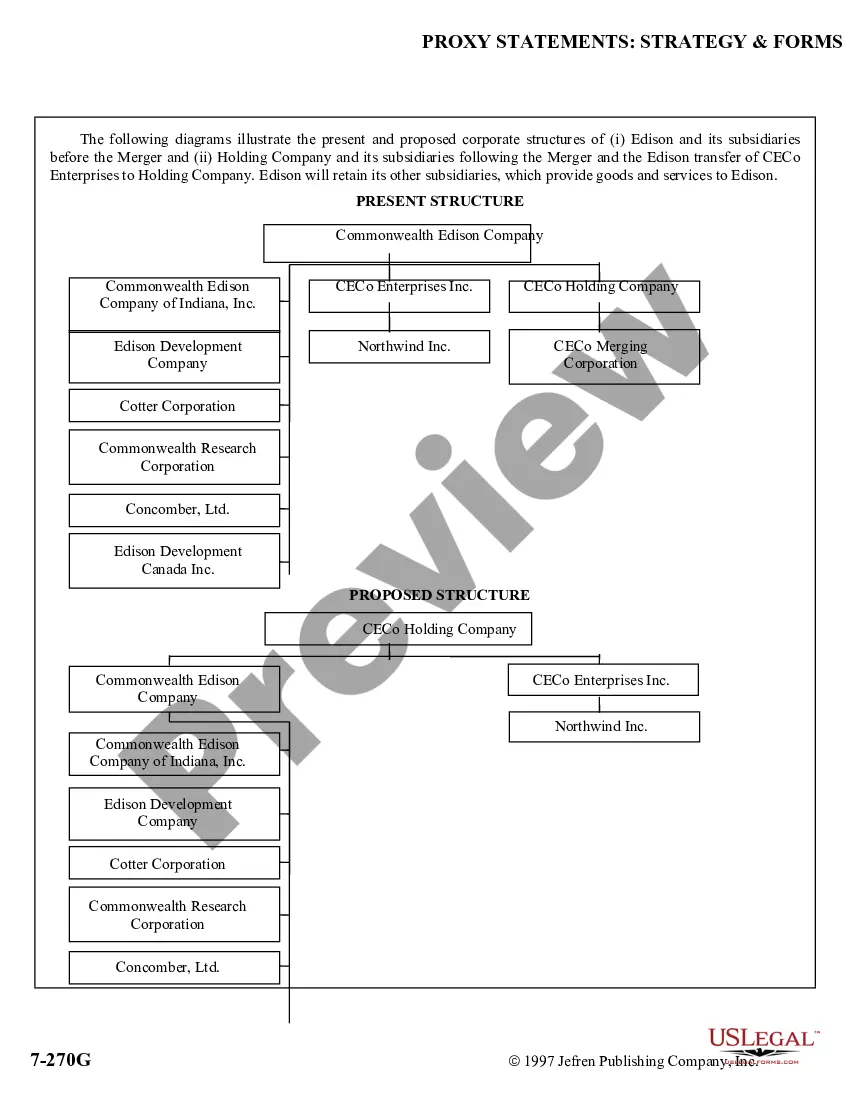

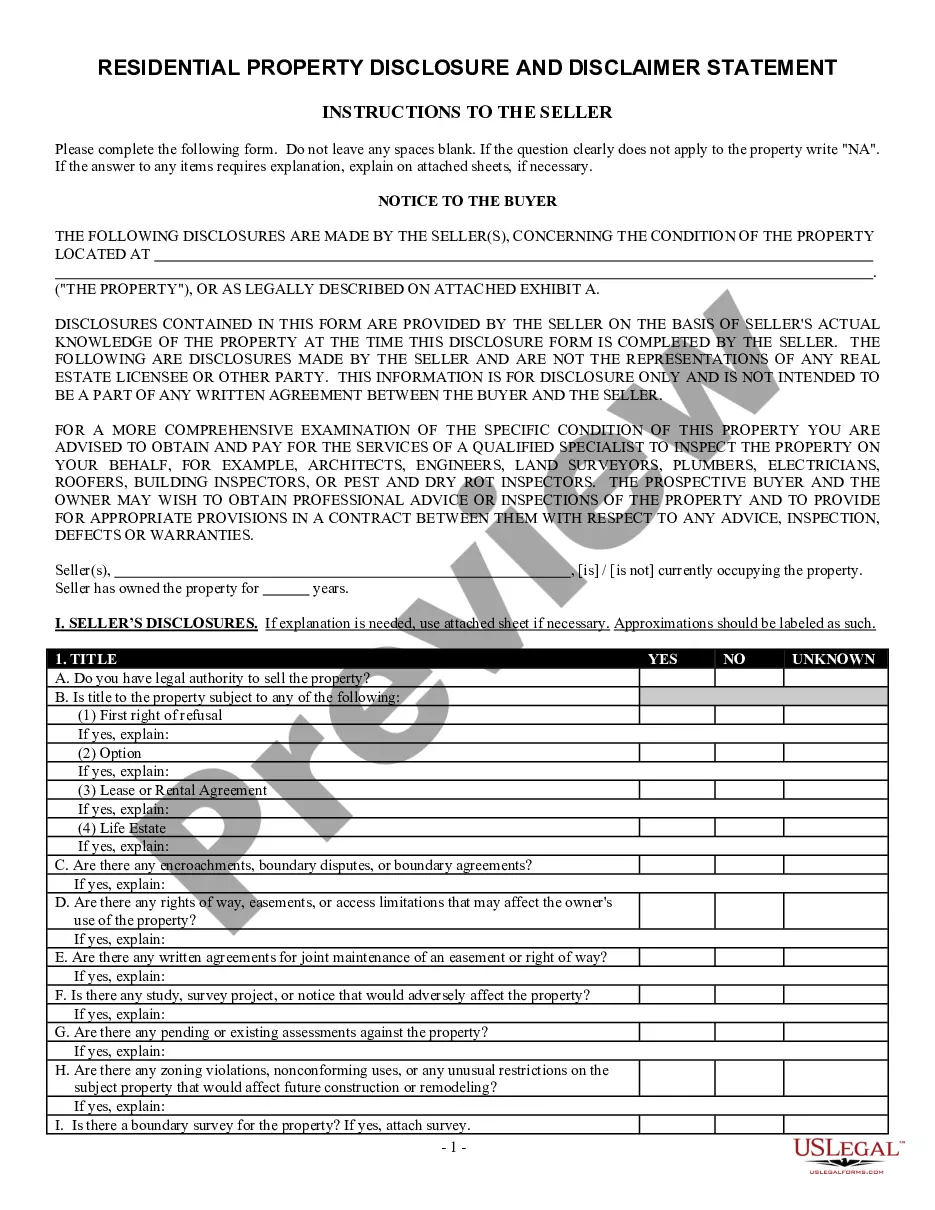

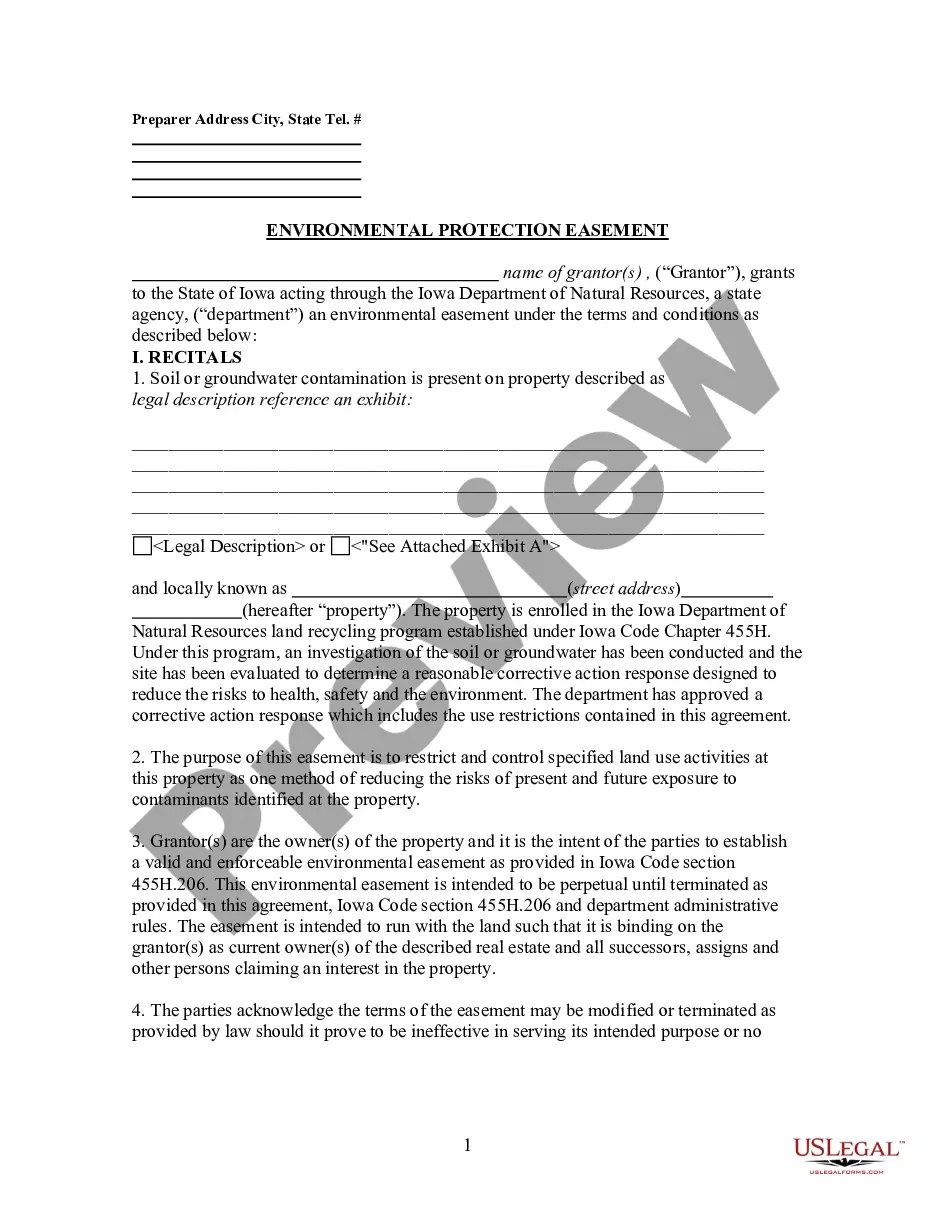

Maine Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company

Description

How to fill out Proxy Statement And Prospectus With Exhibits For Commonwealth Edison Company?

US Legal Forms - one of the most significant libraries of legitimate types in the USA - delivers a wide range of legitimate record web templates you may down load or print out. Making use of the internet site, you may get thousands of types for organization and personal uses, categorized by groups, claims, or search phrases.You can find the newest models of types just like the Maine Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company within minutes.

If you already have a registration, log in and down load Maine Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company from the US Legal Forms collection. The Down load button will show up on every develop you view. You have access to all in the past acquired types inside the My Forms tab of your own profile.

If you would like use US Legal Forms the very first time, here are basic directions to obtain started:

- Ensure you have picked out the best develop for the city/region. Go through the Review button to examine the form`s articles. See the develop outline to actually have chosen the right develop.

- In the event the develop doesn`t fit your requirements, utilize the Look for area on top of the monitor to obtain the the one that does.

- If you are pleased with the shape, confirm your choice by clicking on the Buy now button. Then, pick the prices strategy you want and give your credentials to register for the profile.

- Procedure the financial transaction. Make use of your credit card or PayPal profile to perform the financial transaction.

- Choose the format and down load the shape in your device.

- Make alterations. Load, modify and print out and signal the acquired Maine Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company.

Each template you included in your account does not have an expiration date which is yours eternally. So, if you wish to down load or print out another duplicate, just check out the My Forms portion and click on around the develop you require.

Obtain access to the Maine Proxy Statement and Prospectus with exhibits for Commonwealth Edison Company with US Legal Forms, probably the most comprehensive collection of legitimate record web templates. Use thousands of expert and condition-particular web templates that meet up with your business or personal requires and requirements.