Maine Insurance Agents Stock option plan

Description

How to fill out Insurance Agents Stock Option Plan?

Choosing the best legal papers web template could be a have a problem. Needless to say, there are a lot of themes available online, but how do you obtain the legal type you require? Utilize the US Legal Forms web site. The service provides a large number of themes, for example the Maine Insurance Agents Stock option plan, which can be used for business and personal demands. Every one of the varieties are examined by specialists and fulfill federal and state needs.

If you are currently registered, log in to the bank account and click the Down load option to find the Maine Insurance Agents Stock option plan. Make use of your bank account to appear throughout the legal varieties you have purchased in the past. Go to the My Forms tab of your respective bank account and acquire an additional copy of your papers you require.

If you are a brand new end user of US Legal Forms, listed below are simple recommendations for you to adhere to:

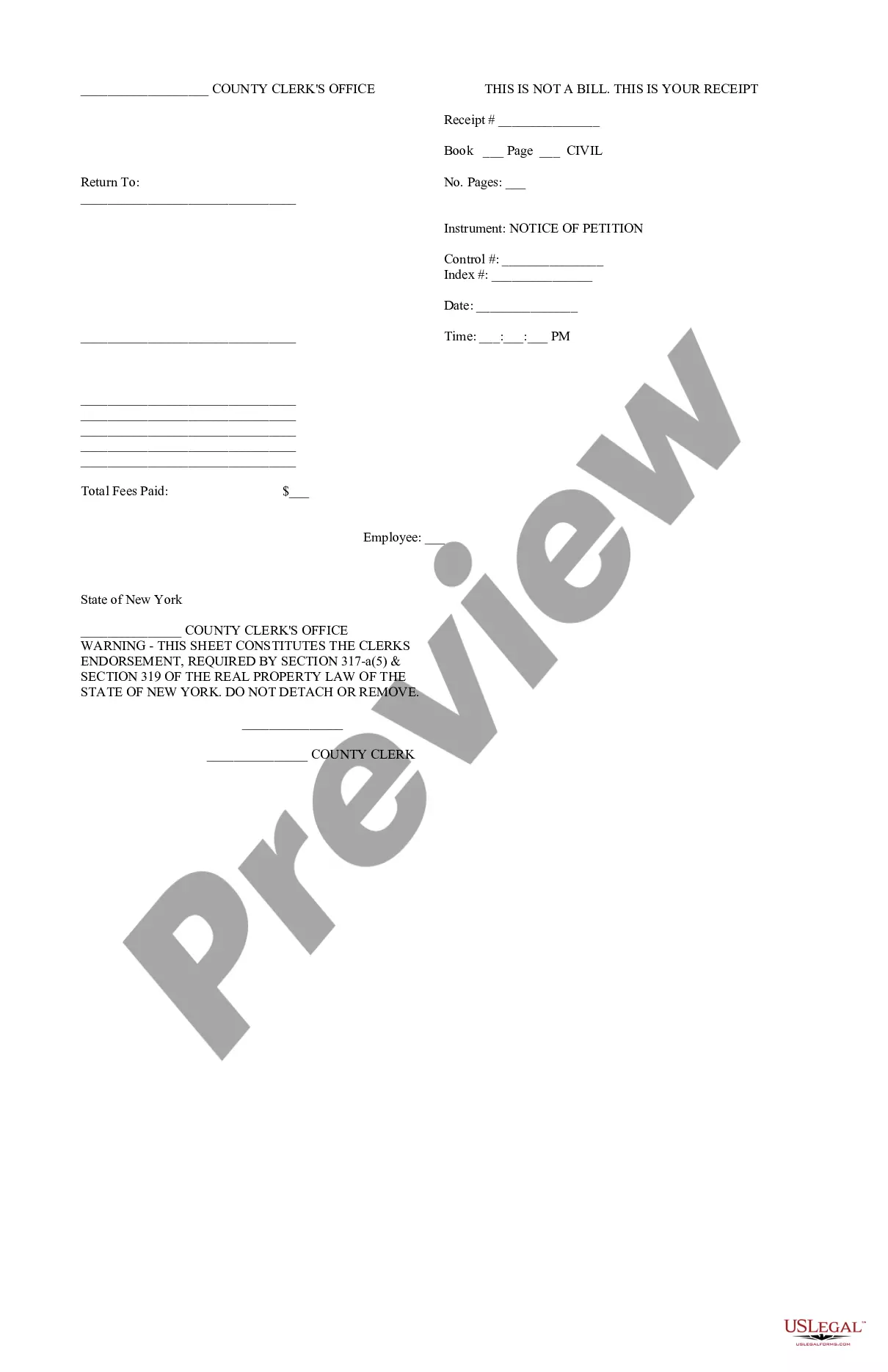

- First, ensure you have chosen the right type for your area/area. You can look over the form while using Preview option and read the form outline to ensure this is the best for you.

- In case the type fails to fulfill your needs, use the Seach discipline to obtain the right type.

- Once you are certain that the form is suitable, select the Buy now option to find the type.

- Choose the costs prepare you desire and enter in the required information. Create your bank account and pay money for the order using your PayPal bank account or Visa or Mastercard.

- Opt for the file file format and down load the legal papers web template to the system.

- Comprehensive, change and produce and signal the received Maine Insurance Agents Stock option plan.

US Legal Forms will be the biggest catalogue of legal varieties that you can see numerous papers themes. Utilize the service to down load expertly-manufactured documents that adhere to condition needs.

Form popularity

FAQ

Anyone who is a resident of Maine for any part of the tax year, and has taxable Maine-source income, must file a Maine return.

Income Tax Brackets Single FilersMaine Taxable IncomeRate$0 - $22,9995.80%$23,000 - $54,4496.75%$54,450+7.15%

Generally. Income received by a nonresident is attributable to and taxable by Maine when the income is derived from or connected with sources in Maine ("Maine-source income"). The itemized and standard deductions, credits, income modifications and personal exemptions applicable to residents also apply to nonresidents.

If you earn income in one state while living in another, you should expect to file a tax return for the state where you are living (your ?resident? state). You may also be required to file a state tax return where your employer is located or any state where you have a source of income.

Non-resident return This is for taxpayers that are Non-residents of Maine. The taxpayer lives in a state other than Maine, they have earned some of their income in Maine. Consequently, they owe Maine Non-resident income tax.

You'll likely file a part-year resident return in both states. Usually, you'll have to file a state return in any states that you: Have earned income from wages or self-employment. Have property that produces income.

Wages, business income, and capital gains from sources within Maine are Maine income even if you received the income as a nonresident. All part-year residents, nonresidents and safe harbor residents must send a copy of their federal return with their Maine return.