Alabama Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split

Description

How to fill out Proposal To Amend Certificate Of Incorporation To Effectuate A One For Ten Reverse Stock Split?

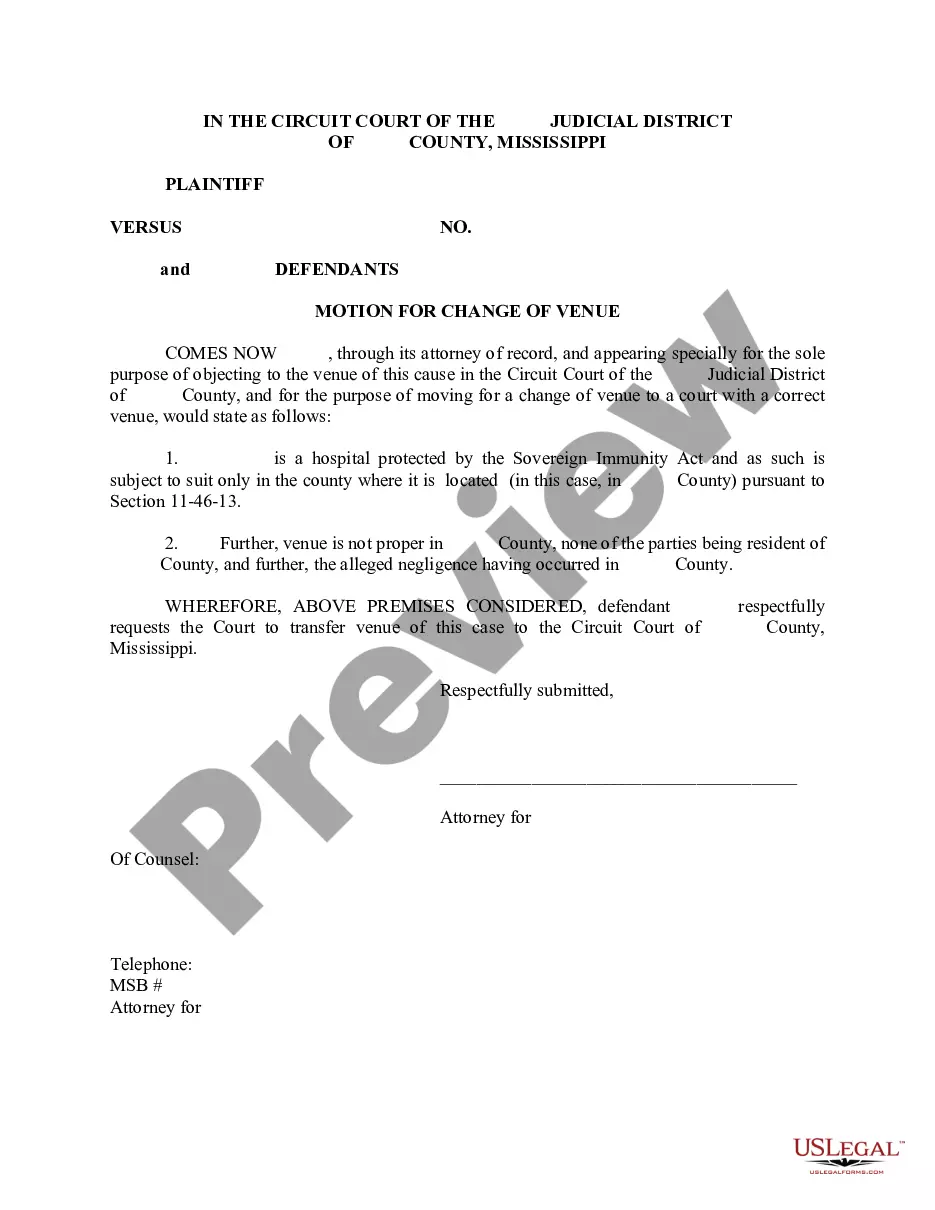

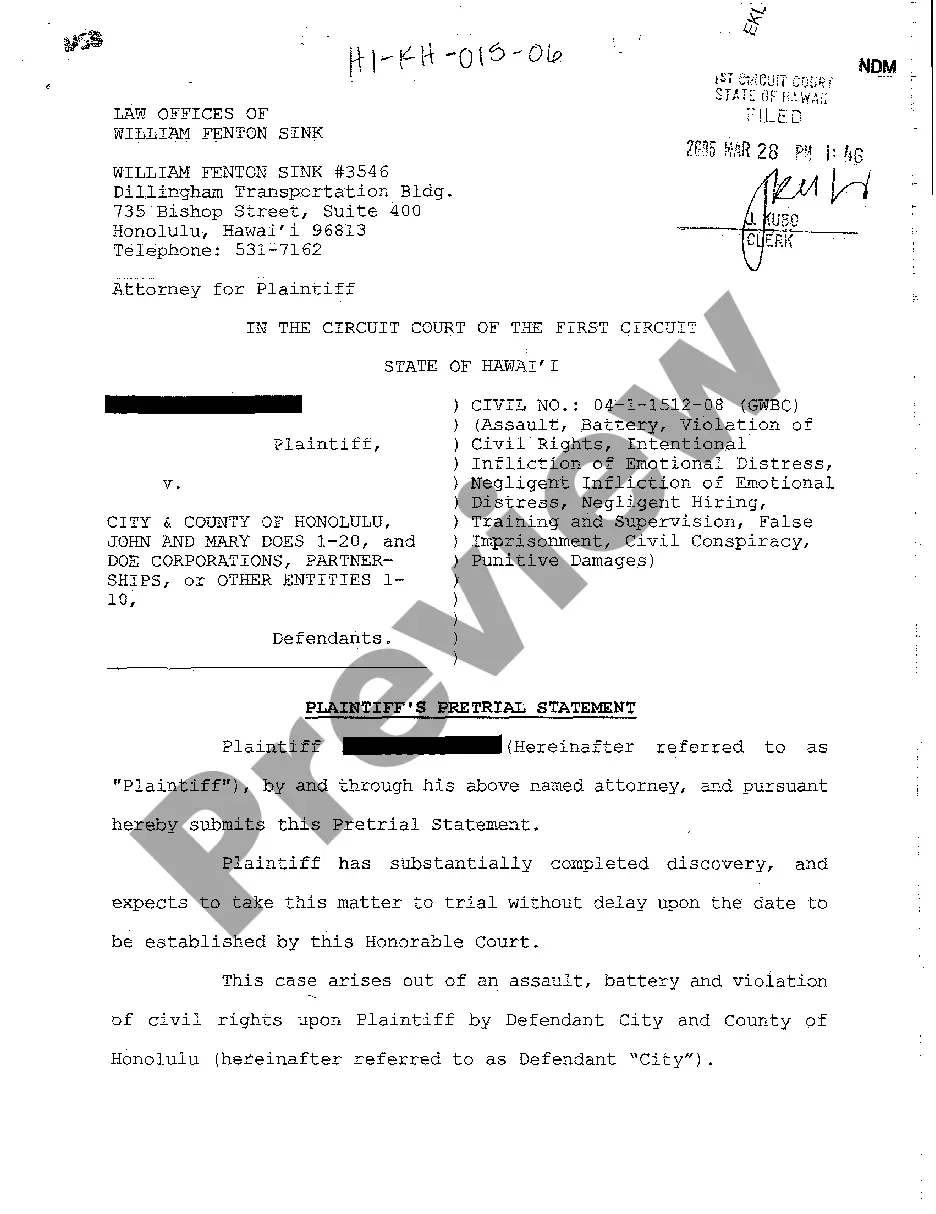

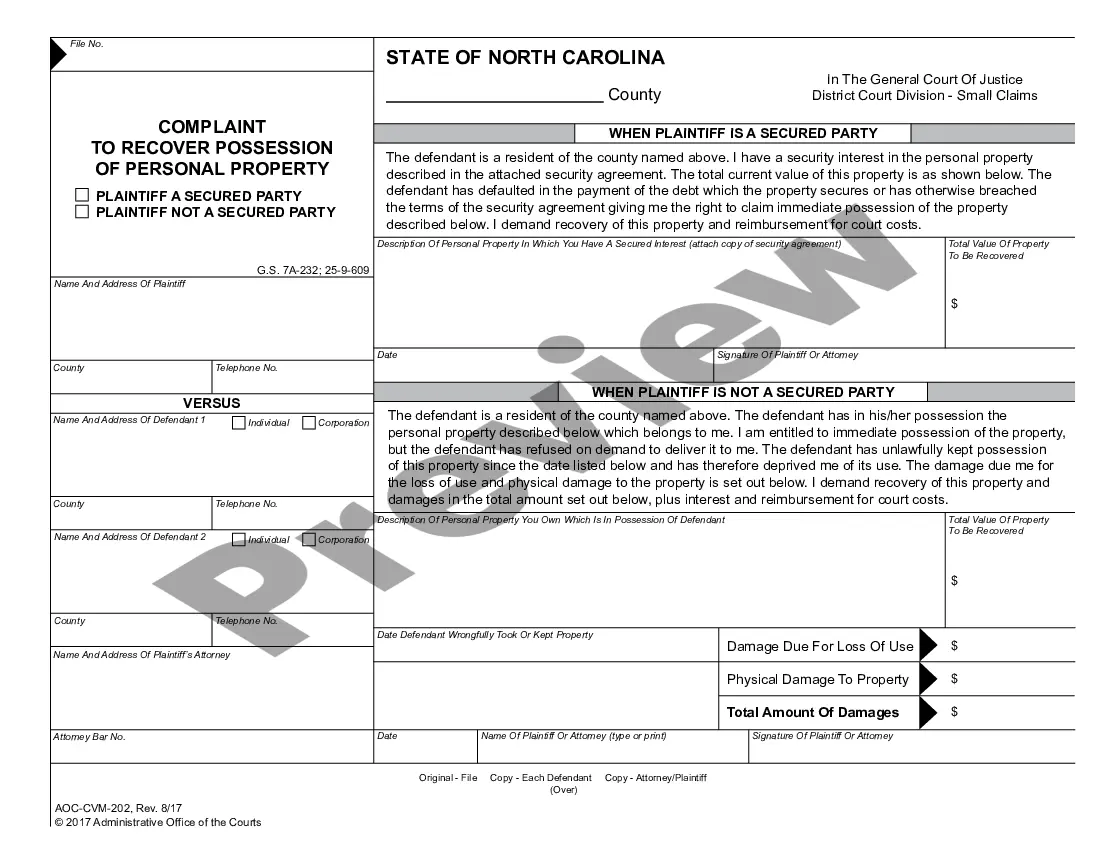

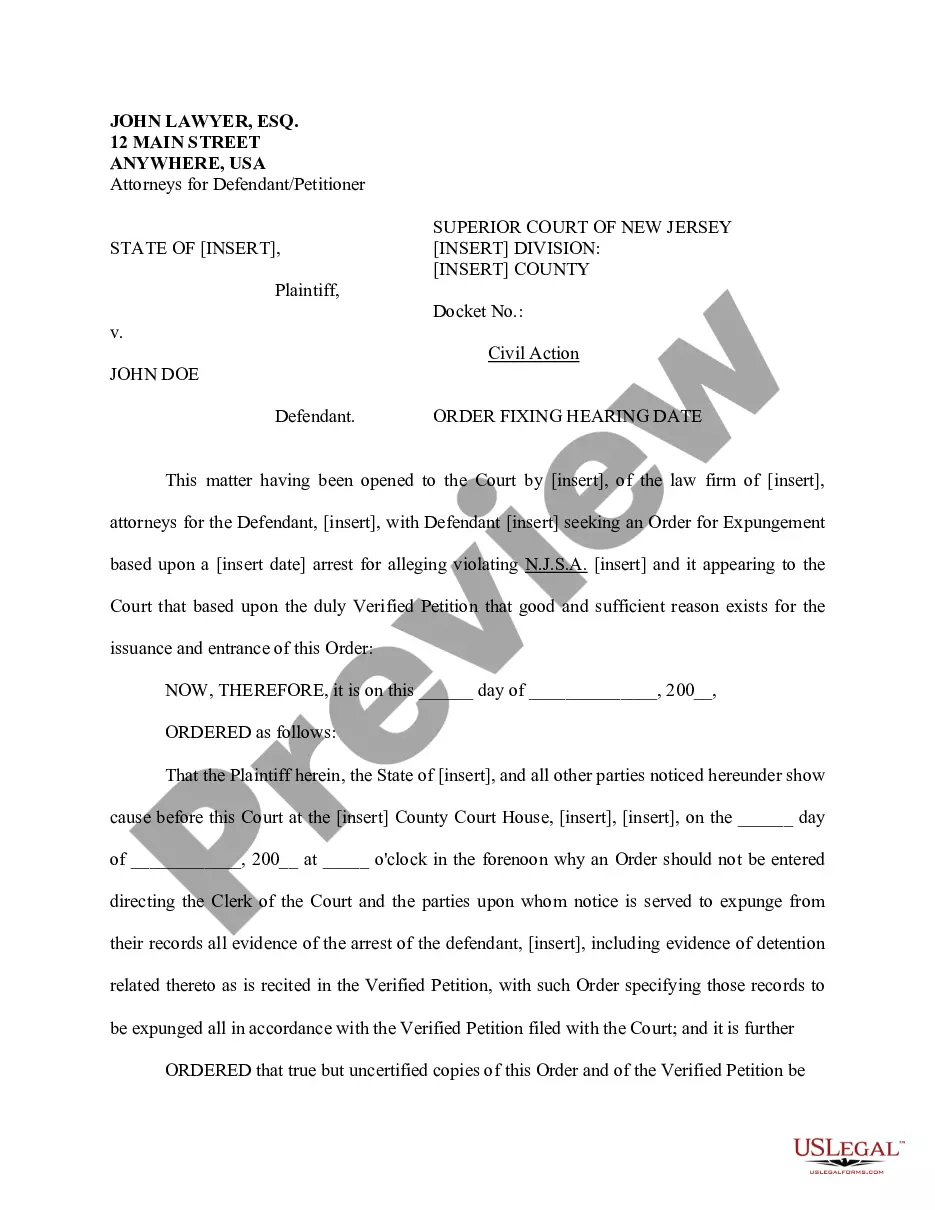

Are you currently within a position in which you will need documents for possibly organization or personal functions just about every day time? There are a variety of lawful file templates available on the Internet, but getting types you can rely is not simple. US Legal Forms offers thousands of form templates, much like the Alabama Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split, that happen to be composed to fulfill state and federal demands.

In case you are previously familiar with US Legal Forms internet site and possess your account, merely log in. Following that, you can down load the Alabama Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split format.

Unless you have an accounts and wish to begin to use US Legal Forms, abide by these steps:

- Discover the form you will need and ensure it is for the appropriate area/area.

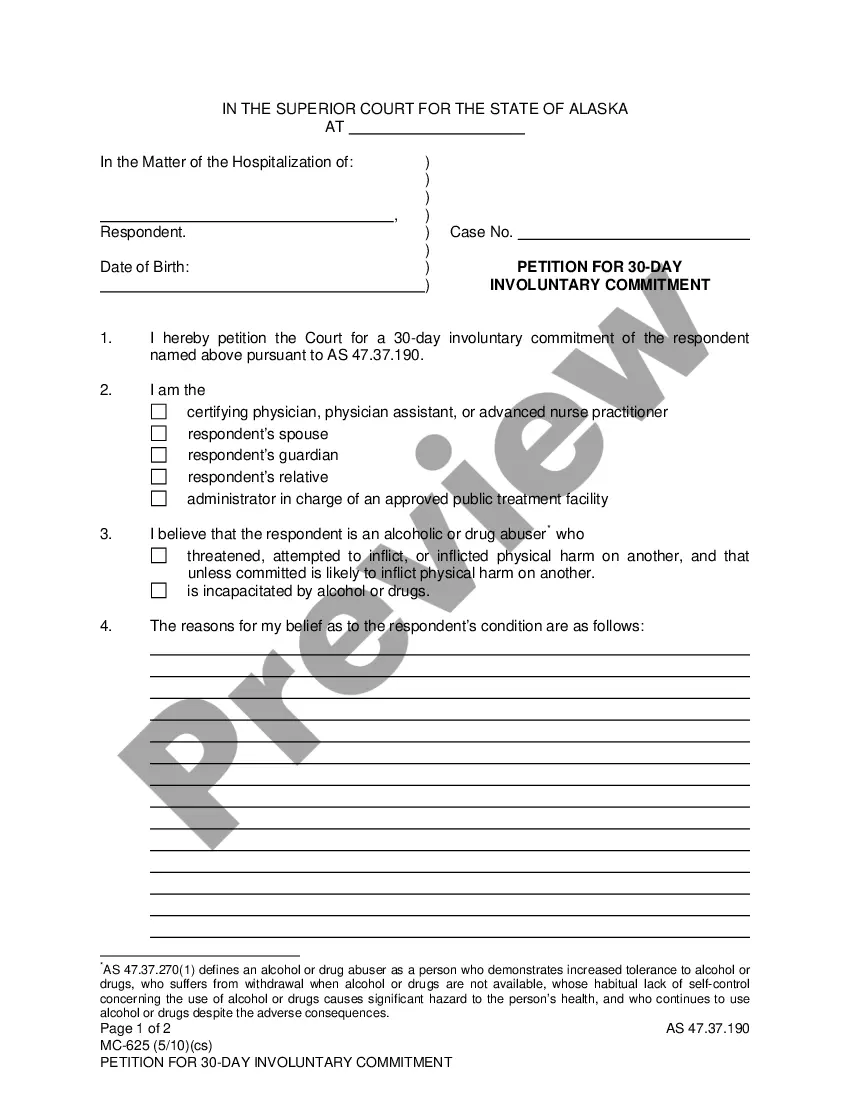

- Take advantage of the Review key to analyze the form.

- Read the explanation to actually have chosen the appropriate form.

- If the form is not what you`re looking for, make use of the Lookup area to find the form that meets your requirements and demands.

- Once you discover the appropriate form, click Purchase now.

- Opt for the pricing prepare you want, fill out the required information to create your account, and pay for your order with your PayPal or bank card.

- Pick a convenient data file formatting and down load your version.

Get each of the file templates you have bought in the My Forms menu. You can get a further version of Alabama Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split at any time, if possible. Just click on the needed form to down load or print the file format.

Use US Legal Forms, one of the most extensive selection of lawful types, to save some time and steer clear of mistakes. The service offers expertly produced lawful file templates that can be used for a range of functions. Produce your account on US Legal Forms and initiate generating your daily life a little easier.

Form popularity

FAQ

Reverse stock splits are proposed by company management and are subject to consent from the shareholders through their voting rights.

When a company completes a reverse stock split, each outstanding share of the company is converted into a fraction of a share. For example, if a company declares a one for ten reverse stock split, every ten shares that you own will be converted into a single share.

The only journal entry required for a reverse stock split is a memorandum entry to indicate that the numbers of shares outstanding have decreased. A journal entry with debits and credits are not needed since the line items on shareholders equity do not change in a reverse stock split.

Simply divide the number of shares you own by the split ratio and multiply the pre-split share price by the same amount. For instance, say a stock trades at $1 per share and the company does a 1-for-10 reverse split.

NOTE: A new CUSIP number is required for a reverse stock split prior to the Marketplace Effective Date. This information can be provided by selecting the box for section 2 above. Is there a cash out associated with this reverse stock split?

Listing Rule 5250(b)(4) will require companies to provide public notice of a reverse split, using a Reg FD-compliant method, no later than p.m. ET at least two business days prior to the proposed market effective date.

The number of outstanding shares of Common Stock will be decreased as a result of a Reverse Stock Split, but the number of authorized shares of Common Stock will not be so decreased.