Maine Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005

Description

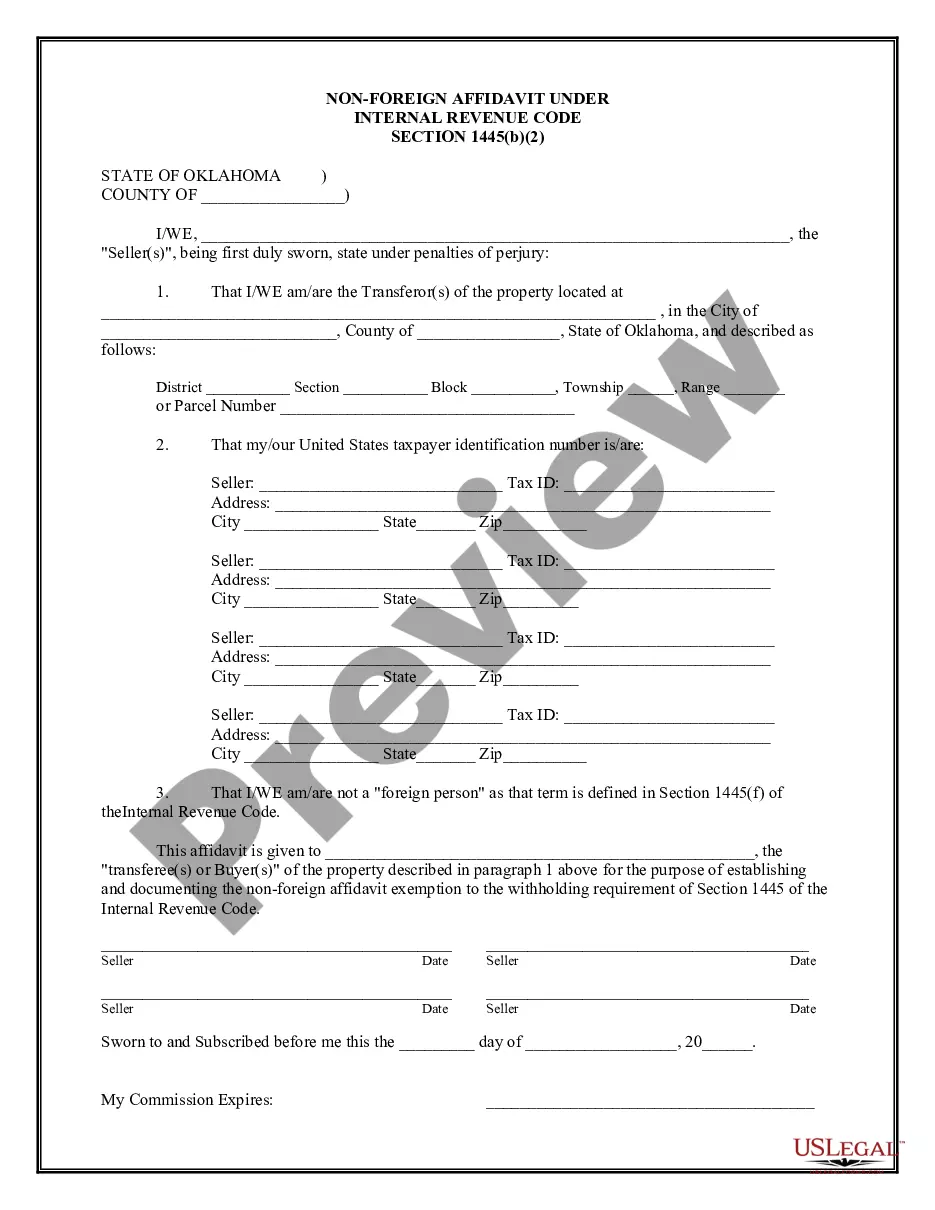

How to fill out Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005?

US Legal Forms - one of the greatest libraries of legitimate forms in the States - gives a variety of legitimate papers templates you are able to obtain or printing. Utilizing the web site, you may get thousands of forms for company and individual purposes, sorted by classes, says, or keywords.You can get the most recent variations of forms much like the Maine Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 in seconds.

If you already possess a subscription, log in and obtain Maine Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 in the US Legal Forms library. The Download switch will appear on each and every develop you view. You have access to all in the past delivered electronically forms from the My Forms tab of your respective accounts.

In order to use US Legal Forms initially, listed here are straightforward directions to obtain started out:

- Be sure you have picked the best develop to your metropolis/state. Go through the Preview switch to check the form`s content. Browse the develop description to actually have selected the correct develop.

- If the develop does not fit your needs, use the Look for discipline on top of the screen to obtain the one which does.

- Should you be pleased with the shape, confirm your selection by clicking on the Acquire now switch. Then, select the prices prepare you prefer and offer your references to sign up on an accounts.

- Approach the transaction. Utilize your bank card or PayPal accounts to finish the transaction.

- Choose the format and obtain the shape in your gadget.

- Make adjustments. Load, edit and printing and indication the delivered electronically Maine Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005.

Every design you included in your money lacks an expiry particular date which is your own property for a long time. So, in order to obtain or printing yet another duplicate, just check out the My Forms segment and click about the develop you need.

Get access to the Maine Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 with US Legal Forms, one of the most comprehensive library of legitimate papers templates. Use thousands of skilled and state-specific templates that meet up with your business or individual requires and needs.

Form popularity

FAQ

Priority Unsecured Debts Examples of bankruptcy priority claims include most taxes, alimony, child support, restitution, and administrative claims. In a Chapter 7 asset case, priority claims receive payment in full before any payments to general unsecured creditors. Priority debts are nondischargeable.

Now, in most consumer cases, creditors don't attend the 341 meeting, even though it's called the meeting of creditors. In probably 95, if not 98% of cases, no creditors actually attend. It's only going to be the trustee that will be asked some questions to verify your financial situation.

The meeting of creditors is an important part of every bankruptcy case. The typical Chapter 7 creditors' meeting takes less than 10 minutes. During that time, the bankruptcy trustee will verify your identity and ask you a series of questions about your financial situation.

Schedule E/F: Unsecured Debts Official Form 106E/F - Schedule E/F: Creditors Who Have Unsecured Claims (individuals) is where all other debts are listed. Some unsecured debts, like taxes and child support are given special ?priority? treatment in the Bankruptcy Code. These priority debts are listed in Part 1.

A creditor schedule is a statement that details the balances of the creditor control account and compares them with the individual creditor balances. A debtor schedule compares the individual customer balances with the balances of the debtor control account.

?Is the claim subject to Offset?? Asks if you have to pay back the whole debt. For example, if you owe the creditor $1,000 but the creditor owes you $200, then the claim can be ?offset?.

A creditor with an unsecured claim has a promise to pay from the borrower but doesn't have a lien. There are two types of unsecured claims: Priority unsecured claims. These debts aren't dischargeable in bankruptcy, and, if money is available, the claim will get paid before nonpriority unsecured claims.

The Chapter 7 meeting of creditors (also called the 341 hearing) is a meeting at which the bankruptcy trustee and your creditors get to ask you questions under oath about your bankruptcy petition and the documents you're required to provide the trustee.