Maine Sample Letter for Corrections to Credit Report

Description

How to fill out Sample Letter For Corrections To Credit Report?

If you need to complete, obtain, or create authentic document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search feature to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to locate the Maine Sample Letter for Corrections to Credit Report in just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to all forms saved in your account. Select the My documents section and choose a form to print or download again.

Complete and download, then print the Maine Sample Letter for Corrections to Credit Report with US Legal Forms. There are thousands of professional and state-specific forms you can use for your personal or business needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to access the Maine Sample Letter for Corrections to Credit Report.

- You can also retrieve forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

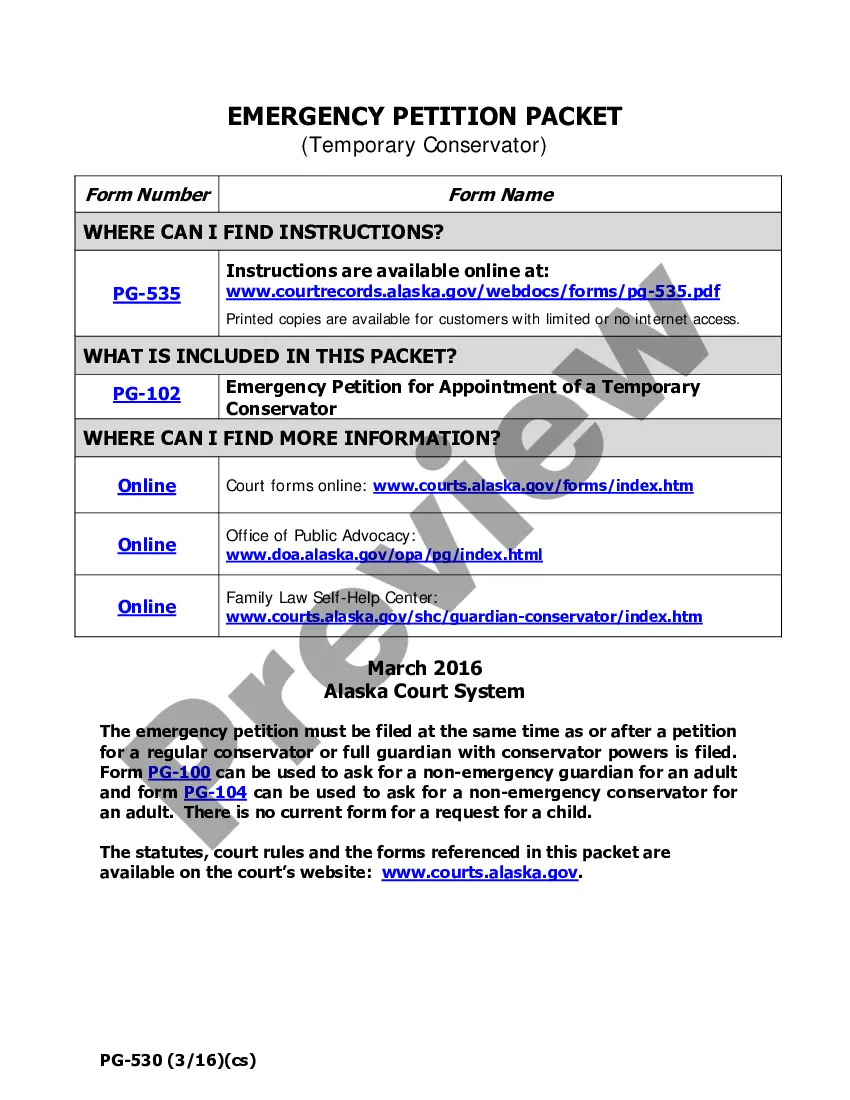

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Review option to inspect the content of the form. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to discover other versions of the legal form template.

- Step 4. Once you find the form you need, click on the Get now button. Choose your preferred payment plan and provide your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Maine Sample Letter for Corrections to Credit Report.

Form popularity

FAQ

Creating a credit report dispute letter is simple and essential for correcting inaccuracies. Begin by using a Maine Sample Letter for Corrections to Credit Report as a template, which provides a clear structure. Ensure you include your personal details, highlight the incorrect information, and state your request for correction. With a well-crafted letter, you can facilitate faster action on your dispute.

Making corrections to your credit report involves contacting the reporting agency and disputing any inaccuracies. You can prepare and send a Maine Sample Letter for Corrections to Credit Report to detail the corrections you are requesting. Once submitted, the agency will investigate and respond with their findings, ensuring your credit report reflects accurate information.

A 623 letter is a written request used to inform a credit reporting agency about inaccuracies in your credit report. This letter references Section 623 of the Fair Credit Reporting Act, which outlines the responsibility of data furnishers. By using a Maine Sample Letter for Corrections to Credit Report, you can effectively communicate the errors you want corrected, making the process smoother.

To add a notice of correction to your credit file, contact the credit bureau directly and inquire about their process. You can use a Maine Sample Letter for Corrections to Credit Report to describe the correction needed. Each bureau has specific guidelines, so be sure to follow their instructions carefully to ensure your request is processed efficiently.

Adding a notice of correction to your TransUnion account is a straightforward process. First, access your online account and locate the dispute section. You can submit a Maine Sample Letter for Corrections to Credit Report detailing the specific issues. After submission, TransUnion will review your request and implement the necessary changes.

To add a notice of correction to your Experian account, log into your online profile and navigate to the section for disputes. Here, you can upload a Maine Sample Letter for Corrections to Credit Report, which clearly states the correction you want to make. Make sure to follow the prompts to submit your request and allow Experian time to process your corrections.

The best reason for disputing a collection is to highlight inaccuracies, such as incorrect amount, date, or status of the account. Include clear evidence to support your claim, as this will enhance your chances of success. Using the Maine Sample Letter for Corrections to Credit Report can provide a solid framework for your arguments.

To make corrections, identify the errors on your report and prepare a dispute letter for the credit bureau. It is essential to provide evidence supporting your claim. The Maine Sample Letter for Corrections to Credit Report offers a proven format that can simplify this process, ensuring each point is communicated effectively.

Writing a dispute letter involves clearly stating the inaccuracy and supporting your claim with necessary documentation. You can rely on the Maine Sample Letter for Corrections to Credit Report to help you structure your letter effectively. Make sure to include your personal details and maintain a calm, factual tone throughout.

To add a notice of correction, you need to contact the credit bureau directly and request the addition. Prepare a statement explaining your reason for the correction. The Maine Sample Letter for Corrections to Credit Report can be an invaluable resource in crafting this request to ensure clarity and compliance.