This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maine Notice of Non-Responsibility of Wife for Debts or Liabilities

Description

How to fill out Notice Of Non-Responsibility Of Wife For Debts Or Liabilities?

If you desire to access, download, or print authentic legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the website's basic and user-friendly search to find the documents you need. Various templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to obtain the Maine Notice of Non-Responsibility of Wife for Debts or Liabilities with just a few clicks.

Every legal document template you obtain is yours forever. You have access to every form you purchased within your account. Click on the My documents section and select a form to print or download again.

Compete and download, and print the Maine Notice of Non-Responsibility of Wife for Debts or Liabilities with US Legal Forms. There are countless professional and state-specific forms you can utilize for your business or personal requirements.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to get the Maine Notice of Non-Responsibility of Wife for Debts or Liabilities.

- You can also access forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

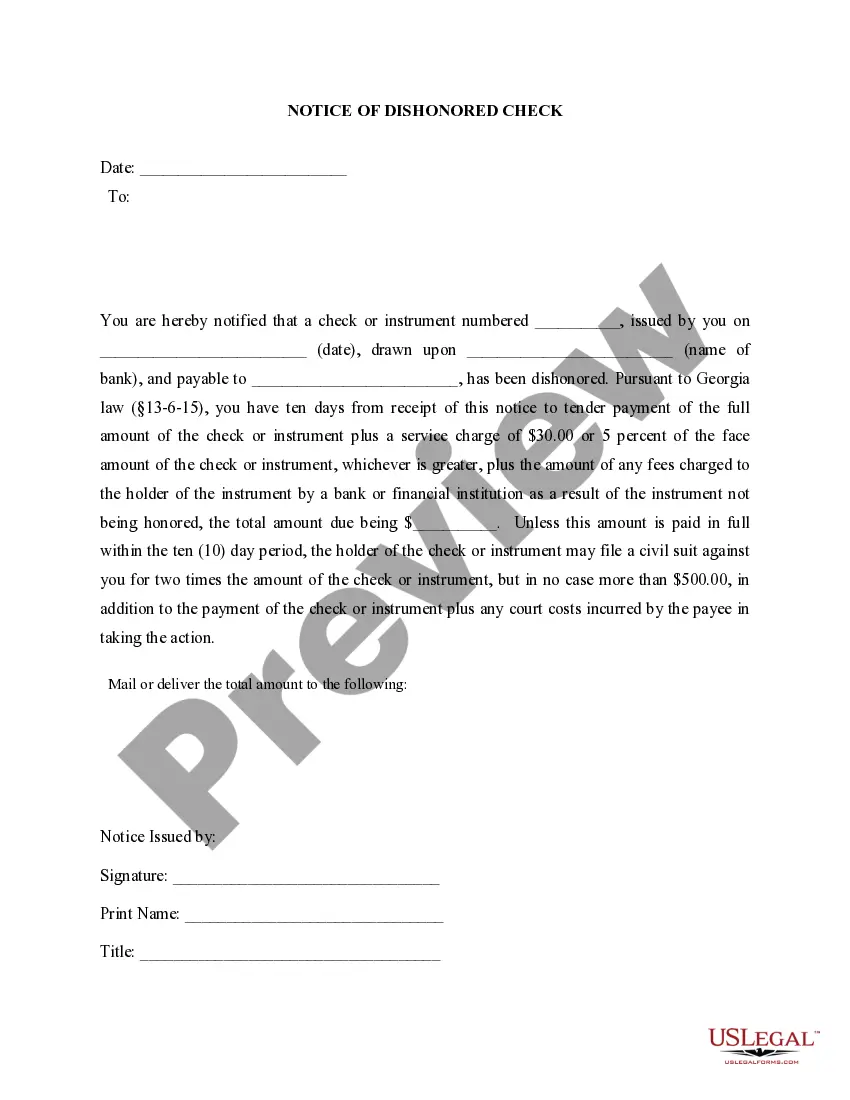

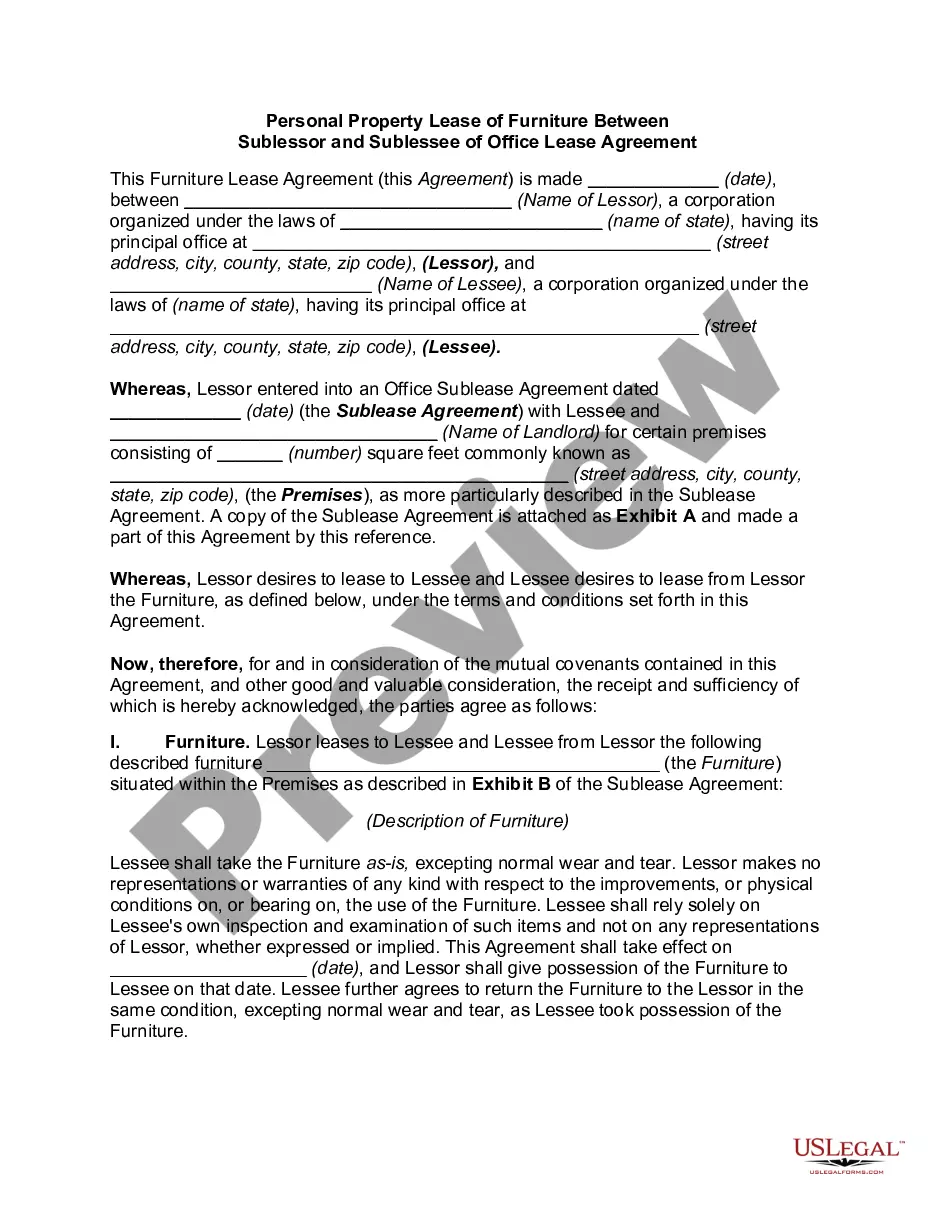

- Step 2. Utilize the Preview option to browse through the form's content. Remember to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have identified the form you need, click the Purchase now button. Choose the payment plan you prefer and provide your details to register for an account.

- Step 5. Process the transaction. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it onto your device.

- Step 7. Complete, edit, and print or sign the Maine Notice of Non-Responsibility of Wife for Debts or Liabilities.

Form popularity

FAQ

A husband or wife is not automatically responsible for the other's debts in Maine, especially when the Maine Notice of Non-Responsibility of Wife for Debts or Liabilities has been properly executed. This legal tool can help clarify financial responsibilities between spouses and protect individual assets. Understanding your rights and obligations is essential, and platforms like USLegalForms can guide you through creating necessary documents to safeguard your interests.

In Maine, whether a spouse is liable for the other spouse's debt often depends on the nature of the debt. Generally, debts incurred during the marriage may require both spouses to share liability. However, the Maine Notice of Non-Responsibility of Wife for Debts or Liabilities establishes a clear boundary, helping to protect one spouse from the other's financial obligations. For specific advice tailored to your situation, consider using resources like USLegalForms to navigate this complex topic.

If your name is not on a deed but you are married in Maine, you may still have rights to the property under Maine marital property laws. The Maine Notice of Non-Responsibility of Wife for Debts or Liabilities may help you assert these rights, preventing you from being held liable for debts associated with the property. To ensure you fully understand your position and protect your interests, consulting a legal expert is advisable.

Maine follows the principle of equitable distribution in marital property law, which means that property is divided fairly but not necessarily equally upon divorce. The Maine Notice of Non-Responsibility of Wife for Debts or Liabilities can play a crucial role in protecting spouses from incurring debts or liabilities related to property not jointly owned. Understanding these laws is essential for both financial planning and protection, and you might consider using resources like USLegalForms to help navigate these complexities.

In Maine, you may not be responsible for your spouse’s medical debts incurred before marriage, especially if you have filed a Maine Notice of Non-Responsibility of Wife for Debts or Liabilities. However, this can change based on various factors, including marital assets or joint accounts. It is advisable to seek legal guidance to explore your rights and responsibilities regarding your spouse's medical debts.

If a spouse's name is not on a deed, they may not have a legal claim to the property. However, in Maine, the marital property laws could influence the rights of a spouse regarding debts or liabilities. The Maine Notice of Non-Responsibility of Wife for Debts or Liabilities indicates that a spouse may still be protected from certain financial obligations. It’s important to consult with a legal professional to understand your specific circumstances.

In most cases, a wife is not liable for her husband's medical debt under Maine law. Filing a Maine Notice of Non-Responsibility of Wife for Debts or Liabilities is an effective way to affirm this protection. Medical debt typically falls under the responsibility of the individual who received the care, not the spouse. By being informed about these legal protections, you can safeguard your financial future.

Typically, creditors cannot pursue you for your spouse's debt if you have filed a Maine Notice of Non-Responsibility of Wife for Debts or Liabilities. This notice acts as a formal statement of your non-liability. However, if you are a co-signer or joint account holder, creditors may still seek payment from you. Always understand your financial agreements to avoid unexpected responsibilities.

To ensure you are not liable for your spouse's debt, consider filing a Maine Notice of Non-Responsibility of Wife for Debts or Liabilities. This legal option clarifies your non-responsibility regarding any debts your spouse incurs. Additionally, maintain separate credit accounts, and avoid co-signing loans. Clear communication about financial boundaries can also help protect your interests.

Generally, you are not responsible for your wife's debts unless they are shared or you have co-signed. Each spouse is accountable for their individual debts. By utilizing the Maine Notice of Non-Responsibility of Wife for Debts or Liabilities, you can further affirm your lack of responsibility, ensuring your financial security remains intact.