This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

Maine Bank Loan Application Form and Checklist - Business Loan

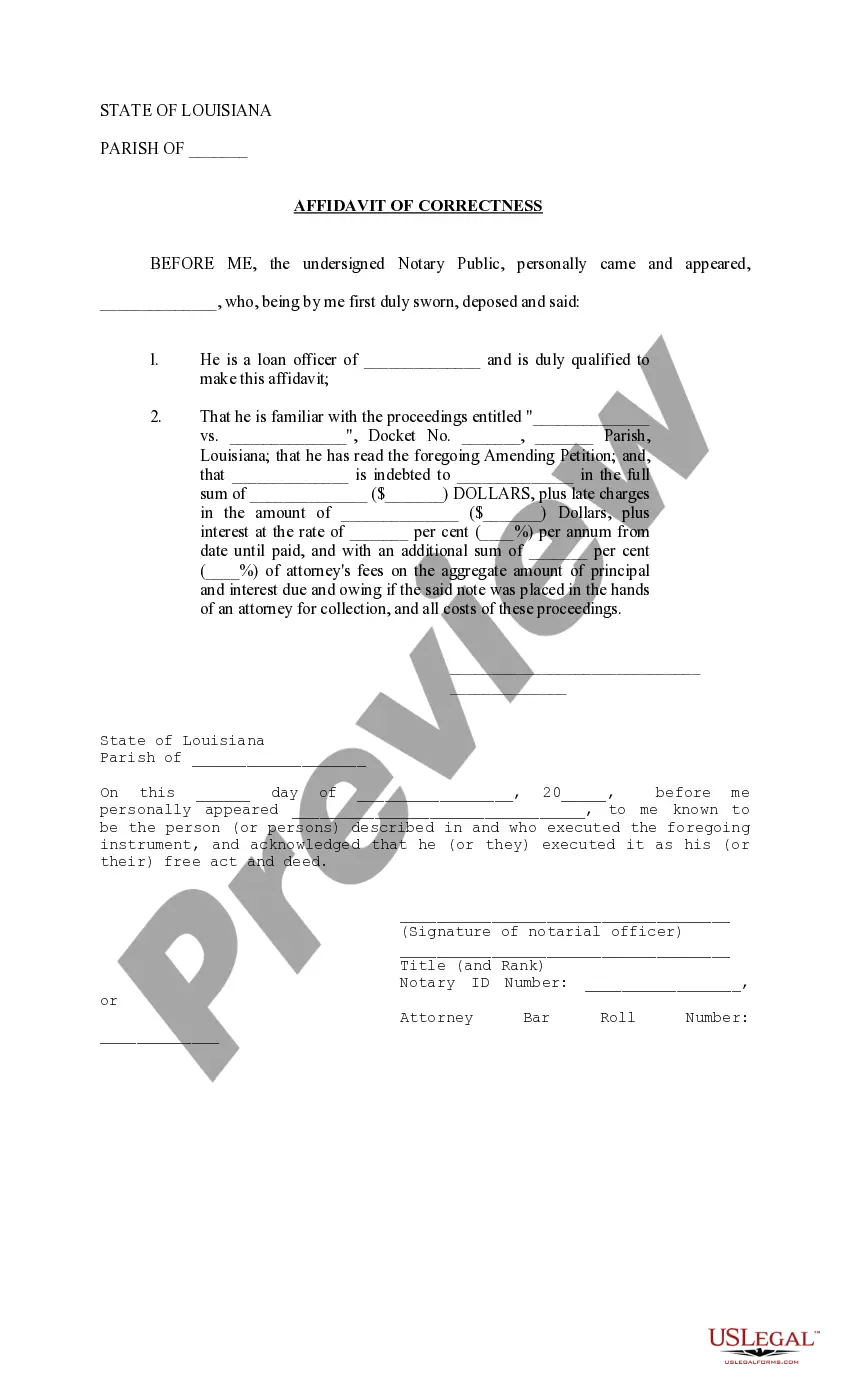

Description

How to fill out Bank Loan Application Form And Checklist - Business Loan?

US Legal Forms - one of many largest libraries of legitimate forms in America - provides an array of legitimate papers templates you are able to acquire or produce. Making use of the website, you may get thousands of forms for organization and specific purposes, sorted by groups, says, or keywords and phrases.You will find the most up-to-date variations of forms much like the Maine Bank Loan Application Form and Checklist - Business Loan in seconds.

If you already have a monthly subscription, log in and acquire Maine Bank Loan Application Form and Checklist - Business Loan through the US Legal Forms collection. The Download switch will show up on each and every develop you see. You have access to all in the past delivered electronically forms within the My Forms tab of the account.

In order to use US Legal Forms initially, listed here are simple recommendations to obtain started:

- Be sure you have chosen the best develop for the town/state. Click on the Preview switch to examine the form`s articles. Read the develop outline to actually have selected the proper develop.

- In case the develop doesn`t satisfy your demands, take advantage of the Search area near the top of the display screen to discover the the one that does.

- If you are satisfied with the shape, verify your selection by clicking on the Get now switch. Then, pick the rates prepare you prefer and provide your accreditations to sign up to have an account.

- Procedure the financial transaction. Use your Visa or Mastercard or PayPal account to perform the financial transaction.

- Choose the structure and acquire the shape in your gadget.

- Make alterations. Load, revise and produce and indicator the delivered electronically Maine Bank Loan Application Form and Checklist - Business Loan.

Each and every web template you included with your bank account does not have an expiry time which is your own property permanently. So, if you would like acquire or produce an additional duplicate, just go to the My Forms segment and click on around the develop you need.

Get access to the Maine Bank Loan Application Form and Checklist - Business Loan with US Legal Forms, one of the most extensive collection of legitimate papers templates. Use thousands of skilled and status-specific templates that satisfy your business or specific requirements and demands.

Form popularity

FAQ

Evaluate What Kind of Loan You Need. Many small business owners opt for financing through traditional banks and credit unions. ... Check Your Business and Personal Credit Scores. ... Gather and Prepare Required Documents. ... Research and Compare Lenders. ... Submit Your Application.

Each lender will have unique documentation requirements, but at the very least, you'll likely need to provide: Business and personal bank statements. Business and personal tax returns. Financial statements, like balance sheets and income statements.

Documents required for a personal loan Proof of identity, like a government-issued ID. Proof of address, like a utility bill or mortgage statement. Proof of income and employment status, like a pay stub, tax return or W-2. Proof of additional income such as retirement, alimony or child support.

Creditagreement_300ps. jpg Loan Application Form. Forms vary by program and lending institution, but they all ask for the same information. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.

Financial documents Up to one year of business bank account statements. Personal and business tax returns from the most recent three years. Most recent and projected balance sheets. Income statement and cash flow statement.

What do I need to apply for a personal loan? Application form. ... Proof of identity. ... Employer and income verification. ... Proof of address. ... Get a co-signer. ... Choose a secured personal loan. ... Work on your credit score. ... Consider a credit card.

In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose. Even those with bad credit may qualify for startup funding.

How to apply for a business loan in 7 steps Prepare documentation. ... Review your credit score. ... Gather financial documents. ... Create a business plan. ... Consider your collateral. ... Consider which loan to apply for. ... Assemble and submit your application.