This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maine Loan Application - Review or Checklist Form for Loan Secured by Real Property

Description

How to fill out Loan Application - Review Or Checklist Form For Loan Secured By Real Property?

Have you been in a position in which you will need files for possibly organization or person uses virtually every day time? There are plenty of authorized file templates available online, but discovering kinds you can rely isn`t simple. US Legal Forms delivers a huge number of develop templates, like the Maine Loan Application - Review or Checklist Form for Loan Secured by Real Property, that are created in order to meet state and federal demands.

Should you be currently familiar with US Legal Forms site and possess a free account, basically log in. Following that, you may download the Maine Loan Application - Review or Checklist Form for Loan Secured by Real Property template.

If you do not provide an account and would like to start using US Legal Forms, follow these steps:

- Discover the develop you will need and make sure it is for your right area/area.

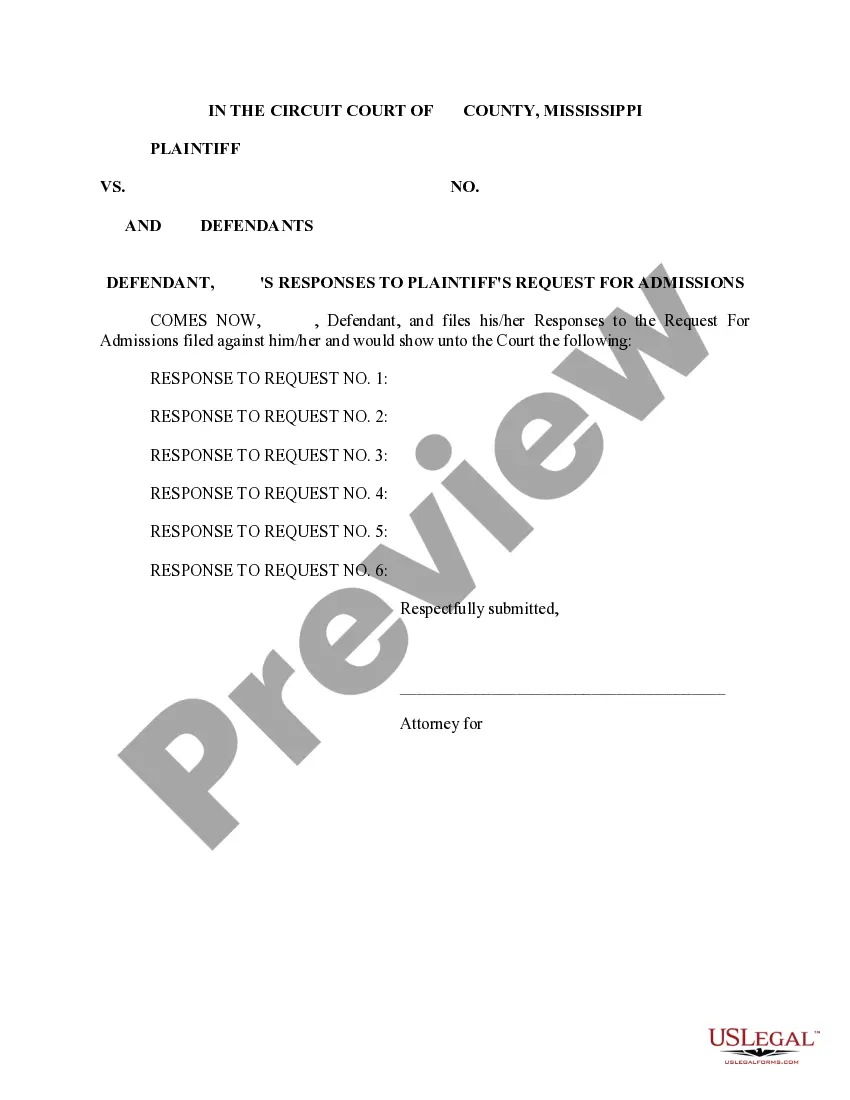

- Take advantage of the Preview option to check the shape.

- See the information to ensure that you have chosen the proper develop.

- When the develop isn`t what you`re looking for, take advantage of the Lookup field to find the develop that suits you and demands.

- If you discover the right develop, click on Acquire now.

- Opt for the prices prepare you want, complete the necessary information to create your money, and pay for the order making use of your PayPal or Visa or Mastercard.

- Pick a practical paper formatting and download your backup.

Locate every one of the file templates you may have purchased in the My Forms food selection. You can aquire a further backup of Maine Loan Application - Review or Checklist Form for Loan Secured by Real Property whenever, if possible. Just click the required develop to download or printing the file template.

Use US Legal Forms, by far the most substantial selection of authorized kinds, to save lots of time and avoid faults. The support delivers skillfully produced authorized file templates that you can use for a selection of uses. Create a free account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

Let's discuss each of the four C's. Character. Character is the ?common sense? factor that lenders look at when considering a loan application. ... Collateral. Collateral are the assets that a lender can take possession of if a borrower defaults on his/her loan. ... Good Credit Score. ... Capacity.

The five Cs of credit are important because lenders use these factors to determine whether to approve you for a financial product. Lenders also use these five Cs?character, capacity, capital, collateral, and conditions?to set your loan rates and loan terms.

Your income and employment history are good indicators of your ability to repay outstanding debt. Income amount, stability, and type of income may all be considered. The ratio of your current and any new debt as compared to your before-tax income, known as debt-to-income ratio (DTI), may be evaluated.

What Is Collateral? Collateral in the financial world is a valuable asset that a borrower pledges as security for a loan. For example, when a homebuyer obtains a mortgage, the home serves as the collateral for the loan. For a car loan, the vehicle is the collateral.

Here are four things you might look at when evaluating a loan offer. The total payback amount. ... Speed and convenience of application and funding. ... Ease of repayment. ... Reputation and dependability of the lender.

A credit review?also known as account monitoring or account review inquiry?is a periodic assessment of an individual's or business's credit profile. Creditors?such as banks, financial services institutions, credit bureaus, settlement companies, and credit counselors?may conduct credit reviews.

Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan. Some of the documents you'll be asked to provide include, copies of your state- or government-issued ID, copies of paystubs, tax returns or bank statements.

In California, loans can be secured by real property through a deed of trust. ingly, a deed of trust is a security instrument that functions like a mortgage.