Maine Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Choosing the right legal record format could be a have a problem. Obviously, there are tons of templates available on the Internet, but how would you obtain the legal kind you will need? Make use of the US Legal Forms web site. The services delivers a large number of templates, for example the Maine Articles of Incorporation, Not for Profit Organization, with Tax Provisions, that can be used for enterprise and personal requirements. All the varieties are examined by specialists and meet up with state and federal demands.

In case you are currently registered, log in to the account and then click the Download switch to get the Maine Articles of Incorporation, Not for Profit Organization, with Tax Provisions. Make use of account to look throughout the legal varieties you might have purchased previously. Check out the My Forms tab of the account and obtain one more backup of the record you will need.

In case you are a brand new user of US Legal Forms, listed below are basic directions that you should comply with:

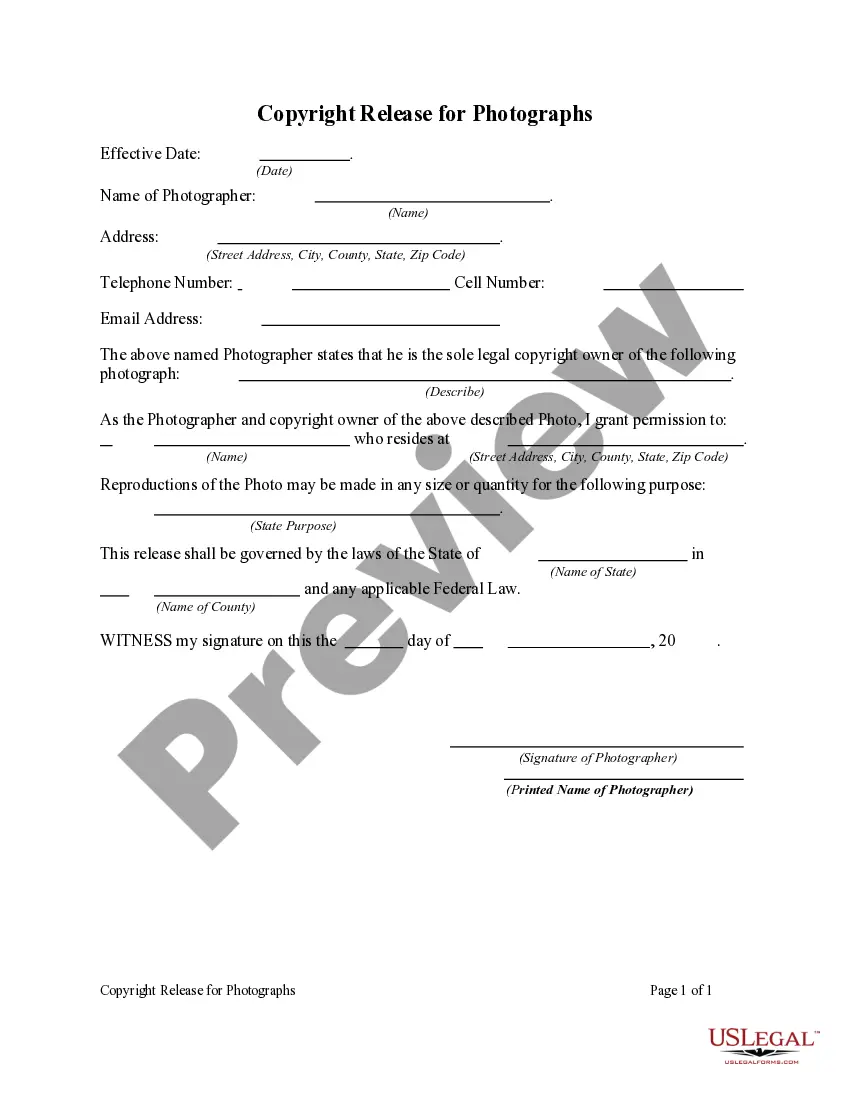

- Initial, make certain you have chosen the appropriate kind for your personal area/county. It is possible to look through the form using the Preview switch and look at the form description to make sure this is the best for you.

- If the kind does not meet up with your requirements, utilize the Seach industry to obtain the appropriate kind.

- When you are certain the form would work, click on the Buy now switch to get the kind.

- Pick the costs plan you need and enter in the needed details. Build your account and pay for the order utilizing your PayPal account or credit card.

- Pick the submit file format and download the legal record format to the gadget.

- Comprehensive, edit and print and sign the received Maine Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

US Legal Forms is definitely the largest catalogue of legal varieties for which you will find a variety of record templates. Make use of the company to download professionally-produced paperwork that comply with status demands.

Form popularity

FAQ

Corporations, and any community chest, fund, or foundation, organized and operated exclusively for religious, charitable, scientific, testing for public safety, literary, or educational purposes, or to foster national or international amateur sports competition (but only if no part of its activities involve the ...

A 501(c) organization and a 501(c)3 organization are similar in designation, however they differ slightly in their tax benefits. Both types of organization are exempt from federal income tax, however a 501(c)3 may allow its donors to write off donations whereas a 501(c) does not.

How to Incorporate in Maine Appoint a Registered Agent. Per 13-C ME Rev Stat § 511 (2019), every Maine corporation must appoint a registered agent (also called a ?clerk,? ?commercial clerk,? and ?noncommercial clerk?). ... Name Your Corporation. ... Submit Maine Articles of Incorporation.

Nonprofit organizations are exempt from federal income taxes under subsection 501(c) of the Internal Revenue Service (IRS) tax code. A nonprofit organization is an entity that engages in activities for both public and private interest without pursuing the goal of commercial or monetary profit.

The exempt purposes set forth in section 501(c)(3) are charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals.

How To Start A Nonprofit In Maine Choose your Maine nonprofit filing option. File ME nonprofit articles of incorporation. Get a Federal EIN from the IRS. Adopt your nonprofit's bylaws. Apply for federal and/or state tax exemptions. Apply for any required business licenses. Open a bank account for your ME nonprofit.

Both nonprofits and for-profit organizations seek to maximize revenues. Whereas for-profits may distribute revenues above the profit line to shareholders, nonprofits must recycle those earnings back into the organization. Not-for-profit organizations simply seek to generate enough money to keep the lights on.

Are Nonprofits Taxed? Nonprofit organizations are exempt from federal income taxes under subsection 501(c) of the Internal Revenue Service (IRS) tax code. A nonprofit organization is an entity that engages in activities for both public and private interest without pursuing the goal of commercial or monetary profit.