Maine Revocable Trust for Real Estate

Description

How to fill out Revocable Trust For Real Estate?

Are you currently in a situation where you require documents for either business or personal purposes almost daily.

There is an array of legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers a vast collection of form templates, including the Maine Revocable Trust for Real Estate, which can be customized to comply with state and federal regulations.

When you locate the appropriate form, click on Acquire now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and finalize the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Maine Revocable Trust for Real Estate template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

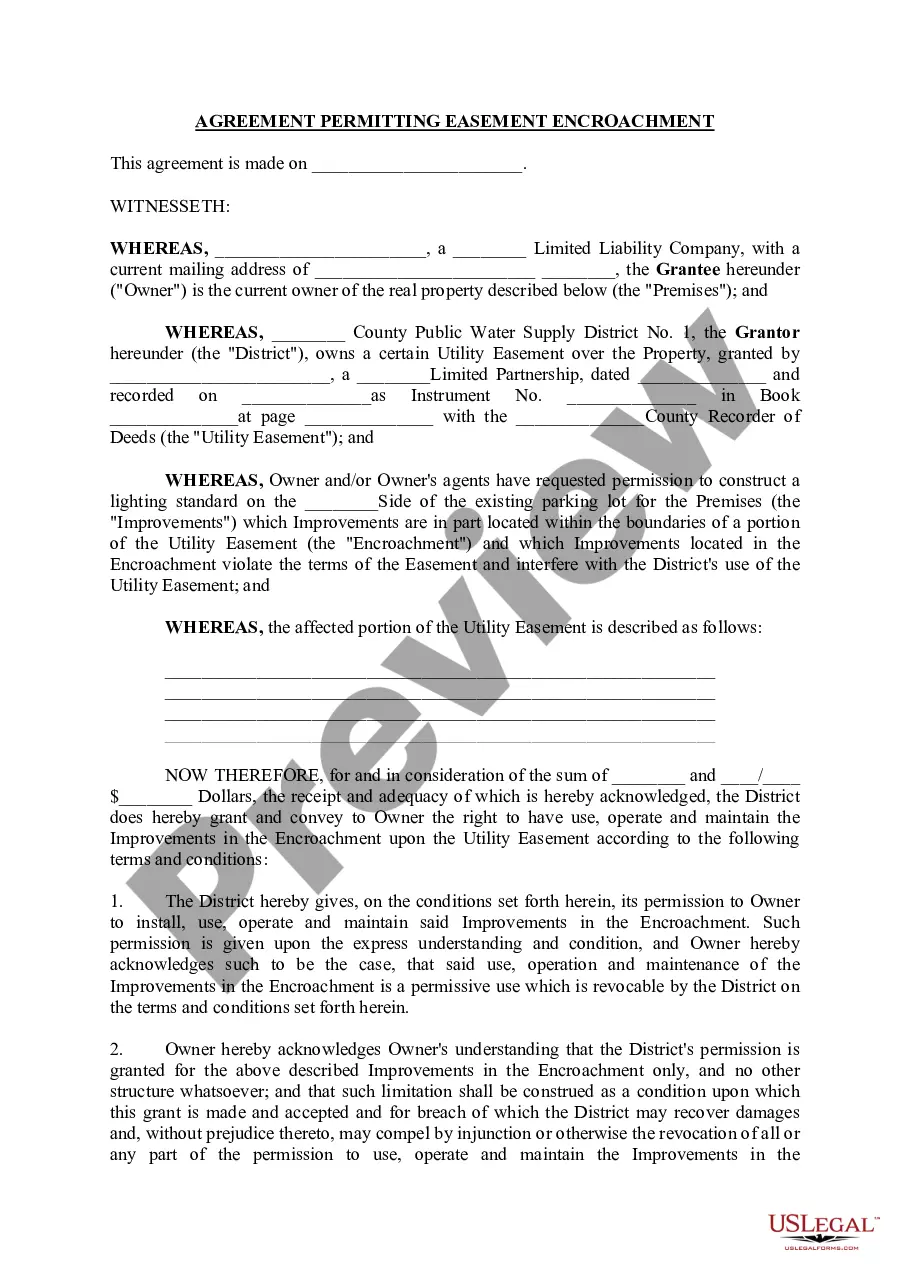

- Use the Review button to check the form.

- Read the description to confirm you have selected the correct form.

- If the form does not meet your requirements, use the Search section to find the form that suits your needs.

Form popularity

FAQ

You should generally avoid placing your everyday checking accounts or savings accounts into a Maine Revocable Trust for Real Estate. These accounts serve daily financial needs and are often easier to manage outside a trust framework. Instead, consider reserving your trust for savings accounts that are intended to grow over time or hold larger sums meant for long-term investment and estate planning.

Some assets are often better left outside a Maine Revocable Trust for Real Estate. This includes assets that require specific beneficiary designations, such as 401(k) plans and IRAs. Additionally, assets that are difficult to transfer into a trust, like certain collectibles or vehicles, may also be better handled through other estate planning tools to ensure clarity and efficiency.

While a Maine Revocable Trust for Real Estate can hold many assets, it is advisable not to place certain items in the trust, such as life insurance policies, retirement accounts, and certain types of personal property. These assets typically have designated beneficiaries which help in governing the transfer without trust involvement. Keeping them outside the trust can streamline the process and ensure they go directly to your chosen beneficiaries.

When creating a Maine Revocable Trust for Real Estate, you should include assets such as real estate properties, bank accounts, investments, and valuable personal items. By placing these assets in your trust, you can simplify the process of transferring ownership to your beneficiaries. This step ensures that your estate plan is comprehensive and that your wishes are respected after your passing.

A disadvantage of a family trust, such as a Maine Revocable Trust for Real Estate, is that it may require ongoing management and potential legal fees that could add up over time. Family dynamics can also complicate decisions regarding trust leadership and distribution of assets. Therefore, it is vital to have open communication among family members and to seek professional guidance to avoid misunderstandings.

One significant mistake parents often make when setting up a trust fund is failing to fund the trust properly. While they may create a Maine Revocable Trust for Real Estate, not transferring assets into it renders the trust ineffective. It is crucial for parents to ensure that all intended assets are correctly placed within the trust to achieve their estate planning objectives.

Deciding whether your parents should place their assets in a trust depends on their specific needs. A Maine Revocable Trust for Real Estate can streamline the transfer of property upon death, ensuring their wishes are fulfilled with minimal hassle. However, they should consider their overall financial situation and consult with a legal expert to assess if a trust aligns with their goals.

A major disadvantage of a trust, particularly a Maine Revocable Trust for Real Estate, is that it lacks privacy compared to a will. While probate proceedings are public, a trust allows for asset management without disclosure in court. However, because of this lack of privacy, any disputes or changes can become more complicated, leading to potential family tensions.

While a revocable trust provides flexibility, a key downside is that it does not shield assets from creditors. Additionally, a Maine Revocable Trust for Real Estate remains part of your taxable estate, meaning that beneficiaries may face estate taxes upon your passing. Consequently, this may lead individuals to seek estate planning solutions that better protect their assets.

The 5-year rule for trusts often refers to how assets are treated for Medicaid eligibility. If you transfer assets into a Maine Revocable Trust for Real Estate and plan to apply for Medicaid, these assets may be subject to a look-back period of 5 years. This means that any transfer made within this period could affect your eligibility for benefits, potentially complicating your financial planning.