Maine Revocable Trust for Property

Description

How to fill out Revocable Trust For Property?

Are you currently in a location where you frequently require documentation for either business or particular purposes.

There are numerous legal document templates accessible online, yet locating reliable ones is not straightforward.

US Legal Forms offers a vast array of form templates, such as the Maine Revocable Trust for Property, designed to comply with both state and federal regulations.

Once you find the suitable form, click Purchase now.

Choose the pricing plan you desire, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Maine Revocable Trust for Property anytime if needed. Just select the desired form to download or print the document template. Utilize US Legal Forms, the most extensive selection of legal forms, to save time and prevent mistakes. The service provides appropriately drafted legal document templates usable for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can obtain the Maine Revocable Trust for Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the necessary form ensuring it corresponds to the correct area/state.

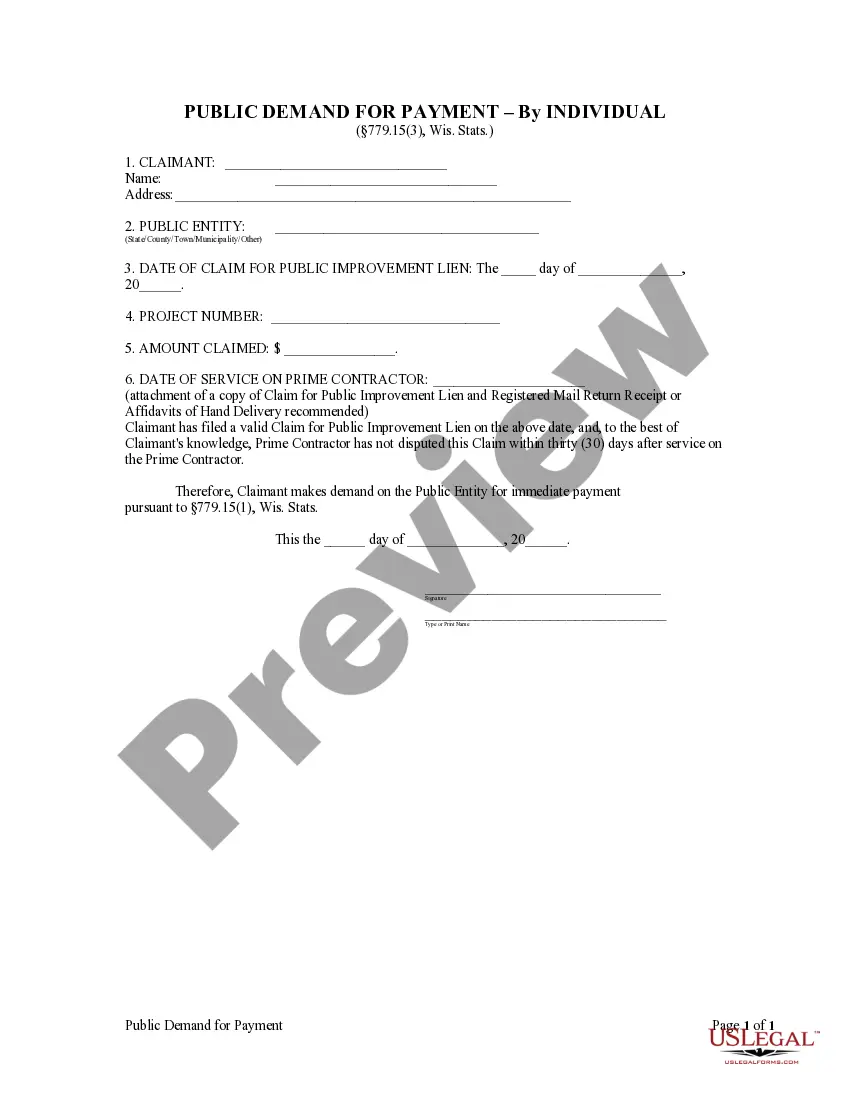

- Utilize the Review button to evaluate the form.

- Read the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that suits your needs.

Form popularity

FAQ

The best trust for your house is generally a Maine Revocable Trust for Property. This type of trust offers flexibility and control, allowing you to change the terms or dissolve the trust during your lifetime. With a Maine Revocable Trust for Property, you can avoid probate, ensuring a smoother transition of your property to your beneficiaries. By using this trust, you can manage your assets effectively while reducing complexity for your loved ones.

Maine does not have a state-level sales tax on most services, which can be a significant advantage for residents. Additionally, Maine does not impose an inheritance tax, making it easier for beneficiaries to receive their assets. Establishing a Maine Revocable Trust for Property can further optimize your estate by avoiding potentially burdensome taxes. Be sure to consult legal experts who can guide you in creating an effective plan.

Yes, Maine does tax pension income, but there are certain exemptions for qualified pensions, particularly for retirees over a certain income threshold. This means that if you're drawing a pension, you have to consider its tax implications. Utilizing a Maine Revocable Trust for Property can assist in managing your overall estate plan, including how pensions may impact your estate and your heirs. It's beneficial to seek professional guidance for clarity.

Maine does impose taxes on trusts, particularly if the trust generates income. The tax implications can vary based on the type of trust you have and its residency. If you are considering a Maine Revocable Trust for Property, understanding these tax implications is crucial for effective planning. Consulting with a tax advisor can provide specific advice tailored to your situation.

In Maine, you can inherit property without paying state inheritance taxes if the value is below $1 million. Property above this threshold may incur taxes, depending on the relationship to the deceased. Planning with a Maine Revocable Trust for Property can help ensure your assets are distributed efficiently, potentially reducing tax impacts on your heirs. It's wise to consult a tax professional to gain further insight.

In Maine, there is no specific age at which you stop paying property taxes. However, there are programs available, such as the Homestead Exemption, that can reduce property tax liabilities for eligible residents. It's essential to consult local regulations and programs to maximize your benefits. A Maine Revocable Trust for Property can help manage or minimize tax burdens for your heirs.

Creating a Maine Revocable Trust for Property can be a smart decision for many residents. A trust helps manage your assets during your lifetime and simplifies the transfer of your property after you pass away. It can also provide you with peace of mind, knowing that your wishes will be honored. Additionally, using a trust can help you avoid probate, making the process easier for your loved ones.

Though the question pertains to the UK, parallels exist with setting up a Maine Revocable Trust for Property. One common mistake parents make is failing to communicate their intentions clearly with their children. Without clear dialogue, children may feel uncertain about the trust and its purposes, leading to potential disputes later. Educating beneficiaries on the trust’s objectives can promote harmony and understanding within families.

To put your house in a Maine Revocable Trust for Property, you need to transfer the title of your home into the trust's name. This process typically involves drafting a new deed that names the trust as the owner of the property. It’s advisable to consult a legal professional to ensure all documents are correctly filed and that all steps meet Maine law. This way, you can protect your property and simplify future estate planning.

While a trust has many advantages, there are negative aspects to consider with a Maine Revocable Trust for Property. These include costs related to setup and maintenance, as legal assistance can be essential to ensure it is properly structured. Additionally, if you make changes to the trust, you may need to update other documents, which adds another layer of complexity. Be sure to evaluate these factors before proceeding.