Maine UCC-1 for Personal Credit

Description

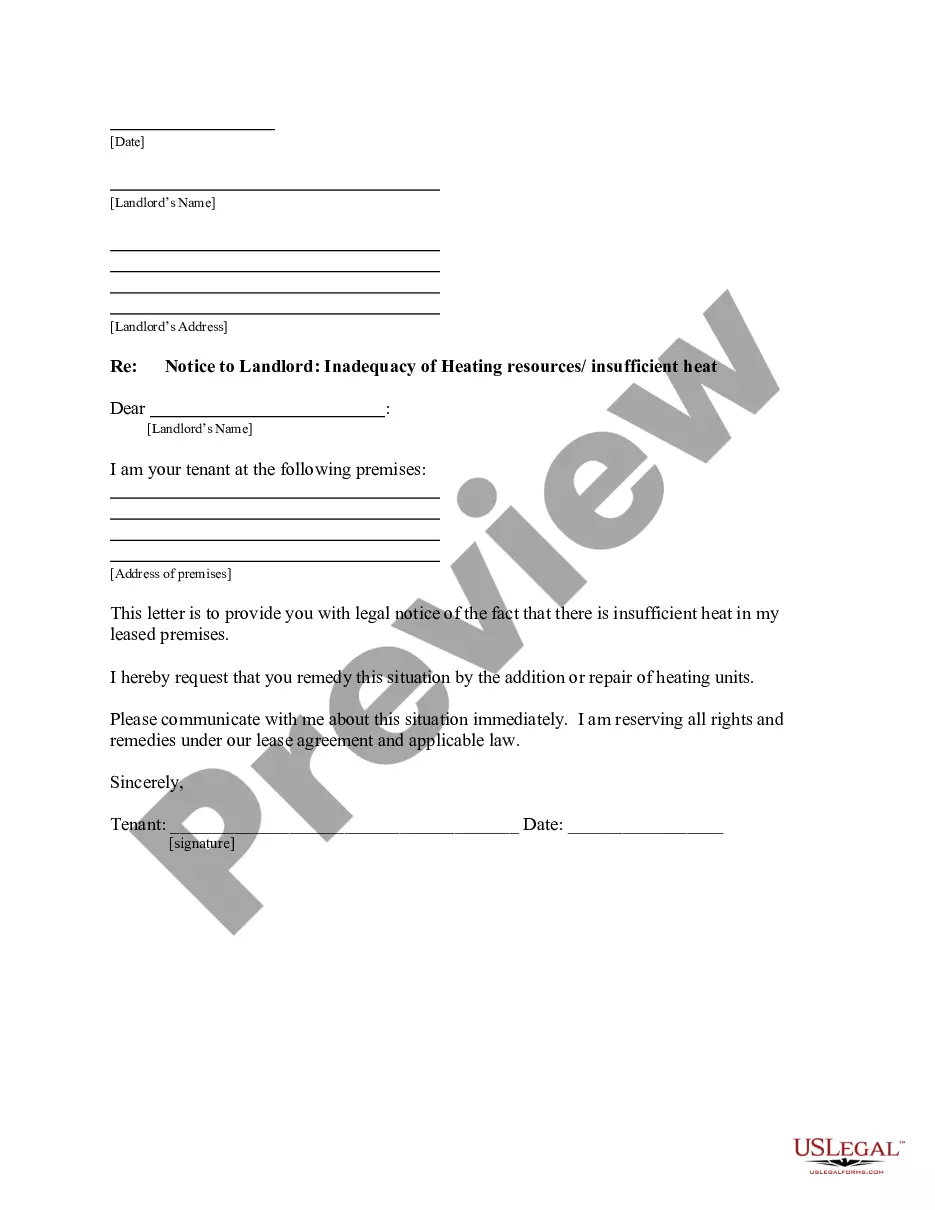

How to fill out UCC-1 For Personal Credit?

Have you ever been in a situation where you need documents for either business or personal needs almost every workday.

There are numerous legitimate document templates available online, but locating ones you can trust isn’t easy.

US Legal Forms offers thousands of document templates, such as the Maine UCC-1 for Personal Credit, that are designed to meet federal and state requirements.

Once you find the correct form, click Purchase now.

Select the pricing plan you prefer, fill out the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Maine UCC-1 for Personal Credit template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

- Use the Review button to examine the document.

- Check the information to make sure you have selected the right form.

- If the form isn’t what you are searching for, utilize the Lookup field to find the document that fits your needs and specifications.

Form popularity

FAQ

To file a UCC-1 in Maine, you must meet several requirements. First, you need to provide the full name and address of the debtor, along with a description of the collateral. Additionally, the form must be signed by the secured party. Using a reliable platform like USLegalForms can simplify this process by offering templates and guidance for correctly completing your Maine UCC-1 for Personal Credit.

Yes, you can file a UCC against an individual, as long as the transaction involves a secured interest in personal property. When filing a Maine UCC-1 for Personal Credit, be sure to provide accurate information about the individual and the collateral involved. By doing so, you create a public record that protects your interest in the collateral. This process is crucial for securing loans and establishing credit.

To fill out a Maine UCC-1 for Personal Credit, start by gathering the necessary information about the debtor and collateral. You will need the debtor's name, address, and a description of the collateral. Next, complete the form by entering this information clearly. After filling in all required fields, sign and date the form before submitting it for filing to the appropriate state office.

To locate your UCC-1 filing, you can search the public records through the Maine Secretary of State's office or their online database. It’s important to have the correct details, such as your name or the debtor's name, on hand for an effective search. Platforms like uslegalforms also offer resources that can help track down filings and ensure you obtain necessary documents promptly.

You can file your UCC-1 statement with the Secretary of State in Maine. This is typically done online or via mail, depending on your preference. Filing correctly is essential for securing your interests in personal credit transactions, and using uslegalforms can streamline this process, making it easier to navigate.

For a foreign entity, you generally need to file a UCC-1 in the state where the business operates or where the collateral is located. If the foreign entity has interests in Maine personal credit, it's vital to ensure compliance with local laws. The uslegalforms platform can assist in ensuring that your filing is done correctly and in accordance with Maine regulations.

Yes, a UCC filing can appear on your personal credit report, especially if it involves personal assets or guarantees. This can impact your credit score and future borrowing potential. By filing a Maine UCC-1 for Personal Credit, you establish a public record of your obligations, which creditors may review when assessing your creditworthiness.

A UCC fixture filing should be submitted to the local county clerk's office where the real property is located. This helps provide notice of your claim on fixtures, which can impact personal credit in certain situations. Filing in Maine requires attention to detail, and platforms like uslegalforms can guide you through the specific steps needed to ensure proper filing.

You should file a UCC-1 in the appropriate state where the debtor is located. For personal credit purposes, this often means filing in Maine if that is where you reside. The filing helps establish a legal claim against collateral and ensure your interests are protected when it comes to personal credit. Using uslegalforms can simplify the filing process and ensure you meet all requirements.

No, a UCC financing statement is not a mortgage. While both documents are used to secure interests in property or assets, a UCC-1 filing covers personal property rather than real estate. In the context of personal credit, the Maine UCC-1 operates differently from traditional mortgages, focusing on movable assets. For individuals navigating credit options, understanding this distinction is crucial for proper asset management.