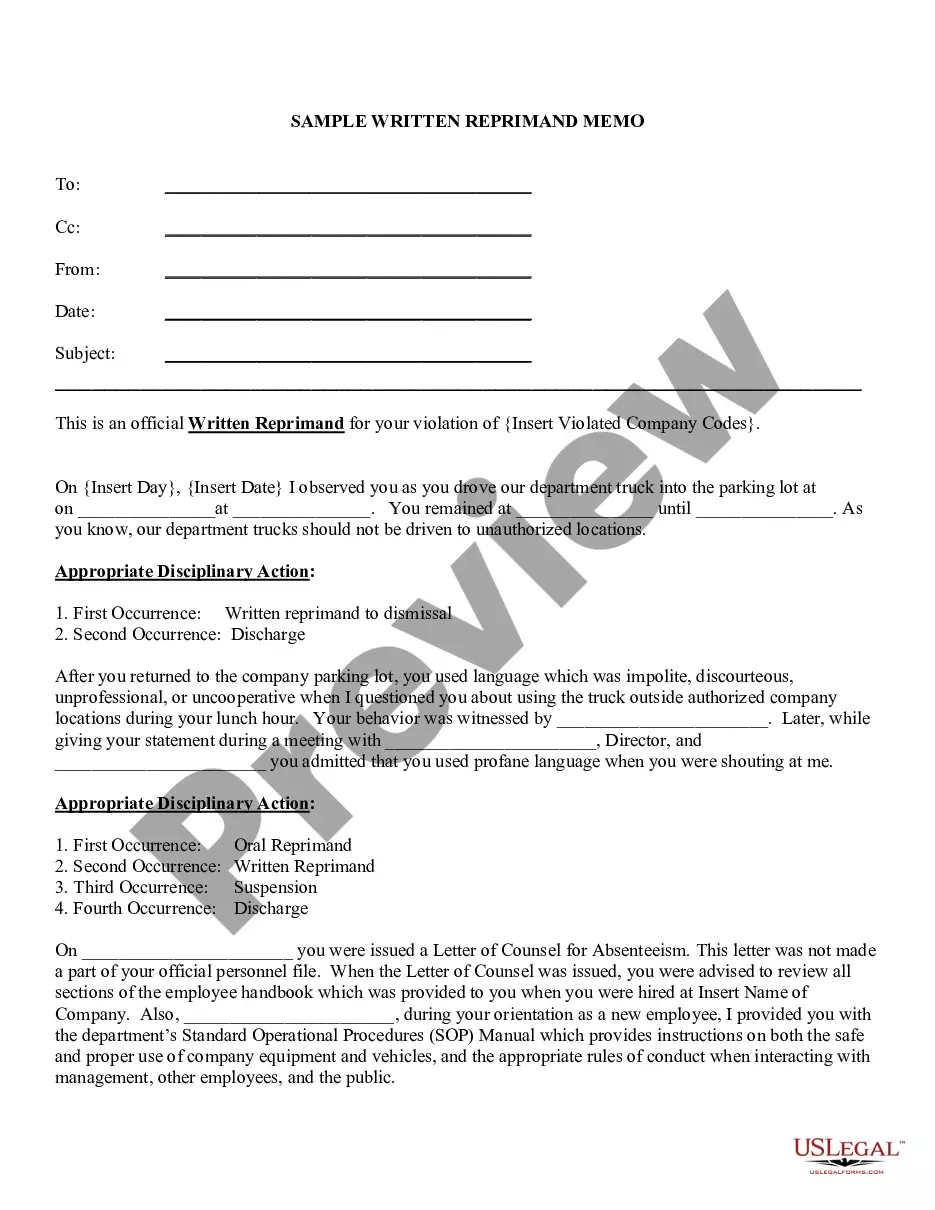

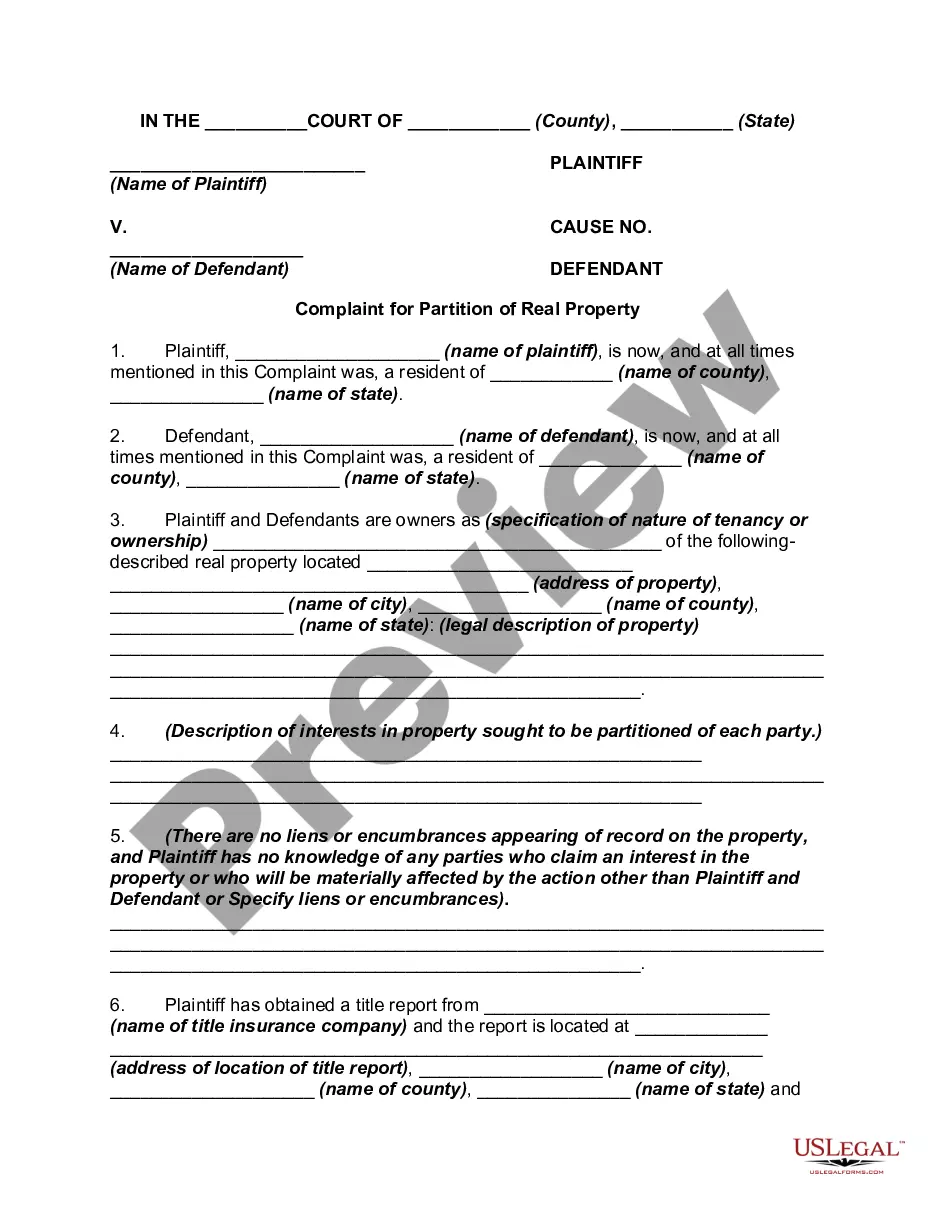

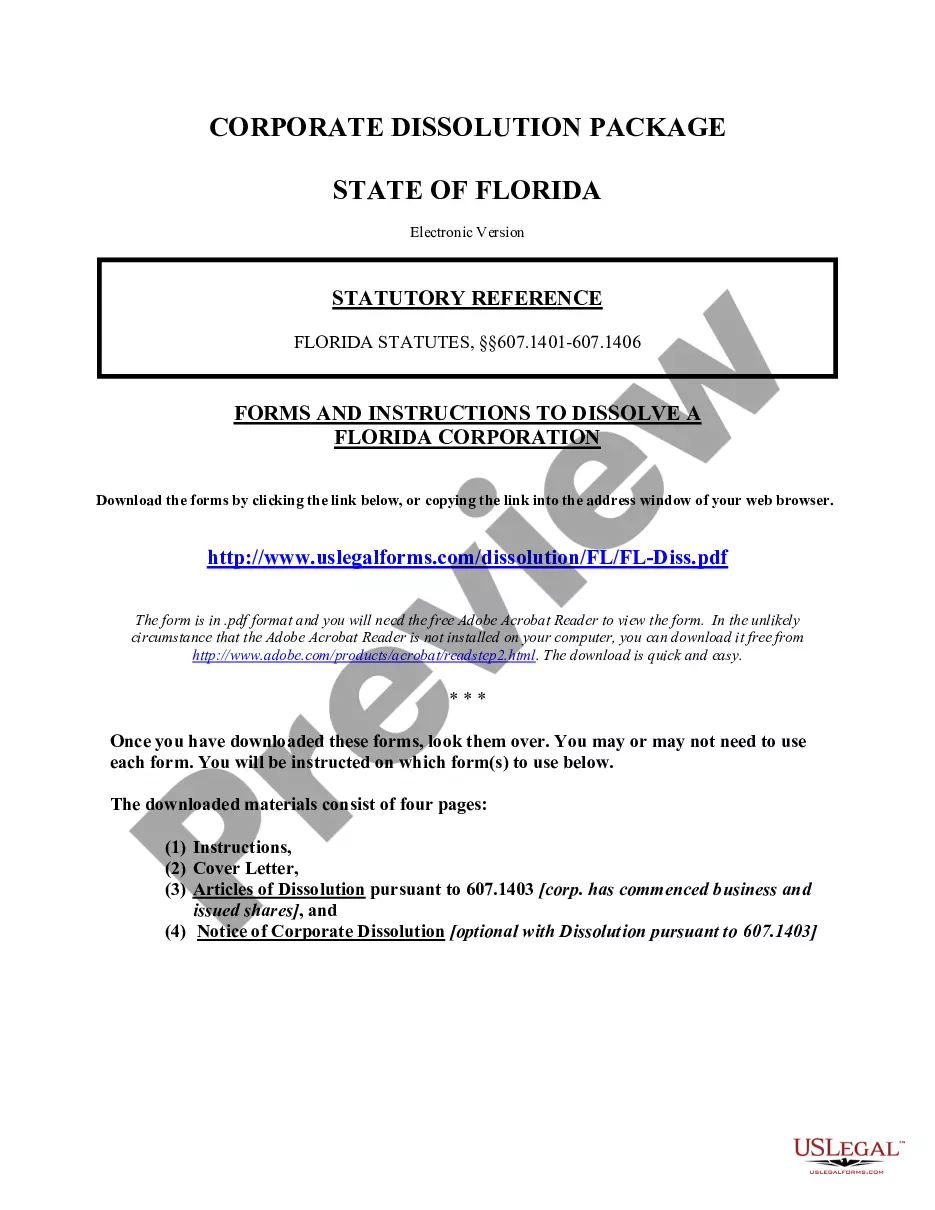

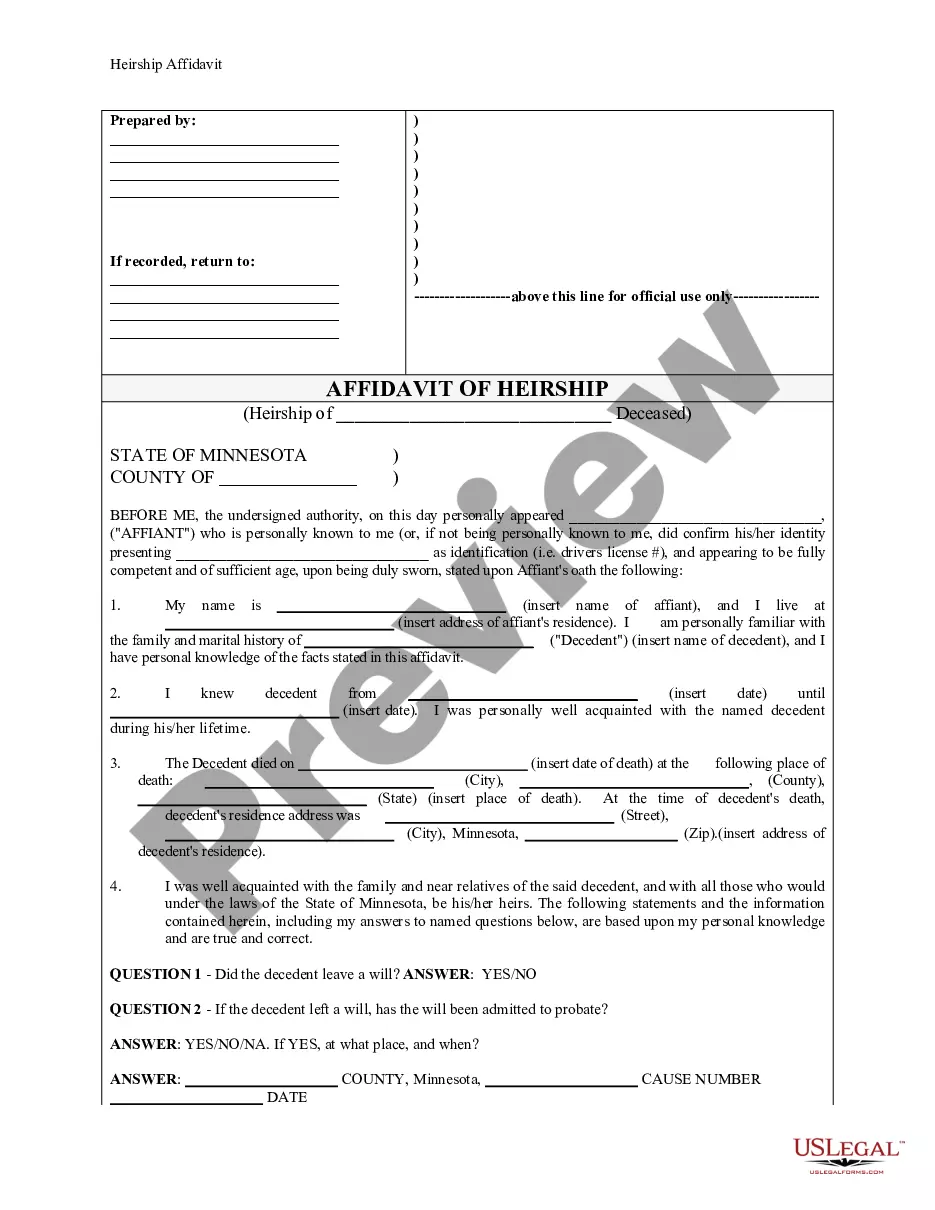

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad range of legal form templates that you can download or print.

By utilizing the website, you can discover thousands of forms for both business and personal purposes, categorized by type, state, or keywords.

You can quickly access the latest templates like the Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually.

If the form does not meet your requirements, use the Search box at the top of the page to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Buy Now button. Then, choose your preferred payment plan and enter your information to register for an account. Complete the transaction. Use your credit card or PayPal account to finalize the payment. Access the format and download the form to your device. Make edits. Complete, modify, print, and sign the downloaded Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. Each template saved in your account has no expiration and belongs to you indefinitely. Therefore, if you wish to download or print another copy, just navigate to the My documents section and click on the form you need. Obtain the Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually from US Legal Forms, the most extensive library of legal document templates. Access thousands of professional and state-specific templates that satisfy your business or personal requirements.

- If you already have a membership, Log In to download the Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are new to US Legal Forms, here are some easy tips to help you get started.

- Ensure you have selected the correct form for your area/region.

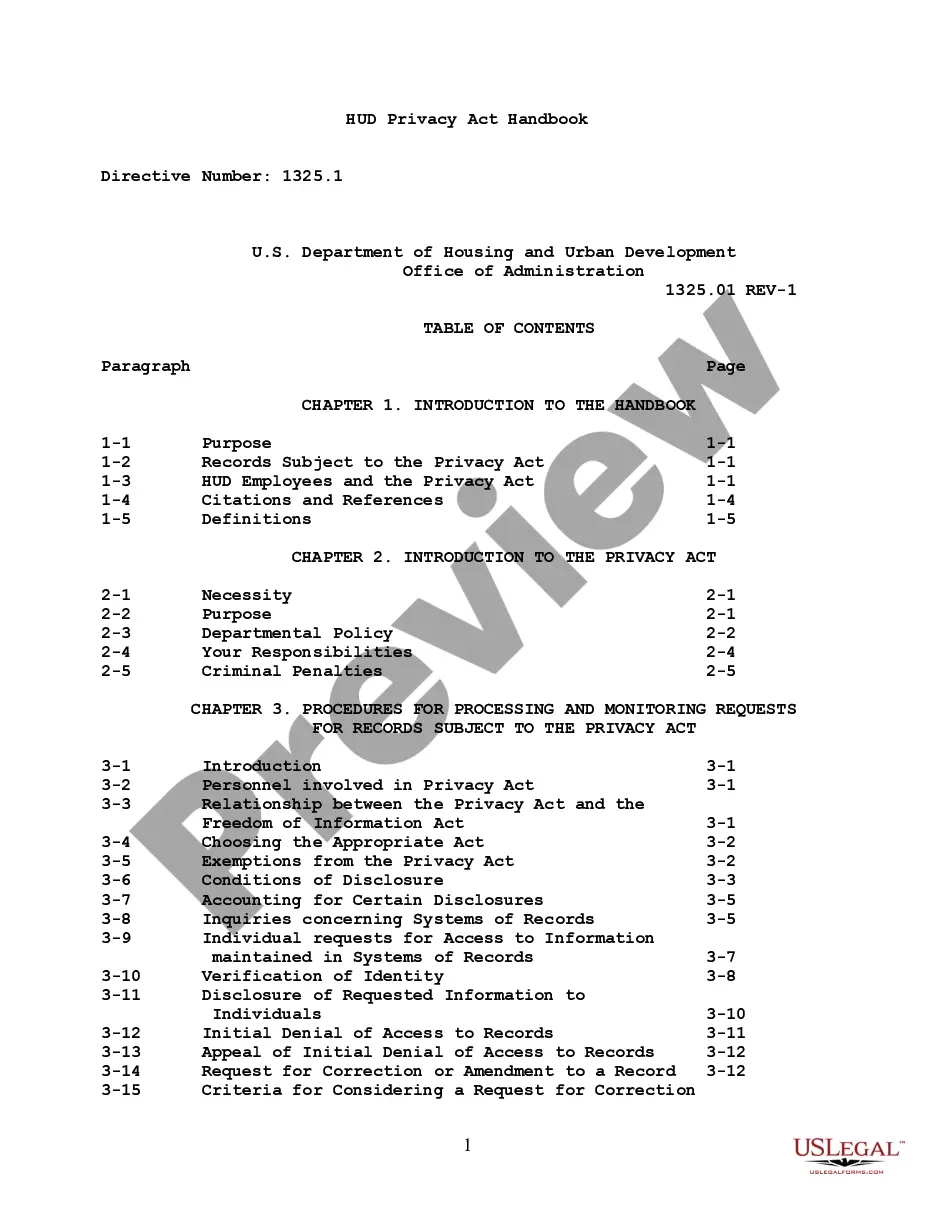

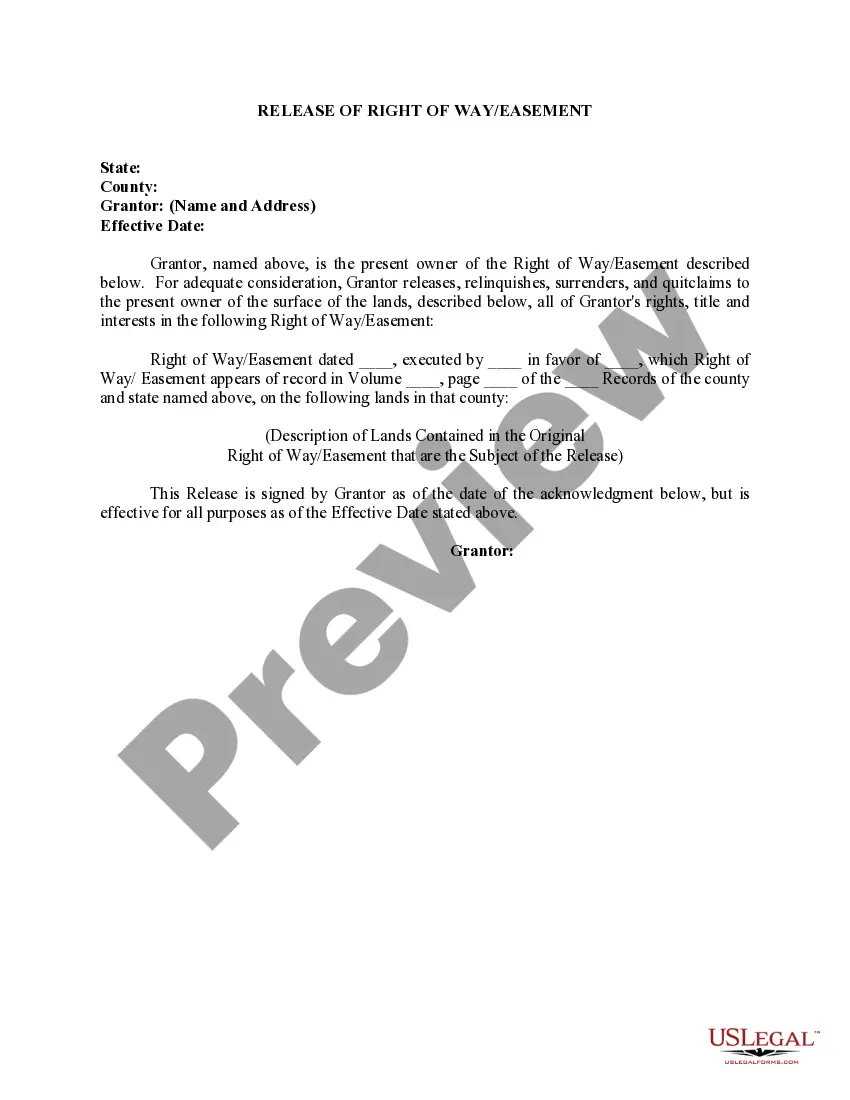

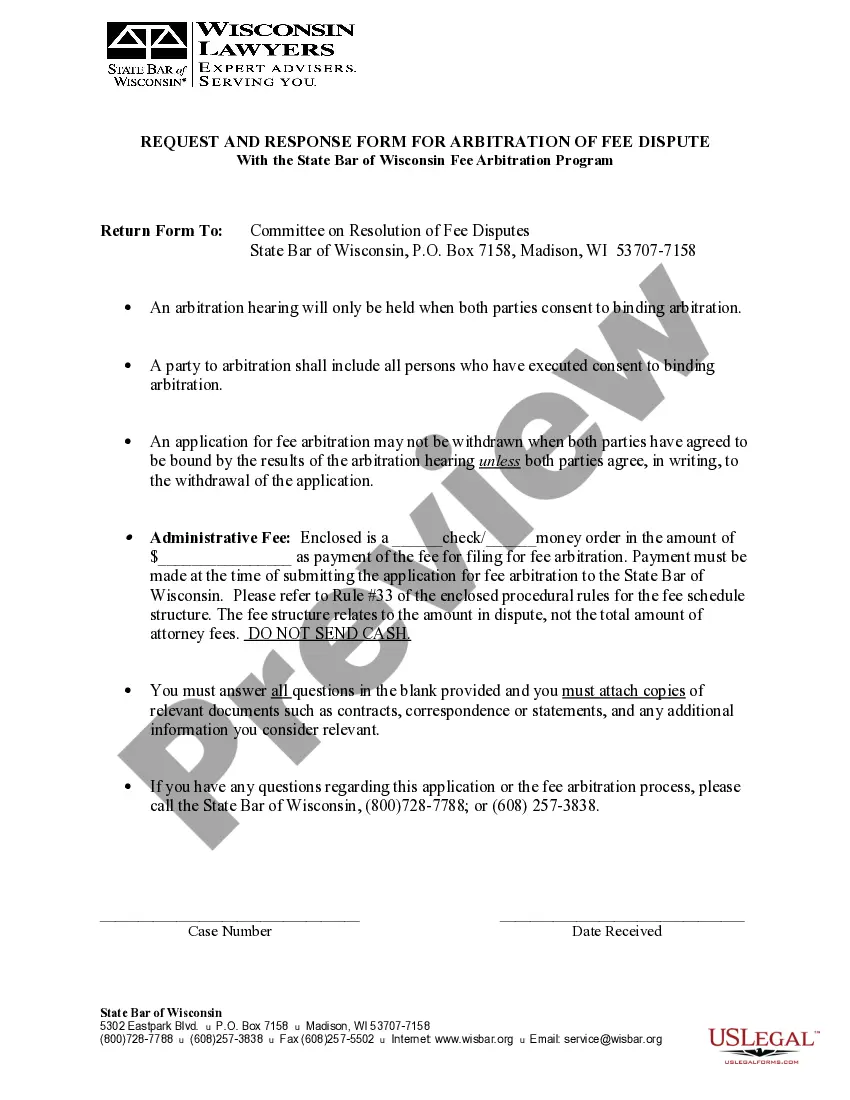

- Select the Preview option to review the content of the form.

Form popularity

FAQ

A Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is a financial instrument that allows a borrower to promise repayment at a future date without the obligation of making interim payments. This type of note provides flexibility for both the lender and borrower, as it delays payment until the maturity date. Additionally, the interest compounds annually, which can lead to a larger payoff amount at maturity. Understanding this note is essential for parties looking to structure loans effectively, and uslegalforms offers resources to help you navigate these agreements with ease.

The four main types of promissory notes include personal notes, business notes, real estate notes, and demand notes. Each type serves a different purpose, but all can have features like a Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. Knowing the differences can guide you in selecting the right note for your needs.

Interest on a promissory note is typically calculated using the principal amount, interest rate, and time period. For a Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, the formula can provide clear insights into how much interest will accumulate. It’s important to read your agreement closely to ensure you understand the calculations involved.

Yes, promissory notes do accrue interest over time, based on the terms specified in the agreement. For example, a Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually will accumulate interest until the maturity date, at which point the total amount is due. Understanding this can help you plan your finances accordingly.

Yes, interest can compound on a promissory note, especially if it is structured as a Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. This feature allows the interest to be calculated on an increasing principal amount over time, which can significantly impact the total amount owed. Be sure to check the terms in your note to understand how interest is applied.

A Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually typically involves compound interest. This means that the interest earned on the principal amount is added to the principal itself, leading to interest on interest over time. Understanding how this works can help you maximize returns on your investment.

While many promissory notes include a maturity date, it is not a strict requirement. In the case of a Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, you could create terms without specifying a maturity date. However, including one can provide clarity for both parties. Ultimately, it is advisable to consult legal advice when determining the note's structure.

A promissory note is a legally binding document when crafted correctly. For instance, a Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually will hold up in court as long as it includes essential terms and signatures. The presence of these elements affirms both parties' commitment to the agreement. Therefore, treat it with the same seriousness as a contract.

An example of a promissory note could be a document where John borrows $10,000 from Emily, agreeing to repay the full amount after five years. The agreement specifies that interest will be compounded annually, embodying the aspect of the Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. Including such details ensures clarity on repayment conditions.

In Maine, notarization is not required for a promissory note to be legally binding, including the Maine Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. However, having the note notarized can provide added legitimacy and protect against disputes. It is always a good practice to have witnesses or notarization for additional assurance.