If you have to total, acquire, or print legal document themes, use US Legal Forms, the largest assortment of legal forms, that can be found online. Use the site`s simple and hassle-free search to get the documents you require. A variety of themes for company and person reasons are categorized by groups and states, or key phrases. Use US Legal Forms to get the Indiana Petition for Representation of a Probate Estate's Insolvency and Request with a few click throughs.

If you are already a US Legal Forms consumer, log in in your bank account and click the Obtain option to have the Indiana Petition for Representation of a Probate Estate's Insolvency and Request. Also you can gain access to forms you earlier downloaded inside the My Forms tab of your own bank account.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for the proper metropolis/land.

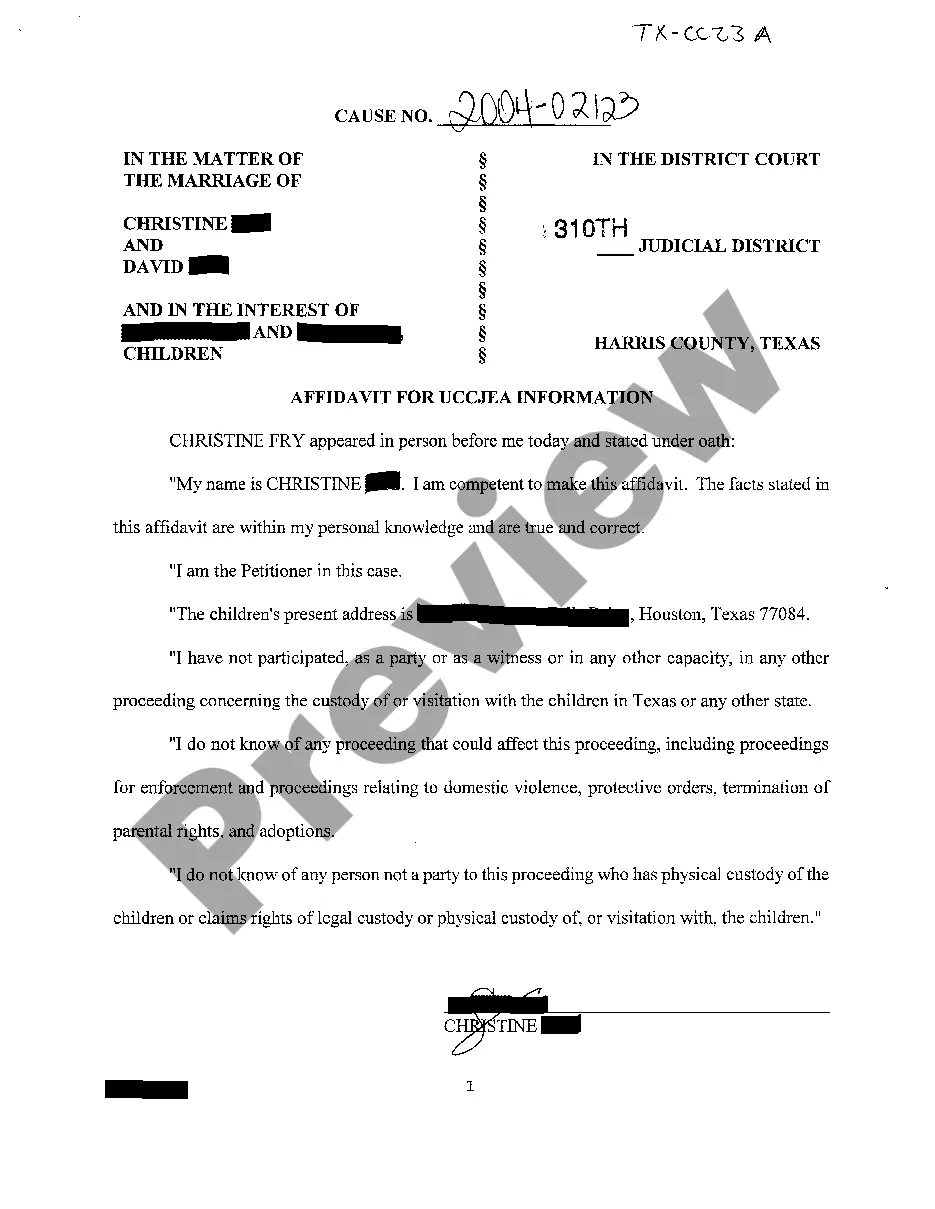

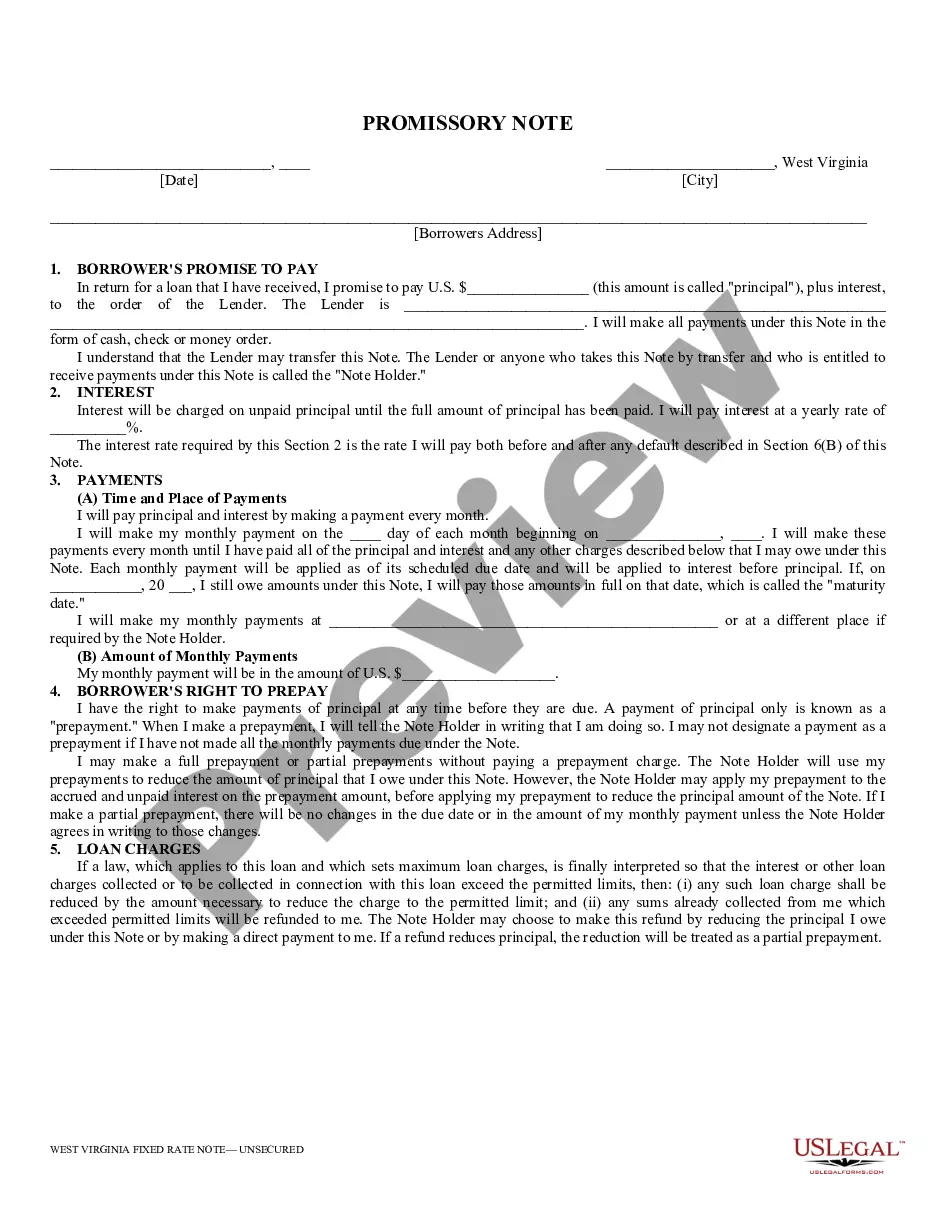

- Step 2. Use the Review method to check out the form`s articles. Never forget to learn the outline.

- Step 3. If you are unsatisfied with all the type, make use of the Research field towards the top of the monitor to discover other variations from the legal type template.

- Step 4. After you have identified the form you require, click on the Get now option. Opt for the rates program you prefer and add your accreditations to sign up on an bank account.

- Step 5. Procedure the purchase. You can use your charge card or PayPal bank account to perform the purchase.

- Step 6. Choose the format from the legal type and acquire it in your device.

- Step 7. Complete, modify and print or indicator the Indiana Petition for Representation of a Probate Estate's Insolvency and Request.

Every single legal document template you buy is your own property forever. You may have acces to every type you downloaded with your acccount. Go through the My Forms portion and select a type to print or acquire once again.

Contend and acquire, and print the Indiana Petition for Representation of a Probate Estate's Insolvency and Request with US Legal Forms. There are thousands of professional and state-distinct forms you can utilize for your company or person needs.