An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Maine Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

How to fill out Assignment By Beneficiary Of A Percentage Of The Income Of A Trust?

Are you currently in a position where you need documents for either business or personal tasks nearly every day.

There are numerous legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms offers thousands of form templates, such as the Maine Assignment by Beneficiary of a Portion of the Income of a Trust, specifically designed to meet federal and state requirements.

Once you find the correct form, click on Buy now.

Select the pricing plan you want, fill in the required information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Maine Assignment by Beneficiary of a Portion of the Income of a Trust template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

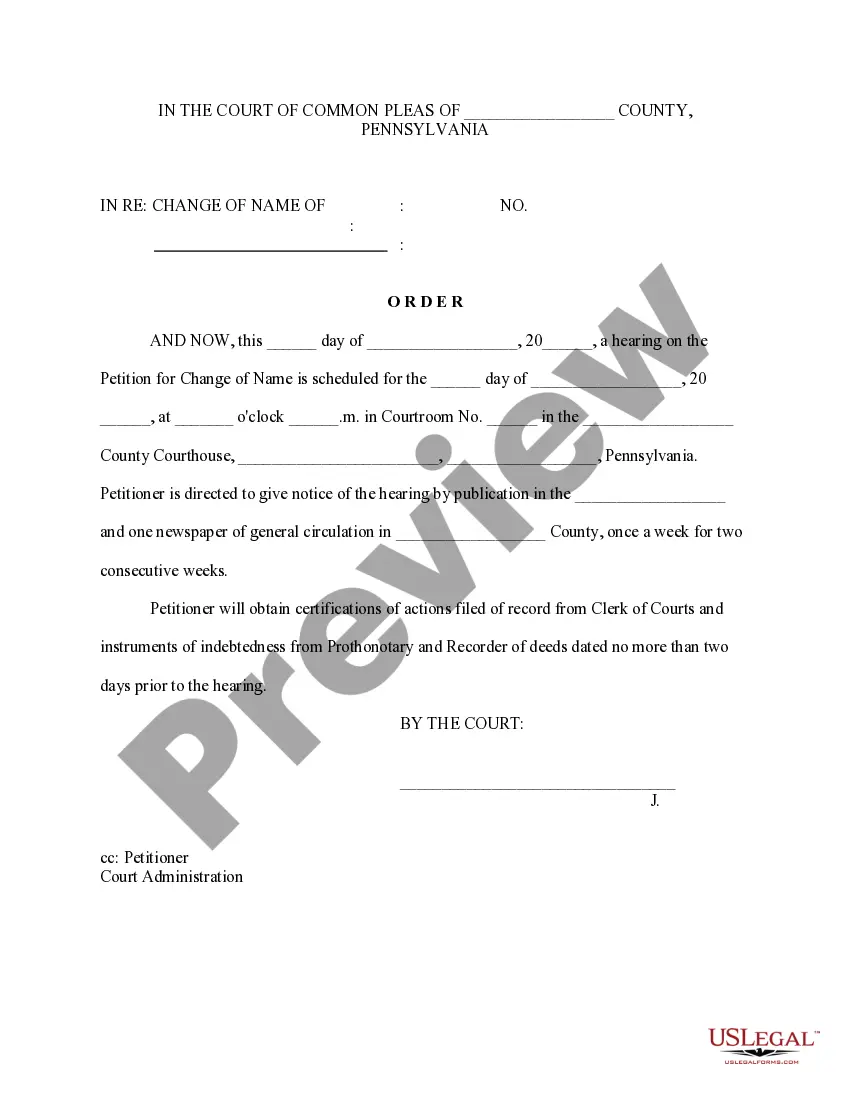

- Use the Preview button to view the form.

- Check the description to make sure you have selected the right form.

- If the form is not what you are looking for, use the Lookup section to find the form that suits your needs.

Form popularity

FAQ

To report a beneficiary income from a Maine Assignment by Beneficiary of a Percentage of the Income of a Trust, you should first gather all relevant documents outlining the trust's distributions. When reporting, ensure you include the percentage assigned to the beneficiary and any other required details specified by the IRS. Using tax preparation software or consulting a tax advisor can simplify this process, ensuring you comply with state and federal regulations. For additional assistance, you can also explore resources available on our US Legal Forms platform, which can provide templates and guidance tailored to your needs.

Reporting income from a trust typically requires the trustee to provide beneficiaries with a Schedule K-1 form, detailing the income they received. Beneficiaries must then report this income on their personal tax returns. If you utilize a Maine Assignment by Beneficiary of a Percentage of the Income of a Trust, it is vital to ensure all income is accurately reported to comply with tax regulations. Our platform can help you navigate these reporting requirements effortlessly.

A beneficiary is anyone entitled to receive benefits from a trust, which may include both income and principal. An income beneficiary, however, specifically receives the income produced by the trust assets, not the principal itself. When structuring a Maine Assignment by Beneficiary of a Percentage of the Income of a Trust, this distinction is crucial for determining who gets what. Understanding these roles can help you manage your trust efficiently.

Distributing trust income to beneficiaries involves following the terms set in the trust document. Generally, the trustee calculates the income generated by the trust and determines how much each beneficiary receives. This process may include deciding on a Maine Assignment by Beneficiary of a Percentage of the Income of a Trust to specify what each beneficiary gets. Utilizing our platform can simplify this process, providing necessary forms and guidance.

Some tax loopholes related to trusts allow for tax savings that can benefit beneficiaries. These loopholes often hinge on the trust's structure and how income is reported separately from personal income. With the Maine Assignment by Beneficiary of a Percentage of the Income of a Trust, understanding these loopholes could aid beneficiaries in optimizing their tax outcomes.

Allocating trust income requires clarity on the terms set forth in the trust agreement. The Maine Assignment by Beneficiary of a Percentage of the Income of a Trust allows for specific percentages to be allocated to each beneficiary. It is wise to consult with a legal professional or a platform like uslegalforms to navigate this process successfully.

Allocating trust income to beneficiaries involves distributing the income generated by the trust according to the terms established in the trust document. With the Maine Assignment by Beneficiary of a Percentage of the Income of a Trust, beneficiaries may receive a designated percentage of the income. Ensuring compliance with the trust’s directives is crucial for a smooth allocation.

Yes, income from a trust is generally taxable to the beneficiary under the Maine Assignment by Beneficiary of a Percentage of the Income of a Trust. Beneficiaries must report this income on their tax returns, usually in the year they receive it. It's essential to be informed about the specific tax implications, as these can vary significantly depending on the trust's structure.