A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of an agreement to purchase common stock from another stockholder.

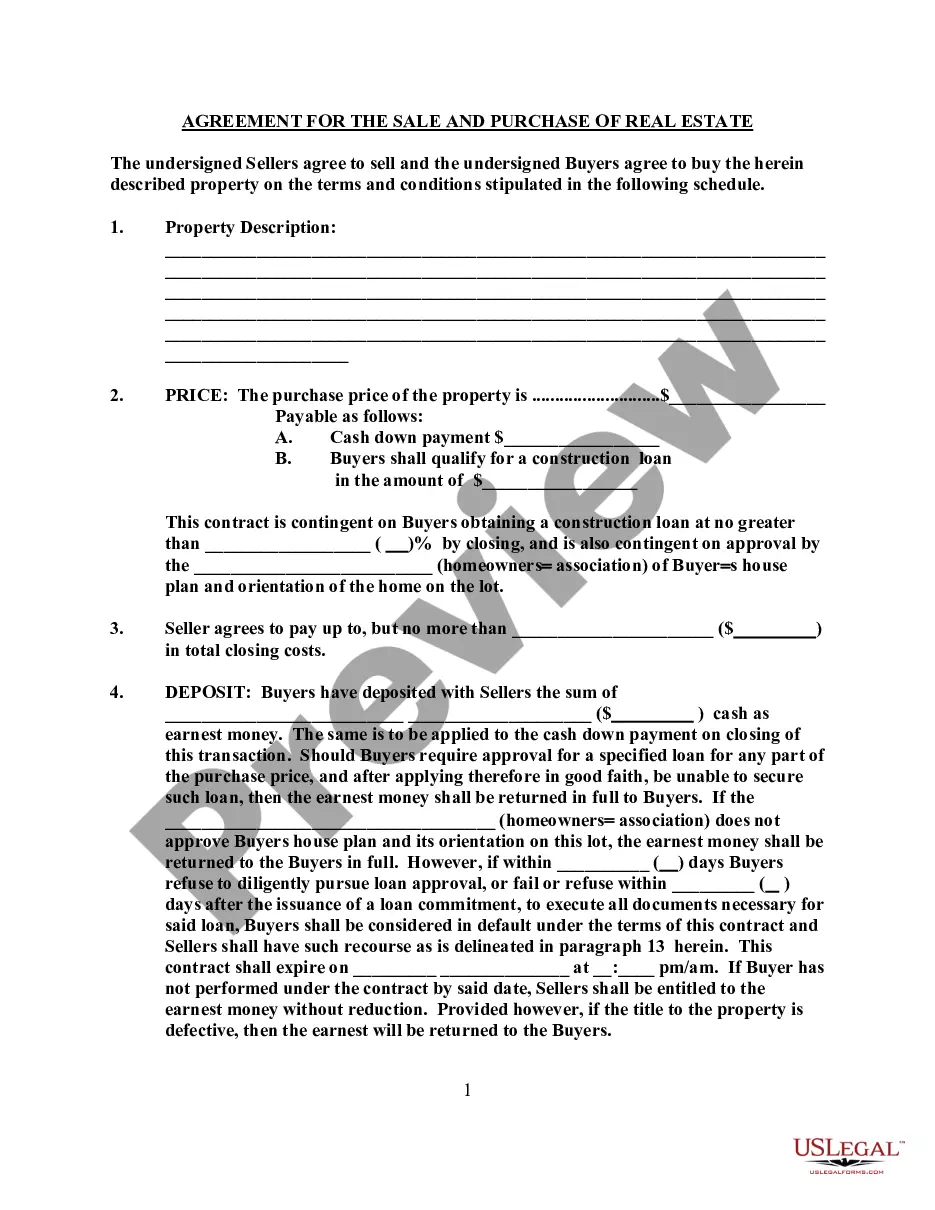

Maine Agreement to Purchase Common Stock from another Stockholder

Description

How to fill out Agreement To Purchase Common Stock From Another Stockholder?

You might spend time online searching for the appropriate legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that can be reviewed by professionals.

You can download or print the Maine Agreement to Purchase Common Stock from another Stockholder through the service.

Review the form description to confirm you have selected the right document. If available, utilize the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you may Log In and then click the Obtain button.

- Then, you can fill out, modify, print, or sign the Maine Agreement to Purchase Common Stock from another Stockholder.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the relevant button.

- If you’re using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

Form popularity

FAQ

Upon completion of a buyout, the S corp. issues a final Partner's Share of Income, Deductions, Credits, etc. (Form 1065, Schedule K-1) to the exiting shareholder. The K-1 lists the company's losses and revenues that the exiting shareholder must include in his personal tax return.

If we can't come to an agreement, there's no simple way to compel the minority shareholder to sell. In general, the majority shareholder will need to address the minority's reasons for refusing to sell, convincing the minority to accept a fair value for their shares.

A shareholder buyout occurs when a company purchases stock back from shareholders, according to . A buyout is known as "stock redemption" for tax purposes. The terms of shareholder buyouts are outlined in the shareholder agreement, including the buyout clause and the buyout price.

If the buyout is an all-cash deal, shares of your stock will disappear from your portfolio at some point following the deal's official closing date and be replaced by the cash value of the shares specified in the buyout. If it is an all-stock deal, the shares will be replaced by shares of the company doing the buying.

When a corporate buyout is executed, it generally requires a vote by the shareholders. The corporate bylaws define the conditions for significant transactions like a buyout.

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

A shareholder buyout is commonly structured as a share buy back but there are other arrangements which can be utilised. Where the values involved are significant, buy outs can be paid over a period of time.

To buyout a shareholder, a company must be able to pay for the value of the ownership interest. A company can fund the purchase of a shareholder's interest by using: The Assets of the Business: A buyout agreement may stipulate that the company can pay over time with the income earned from the business.

Can you buy stock for someone else? Besides gifting stock you already own, another option is to buy a new stock and then transfer ownership of it to someone else. After making the purchase with your broker, you can initiate a transfer to the recipient's account, usually accomplished using a transfer authorization form.

Generally, a majority of shareholders can remove a director by passing an ordinary resolution after giving special notice. This is straightforward, but care should be taken to check the articles of association of the company and any shareholders' agreement, which may include a contractual right to be on the board.