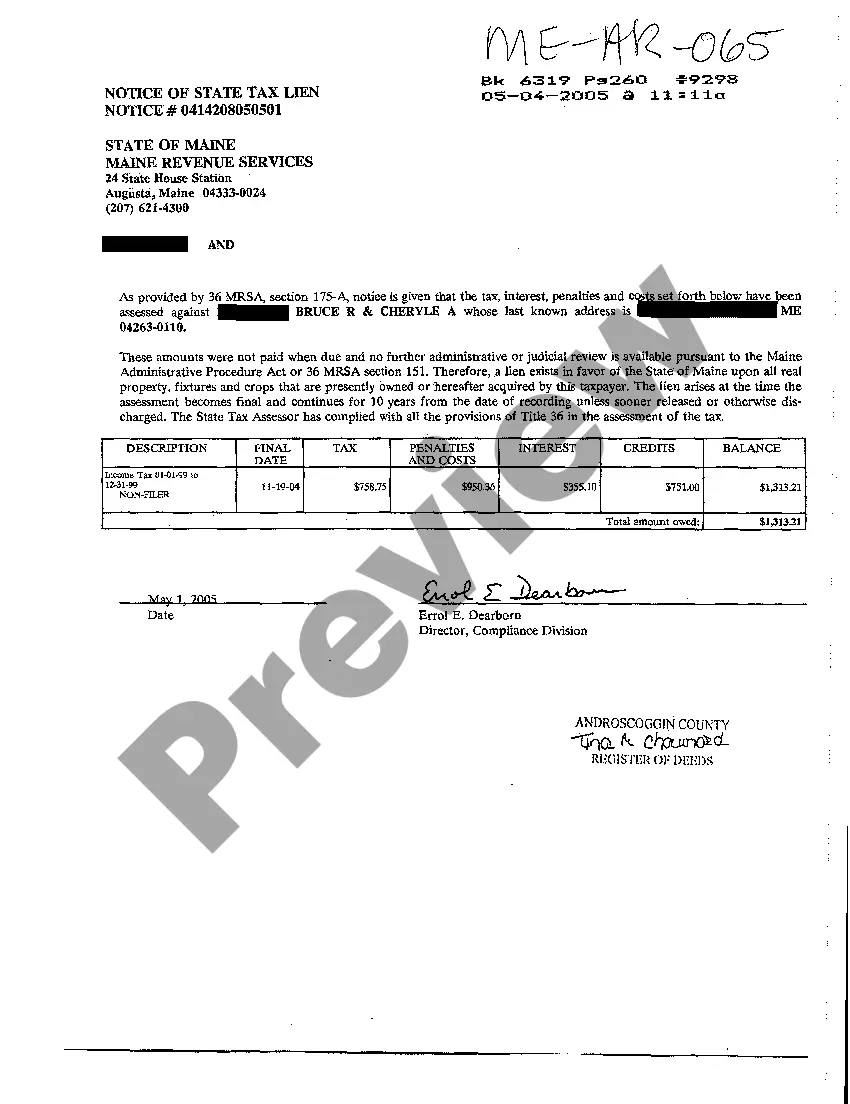

Maine Notice of State Tax Lien

Description

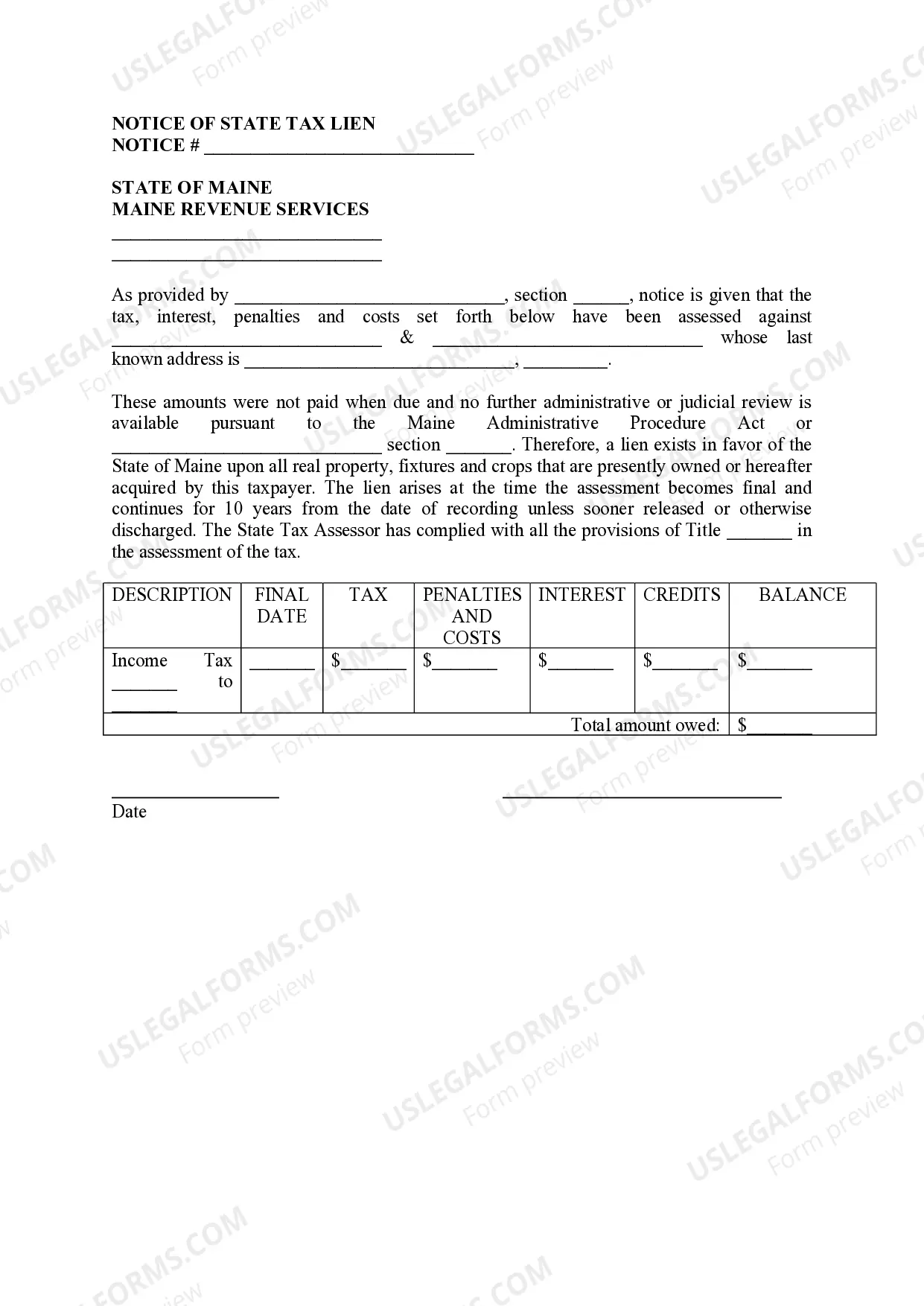

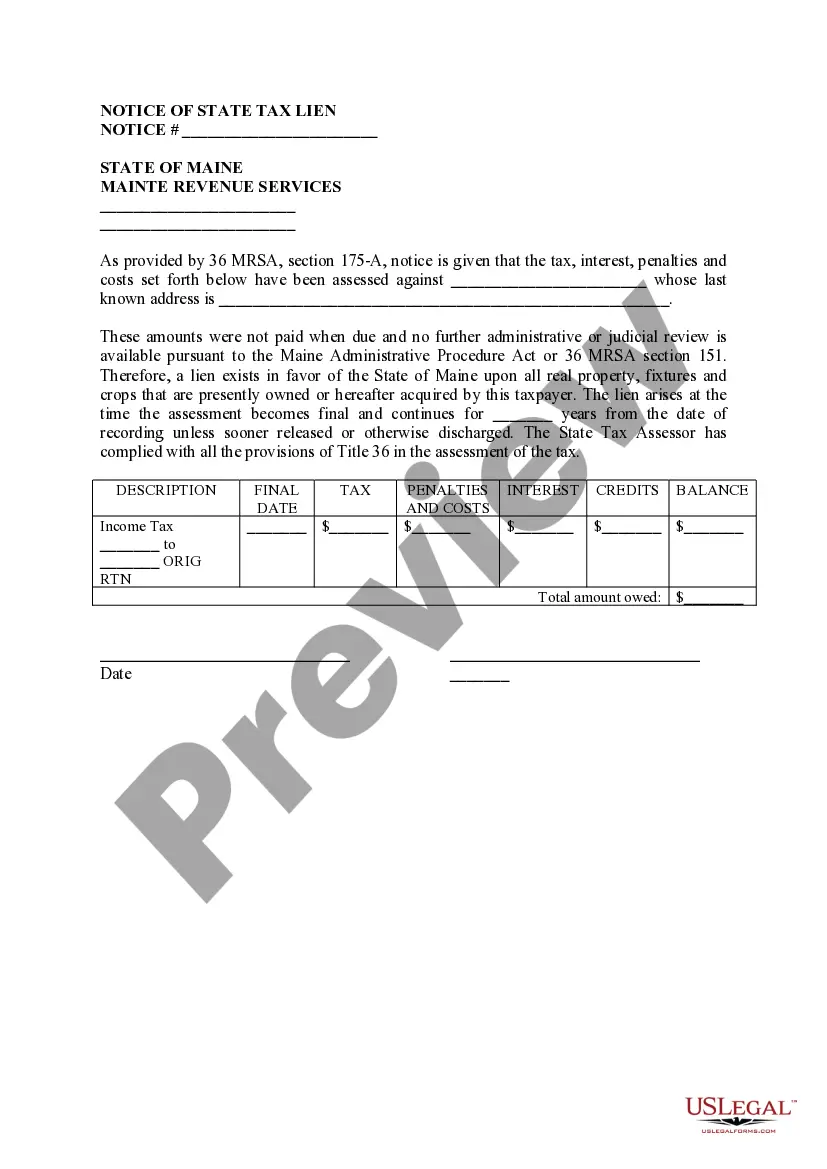

How to fill out Maine Notice Of State Tax Lien?

Access any type from 85,000 official documents including Maine Notice of State Tax Lien online with US Legal Forms. Every template is crafted and refreshed by state-certified lawyers.

If you have a subscription, Log In. When you’re on the form’s page, click on the Download button and navigate to My documents to retrieve it.

If you have not subscribed yet, follow the instructions below.

With US Legal Forms, you will consistently have instant access to the correct downloadable template. The platform facilitates your access to documents and organizes them into categories to streamline your search. Utilize US Legal Forms to obtain your Maine Notice of State Tax Lien quickly and efficiently.

- Review the state-specific criteria for the Maine Notice of State Tax Lien you wish to utilize.

- Examine the description and view the sample.

- When you are convinced that the template meets your needs, simply click Buy Now.

- Choose a subscription plan that aligns with your financial situation.

- Establish a personal account.

- Make payment in one of two acceptable methods: by credit card or through PayPal.

- Select a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- Once your reusable template is ready, print it out or store it on your device.

Form popularity

FAQ

With the judgment in hand, a judgment creditor can place a judgment lien on your real estate and occasionally on personal property depending on the state in which you live.

Tax liens put your assets at risk. To remove them you'll need to work with the IRS to pay your back taxes. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page.

When homeowners fail to pay their property taxes, some tax jurisdictions choose to hold tax deed home sales to make back the money they are owed. Interested buyers can register to participate as a bidder on these homes in a tax deed auction.

When a taxpayer fails to pay the entire real estate tax obligation within twelve months after commitment, by law, the tax collector will record a lien at the Hancock County registry of Deeds.

In Maine, all lien claimants without a contract directly with the property owner must file their lien claim (called a Notice of Lien) in the registry of deeds for the county in which the property is located within 90 days of the date of last furnishing labor or materials for the project.

A lien secures the government's interest in your property when you don't pay your tax debt. A levy actually takes the property to pay the tax debt. If you don't pay or make arrangements to settle your tax debt, the IRS can levy, seize and sell any type of real or personal property that you own or have an interest in.

If you have unpaid debt of any kind, this can lead the creditors that you owe money to place a lien on your assets.In other cases, liens may be placed on property by a court order as a result of legal action.

Parties that did not contract directly with the property owner must file the mechanics lien claim in the county registry of deeds within 90 days of last furnishing materials or labor to the project, as well as filing the lien like the general contractor (file a complaint in the Superior Court or District Court) within

We may file a Notice of Federal Tax Lien in the public record to notify your creditors of your tax debt.The federal tax lien arises automatically when the IRS sends the first notice demanding payment of the tax debt assessed against you and you fail to pay the amount in full.

If you do happen to find a paid tax lien on your report, and it's been more than seven years since satisfied the debt, you just need to dispute the item with the credit bureaus. Once they verify the date and status, they will typically remove it within 30 days.