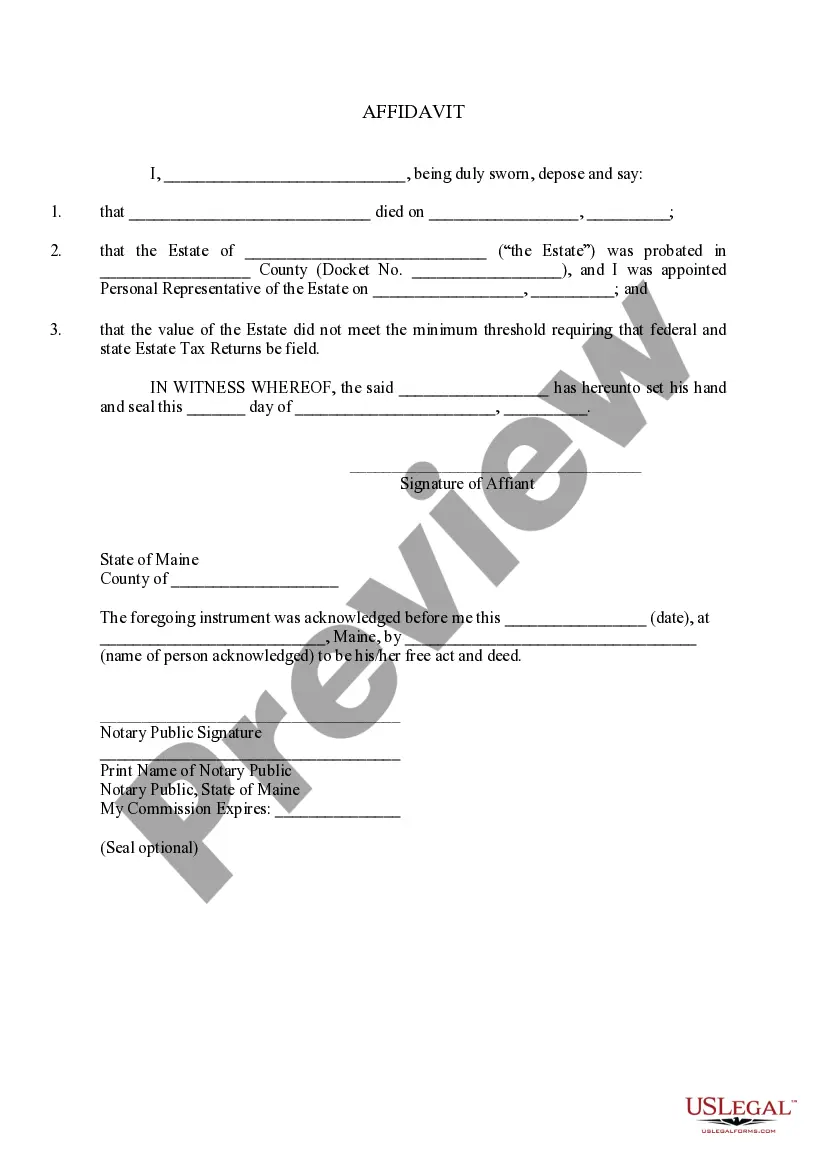

Maine Affidavit regarding Estate Value

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maine Affidavit Regarding Estate Value?

You are invited to the biggest legal document repository, US Legal Forms.

Here, you will discover any example including Maine Affidavit concerning Estate Value forms and obtain them (as many of them as you wish/need).

Prepare official documents within a few hours, instead of days or even weeks, without spending a fortune on a legal expert.

If the document meets all your criteria, simply click Buy Now. To create an account, select a pricing plan. Utilize a credit card or PayPal account to register. Download the file in your preferred format (Word or PDF). Print the document and complete it with your/your business’s details. Once you’ve filled out the Maine Affidavit regarding Estate Value, submit it to your attorney for validation. It’s an extra step but an essential one for ensuring you’re completely protected. Join US Legal Forms now and gain access to thousands of reusable samples.

- Acquire the state-specific form in a few clicks and feel assured knowing it was composed by our experienced attorneys.

- If you’re already a subscribed member, just Log In to your account and then click Download beside the Maine Affidavit regarding Estate Value you desire.

- Since US Legal Forms is an online service, you’ll always have access to your saved templates, no matter the device you’re using.

- Find them under the My documents section.

- If you don't possess an account yet, what are you waiting for.

- Review our instructions below to begin.

- If this is a state-specific model, verify its applicability in your state.

- Examine the description (if available) to ensure it’s the correct template.

Form popularity

FAQ

A small estate affidavit is a sworn written statement that authorizes someone to claim a decedent's assets outside of the formal probate process.

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

In Maine, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

If the total value of all the assets you leave behind is less than a certain amount, the people who inherit your personal property -- that's anything except real estate -- may be able to skip probate entirely. The exact amount depends on state law, and varies hugely.

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.