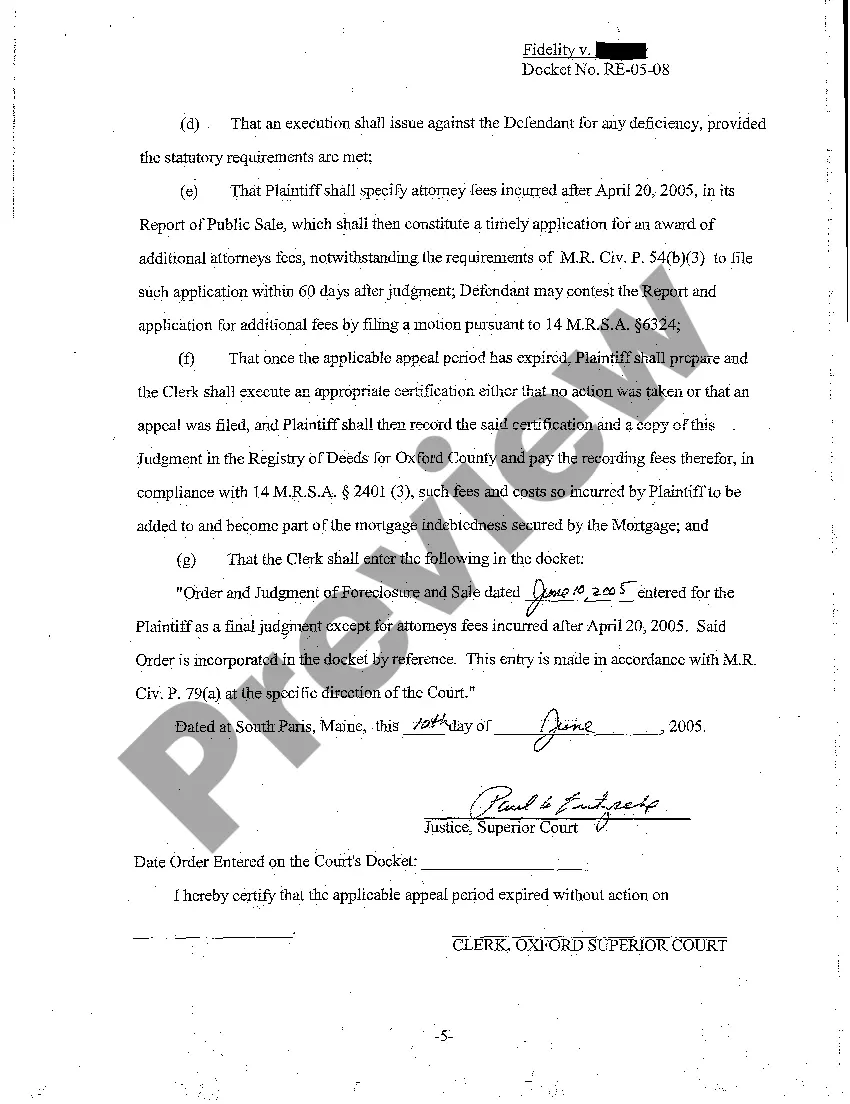

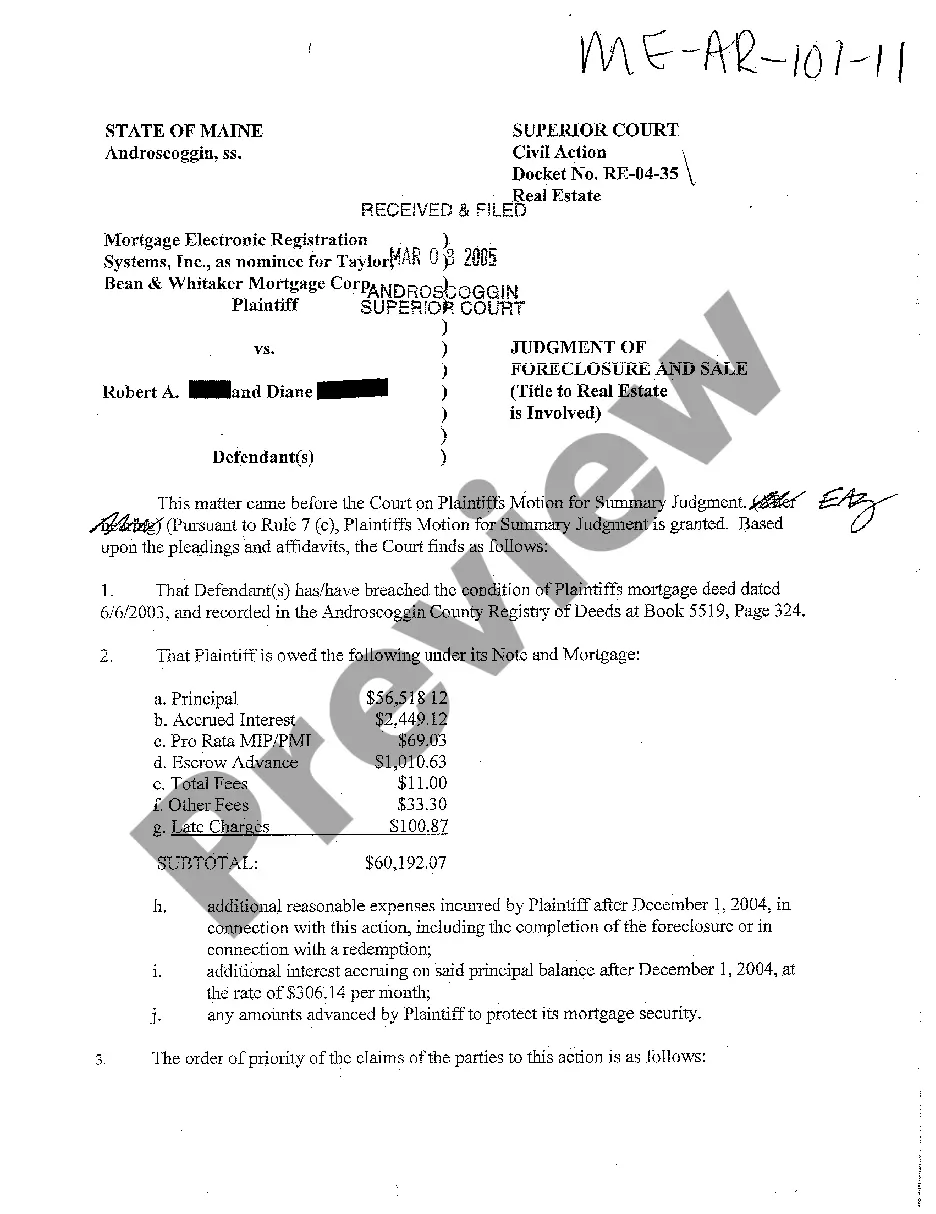

Maine Order and Judgment of Foreclosure and Sale and Entry of Final Judgment

Description

How to fill out Maine Order And Judgment Of Foreclosure And Sale And Entry Of Final Judgment?

You are invited to the largest legal forms repository, US Legal Forms. Here you will discover any sample such as Maine Order and Judgment of Foreclosure and Sale and Entry of Final Judgment documents and download them (as many as you desire/require). Create official paperwork in just a few hours, instead of days or even weeks, without needing to spend a fortune on a legal expert. Obtain your state-specific template in just a few clicks and feel confident knowing that it was drafted by our skilled attorneys.

If you’re already a subscribed member, just sign in to your account and click Download next to the Maine Order and Judgment of Foreclosure and Sale and Entry of Final Judgment you need. Since US Legal Forms is an online solution, you’ll typically have access to your saved documents, regardless of the device you’re using. Find them within the My documents section.

If you haven't created an account yet, just what are you waiting for? Review our guidelines below to get started.

Once you’ve completed the Maine Order and Judgment of Foreclosure and Sale and Entry of Final Judgment, send it to your lawyer for verification. It’s an extra step but a crucial one to ensure you’re fully protected. Join US Legal Forms now and gain access to a wealth of reusable templates.

- If this is a state-specific document, verify its legitimacy in the state where you reside.

- Examine the description (if available) to determine if it’s the correct template.

- View additional content with the Preview feature.

- If the document suits your needs, click Buy Now.

- To establish your account, choose a pricing plan.

- Utilize a credit card or PayPal account to register.

- Download the template in the format you prefer (Word or PDF).

- Print the document and complete it with your/your business’s information.

Form popularity

FAQ

The last decision from a court that resolves all issues in dispute and settles the parties' rights with respect to those issues. A final judgment leaves nothing except decisions on how to enforce the judgment, whether to award costs, and whether to file an appeal.

The final judgment amount in a foreclosure case is how much money is owed on the foreclosed property. This amount could include how much is left unpaid on the mortgage and any fees accrued during the foreclosure process.

If the court grants summary judgment in favor of the bank, typically after a hearing, the bank wins the case, and your home will be sold at a foreclosure sale.order the foreclosure sale, or. dismiss the case, usually without prejudice. (Without prejudice means the bank can refile the foreclosure.)

Foreclosures are generally judicial in the following states: Connecticut, Delaware, District of Columbia (sometimes), Florida, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana (executory proceeding), Maine, Nebraska (sometimes), New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma (if the

Most states allow lenders to sue borrowers for deficiencies after foreclosure or, in some cases, in the foreclosure action itself. Some states allow deficiency lawsuits in judicial foreclosures, but not in nonjudicial foreclosures.Your lender most likely won't sue you if they think they won't recover anything.

If the court grants summary judgment in favor of the bank, typically after a hearing, the bank wins the case, and your home will be sold at a foreclosure sale.order the foreclosure sale, or. dismiss the case, usually without prejudice. (Without prejudice means the bank can refile the foreclosure.)

Once a foreclosure case has successfully been through court proceedings, a judge signs the final judgement.The final judgement lists all amounts that are owed on the property and a copy of the document is provided to the previous owner under the law.

How long it takes for your home to foreclose once you receive notice of lis pendens will depend on the state. In California, it might take a minimum of 120 days, and 180 days in Florida, while in New York it can take as long as 15 months after the notice is filed.

In Maine, lenders may foreclose on mortgages in default by using either a judicial or strict foreclosure process. Although Maine allows lenders to pursue foreclosure by judicial methods, which involves filing a lawsuit to obtain a court order to foreclose, it is only used in special circumstances.