Maine Complaint for Foreclosure of Mortgage Title to Real Estate is Involved

Description

Key Concepts & Definitions

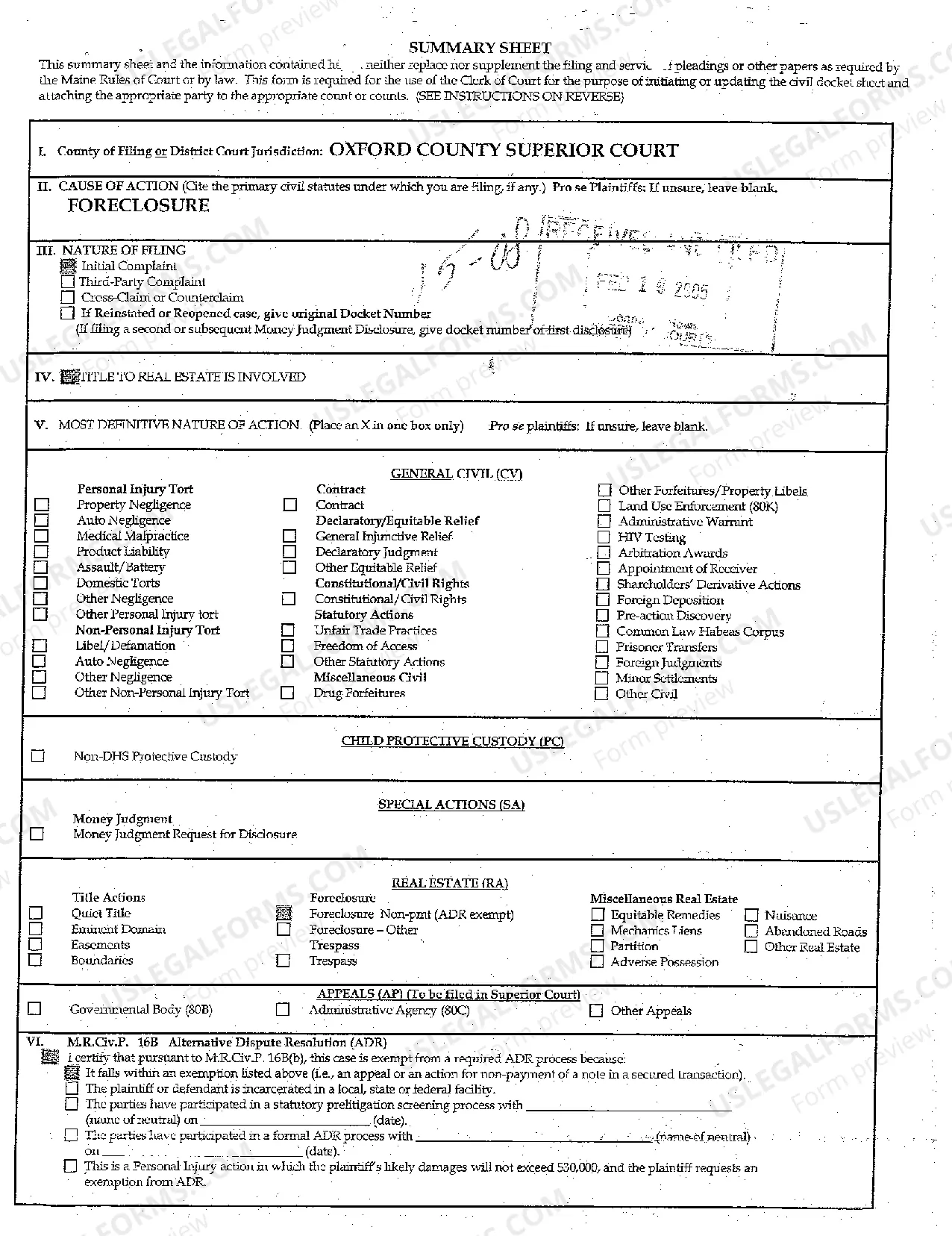

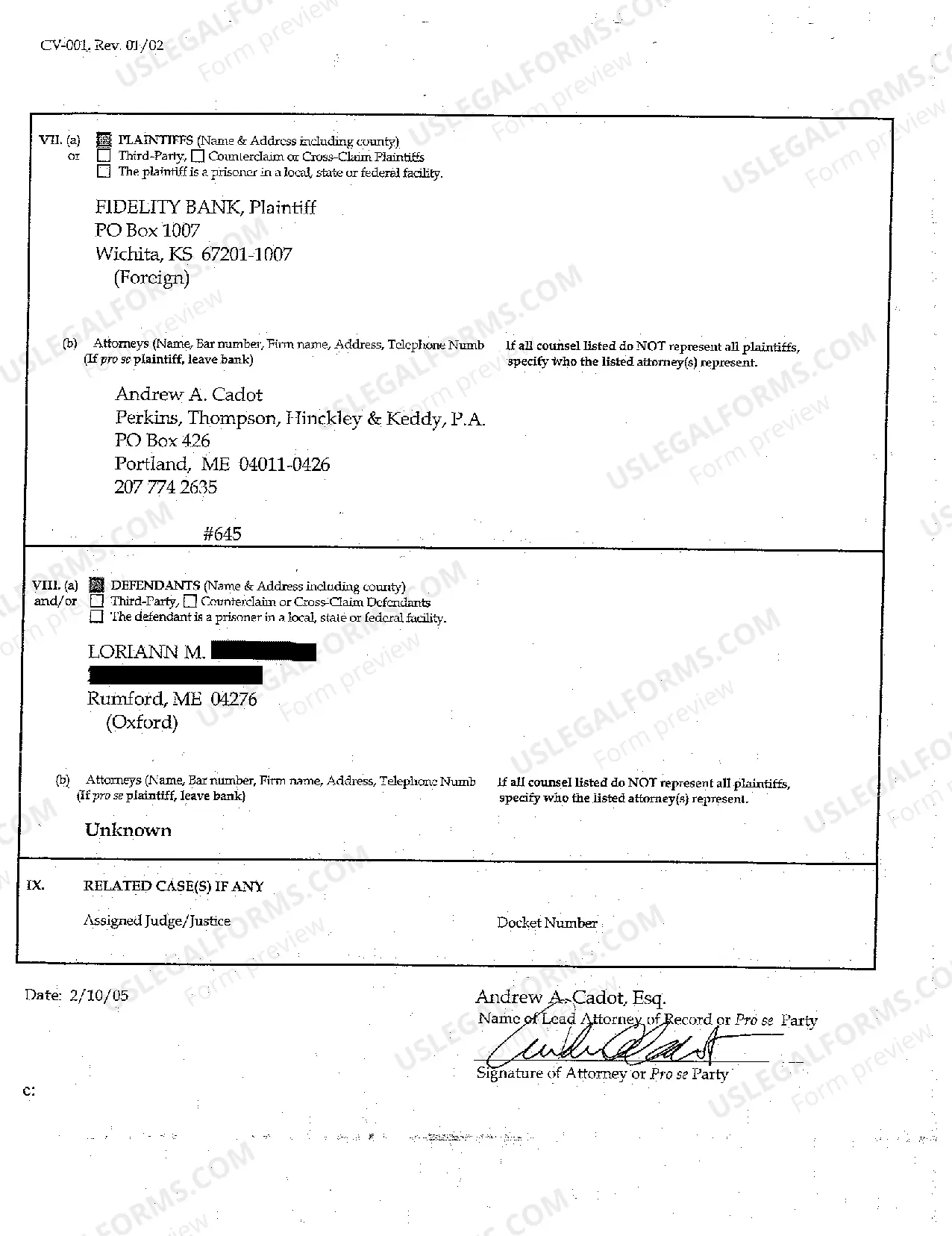

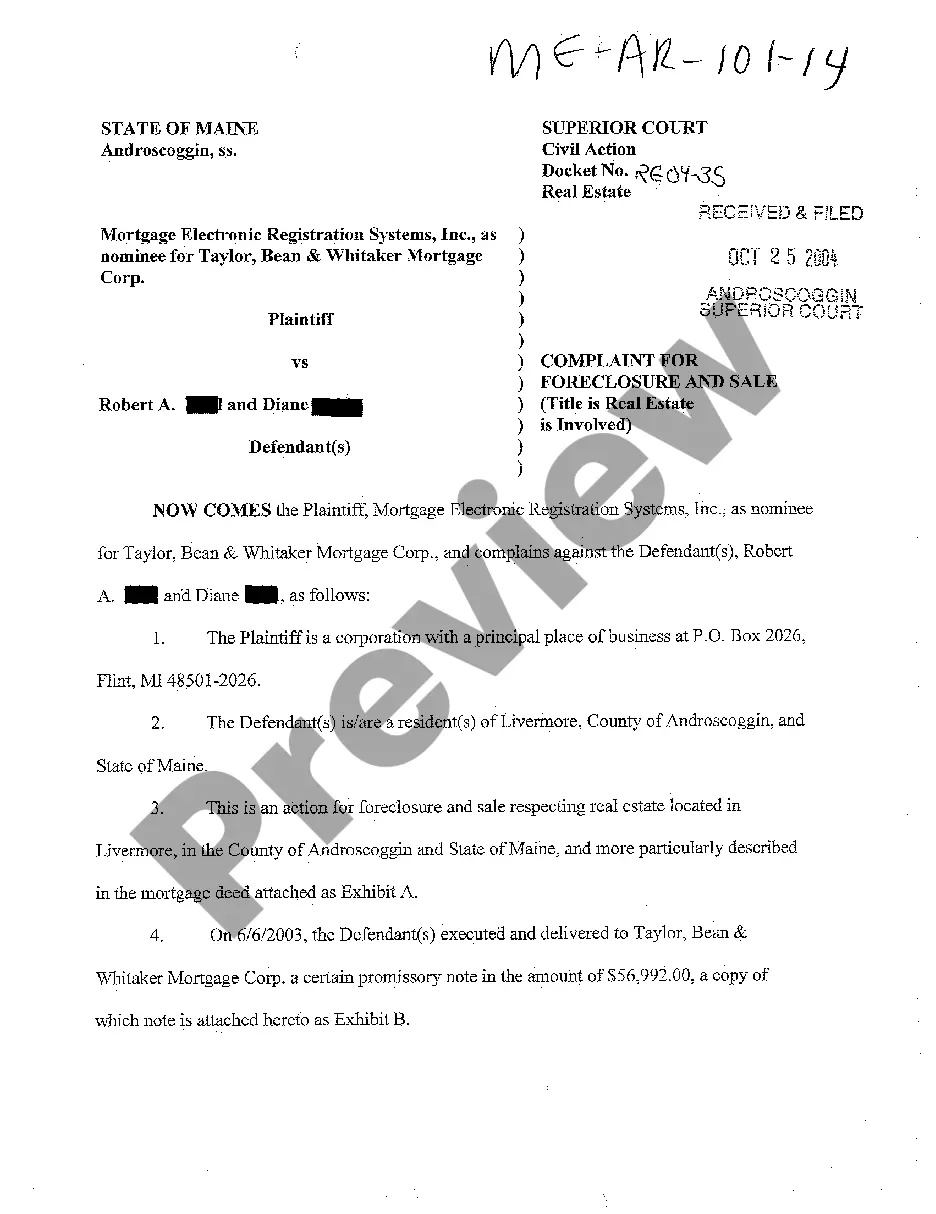

A01 Complaint for Foreclosure of Mortgage Title To is a legal document filed by a lender or mortgage holder seeking to foreclose on a property due to the mortgagor's failure to comply with the terms and conditions of the mortgage agreement. This type of complaint is primarily used in judicial foreclosure states in the United States where court action is required to enforce the foreclosure.

Step-by-Step Guide on Filing an A01 Complaint

- Determine the Type of Foreclosure: Verify whether your state requires judicial (court-involved) or non-judicial foreclosure actions.

- Prepare Documentation: Gather all necessary documents such as the original mortgage agreement, proof of mortgage payments missed, and any previous correspondence with the borrower.

- File the Complaint: Submit the A01 complaint form to the appropriate county court. Include all supporting documents and evidence.

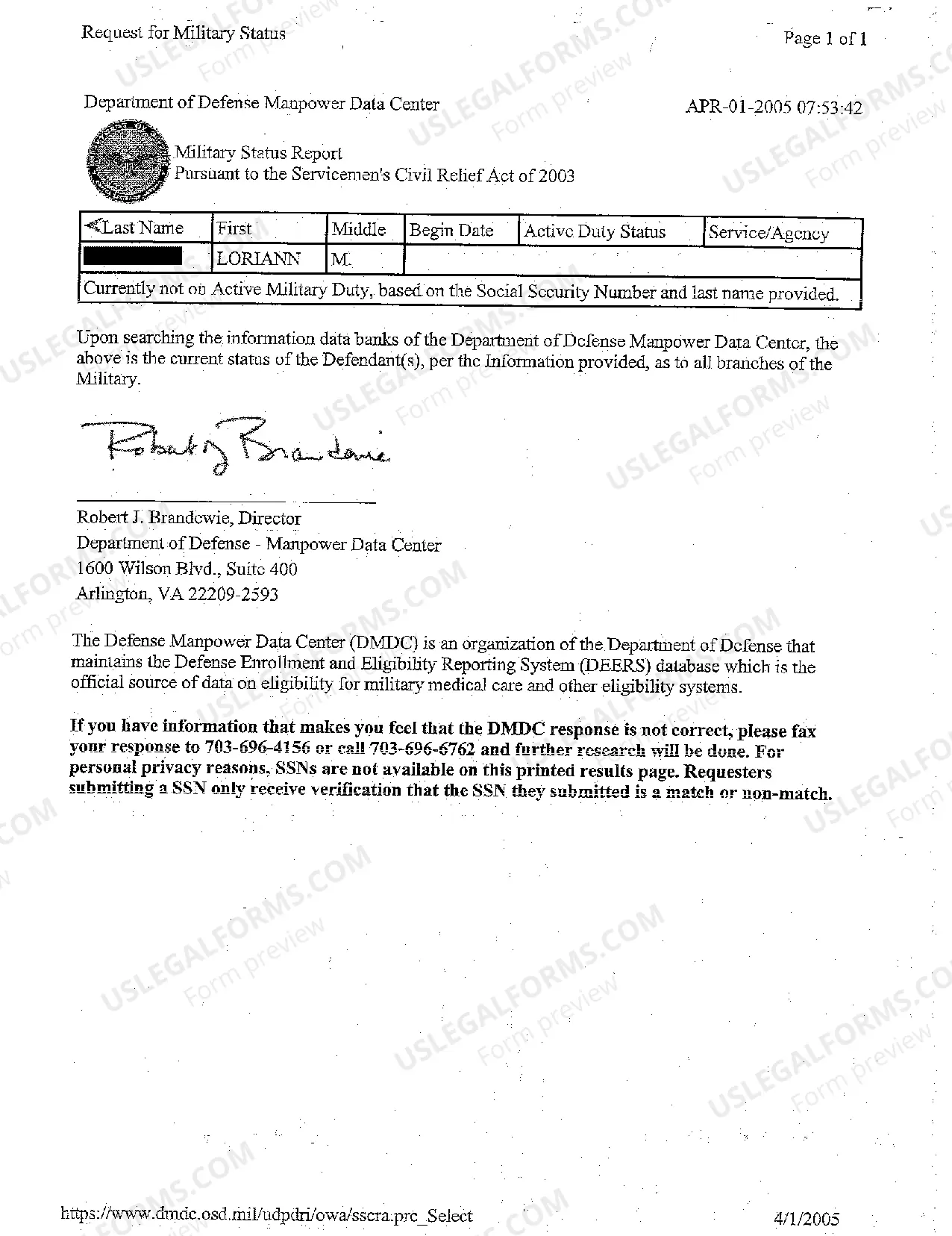

- Serve the Defendant: Legally notify the property owner and any other relevant parties about the foreclosure action.

- Attend Court Hearings: Participate in all scheduled court hearings, presenting the case for foreclosure based on the evidence provided.

- Obtain a Judgment: If the court rules in favor of the foreclosure, follow through by obtaining a judgment that allows the property to be sold.

- Property Sale: Proceed with the sale of the property as outlined by court order, typically at public auction.

Risk Analysis of Foreclosure Processes

- Legal Risks: The possibility of the mortgagor contesting the foreclosure, potentially leading to prolonged legal battles.

- Financial Risks: Losses incurred from unpaid mortgages, reduced property value, and legal costs impacting profitability.

- Reputational Risks: Negative public perception of conducting foreclosures which could impact lender relations and future business.

Common Mistakes & How to Avoid Them

- Insufficient Documentation: Ensure all required documents are accurate and readily available before filing a complaint.

- Failure to Comply with Local Laws: Understanding and adhering to state-specific foreclosure laws to avoid legal complications.

- Inadequate Communication: Maintain clear and documented communications with the borrower throughout the foreclosure process.

FAQ

What is an A01 Complaint? An A01 Complaint for Foreclosure of Mortgage Title To is a legal action initiated by mortgagees to foreclose on properties due to default.

Which states require a judicial foreclosure process? States like Florida, New York, and Illinois require judicial proceedings for foreclosures.

Can a borrower stop a foreclosure once an A01 complaint has been filed? Yes, borrowers can halt foreclosure by filing for bankruptcy, proposing a loan modification, or paying the overdue amount during the pre-foreclosure period.

How to fill out Maine Complaint For Foreclosure Of Mortgage Title To Real Estate Is Involved?

You are invited to the biggest collection of legal documents, US Legal Forms. Here you will discover any template including Maine Complaint for Foreclosure of Mortgage Title to Real Estate is Involved forms and download them (as many as you desire/need). Create official documents in just a few hours, instead of days or weeks, without shelling out a fortune on a lawyer.

Obtain the state-specific example in a few clicks and feel assured knowing that it was crafted by our skilled attorneys.

If you’re already a registered customer, just Log In to your account and then click Download next to the Maine Complaint for Foreclosure of Mortgage Title to Real Estate is Involved you wish to obtain. Since US Legal Forms is online-based, you’ll consistently have access to your downloaded documents, regardless of the device you’re using. Locate them in the My documents section.

Print the document and fill it out with your or your company's information. Once you’ve completed the Maine Complaint for Foreclosure of Mortgage Title to Real Estate is Involved, send it to your attorney for validation. It’s an extra step but a crucial one to ensure you’re fully protected. Register for US Legal Forms today and gain access to thousands of reusable templates.

- If you haven't created an account yet, what are you waiting for? Review our guidelines below to get started.

- If this is a state-specific sample, verify its legitimacy in the state where you reside.

- Examine the description (if available) to determine if it’s the appropriate template.

- Utilize the Preview feature for more content.

- If the sample meets your requirements, click Buy Now.

- To establish an account, select a pricing plan.

- Use a credit card or PayPal account to register.

- Download the document in the format you require (Word or PDF).

Form popularity

FAQ

Essentially, a judicial foreclosure means that the lender goes to court to get a judgment to foreclose on your home, while a non-judicial foreclosure means that the lender does not need to go to court.

Most people do not realize that they can stop foreclosure even if they stopped paying their mortgage. Absolutely! Many recent cases have been filed improperly and an experienced attorney can assist with the identification and filing of substantive and procedural defenses with the court and vigorously defend your case.

Foreclosure is what happens when a homeowner fails to pay the mortgage. More specifically, it's a legal process by which the owner forfeits all rights to the property. If the owner can't pay off the outstanding debt, or sell the property via short sale, the property then goes to a foreclosure auction.

Negotiate With Your Lender. If you found yourself in a situation where you are behind on mortgage payments, and believe that your lender can try to foreclose on your house, try negotiating a new payment plan. Reinstate Your Loan. Forbearance Plan. Sell Your Property.

As part of the lawsuit, the foreclosing party includes a petition for foreclosure that explains why a judge should issue a foreclosure judgment. In most cases, the court will do so, unless the borrower has a defense that justifies the delinquent payments.

Foreclosures are generally judicial in the following states: Connecticut, Delaware, District of Columbia (sometimes), Florida, Hawaii, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana (executory proceeding), Maine, Nebraska (sometimes), New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma (if the

Maine is a Title Theory State which means that legal title is conveyed along with the mortgage subject only to the defeasance clause.

Most states allow lenders to sue borrowers for deficiencies after foreclosure or, in some cases, in the foreclosure action itself. Some states allow deficiency lawsuits in judicial foreclosures, but not in nonjudicial foreclosures.Your lender most likely won't sue you if they think they won't recover anything.

In Maine, lenders may foreclose on mortgages in default by using either a judicial or strict foreclosure process. Although Maine allows lenders to pursue foreclosure by judicial methods, which involves filing a lawsuit to obtain a court order to foreclose, it is only used in special circumstances.