Maine Resignation of Trustee

Description

How to fill out Maine Resignation Of Trustee?

Greetings to the most extensive legal documents repository, US Legal Forms.

Here you can obtain any template such as Maine Resignation of Trustee forms and store them (as many as you want/require). Create official documents within a few hours, rather than days or weeks, without having to spend a fortune on an attorney.

Acquire your state-specific sample in just a few clicks and feel confident knowing that it was prepared by our certified lawyers.

To create an account, select a pricing plan. Use a credit card or PayPal account to subscribe. Store the document in your preferred format (Word or PDF). Print the file and fill it in with your or your business’s details. After you’ve completed the Maine Resignation of Trustee, send it to your lawyer for confirmation. It's an extra step but a necessary one to ensure you’re fully protected. Sign up for US Legal Forms today and gain access to thousands of reusable templates.

- If you are already a subscribed customer, just Log In to your account and click Download next to the Maine Resignation of Trustee you need.

- Since US Legal Forms is online, you will always have access to your downloaded files, regardless of the device you are using.

- Find them under the My documents section.

- If you don't have an account yet, what are you waiting for? Follow our instructions below to get started.

- If this is a state-specific form, verify its relevance in your state.

- Review the description (if available) to ascertain if it’s the correct template.

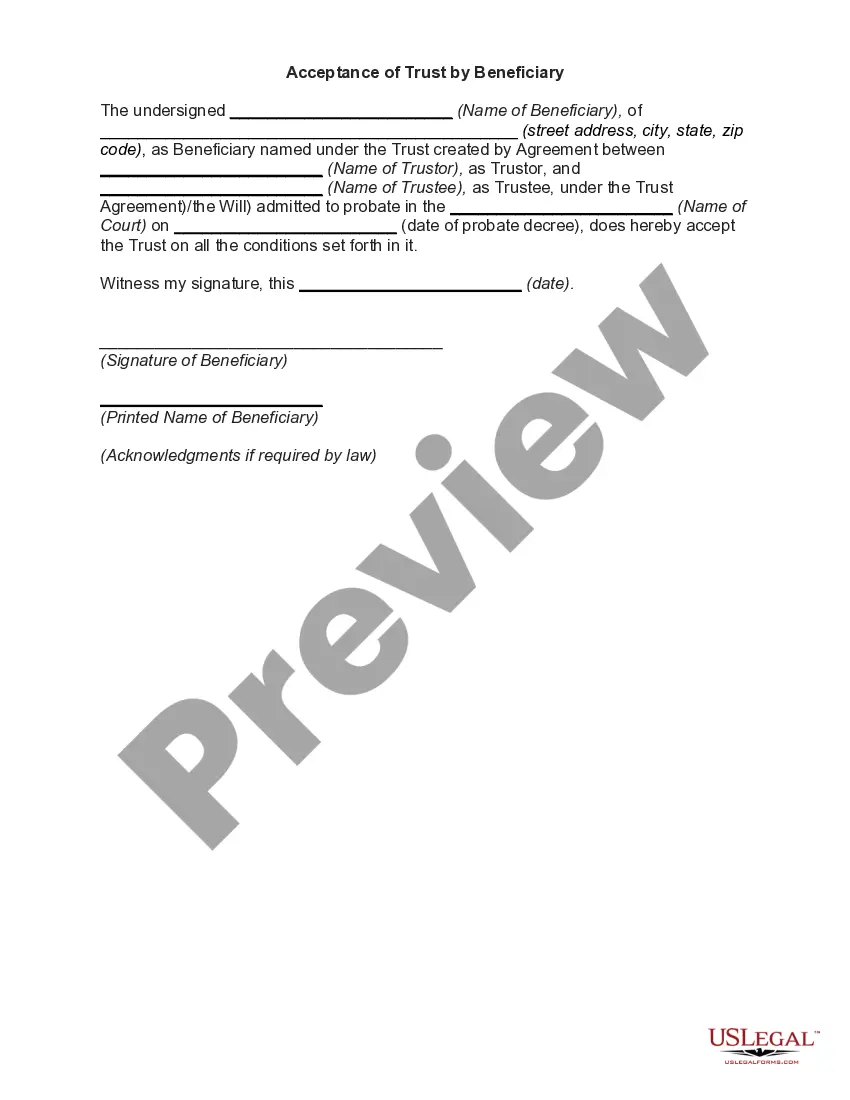

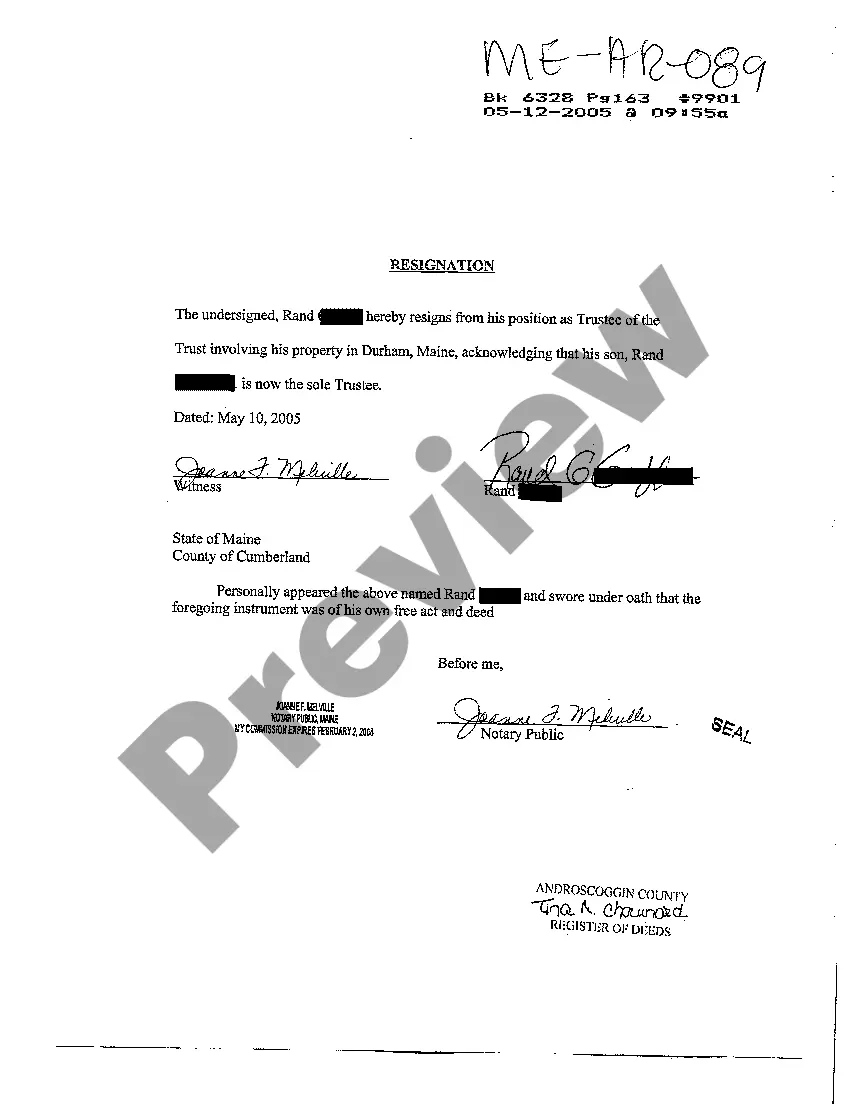

- View additional content with the Preview feature.

- If the document satisfies all your requirements, simply click Buy Now.

Form popularity

FAQ

Obtain a Trustee Resignation Form from your attorney or the Court and complete and sign it in the presence of a notary public. 4. Make copies of your resignation. Give a copy to the new Trustee, mail a copy to all the trust beneficiaries and keep one in your personal file.

A trustee cannot resign without the permission of the court unless the trust instrument so provides or unless all of the beneficiaries who are legally capable to do so consent to the resignation.

1 attorney answer Follow the terms of the Trust. Typically, a letter of resignation will suffice but Trust terms control unless silent. No recording or notary is specifically required either, but a notarization of the resignation certainly wouldn't hurt at all...

Removal by the Trustor A trust agreement should state the circumstances under which a trustee may be removed by the trustor. Trust agreements usually allow the trustor to remove a trustee, including a successor trustee. This may be done at any time, without the trustee giving reason for the removal.

When a Trustee resigns, they must still act in the best interests of the Trust and the Trust beneficiaries. That means the Trust assets must be managed prudently while a new Trustee is selected. Further, the Trustee is required to provide an accounting to the Trust beneficiaries upon resignation.

Under California law, trustees are required to formally notify the beneficiaries of a trust when any significant changes to the trust have transpired. Specifically, these trust notification requirements can come into play when: Someone passes away and, upon death, a new trust is formed by the terms of a will.

If a trustee resigns or dies, the Letters of Authority must be returned to the Master to have that person's name deleted. In case of a resignation, the letter of resignation and a resolution from the remaining trustees accepting his resignation, must be given to the Master.

Obtain a Trustee Resignation Form from your attorney or the Court and complete and sign it in the presence of a notary public. 4. Make copies of your resignation. Give a copy to the new Trustee, mail a copy to all the trust beneficiaries and keep one in your personal file.

Obtain a Trustee Resignation Form from your attorney or the Court and complete and sign it in the presence of a notary public. 4. Make copies of your resignation. Give a copy to the new Trustee, mail a copy to all the trust beneficiaries and keep one in your personal file.